Revocation Living Trust For Foreigners

Description

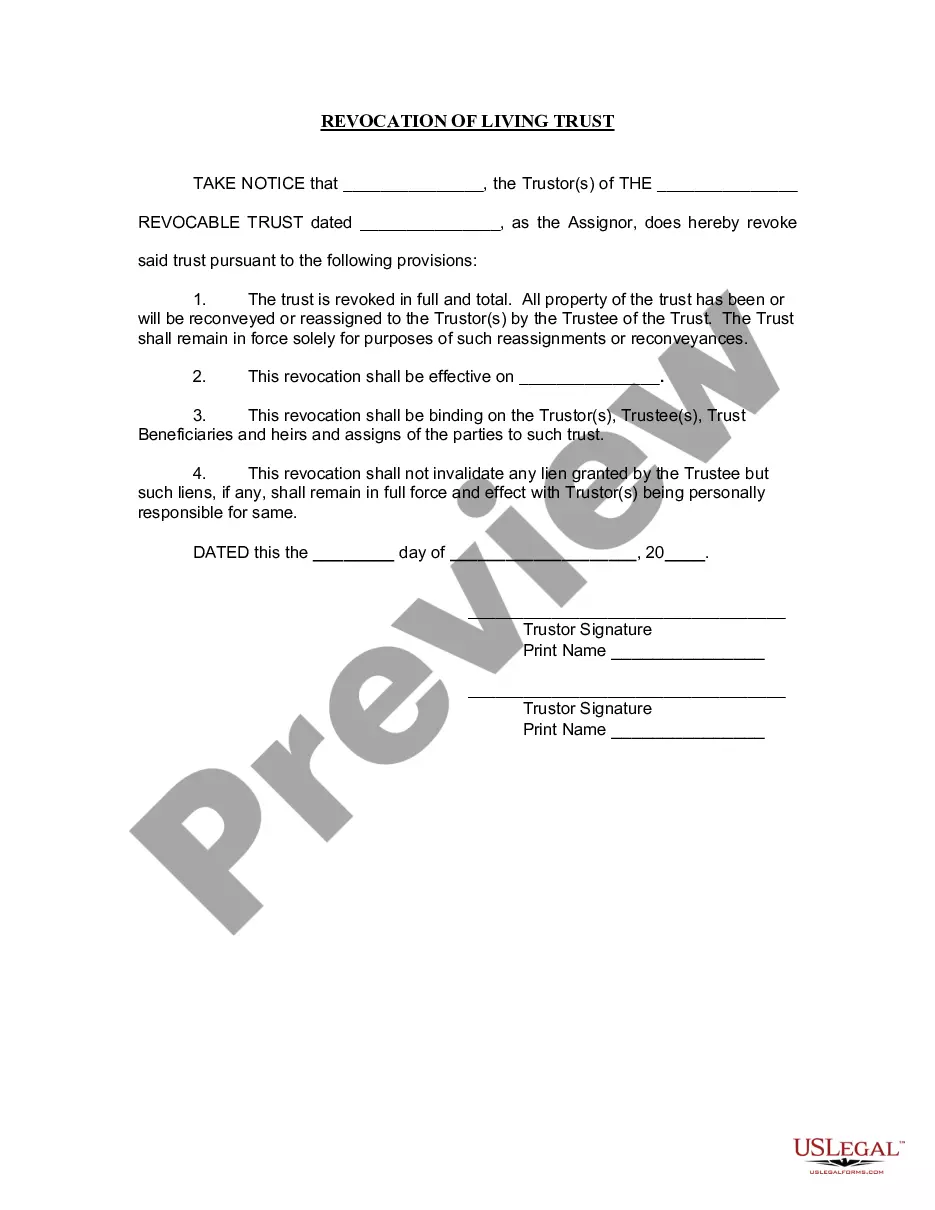

How to fill out Ohio Revocation Of Living Trust?

- Log in to your existing US Legal Forms account and ensure your subscription is active. If necessary, renew your subscription to maintain access.

- Review the available forms by checking the Preview mode and description to find the correct document that meets your legal needs and jurisdiction.

- If the form doesn't match your requirements, use the Search tab to find an alternative template that suits your situation.

- Purchase the required document by clicking the 'Buy Now' button and select a subscription plan that fits your budget. Registration for an account is essential to gain full access to the resources.

- Complete your purchase by entering your payment details via credit card or PayPal to finalize your subscription.

- Download your form to your device for immediate use, and access it anytime through the 'My Forms' section in your profile.

Using US Legal Forms not only grants you access to a vast library of over 85,000 legal documents but also ensures you receive expert assistance for accurate completion. This empowers you to create legally sound documents confidently.

Don’t hesitate—get started now with US Legal Forms to ensure your revocation living trust is managed smoothly and professionally!

Form popularity

FAQ

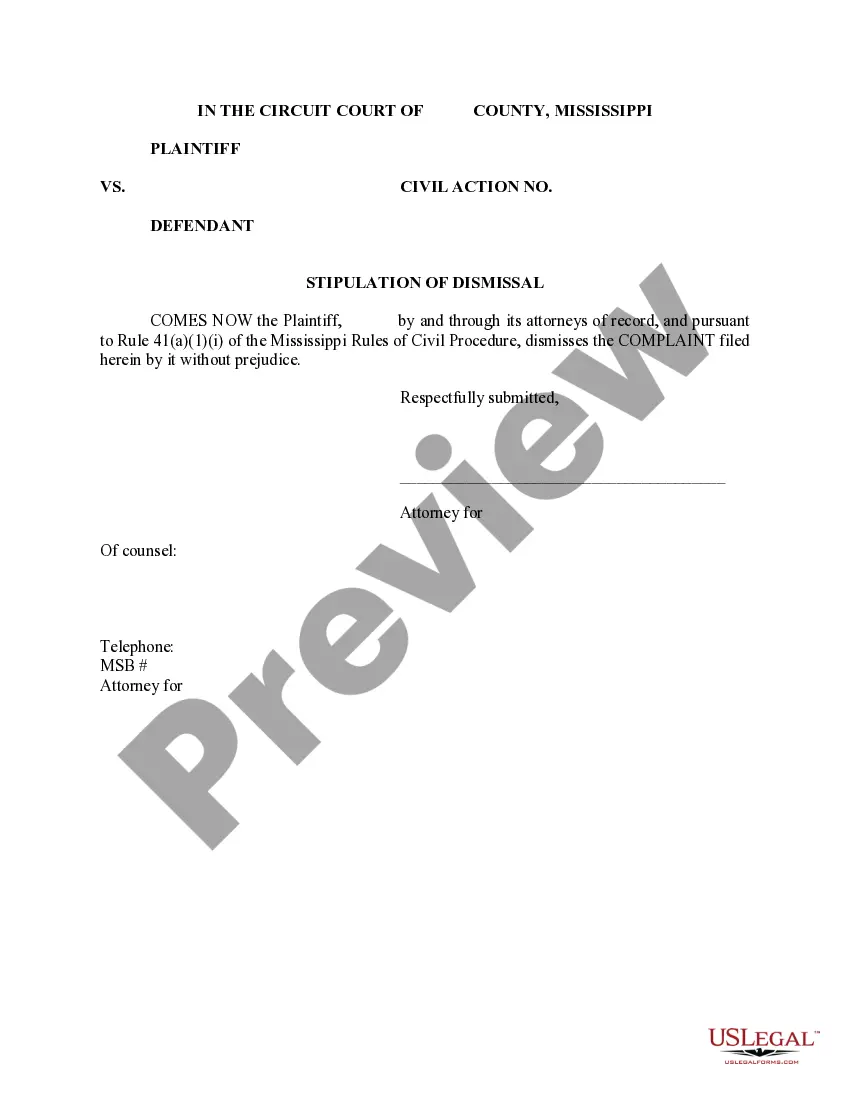

To shut down a trust, the process typically involves formally revoking it through a written document, distributing the trust assets to beneficiaries, and settling any outstanding obligations. For those with a revocation living trust for foreigners, this process can provide clarity and ease in managing your estate. It's crucial to ensure that all legal requirements are met, making it beneficial to utilize platforms like US Legal Forms to navigate the complexities of trust termination.

There are several ways to terminate a trust, including revocation by the grantor, expiration of the trust term, or material change in circumstances. For foreigners considering a revocation living trust for foreigners, understanding these termination methods is essential. Each method may involve different legal processes, so it is wise to consult a legal professional who specializes in estate planning.

A significant mistake parents often make is failing to communicate their intentions clearly with their heirs. Without proper discussions, beneficiaries might misunderstand their roles and the trust’s purpose. Furthermore, ensuring the trust aligns with the goals of a revocation living trust for foreigners can help avoid misunderstandings down the road.

If your parents aim to protect their assets and streamline the distribution process after passing, setting up a trust can be beneficial. However, they should consider if the costs and complexity are worth the potential benefits. Engaging professionals to understand a revocation living trust for foreigners may also help clarify options for asset management.

A notable downfall of having a trust is the complex legal framework that may confuse some individuals, especially if they are unfamiliar with estate planning. This complexity can lead to errors in asset management or compliance issues. Therefore, understanding the nature of a revocation living trust for foreigners is essential to navigate these challenges more effectively.

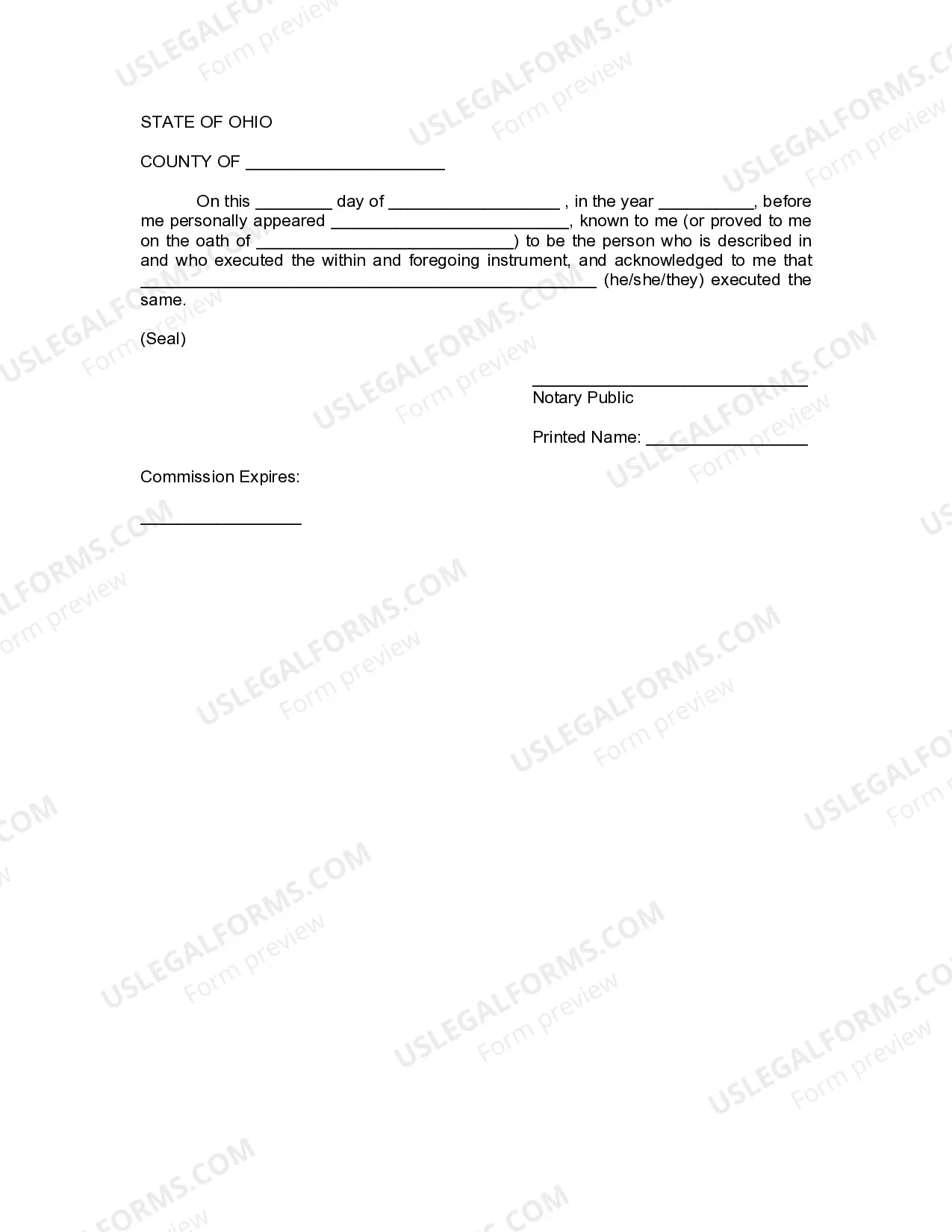

To revoke a revocable living trust, you typically need to create a written revocation document or follow the process specified in the trust agreement. It's important to notify all beneficiaries and relevant parties to avoid confusion. For foreigners, using a platform like USLegalForms can simplify this process, providing clear templates to ensure that all legal terms are correctly addressed.

While a family trust offers benefits like privacy and asset protection, one significant disadvantage is the potential for family disputes over trust management and distribution. It's crucial to communicate clearly with beneficiaries and ensure everyone understands the terms of the trust. As part of the revocation living trust for foreigners, revise the trust structure periodically to prevent such conflicts.

A trust revocation declaration is a formal document that nullifies an existing trust. For instance, if a foreigner established a revocable living trust, they could create a declaration stating their intent to revoke this trust and name all assets to be withdrawn. This process allows for a clearer transition and understanding of asset distribution, particularly for personal circumstances.

One downside of placing assets in a trust is the associated costs, which can include legal fees, setup expenses, and ongoing maintenance costs. Additionally, while a living trust helps avoid probate, it may not provide complete protection against creditors. As a foreigner, it's essential to understand how a revocation living trust for foreigners can impact your asset management and succession planning.

To invalidate a living trust, one must typically provide clear evidence that the trust was created under duress, fraud, or that the creator lacked the mental capacity. Alternatively, the creator can formally revoke the trust by executing a revocation document. If you're establishing a revocation living trust for foreigners and want to ensure its validity, utilizing resources from uslegalforms can be beneficial.