Revocation Living Trust With A Beneficiary

Description

How to fill out Ohio Revocation Of Living Trust?

- Log in to your US Legal Forms account if you’re a returning user and verify your subscription status. Click the Download button to obtain the necessary template for revocation.

- If you’re new to the service, start by browsing the extensive library. Use the Preview mode to confirm you’ve found the right revocation form that fits your legal requirements.

- Should you need a different template, use the Search tab to locate the appropriate form that aligns with your needs.

- Initiate the purchase process by clicking on the Buy Now button, selecting the subscription plan that suits you best. Create an account to access premium features.

- Complete your purchase safely using credit card details or PayPal. After confirmation, download the revocation form directly to your device.

- Access your purchased documents effortlessly in the My Forms section of your profile whenever you require them.

Utilizing US Legal Forms not only saves you time but ensures you have access to a robust collection of legal documents that cater to your specific needs. This resource empowers both individuals and attorneys without the hassle of traditional legal processes.

Take control today! Start your journey by visiting US Legal Forms and find the perfect template to revoke your living trust with a beneficiary.

Form popularity

FAQ

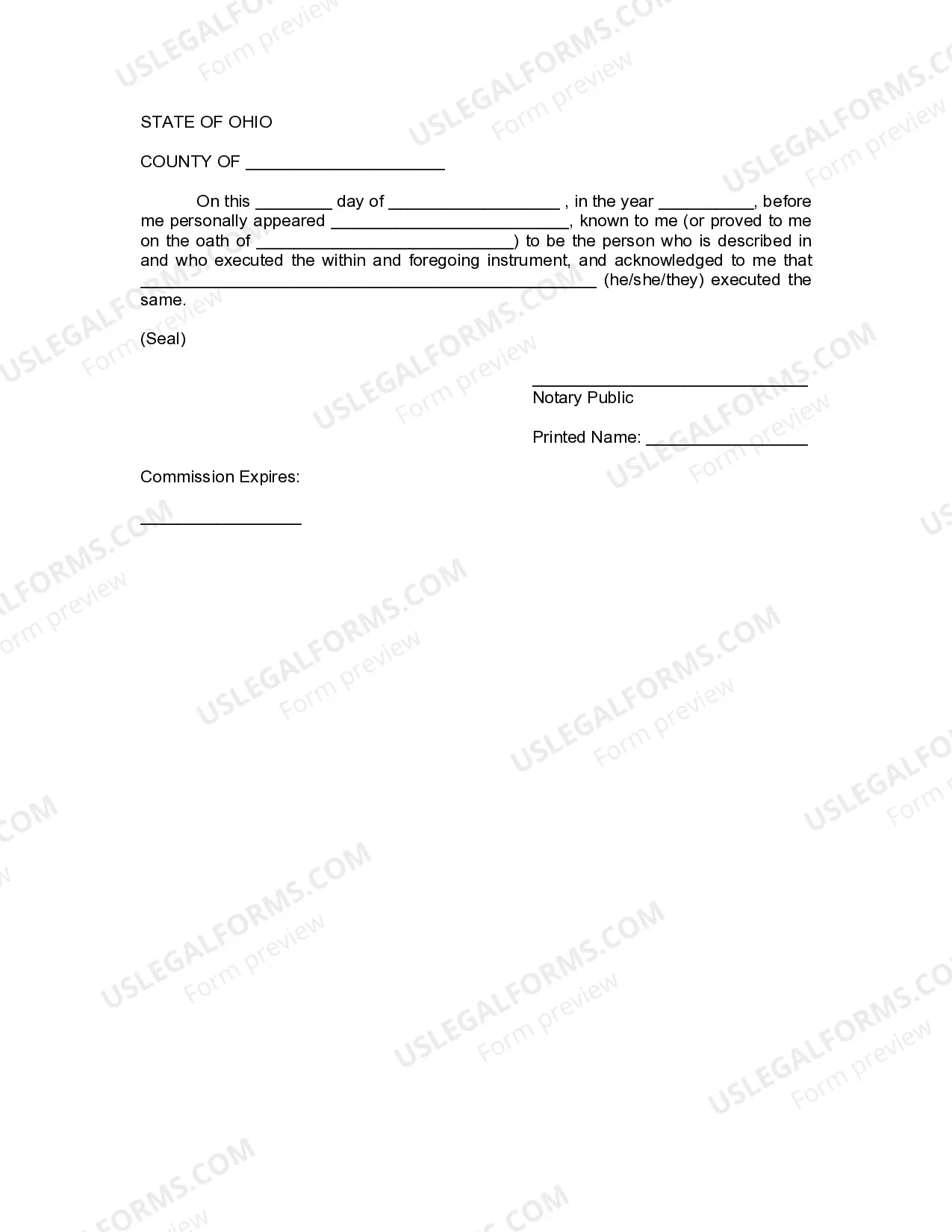

Revoking a revocable trust with a beneficiary is generally straightforward. You need to follow the steps outlined in the trust document itself, which often include drafting a revocation declaration and notifying the involved parties. Using a reliable service like US Legal Forms can simplify this process, as they provide the necessary documents and guidance to ensure that the revocation of your living trust complies with legal requirements. Keep in mind that this process helps you maintain control over your assets and can adapt to changes in your circumstances.

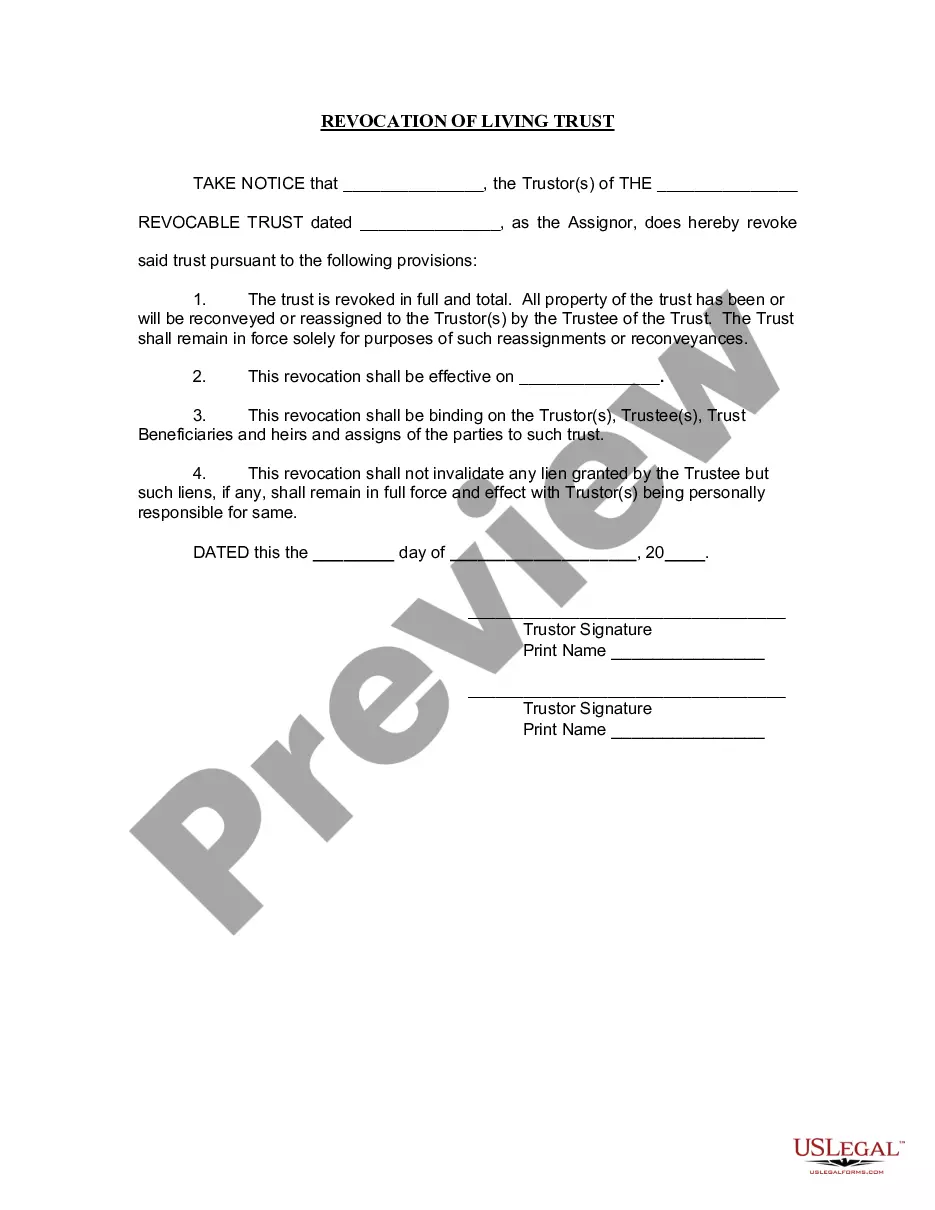

A sample of revocation of a living trust typically includes a written document that explicitly states the intention to revoke the trust. This document should mention the trust's name and the date it was established, as well as indicate that all provisions are void. It’s crucial to execute the revocation properly, especially if you have a revocation living trust with a beneficiary, as this ensures that your beneficiaries understand the changes. To create a valid revocation document, consider using resources from US Legal Forms for guidance.

One major mistake parents often make when establishing a trust fund is failing to specify the beneficiaries clearly. Without clear instructions, conflicts may arise among family members after your passing. It is essential to outline the roles of a revocation living trust with a beneficiary to avoid confusion. Engaging a trustworthy service like US Legal Forms can assist you in creating a well-defined trust that meets your family's needs.

An example of a revocation of a trust is when an individual decides to disband their revocable living trust due to changes in personal circumstances, such as marriage or divorce. In this case, they would typically execute a written document that outlines the decision to revoke the trust and distribute its assets accordingly. This action exemplifies a proactive approach in managing a revocation living trust with a beneficiary, helping to maintain clarity and intent in estate planning.

Yes, a beneficiary of a trust can be removed, though this process depends on the trust's terms and applicable state laws. When considering the revocation living trust with a beneficiary, it's crucial to review the trust document for any conditions that govern changes in beneficiaries. You may need to formally amend the trust, often requiring legal assistance to ensure compliance and clarity.

To revoke a revocable living trust, you must follow specific legal steps. Begin by reviewing the trust document to identify the revocation process it outlines. Next, prepare a written revocation notice that explicitly states your intention to end the trust. Finally, sign the notice and notify any beneficiaries of the revocation, ensuring that the trust's assets are properly managed afterwards.

A trust can be terminated through revocation by the creator, when its purpose has been fulfilled, or by court order. Revocation often involves a clear declaration of intent, while fulfillment can occur when the trust has executed its intended distributions. Understanding these methods can help you manage your revocation living trust with a beneficiary effectively and ensure your estate plans are clear and actionable.

A trust may be invalid if it lacks clear intent, is not properly funded, or if it violates state laws. Additionally, a lack of the creator's legal capacity or undue influence from others can render a trust invalid. For those concerned about potential invalidation, a thorough review of their revocation living trust with a beneficiary is recommended.

A living trust does not necessarily override a beneficiary designation unless explicitly stated in the trust document. If your living trust has specific terms regarding asset distribution, those terms will prevail over standard beneficiary designations. Therefore, reviewing your revocation living trust with a beneficiary is essential to ensure it reflects your current wishes.

The 5-year rule refers to IRS provisions concerning the tax implications of trusts and days of asset transfers, typically impacting Medicaid eligibility. If a person transfers their assets into a trust and seeks Medicaid within five years, those assets can be counted against their eligibility. Therefore, understanding this rule is crucial when discussing revocation living trust with a beneficiary, especially for future planning.