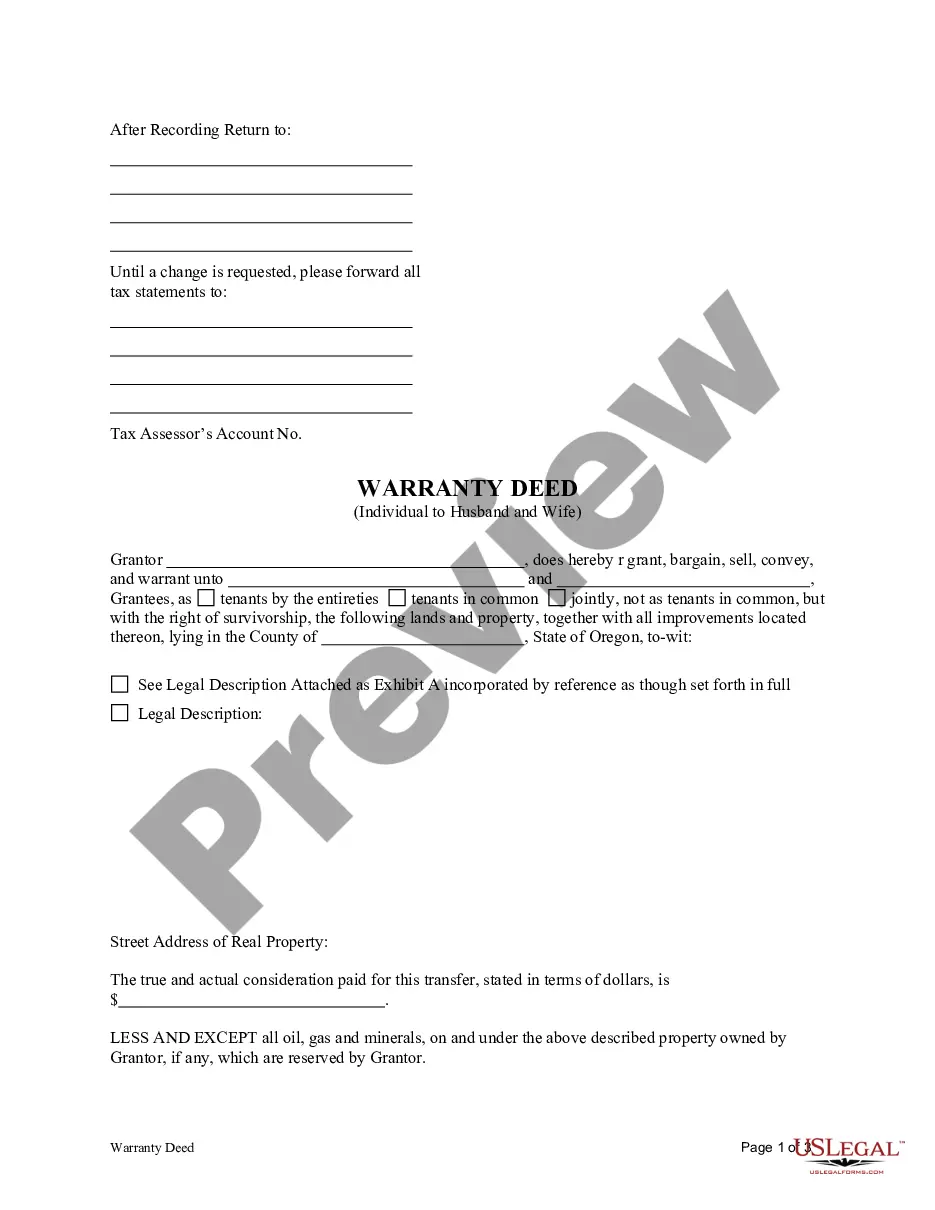

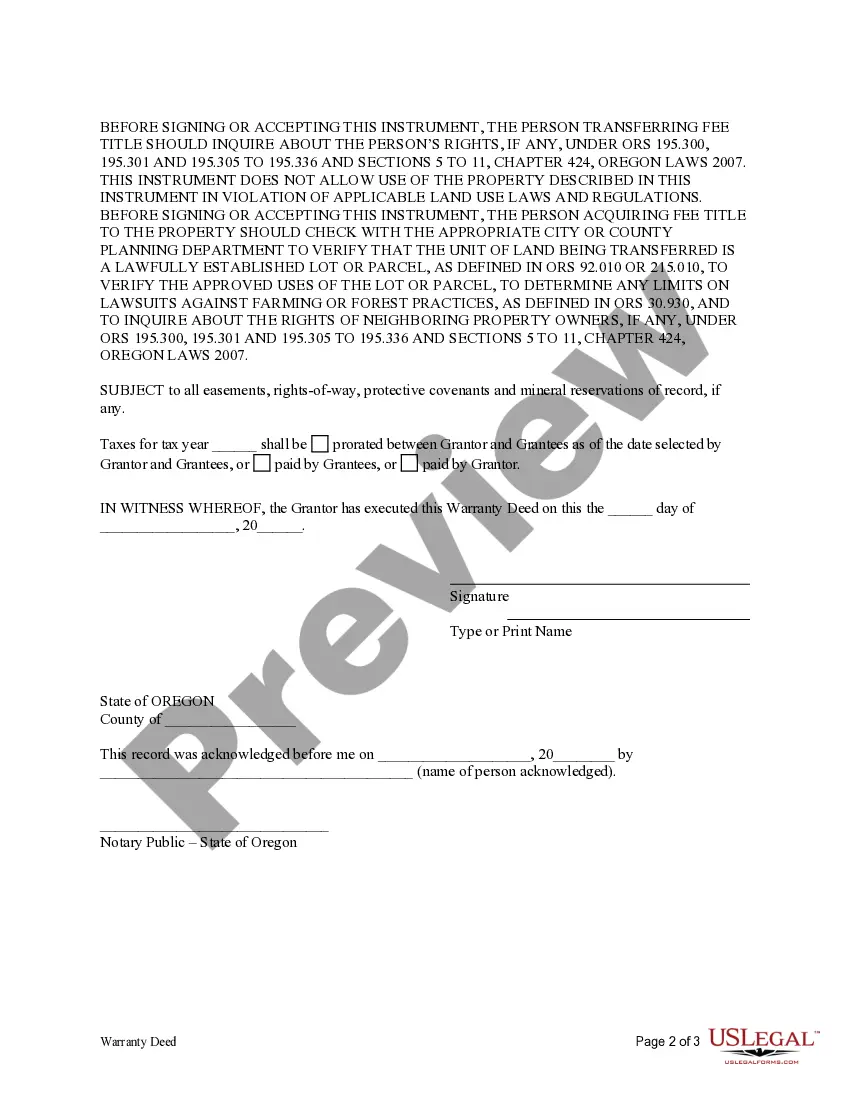

This Warranty Deed from Individual to Husband and Wife form is a Warranty Deed where the Grantor is an individual and the Grantees are husband and wife. Grantor conveys and warrants the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

Deed Ind Husb With Mortgage

Description

How to fill out Deed Ind Husb With Mortgage?

How to obtain professional legal documents that comply with your state's regulations and create the Deed Ind Husb With Mortgage without hiring a lawyer.

Numerous services online offer templates to address various legal situations and formal requirements. However, it may require some time to identify which of the available samples meet both your usage and legal standards.

US Legal Forms is a trustworthy platform that assists you in finding formal documents crafted according to the latest updates in state law, saving you money on legal fees.

If you do not have an account with US Legal Forms, follow the instructions below: Review the webpage you've opened to confirm whether the form meets your needs. Use the form description and preview features if accessible. Look for another example in the header by entering your state if necessary. Click the Buy Now button when you discover the correct document. Choose the most appropriate pricing plan, then Log In or pre-register for an account. Select your payment method (either by credit card or via PayPal). Adjust the file format for your Deed Ind Husb With Mortgage and click Download. The purchased templates are yours: you can always return to them in the My documents tab of your profile. Subscribe to our library and prepare legal documents independently like a skilled legal professional!

- US Legal Forms is more than just a traditional online directory.

- It consists of over 85,000 verified templates suited for various business and personal circumstances.

- All documents are categorized by area and state for a quicker and easier search experience.

- Moreover, it connects with robust solutions for PDF editing and eSignatures, enabling users with a Premium subscription to easily complete their documentation online.

- Minimal effort and time is needed to secure the necessary documents.

- If you already possess an account, Log In to ensure your subscription is current.

- Download the Deed Ind Husb With Mortgage using the appropriate button next to the file name.

Form popularity

FAQ

Adding someone to your mortgage without remortgaging can be challenging. Typically, lenders require you to remortgage to officially add a person, such as your husband. However, you can create a deed in husb with mortgage that may serve as a temporary solution, giving your husband rights to the property without altering the mortgage terms. To navigate this process, consider consulting with a legal expert or using USLegalForms to streamline the necessary documentation.

A Trust Deed is important because it serves as a legal document that protects both the borrower and lender in real estate transactions. It allows for a streamlined foreclosure process, which benefits lenders by reducing potential losses. Furthermore, if you complete a deed ind husb with mortgage, establishing a Trust Deed can provide reassurance and clarity in your contractual obligations.

Yes, securing a mortgage after having a Trust Deed is often possible, but it may depend on your financial health and time since the Trust Deed. Lenders usually want to see a solid repayment history post-Trust Deed. If you are considering a deed ind husb with mortgage, demonstrating capable financial management can improve your chances of obtaining a mortgage.

The best type of deed often depends on your needs and circumstances. For most individuals, a warranty deed provides the strongest protection, ensuring no future claims against the property. It assures you receive clear title ownership. In contrast, if you are considering a deed ind husb with mortgage, the type of deed you choose can significantly impact your rights and responsibilities.

When deciding between a deed of trust and a mortgage, you should consider your financial situation and local laws. A deed of trust may offer more flexibility, as it involves a third party who can quickly handle foreclosure. This can be beneficial if you face financial difficulties. Ultimately, the best choice between a deed ind husb with mortgage or a deed of trust depends on your specific circumstances.