Amendment Living Trust With The Beneficiary

Description

How to fill out Ohio Amendment To Living Trust?

- If you're a returning user, log in to your US Legal Forms account and navigate to the form section. Ensure your subscription is active; renew if necessary.

- For new users, start by browsing the extensive library. Utilize the Preview mode to check the form details and confirm it suits your needs.

- Use the Search option if the form is not suitable. Find an alternative that meets your requirements.

- Select the desired document by clicking 'Buy Now' and choose your preferred subscription plan. You will need to create an account to access resources.

- Complete your purchase by entering your payment information using a credit card or PayPal.

- Download your chosen form to your device and find it in your 'My Forms' section whenever you need it.

By utilizing US Legal Forms, you ensure a smooth experience in creating your amendment living trust with the beneficiary. The service not only offers a wealth of resources but also provides access to experienced professionals for help in completing your documents.

Embrace a hassle-free legal document process today by signing up for US Legal Forms and take control of your estate planning effectively!

Form popularity

FAQ

You do not necessarily need a lawyer to amend a living trust with the beneficiary. Many individuals handle simple amendments on their own using online resources. However, seeking legal advice can provide clarity on complex changes, ensuring that your amendments are valid and meet state requirements. Platforms like uSlegalForms offer tools and templates that guide you through the amendment process, making it easier for you to manage your trust effectively.

An amendment to a trust typically does not need to be recorded with a state office, as trusts are private documents. However, it's essential to keep copies of the amendment with the original trust documents. Doing so ensures clarity regarding the current terms of the trust. For best practices, you may want to check with a legal professional or use US Legal Forms to access accurate resources tailored to your situation.

Writing a codicil to a trust involves drafting a new document that outlines specific changes or additions to the trust. Clearly state the provisions that you are amending, adding, or revoking. Just like with an amendment, getting your codicil signed and notarized adds an extra layer of security. Consider utilizing resources from US Legal Forms to guide you in drafting a clear and valid codicil.

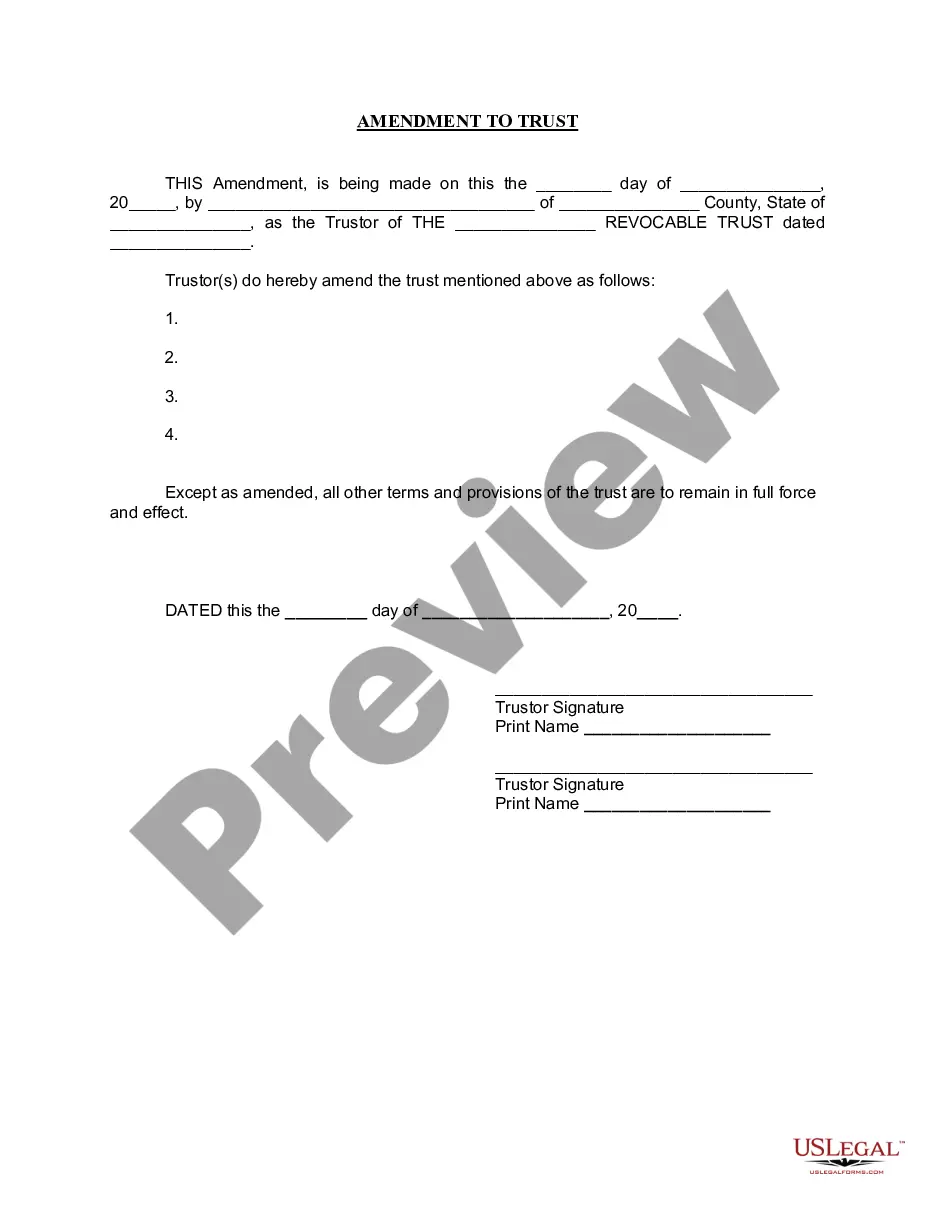

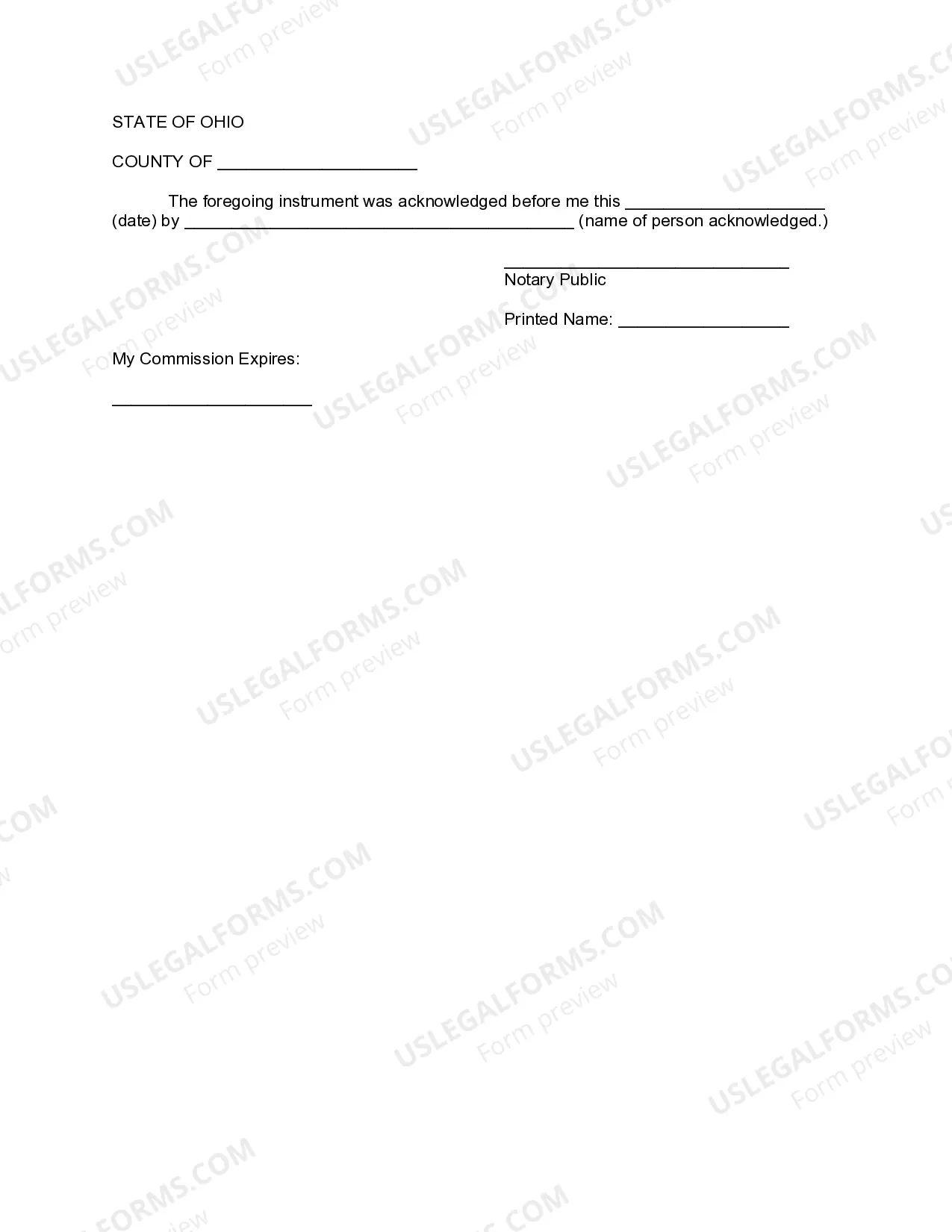

To write an amendment to a living trust, start by clearly identifying the trust and its original provisions. Next, specify the changes you wish to make regarding the beneficiaries or other aspects of the trust. It is essential to sign and date the amendment, preferably in front of a notary, to ensure its validity. Using reliable templates, such as those from US Legal Forms, can streamline this process and help you create a legally sound document.

Amending a trust can be a straightforward process, depending on the trust's terms and state laws. Generally, the grantor must follow specific procedures to ensure the amendment is valid. When undertaking an amendment living trust with the beneficiary's input, utilizing platforms like US Legal Forms can streamline the process and provide necessary documentation.

Yes, beneficiaries of a trust can be changed, a process often outlined within the trust document itself. The grantor typically has the rights to modify whom they designate as beneficiaries through amendments. Engaging in an amendment living trust with the beneficiary can clearly express your intentions and updates regarding the distribution of assets.

Beneficiaries do not have the authority to make changes to a trust directly. Changes to a trust require the consent of the grantor or the trustee. However, facilitating an amendment to a living trust with the beneficiary's concerns in mind can lead to a smoother process, especially when using online resources like US Legal Forms.

In most cases, a beneficiary cannot override the terms of a trust. The trust’s guidelines govern how assets are managed and distributed. If you are considering an amendment to a living trust with the beneficiary involved, it is essential to consult with legal experts, such as those at US Legal Forms, to ensure compliance with legal standards.

Typically, a beneficiary cannot modify a trust without the permission of the trustee or the grantor. This limitation ensures that the original intentions of the trust creator are respected. However, if you want to amend a living trust with the beneficiary's input, communication with the trustee is crucial to facilitate any changes.

A trust does not inherently override beneficiaries; instead, it establishes how your assets should be managed and allocated. The terms within your trust dictate the relationship with your beneficiaries, making it essential to clearly outline your intentions in the document. By effectively managing your amendment living trust with the beneficiary, you can avoid potential conflicts and ensure your wishes are honored.