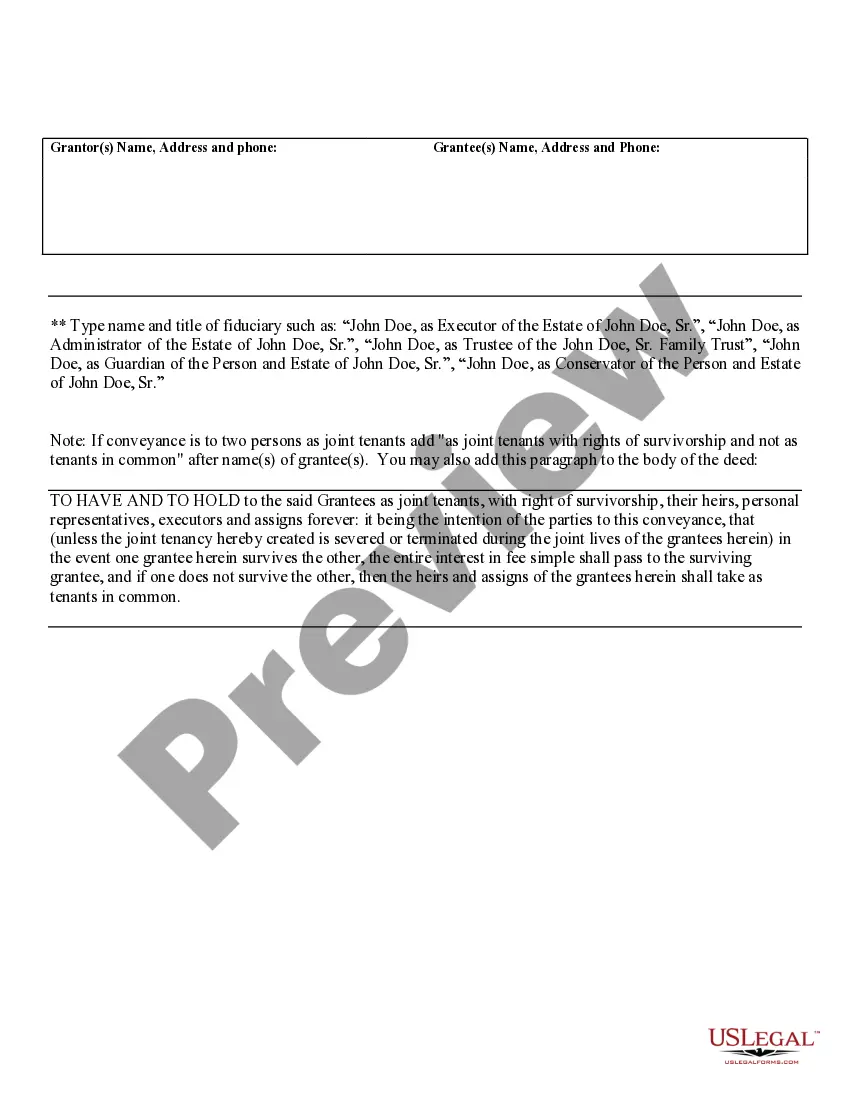

Oklahoma Executor Deed Form With Mortgage

Description

How to fill out Oklahoma Executor Deed Form With Mortgage?

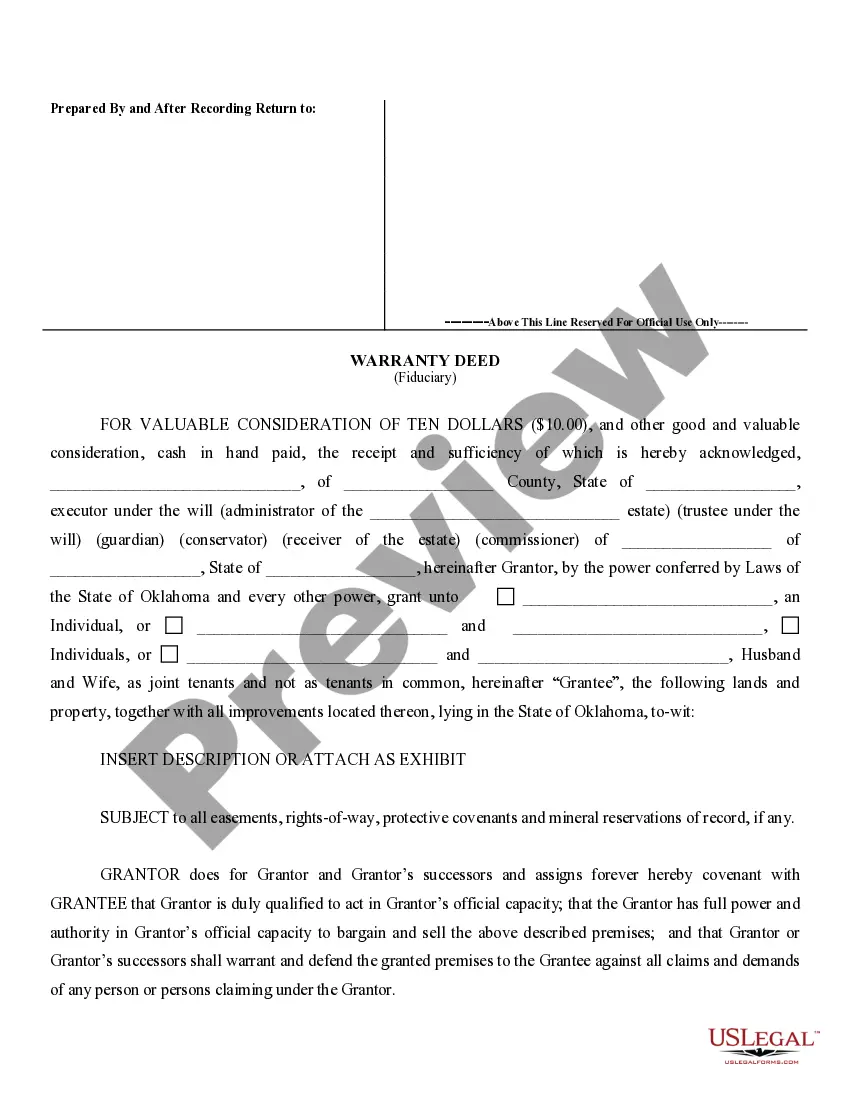

Properly composed official documentation serves as a crucial safeguard against issues and legal disputes, yet acquiring it without the aid of an attorney may be time-consuming.

Whether you're looking for a current Oklahoma Executor Deed Form With Mortgage or other forms related to work, family, or business scenarios, US Legal Forms is always available to assist.

The procedure is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you merely need to Log In to your account and click the Download button next to the chosen document. Additionally, you can access the Oklahoma Executor Deed Form With Mortgage at any time in the future, as all paperwork ever acquired on the platform remains accessible under the My documents tab of your profile. Save time and resources on preparing official documents. Experience US Legal Forms today!

- Verify that the form aligns with your circumstances and region by reviewing the description and preview.

- Search for additional examples (if necessary) using the Search bar located in the page header.

- Press Buy Now upon finding the appropriate template.

- Choose the pricing plan, Log In to your account, or create a new one.

- Select your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Select the file format, either PDF or DOCX, for your Oklahoma Executor Deed Form With Mortgage.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

In Oklahoma, the statute of limitations for enforcing a mortgage is typically five years. This time period begins from the date of default or when a payment has not been made. Keeping track of your mortgage terms is essential as you may utilize an Oklahoma executor deed form with mortgage for clarity in ownership and legal proceedings. Understanding these timelines enables better management of your mortgage obligations.

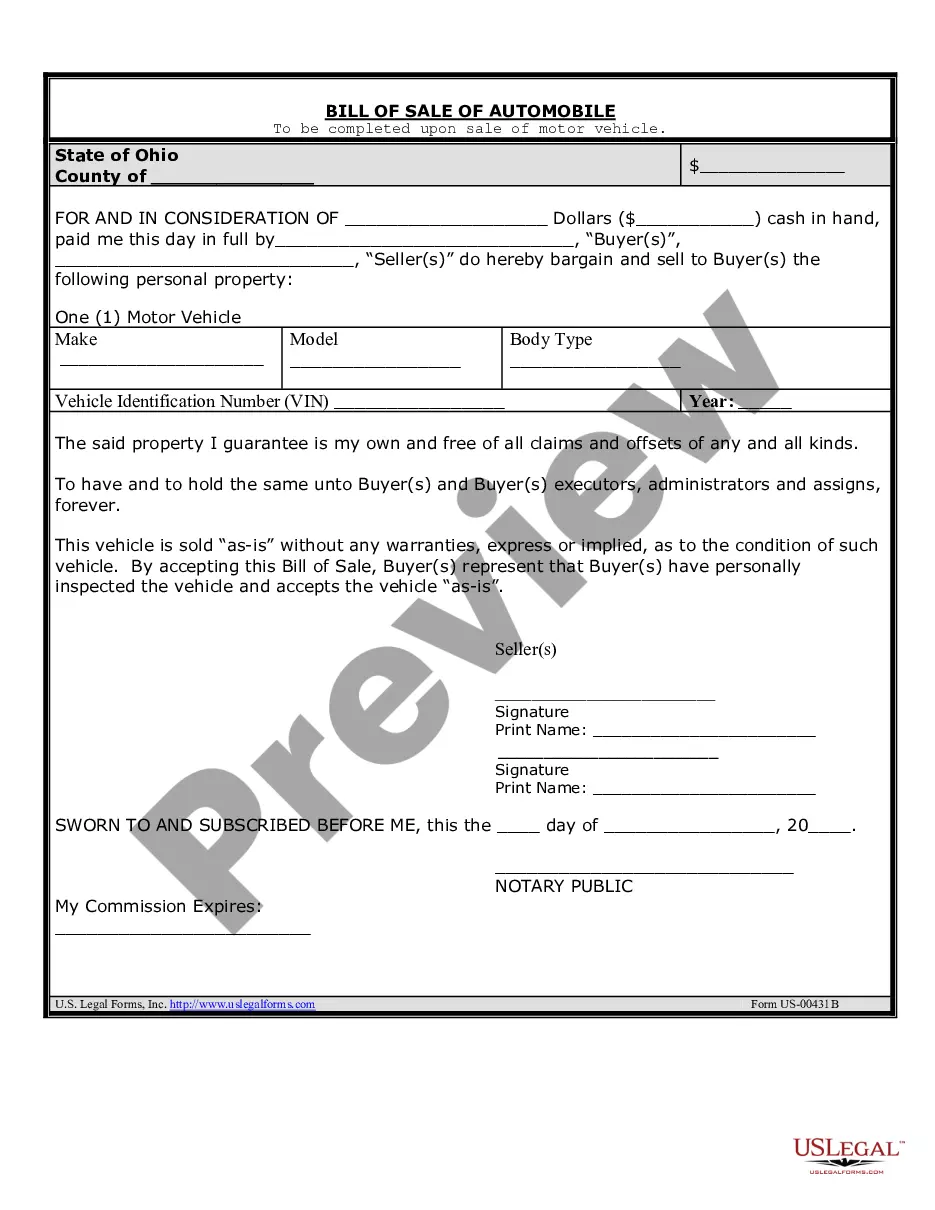

Transferring ownership of a house in Oklahoma typically involves completing a deed that details the property and the new owner's information. You can use an Oklahoma executor deed form with mortgage to streamline the process, ensuring all necessary information is included. Once completed, you'll need to file this deed with your county's clerk office. Proper documentation simplifies the transfer and clarifies ownership for future reference.

To obtain your house deed in Oklahoma, you should contact the county clerk's office where your property is located. They maintain public records, including property deeds. If you require an Oklahoma executor deed form with mortgage for any transactions, U.S. Legal Forms offers user-friendly templates to help you navigate the process. Staying organized and informed will facilitate smoother transactions.

Yes, Oklahoma allows transfers on death deeds. This type of deed enables property owners to pass their real estate to beneficiaries outside of the probate process. By using an Oklahoma executor deed form with mortgage, you ensure your wishes are clear and legally documented. Taking this route can save your loved ones time and expenses after your passing.

A ladybird deed, also known as an enhanced life estate deed, allows you to retain control of your property during your lifetime while designating a beneficiary for the property upon your death. This type of deed can avoid probate and provides flexibility in managing the property. If you are considering this option, the Oklahoma executor deed form with mortgage can be a useful resource to ensure the transaction aligns with your goals. Consulting a legal professional can help clarify details and benefits.

Yes, you can do a transfer on death deed in Oklahoma. This legal instrument allows you to designate a beneficiary who will receive your property without the need for probate after your death. By utilizing the Oklahoma executor deed form with mortgage, you can clearly outline your wishes, providing peace of mind for you and your loved ones. As always, it’s a good practice to seek legal guidance to navigate the specifics of your situation.

Transferring property title to a family member in Oklahoma can be done through a quitclaim deed or warranty deed. You will need to complete the necessary paperwork, which includes the Oklahoma executor deed form with mortgage if a mortgage is involved. After completing the form, you must file it with the appropriate county office to officially record the transfer. Always consider involving a legal expert to ensure all steps are appropriately handled.

To transfer a deed upon death in Oklahoma, you typically need to file a transfer on death deed. This deed must be signed and notarized while you are alive, and it becomes effective only upon your passing. Using the Oklahoma executor deed form with mortgage can simplify this process, ensuring that your intentions are clear and legally binding. It is advisable to consult with a legal professional to ensure compliance with all requirements.

You can obtain a copy of your house deed from the county clerk or the Register of Deeds in the county where your property is located. Many counties also provide online access to property records, making it easier to retrieve the deed. When updating or transferring property, using the correct Oklahoma executor deed form with mortgage is crucial to ensure accuracy and legality.

In Oklahoma, while there technically isn’t a strict timeframe for transferring property after death, it is beneficial to act quickly. This helps to avoid delays that might arise from potential disputes or confusion among heirs. Employing an Oklahoma executor deed form with mortgage can facilitate a timely and clear transfer, keeping everything organized.