Revocation Living Trust With A Will

Description

How to fill out Oklahoma Revocation Of Living Trust?

- If you already have an account with US Legal Forms, log in to access your saved forms and download the appropriate template.

- If this is your first time, begin by browsing the extensive collection. Use the Preview mode to review form descriptions and ensure it aligns with your specific needs and local laws.

- Should you find your chosen document unsuitable, utilize the Search feature to explore alternative templates that may better suit your requirements.

- Once you have the right document, click the Buy Now button and select your preferred subscription plan. You'll need to create an account to gain access.

- Complete your purchase by entering your payment details or using PayPal for convenient checkout.

- After your transaction is successful, download the completed form to your device and find it later in the My Forms section of your profile.

By following these straightforward steps, you can access a wealth of legal resources that ensure your trust is established accurately and effectively.

Start your journey towards peace of mind today. Leverage the robust offerings of US Legal Forms to streamline your legal document needs.

Form popularity

FAQ

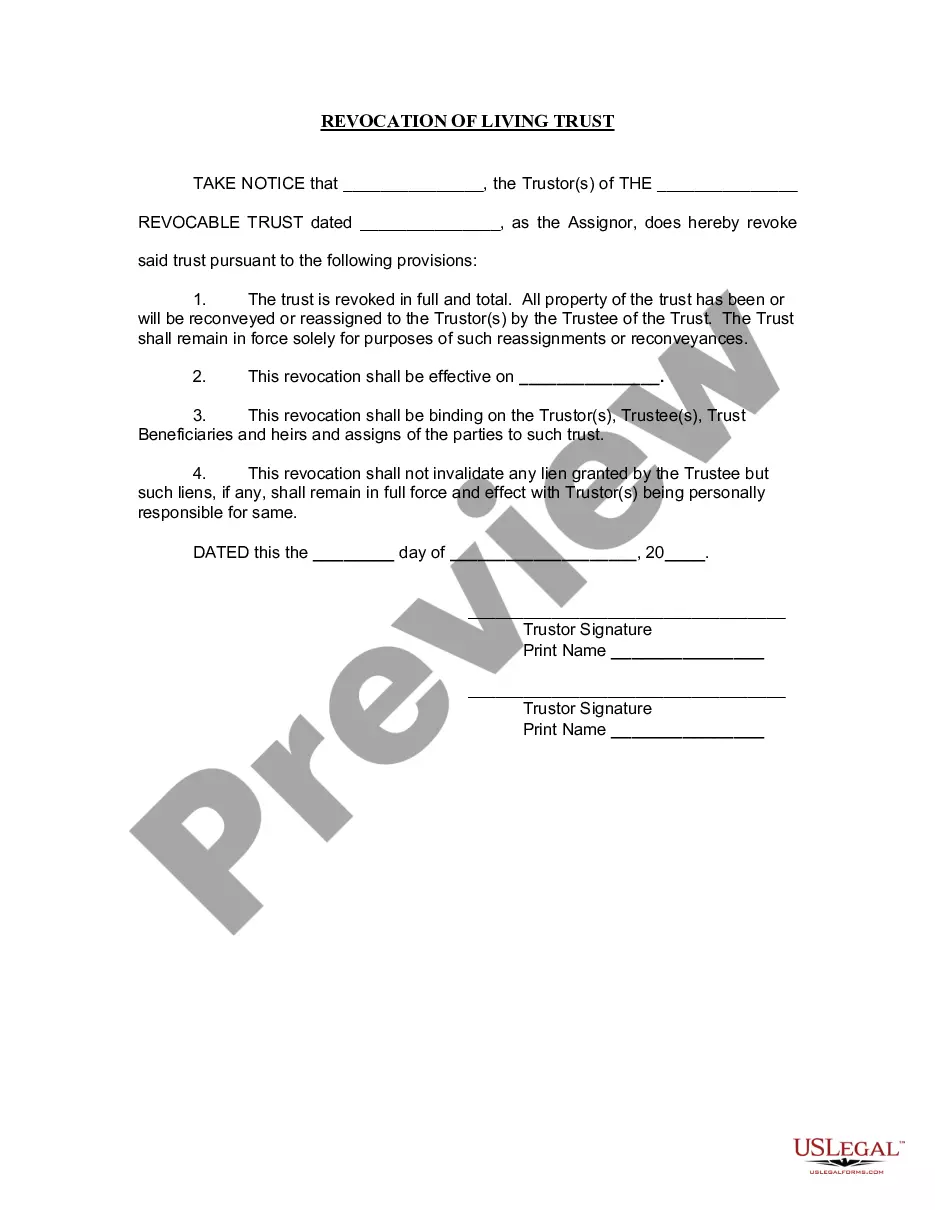

Revoking a revocable trust is generally a straightforward process, especially if you have the right documentation in place. Typically, you will need to create a written revocation document and follow the steps outlined in your trust agreement. While it’s manageable, remember that clarity is crucial, particularly when considering revocation living trust with a will. Platforms like uslegalforms can simplify this process with user-friendly templates and resources.

Yes, a revocable living trust allows the creator to revoke or dissolve it at any time during their lifetime. This flexibility is one of the primary benefits of a revocable living trust, as it provides you control over your assets. If you are navigating revocation living trust with a will, ensure you follow the proper procedures to maintain legality. Trusted resources like uslegalforms can assist you in this process.

One of the biggest mistakes parents make when setting up a trust fund is failing to properly fund the trust. They may create the trust but neglect to transfer assets into it, which defeats its purpose. Without the right assets in the trust, your wishes may not be effectively enacted, especially when you consider revocation living trust with a will. Using platforms like uslegalforms can provide guidance on properly funding your trust.

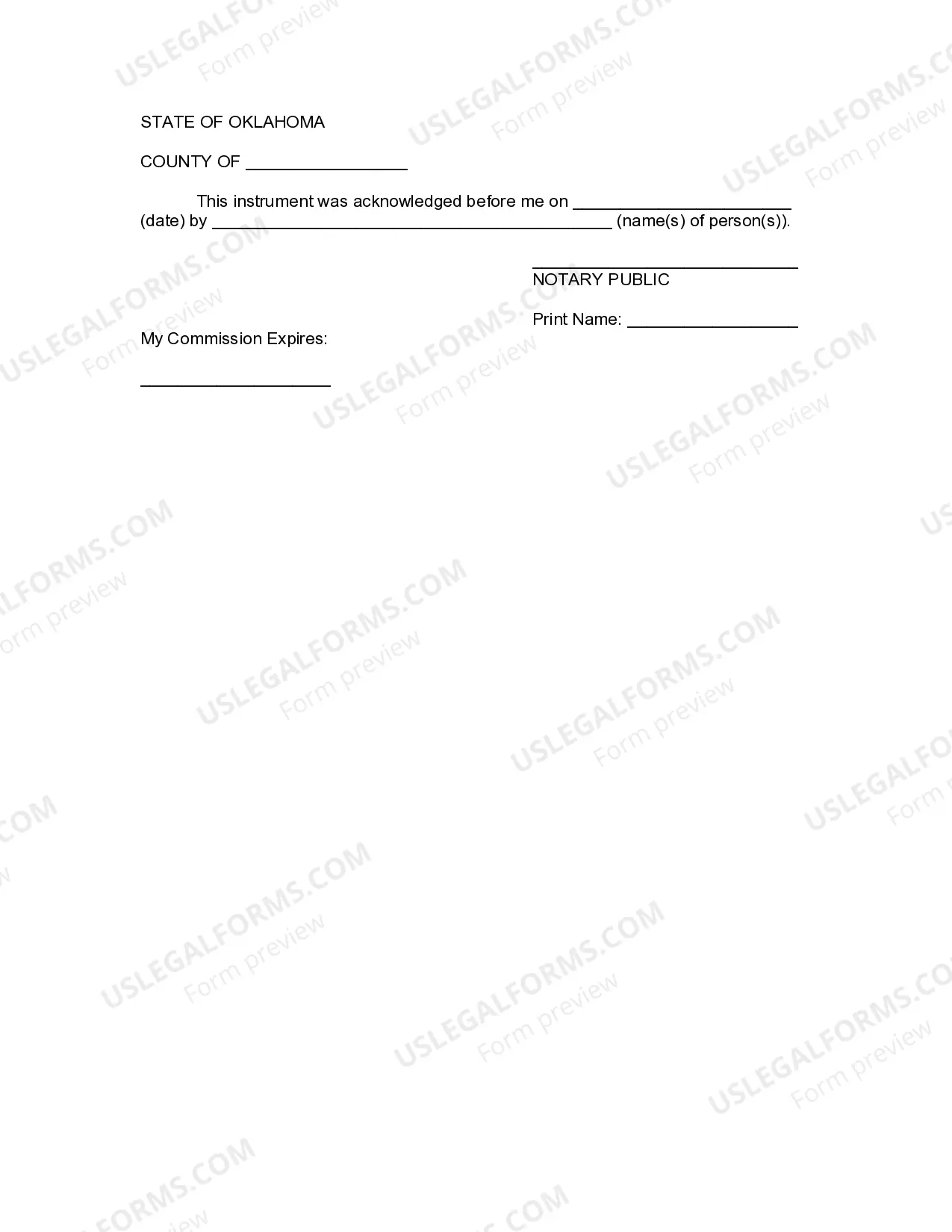

To revoke a revocable living trust, you typically need to draft a revocation document that states your intent to dissolve the trust. It's important to follow the specific procedures outlined in your trust document for revocation. After completing the necessary paperwork, make sure to notify all relevant parties about the revocation to ensure transparency. When dealing with revocation living trust with a will, consulting legal resources can be very beneficial.

A sample of revocation of living trust is a template document that serves as an example for creating your own revocation notice. This document usually includes the name of the trust, the date it was established, and a statement indicating your desire to revoke it. Utilizing a sample can simplify the process, especially if you're learning about revocation living trust with a will. You can find samples easily at uslegalforms.

A form to dissolve a revocable trust is a legal document that formally cancels the trust agreement. This form outlines the intent to revoke the trust and typically requires the signature of the trust creator. If you are considering revocation living trust with a will, using a well-structured form ensures clarity and legality. You can find templates for this form on platforms like uslegalforms.

A revocation living trust with a will can indeed supersede the will for assets held within the trust. This means that if you have designated specific property or assets to be managed by the trust, those instructions take priority over your will. However, any assets not included in the trust remain under the will's direction. It's essential to ensure that both documents align to fully encapsulate your wishes.

The 5-year rule for trusts generally refers to the period during which assets placed into a trust must remain to avoid being included in your taxable estate. If you create a revocation living trust with a will and transfer assets, be aware that these assets may be subject to tax consequences if withdrawn before the five-year mark. It is important to consult with a tax advisor to understand how this ruling may impact your estate planning.

In most cases, a revocation living trust with a will takes precedence over the will for assets placed in the trust. When creating these estate planning documents, you typically designate that your trust dictates the distribution of those specific assets. However, any assets not included in the trust are subject to the terms of your will. It's crucial to ensure that your documents reflect your intentions clearly to avoid confusion.

A revocation living trust with a will typically holds more power in managing your estate. While a will outlines how your assets will distribute after your passing, a trust manages those assets during your lifetime and can avoid probate. This means that a revocation living trust allows for greater control and flexibility over your assets while you are alive. Ultimately, both play important roles, and their effectiveness often depends on your personal goals.