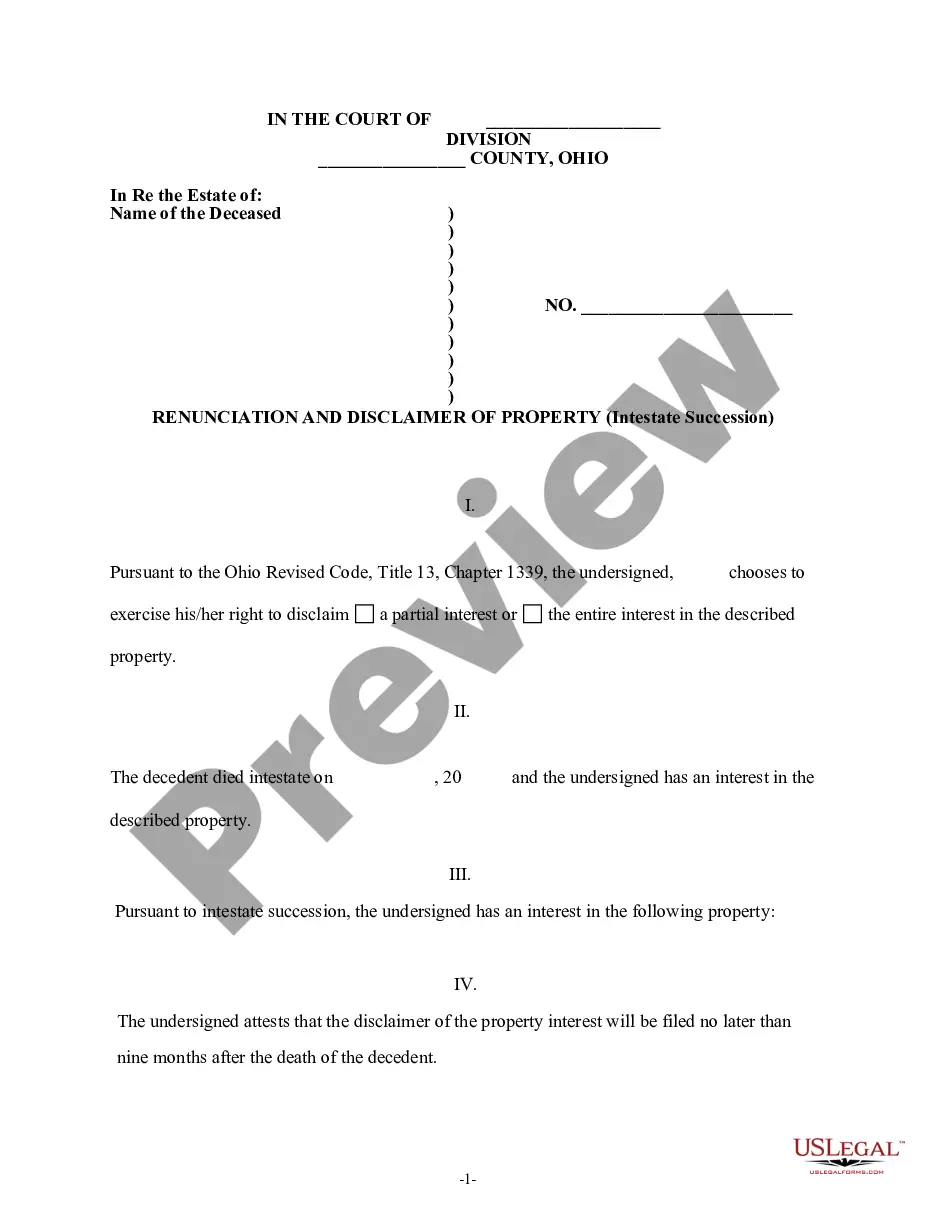

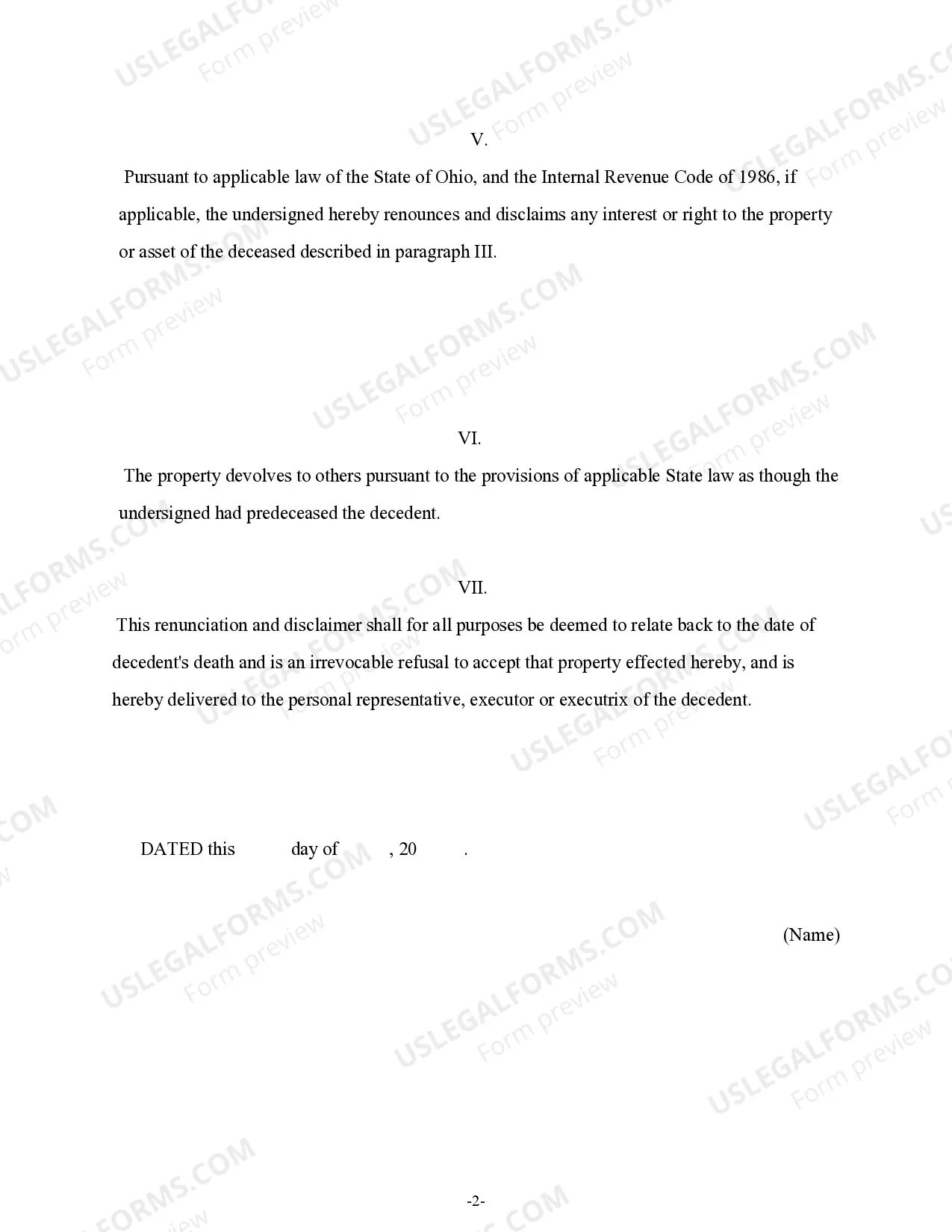

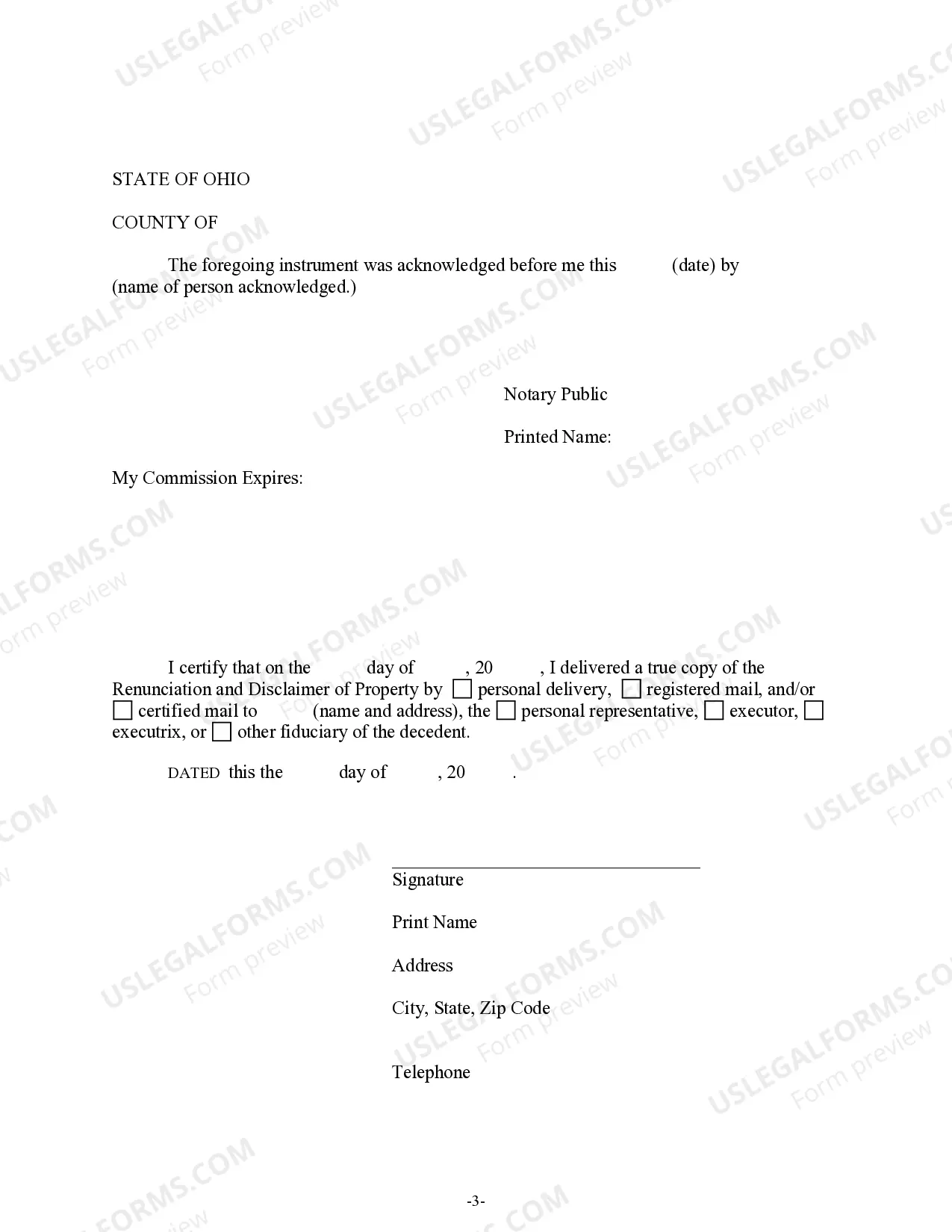

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate (without a will) and the beneficiary gained an interest in the property, but, pursuant to the Ohio Revised Code, Title 13, Chapter 1339, has decided to disclaim a portion of or the entire interest in the property. The property will now devolve to others as though the beneficiary predeceased the decedent. The form also includes a state specific acknowledgment and a certificate to verify document delivery.

Ohio Intestate Succession With Child

Description

How to fill out Ohio Renunciation And Disclaimer Of Property Received By Intestate Succession?

How to locate professional legal documents that comply with your state's regulations and prepare the Ohio Intestate Succession With Child without hiring an attorney.

Numerous online services offer templates to address diverse legal situations and requirements.

However, it might require some time to determine which available samples meet both your usage needs and legal standards.

Download the Ohio Intestate Succession With Child using the corresponding button next to the file name. If you do not have a US Legal Forms account, then follow the steps below: Review the webpage you have opened to ensure the form meets your requirements. Utilize the form description and preview options if provided. If needed, search for another template in the header that specifies your state. Once you find the appropriate document, click the Buy Now button. Select the most appropriate pricing plan, and then sign in or register for an account. Choose your payment method (by credit card or via PayPal). Adjust the file format for your Ohio Intestate Succession With Child and click Download. The purchased templates remain with you: you can always access them in the My documents tab of your account. Join our platform and create legal documents independently like a seasoned legal professional!

- US Legal Forms is a reliable platform that aids you in finding official documents created in accordance with the latest state law updates and helps you save on legal fees.

- US Legal Forms is not just another standard online library.

- It comprises over 85,000 validated templates for various business and personal scenarios.

- All documents are categorized by industry and state to expedite your search process and enhance convenience.

- Moreover, it connects with robust solutions for PDF editing and e-signatures, allowing users with a Premium subscription to efficiently finalize their paperwork online.

- Obtaining the necessary documents requires minimal time and effort.

- If you already possess an account, Log In and verify that your subscription is active.

Form popularity

FAQ

If a stepparent dies without a will, the stepchild generally does not inherit under Ohio intestate succession with child laws, unless adopted. This can lead to confusion and potentially unfair outcomes in blended families. It's wise to discuss estate planning options with a knowledgeable professional to ensure every family member's rights are protected.

When someone dies without a will in Tennessee, the laws of intestate succession dictate how the estate is divided. Many factors influence this process, including the presence of children, spouses, and other relatives. For a clearer understanding of these laws and how they might apply to your situation, consider seeking guidance from an estate planning resource.

Inheritance rules regarding stepchildren can vary under Ohio intestate succession with child. Stepchildren typically have no automatic inheritance rights unless legally adopted. By consulting resources or legal professionals, families can clarify how to address inheritance issues involving stepchildren to ensure everyone is treated fairly.

In Ohio intestate succession with child, if a child passes away before their parent, the grandchild may inherit the parent's share. This applies if the deceased child has children of their own, ensuring that the family line continues to benefit from the parent's estate. Understanding these nuances can be complex, so utilizing platforms like US Legal Forms can guide you through the process.

In Ohio intestate succession with child, stepchildren generally do not inherit from a stepparent unless the stepparent legally adopted them. When a person dies without a will, Ohio law prioritizes biological children and other direct heirs. If you have questions about the inheritance rights of stepchildren, consider consulting legal resources or an attorney with expertise in estate planning.

In Ohio, the next of kin is determined by the state's intestate succession laws. When a person passes away without a will, Ohio intestate succession with child laws specify that the deceased's children are often the primary beneficiaries. If the decedent has children, they inherit equally, regardless of the child's relationship to the deceased. If there are no children, the estate may pass to parents, siblings, or other relatives, following a specific order outlined in the law.

To acquire heir property when you lack a will, you will need to navigate Ohio intestate succession with child laws. First, determine your legal relationship to the deceased—it impacts your rights as an heir. Then, gather necessary documentation that proves your relationship and initiate an estate administration process. Additionally, consider using resources like USLegalForms to guide you through the paperwork and ensure compliance with state laws.

Similar to the previous question, child support can take your inheritance in Ohio if deemed income, depending on your financial circumstances. The court’s perspective on your financial assets will guide the determination. Protecting your inheritance as a separate asset can help shield it from being considered for child support. Understanding these implications of Ohio intestate succession with a child can empower you with the right planning and legal advice.

In Ohio, child support can potentially take a portion of your inheritance if the court views it as income for determining support obligations. If your inheritance is a direct financial benefit, it may be included in calculations. It’s crucial to understand how to structure your inheritance and communicate its nature. Knowing the implications of Ohio intestate succession with a child can help you navigate these complexities.

Generally, inheritance does not count as household income in Ohio. It is viewed as a gift and does not impact eligibility for benefits like food stamps or other assistance programs. However, if the inherited assets generate income, such as interest or dividends, that income will be assessed. Understanding how your inheritance interacts with Ohio intestate succession with a child can help you manage your overall financial plan.