Homeowners Association Lien Form With 2 Points

Description

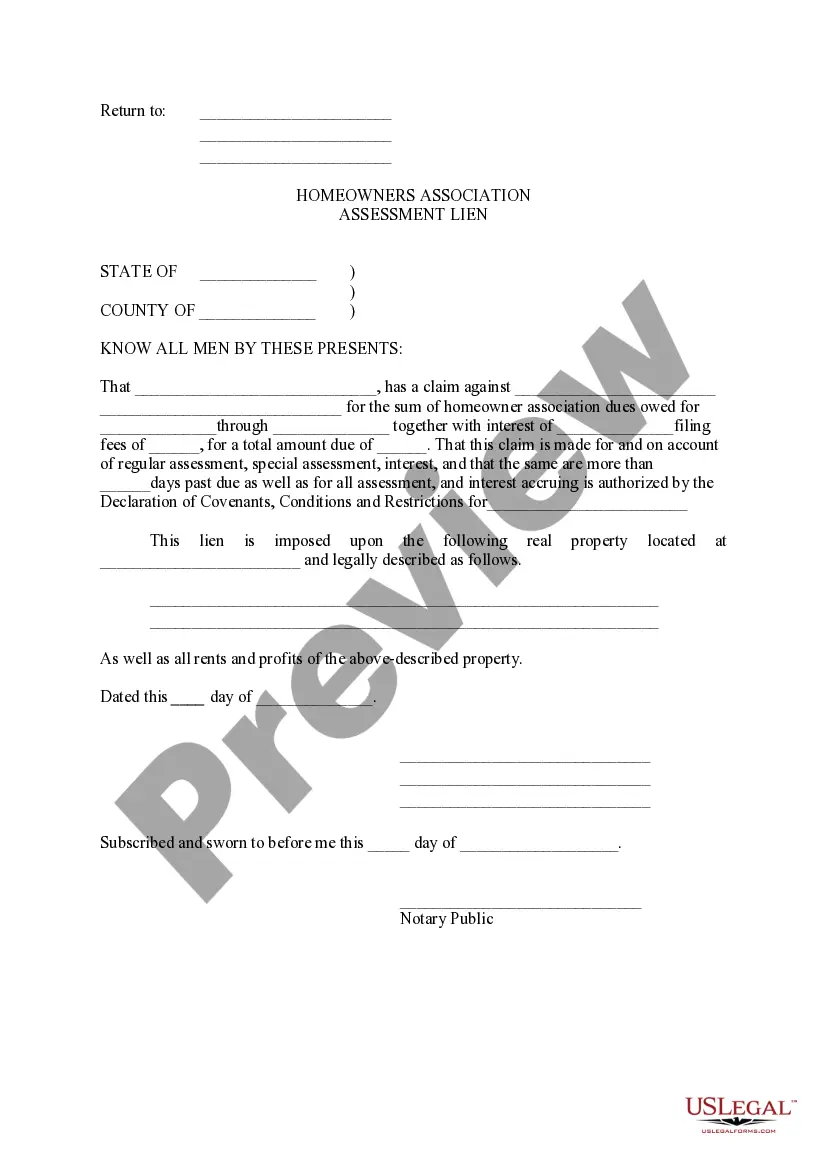

An assessment lien allows the HOA to sell the homeowner's property to repay assessments owed to the HOA.

Form popularity

FAQ

Yes, an HOA can place a lien on your house for violations of community rules, provided that the violations are associated with unpaid fines or assessments. It's important to address any notices from your HOA to avoid such actions. Using a homeowners association lien form can help you contest any penalties and seek an amicable resolution.

The statute of limitations for enforcing an HOA lien in Texas is typically four years from the date the assessment becomes due. Understanding this time frame is crucial for homeowners to ensure that they address any issues promptly. A properly completed homeowners association lien form can help you navigate this process smoothly.

Yes, HOAs possess certain powers in Texas, including the ability to regulate property use and enforce community rules. These powers also extend to placing liens on properties for unpaid assessments. If you find yourself in a dispute, utilizing a homeowners association lien form could be an effective first step in resolving the issue.

In Texas, an HOA lien remains valid for about four years. This time frame allows the HOA to take legal action to collect unpaid dues or enforce rules. If you need assistance, a homeowners association lien form can help you respond appropriately during this period.

Yes, California is recognized as a super lien state for homeowners associations. This designation means that an HOA's lien can take priority over other claims, including mortgages. Homeowners should be aware of this when filing a homeowners association lien form, as it significantly elevates the association's authority in recovery processes.

Yes, Washington permits the enforcement of tax liens against properties. This may coexist with homeowners association liens, impacting homeowners. When preparing a homeowners association lien form, it's important to consider the implications of both tax and association liens to protect your interests.

No, Washington state does not classify as a super lien state. Instead, the priorities among liens may differ, which can affect homeowners associations’ ability to enforce liens. Familiarity with this information empowers homeowners and associations when completing a homeowners association lien form.

Washington, D.C. operates as a super lien state, which means that homeowners associations have priority over other liens, including mortgages. This priority can be critical for associations when filing a homeowners association lien form. Understanding these dynamics can help property managers and homeowners navigate this aspect effectively.

Yes, Washington is a lien theory state. This means the mortgage serves as a lien on the property rather than transferring ownership to the lender. When dealing with homeowners association lien forms, it’s essential to understand how this impacts the enforcement of liens against homeowners.

While it's tempting to seek ways to avoid HOA fees, this can lead to severe consequences, including liens. It’s vital to recognize that these fees maintain community standards and services. If financial burdens arise, consider discussing your situation with the HOA board to explore possible options. Ignoring the dues can lead to a homeowners association lien form against your property, causing more significant challenges down the line.