Transfer On Death Designation With Rights Of Survivorship

Description

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Individual To A Trust?

It’s widely recognized that you cannot transform into a legal expert in an instant, nor can you swiftly learn how to efficiently prepare a Transfer On Death Designation With Rights Of Survivorship without possessing a specialized skill set. Assembling legal documents is a labor-intensive task that necessitates particular education and expertise. So why not leave the creation of the Transfer On Death Designation With Rights Of Survivorship to the professionals.

With US Legal Forms, one of the most extensive legal document repositories, you can discover anything from court documents to templates for internal business communication. We understand how crucial it is to comply with and adhere to federal and state regulations. That’s why, on our platform, all templates are specific to locations and current.

Here’s how you can begin using our platform and obtain the document you require in just a few minutes.

You can regain access to your documents from the My documents tab at any time. If you’re an existing client, you can simply Log In and locate and download the template from the same tab.

Regardless of the reason for your paperwork—whether it’s financial, legal, or personal—our platform has you supported. Try US Legal Forms today!

- Locate the form you need using the search bar at the top of the page.

- Preview it (if the option is available) and read the accompanying description to determine if the Transfer On Death Designation With Rights Of Survivorship is what you're seeking.

- Start your search over if you require any additional forms.

- Sign up for a free account and select a subscription plan to acquire the template.

- Click Buy now. Once the transaction is finalized, you can download the Transfer On Death Designation With Rights Of Survivorship, fill it out, print it, and send or mail it to the necessary recipients or entities.

Form popularity

FAQ

You do not necessarily need a lawyer for a transfer on death designation with rights of survivorship, but consulting one can provide peace of mind. A lawyer can help you navigate the legal requirements and ensure that your deed is properly executed and recorded. If you prefer to handle it yourself, platforms like US Legal Forms can offer valuable tools and templates to assist you.

The process to transfer property after death using a transfer on death designation with rights of survivorship is straightforward. Upon your passing, the designated beneficiary simply needs to file a death certificate along with the deed in the appropriate county office. This process avoids probate, allowing for a smooth transition of property ownership.

Yes, you can create a transfer on death designation with rights of survivorship in Washington state. The state allows property owners to designate beneficiaries for their real estate through a transfer on death deed. To ensure the process is handled correctly, consider using resources like US Legal Forms, which can provide the necessary forms and guidance.

While it is not strictly necessary to hire a lawyer to file a transfer on death designation with rights of survivorship, seeking legal advice can be beneficial. A lawyer can help ensure that all paperwork is completed correctly and complies with state regulations. Additionally, they can guide you through any unique considerations related to your property or beneficiaries.

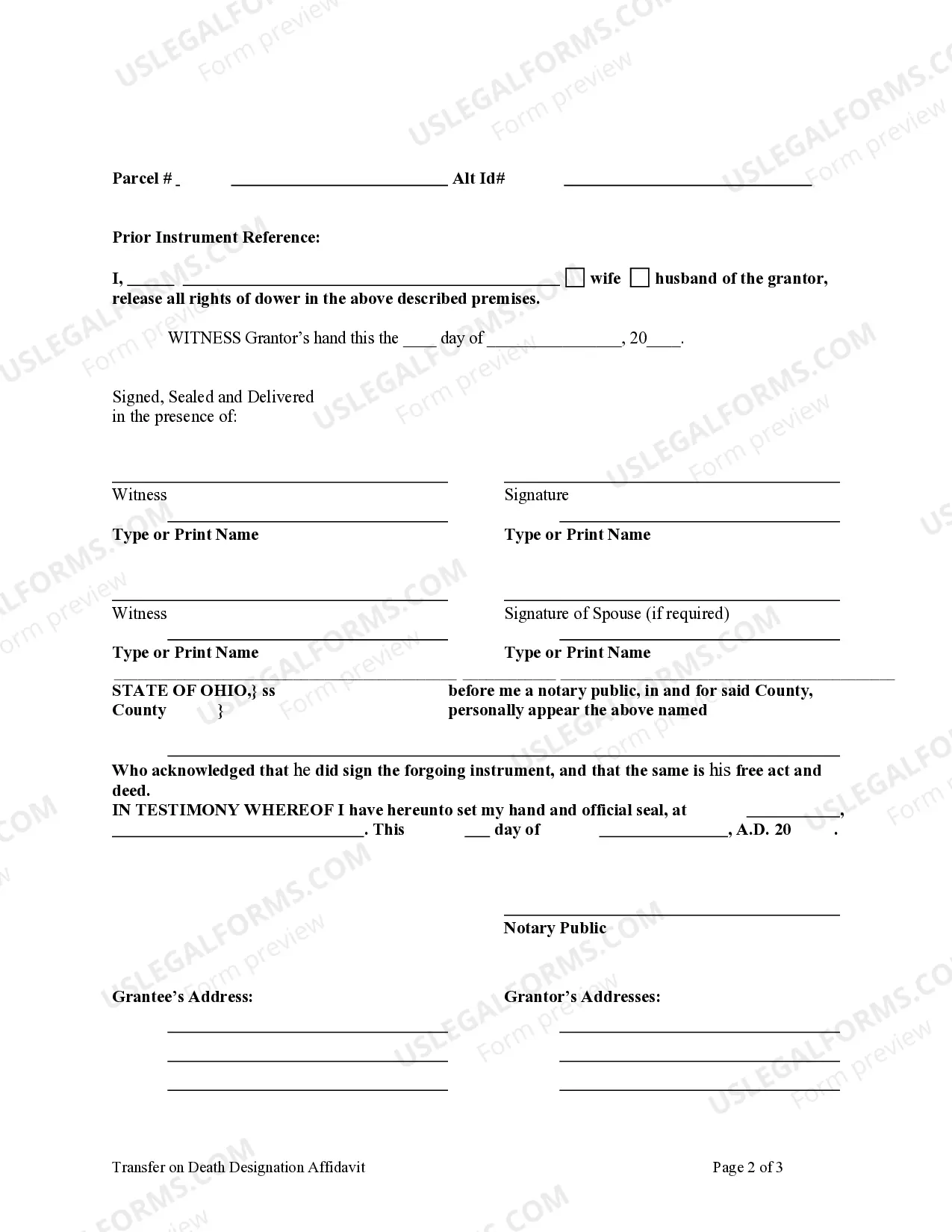

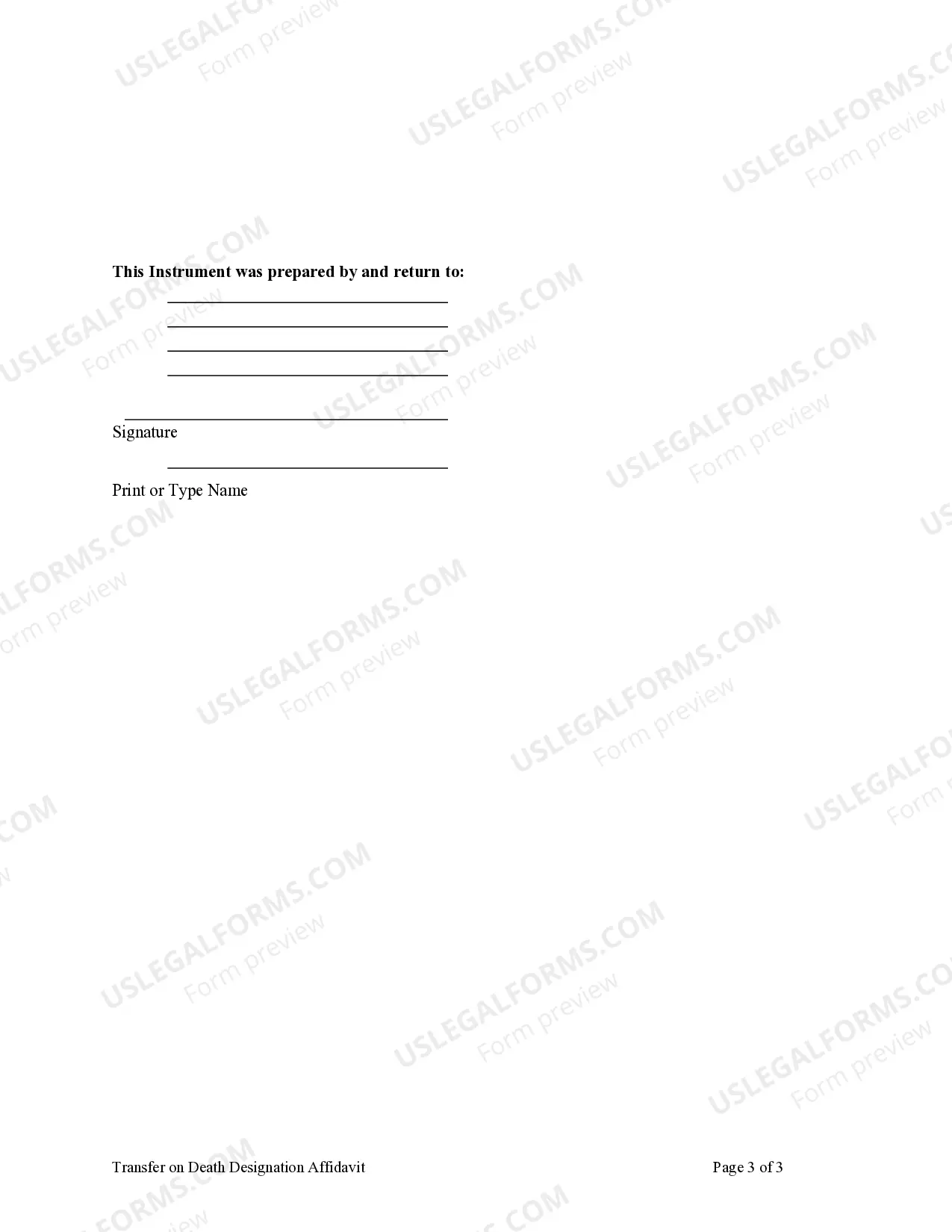

To set up a transfer on death designation with rights of survivorship, you need to complete a specific deed form that complies with your state’s laws. After filling out the form, you must sign it in front of a notary and then record it with the local county office. This ensures that your property will automatically transfer to your designated beneficiary upon your death, simplifying the transfer process.

Rights of survivorship and transfer on death designation with rights of survivorship are closely related but serve different purposes. Rights of survivorship usually apply to joint ownership of property, meaning that if one owner passes away, the other automatically receives full ownership. On the other hand, a transfer on death designation allows an individual to designate who will receive their assets upon their death, without the need for probate. Understanding these differences can help you make informed decisions about your estate planning.

The phrase 'with rights of survivorship' in the context of a transfer on death designation indicates that the surviving owner automatically inherits the asset upon the death of the other owner. This ensures that the asset bypasses probate, allowing for a smooth transition of ownership. It is a beneficial feature for couples or co-owners who want to ensure that their assets remain within the family. Consider checking out US Legal Forms for detailed explanations and templates.

While the transfer on death designation with rights of survivorship can simplify asset transfer, it does have potential downsides. One concern is that it may not provide the same level of control as a living trust, especially if circumstances change or if there are multiple heirs. Additionally, if the designated beneficiary does not handle the assets responsibly, it could lead to disputes among family members. It's wise to consult resources like US Legal Forms for comprehensive guidance.

When considering the transfer on death designation with rights of survivorship, it's important to evaluate your specific situation. A transfer on death designation typically allows assets to pass directly to the designated beneficiaries without going through probate, offering a streamlined process. In contrast, naming a beneficiary can sometimes lead to complications, especially if the beneficiary predeceases you. Ultimately, the best choice depends on your estate planning needs and goals.

The transfer on death designation with rights of survivorship can have some disadvantages. First, it may not address all estate planning needs, as it only transfers property upon death. Additionally, if the property owner incurs debts, creditors may still make claims against the property, even after the transfer. Lastly, changes in state laws or the owner's circumstances may affect the validity and effectiveness of this designation, highlighting the importance of consulting with a legal professional or using platforms like US Legal Forms for guidance.