Form Fl-142

Description

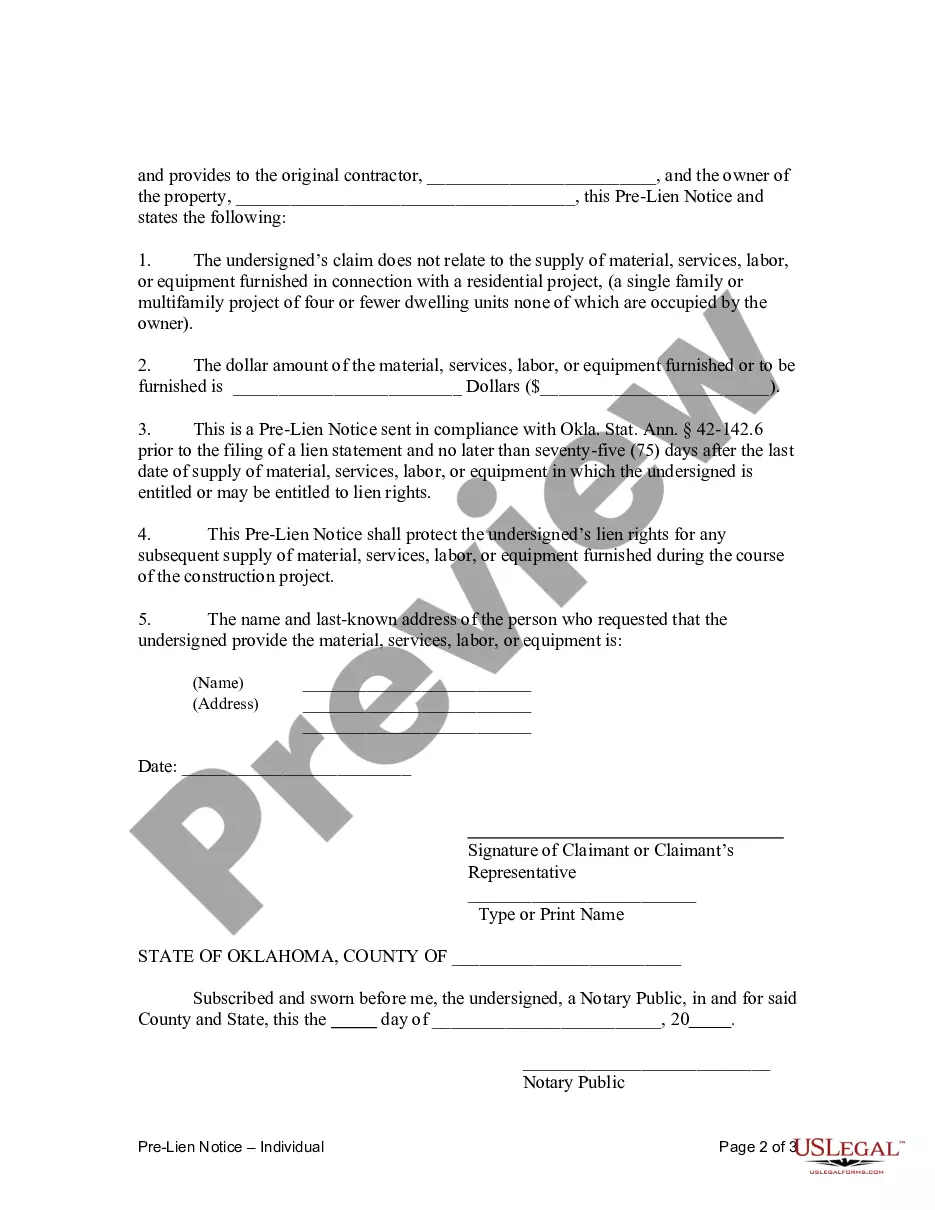

How to fill out Oklahoma Pre-Lien Notice - Individual?

- Log in to your US Legal Forms account or create a new account if you’re a first-time user.

- Once logged in, search for Form FL-142 in the extensive library. Use the preview mode to verify it meets your local jurisdiction requirements.

- If the form is not suitable, utilize the search function to find another template that fits your specific needs.

- Proceed to purchase the document by clicking 'Buy Now' and selecting your preferred subscription plan.

- Complete the payment process using your credit card or PayPal account.

- After confirming your purchase, download Form FL-142 to your device. It will also be stored in the 'My Forms' section of your profile for future access.

By following these steps, you can efficiently acquire Form FL-142 and benefit from the robust features offered by US Legal Forms.

Experience the convenience and accuracy of legal documentation today—visit US Legal Forms to get started!

Form popularity

FAQ

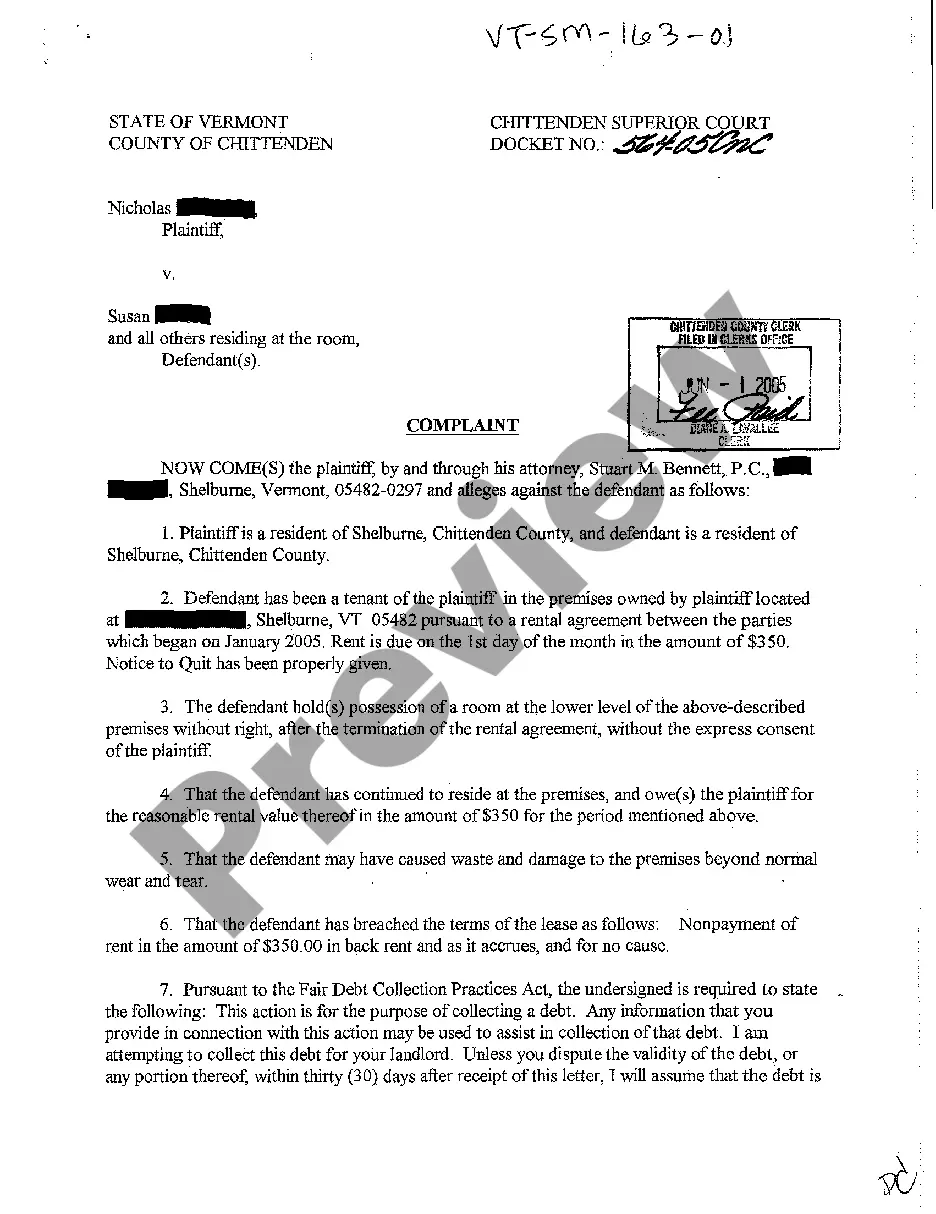

In a civil case, the plaintiff is the party that initiates the lawsuit, while the defendant is the individual or entity being sued. This distinction is critical, as it sets the stage for the legal arguments and responsibilities during the case. Understanding these roles can clarify the legal process, especially when dealing with filings like Form fl-142 that involve financial disclosures.

FL 140 is used to disclose financial information, while FL 141 is specifically for detailing income and expenses. Both are crucial in divorce proceedings but serve distinct purposes. Accurate completion of FL 140 and FL 141 provides a transparent financial landscape that aids in resolving disputes, which also aligns with the disclosures required under Form fl-142.

Use FL 160 when parties involved in a separation or divorce need to establish child custody and visitation agreements. This form outlines the proposed parenting plan, ensuring that the needs of the child are prioritized. It's essential to complete FL 160 accurately to promote healthy co-parenting and to complement any filings involving Form fl-142.

You will need to file Form fl-142 in cases where disclosures are required by the court during divorce or legal separation. This form assists in providing accurate and comprehensive financial disclosures. By filing FL 142, you ensure both parties have a complete understanding of assets and liabilities, facilitating a smoother resolution.

Yes, both parties must file FL 141 when they are involved in a divorce case. This form outlines the income and expenses of each party, contributing to fair negotiations. Filing FL 141 helps establish a clear financial context, which ultimately supports the proceedings and addresses any concerns related to the Form fl-142.

The preliminary declaration of disclosure serves as a starting point in divorce proceedings. It provides an initial overview of financial information, while the final declaration of disclosure, often associated with the Form fl-142, provides a complete account of financial information when the marriage is ending. Essentially, the preliminary is a snapshot, and the final is the full picture, ensuring transparency for both parties.

The schedule of assets and debts for FL-142 outlines all the properties you own and the debts you owe. It is part of the financial disclosure required during divorce proceedings, aimed at achieving a fair resolution. By accurately detailing your financial situation, you can streamline the process and avoid disputes. Utilizing tools available on US Legal Forms can simplify filling out this essential schedule.

Yes, you must file Form FL-142 with the court as part of your divorce proceedings. This form provides the court with essential financial information that assists in asset division and support calculations. Ensure you file it along with other required documents to avoid delays in your case. Always check local rules or consult with a legal professional to confirm your filing responsibilities.

Filling out a financial statement for divorce requires careful attention to your income, expenses, assets, and liabilities. Start by gathering your financial documents, then complete each section of Form FL-142 methodically. Be honest and thorough in your disclosures, as this will aid the court in making informed decisions. If you face challenges, platforms like US Legal Forms can guide you through the process.

The schedule of assets and liabilities is a document used in financial disclosures, particularly during divorce proceedings. It provides a detailed list of your owned assets and any debts you may have. Using Form FL-142, this schedule helps ensure you disclose all financial information to the court. This transparency is crucial for fair division of property.