Revocation Living Trust Form For A Property

Description

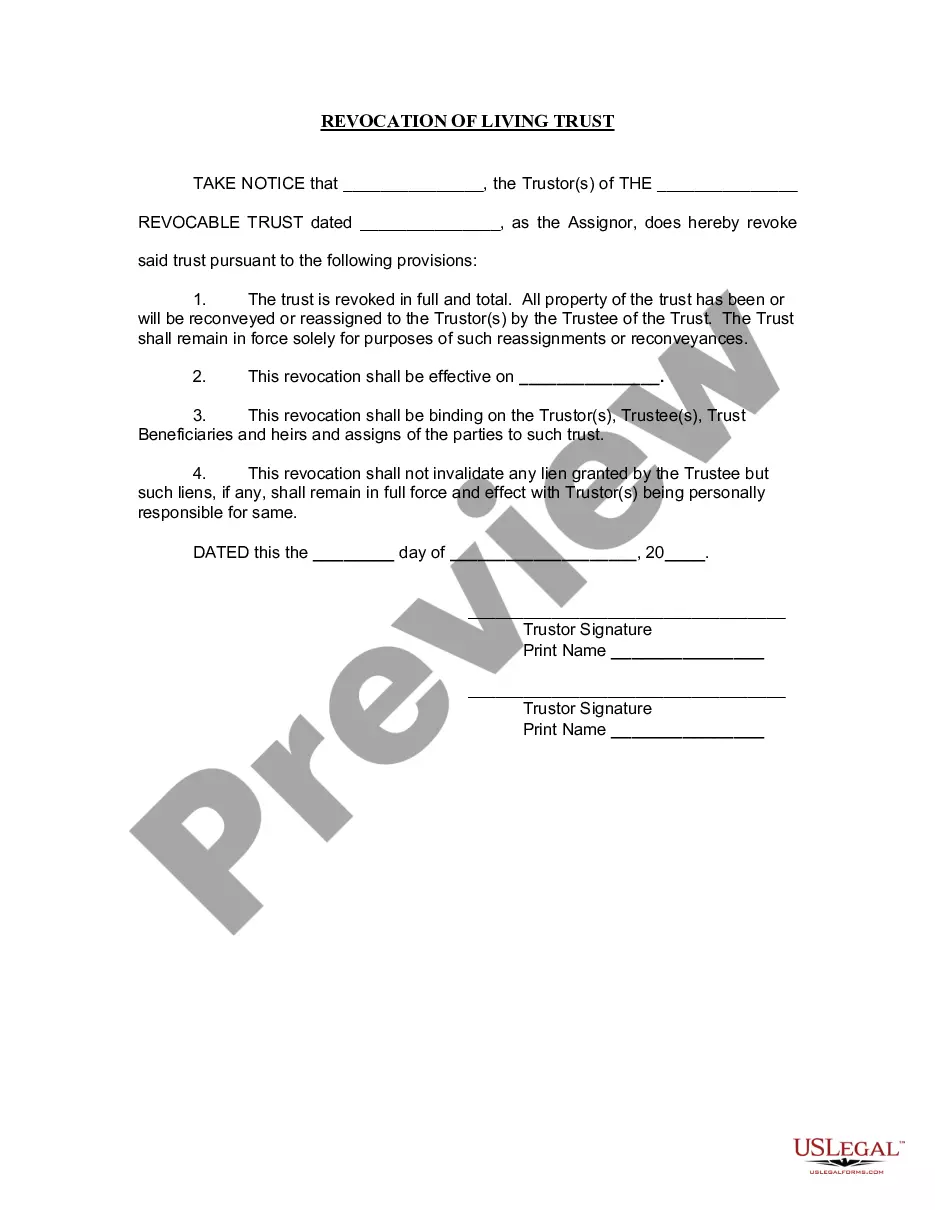

How to fill out Oklahoma Revocation Of Living Trust?

- Log into your account on US Legal Forms if you are a returning user. Ensure your subscription is current to access the necessary templates.

- For first-time users, start by searching for the revocation living trust form. Use the Preview feature to verify it meets your specific requirements.

- If you need additional forms, utilize the Search bar to find alternatives until you identify the right template.

- Purchase the document by clicking the Buy Now button. Choose a subscription plan that fits your needs and create an account for access.

- Complete the payment using a credit card or PayPal to finalize your subscription.

- Download your revocation living trust form to your device and access it later in the My Forms section of your account.

Utilizing US Legal Forms not only saves time but also provides the assurance that your legal documents are accurate and compliant. Their vast collection surpasses competitors, making it easy to find the forms needed for various legal situations.

Start simplifying your legal processes today. Visit US Legal Forms and ensure your property transactions are secure and legally sound.

Form popularity

FAQ

Generally, a nursing home cannot directly take your revocable trust assets, but your income and resources may be assessed for Medicaid eligibility. If you need long-term care, your assets within the revocable trust could potentially be counted against you. Preparing a revocation living trust form for a property can help you plan your estate effectively, considering these factors.

You can revoke a revocable trust by creating a revocation living trust form for a property, which clearly states your intent to dissolve the trust. This process typically requires you to notify the trustee and specify how to handle the trust assets. Always ensure you follow the legal requirements in your state to avoid complications down the road.

A revocable trust becomes irrevocable when the grantor passes away, as they can no longer modify the trust terms. This change ensures that the trust property is distributed according to the established trust document. If you are concerned about this transition, completing a revocation living trust form for a property can help clarify your intentions while you are alive, giving you control over your assets.

Revoking a revocable trust is generally an easy process, primarily depending on how the trust was originally created. You can usually do this by executing a trust revocation declaration, which nullifies the previous trust. However, it is crucial to ensure that all assets are properly transferred or managed afterward. Utilizing a revocation living trust form for a property can make the revocation process straightforward and legally sound.

Writing up a revocable trust involves outlining the trust's rules and stipulations clearly. You'll want to detail who will manage the trust, known as the trustee, and specify how the assets will be distributed upon your passing. Using a streamlined revocation living trust form for a property can simplify this process, guiding you through the essential components to ensure compliance and effectiveness.

A trust revocation declaration typically includes a clear statement indicating the intention to revoke a previous trust. It should specify the trust's name and the date it was originally established. For example, a declaration might state, 'I, Your Name, hereby revoke the revocable trust established on date.' This process can be efficiently managed using a revocation living trust form for a property, ensuring all legal requirements are met.

Certain assets generally should not be placed in a revocable trust. For example, assets that have designated beneficiaries, such as 401(k) accounts or life insurance policies, may complicate the transfer process. Real estate with existing mortgages, or assets requiring oversight from custodial accounts, may also need special consideration. A clear revocation living trust form for a property can help you identify which assets to include and what to leave out.

It is typically advised not to include certain types of property in a revocable trust. For instance, retirement accounts and life insurance policies often benefit from designated beneficiaries, making inclusion unnecessary. Furthermore, some properties may require special handling or should remain outside the trust for tax or legal reasons. To ensure proper management, utilize a revocation living trust form for a property tailored to your unique situations.

One common mistake parents make when setting up a trust fund is failing to communicate their intentions clearly to their children. This lack of communication can lead to confusion and family disputes in the future. Additionally, many overlook the importance of properly funding the trust, which can jeopardize its intended purpose. To streamline this process, consider using a reliable revocation living trust form for a property that ensures all assets are included.

Avoid placing certain items like life insurance policies or retirement accounts directly into a revocable trust, as these typically have designated beneficiaries. Additionally, personal assets with little monetary value may not require inclusion, as it can complicate the trust's management. Understanding how to fill out a revocation living trust form for a property can help you make informed choices about what assets to include for better efficiency.