Shared Equity Agreements For Nonprofits In Utah

Description

Form popularity

FAQ

Not all nonprofits offer equity to their employees, and some may have restrictions or limitations on who can receive it and how much. For example, some nonprofits may only offer equity to senior executives or key personnel, while others may have a cap on the total amount of equity they can distribute.

These agreements let you access funds in exchange for a share of your property's future appreciation. Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page.

The board of directors make up the governing body of the nonprofit corporation and are committed to the purpose and success of the organization. The IRS requires a minimum of three unrelated individuals and Utah law requires them to be 18 years of age or older.

A company provides you with a lump sum in exchange for partial ownership of your home, and/or a share of its future appreciation. You don't make monthly repayments of principal or interest; instead, you settle up when you sell the home or at the end of a multi-year agreement period (typically between 10 and 30 years).

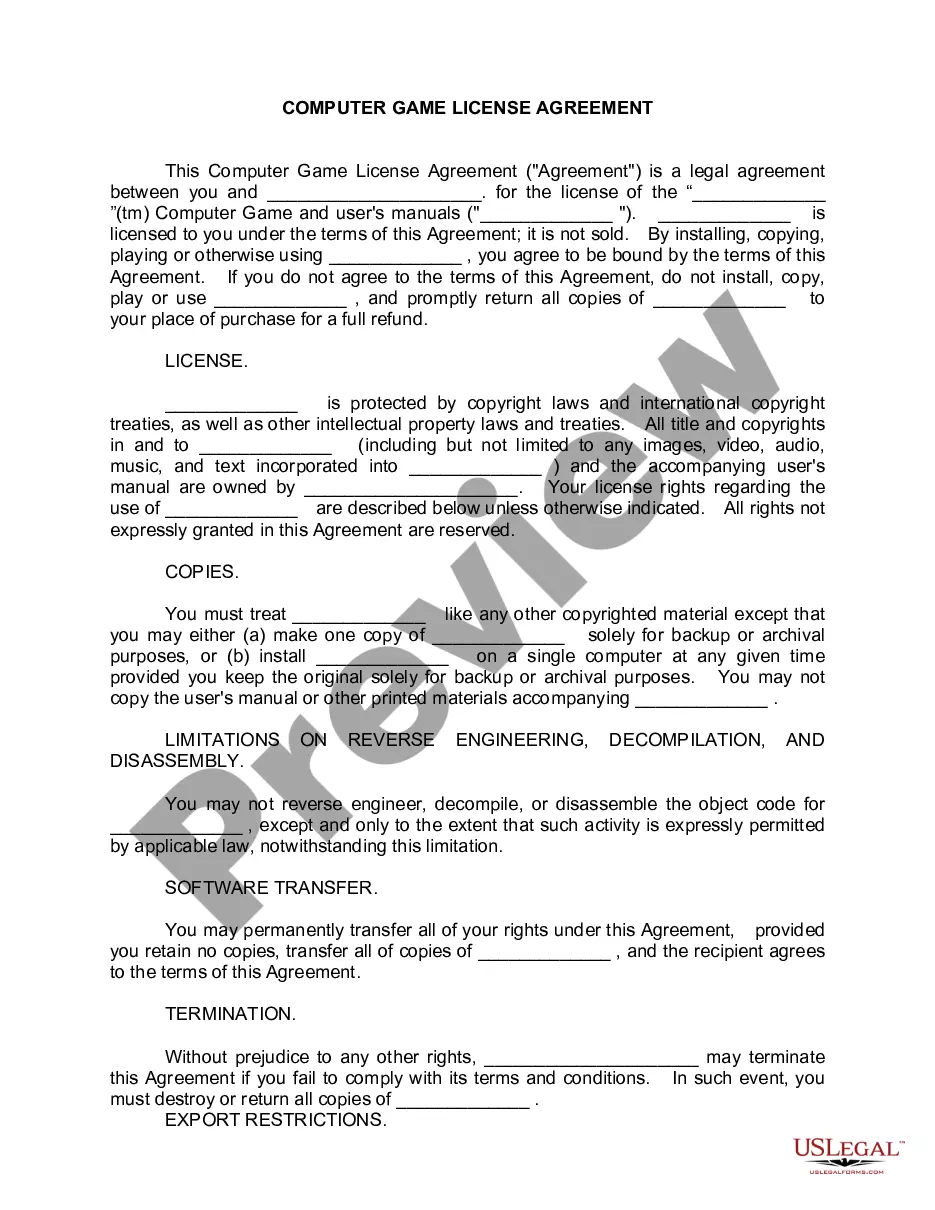

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.

Unison equity sharing agreements are currently available in these states: Arizona. California. Colorado. Delaware. Florida. Illinois. Indiana. Kansas.