Ohio Beneficiary Deed Form

Description

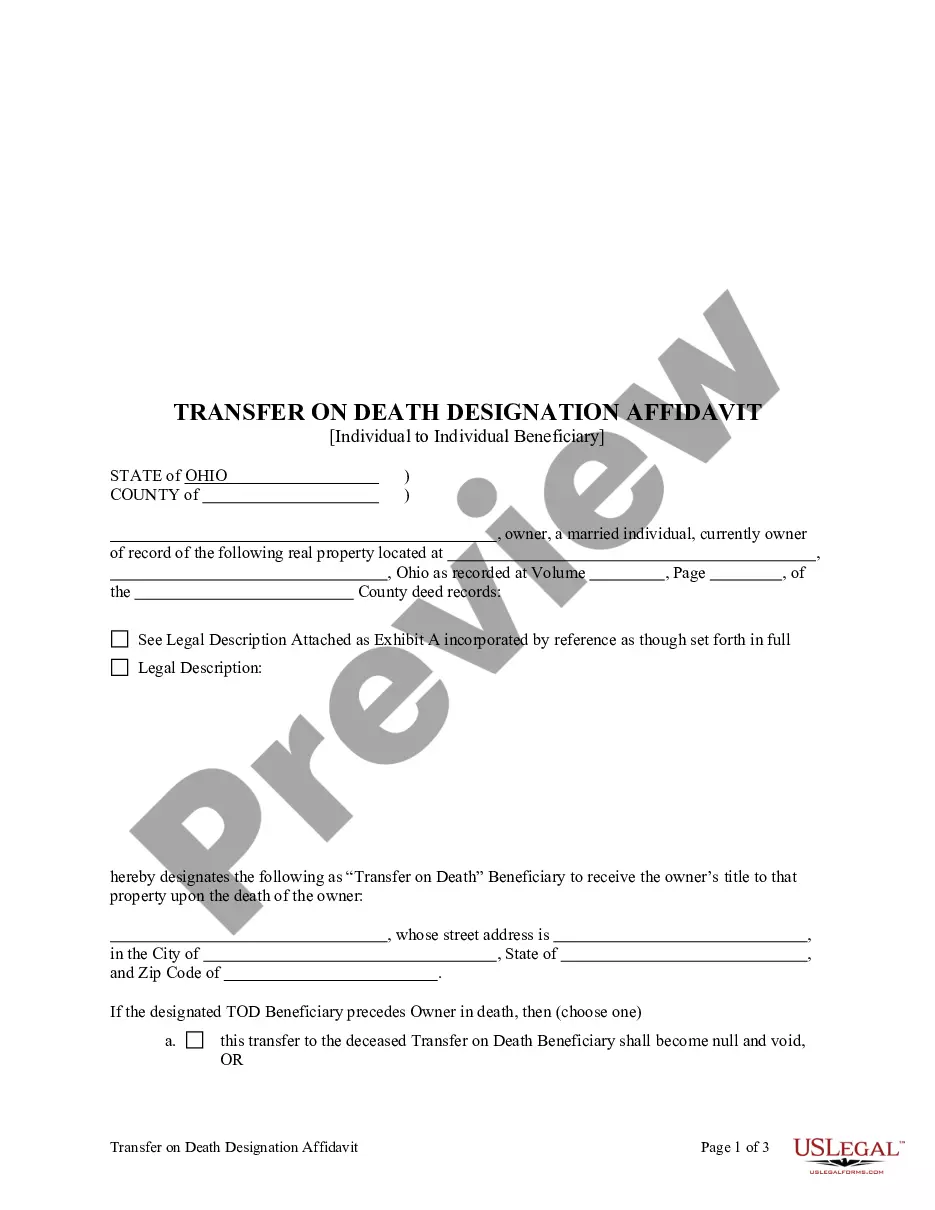

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Individual To Individual With Contingent Beneficiary?

There's no longer a need to waste time looking for legal documents to fulfill your state's requirements.

US Legal Forms has gathered all of them in one location and made them easily accessible.

Our website provides over 85,000 templates for any business and personal legal matters organized by state and use case. All forms are expertly crafted and verified for accuracy, so you can trust that you're receiving an up-to-date Ohio Beneficiary Deed Form.

Print your form to complete it manually or upload the template if you prefer to edit it using an online editor. Preparing legal documents according to federal and state laws and regulations is quick and straightforward with our library. Try US Legal Forms now to keep your paperwork organized!

- If you're already acquainted with our service and have an account, ensure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also access all saved documents anytime by visiting the My documents tab in your profile.

- If this is your first time using our service, the process will involve a few additional steps.

- Here's how new users can locate the Ohio Beneficiary Deed Form in our catalog.

- Carefully review the page content to confirm it contains the example you need.

- Utilize the form description and preview options, if available.

- Use the Search field above to look for another example if the previous one doesn't meet your needs.

- Click Buy Now next to the template title once you find the right one.

- Choose the desired pricing plan and create an account or Log In.

- Make your payment with a credit card or through PayPal to proceed.

- Select the file format for your Ohio Beneficiary Deed Form and download it to your device.

Form popularity

FAQ

In Ohio, a beneficiary named on a beneficiary deed typically takes precedence over a will regarding the specified property. This means that your wishes documented in the Ohio beneficiary deed form will be honored even if there is a conflicting provision in your will. It’s essential to align your estate planning documents to avoid confusion. Consulting with a legal expert can help you navigate these complexities effectively.

A survivorship deed in Ohio allows two or more people to co-own property, where ownership automatically passes to the surviving owner upon death. It is different from a regular deed because it ensures the property avoids probate, simplifying the transfer process. While the Ohio beneficiary deed form designates a beneficiary for property after death, a survivorship deed provides an immediate transfer between co-owners. Choosing the right deed type depends on your specific needs.

Yes, Ohio does have transfers on death deeds, often referred to as beneficiary deeds. This legal instrument allows you to transfer property automatically to a designated beneficiary when you pass away. By using the Ohio beneficiary deed form, you can avoid the lengthy and costly process of probate. It’s a beneficial way to manage your property and ensure it goes to your heirs effortlessly.

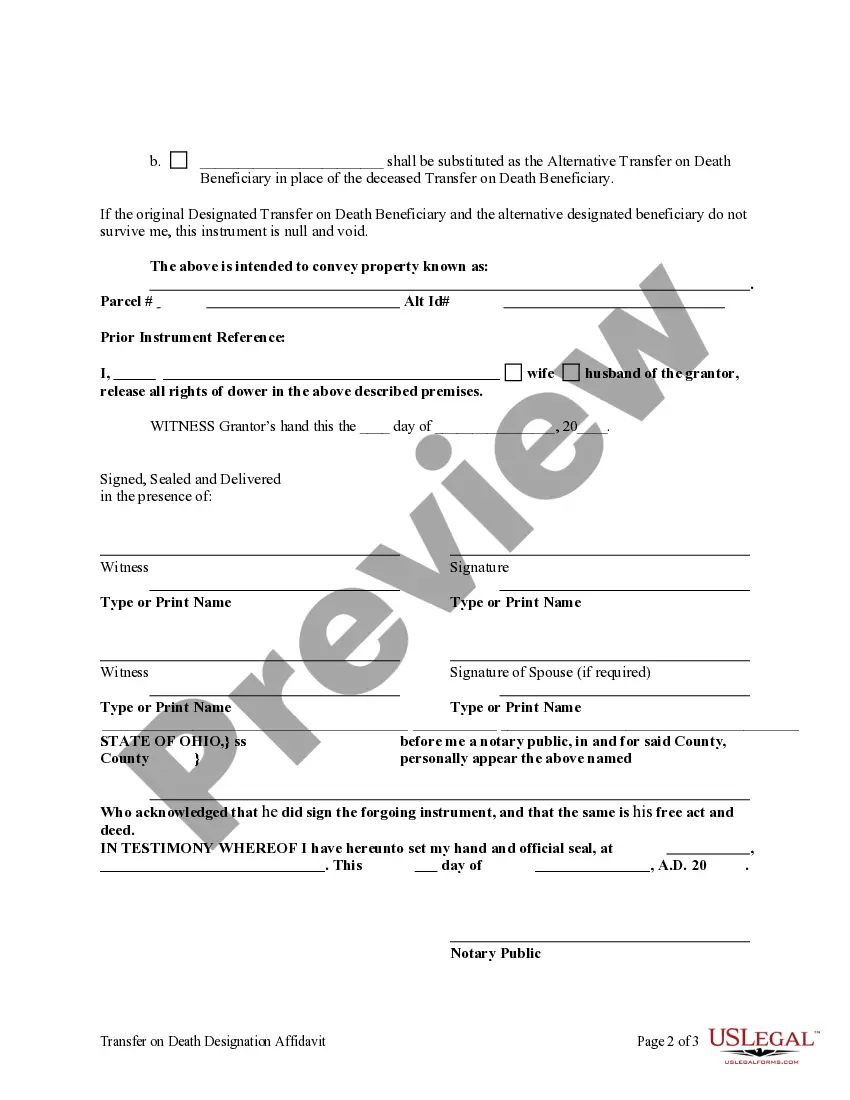

Filling out the beneficiary designation form in Ohio requires careful attention to detail. Start by obtaining the Ohio beneficiary deed form from a reliable source. Next, include your name, the property details, and the beneficiary’s information. Make sure to sign and date the form before having it notarized. This ensures a smooth process in transferring your property later.

To set up a transfer on death deed in Ohio, you must complete the Ohio beneficiary deed form. This form allows you to designate a beneficiary who will receive your property upon your death without going through probate. It’s important to sign the form in front of a notary and record it with your county recorder’s office. By following these steps, you can secure an easy transfer of your property to your chosen beneficiary.

The best way to transfer property title between family members is by using a legal deed, such as a quitclaim deed or a transfer on death deed. This method provides a clear and documented transfer of ownership. Ensure the deed is accurately prepared, signed, and recorded with the county recorder's office to protect all parties involved. You can find helpful templates, including the Ohio beneficiary deed form, on platforms like US Legal Forms, making the process easier for you.

Yes, you can gift a house to someone in Ohio. The process involves preparing a gift deed that clearly outlines the transfer of ownership without any financial exchange. It's essential to have the deed signed and notarized, followed by recording it at the county recorder's office. For a smooth transition, you might benefit from using an Ohio beneficiary deed form from US Legal Forms.

To transfer a house deed to a family member in Ohio, prepare a new deed that names your family member as the new owner. Ensure the deed includes the legal description of the property. After signing the document, have it notarized, and then file it with the county recorder's office. Utilizing resources such as the Ohio beneficiary deed form from US Legal Forms can simplify this process.

Filing a transfer on death deed in Ohio involves creating a deed that specifies the beneficiaries who will receive the property upon your death. You must fill out the deed accurately, sign it in front of a notary, and record it at the county recorder's office. This form ensures that your property transfers directly to your named beneficiaries without going through probate. For further assistance, consider using the Ohio beneficiary deed form available on US Legal Forms.

To file a survivorship deed in Ohio, you need to prepare the deed document, including pertinent details such as the property description and the names of the tenants. Once the document is complete, sign it before a notary. Then, record the deed with the county recorder’s office. This process ensures that the property will pass to the surviving tenant automatically upon death, and you can find templates for the survivorship deed on platforms like US Legal Forms.