Affidavit For Transfer Without Probate Ohio For Estate

Description

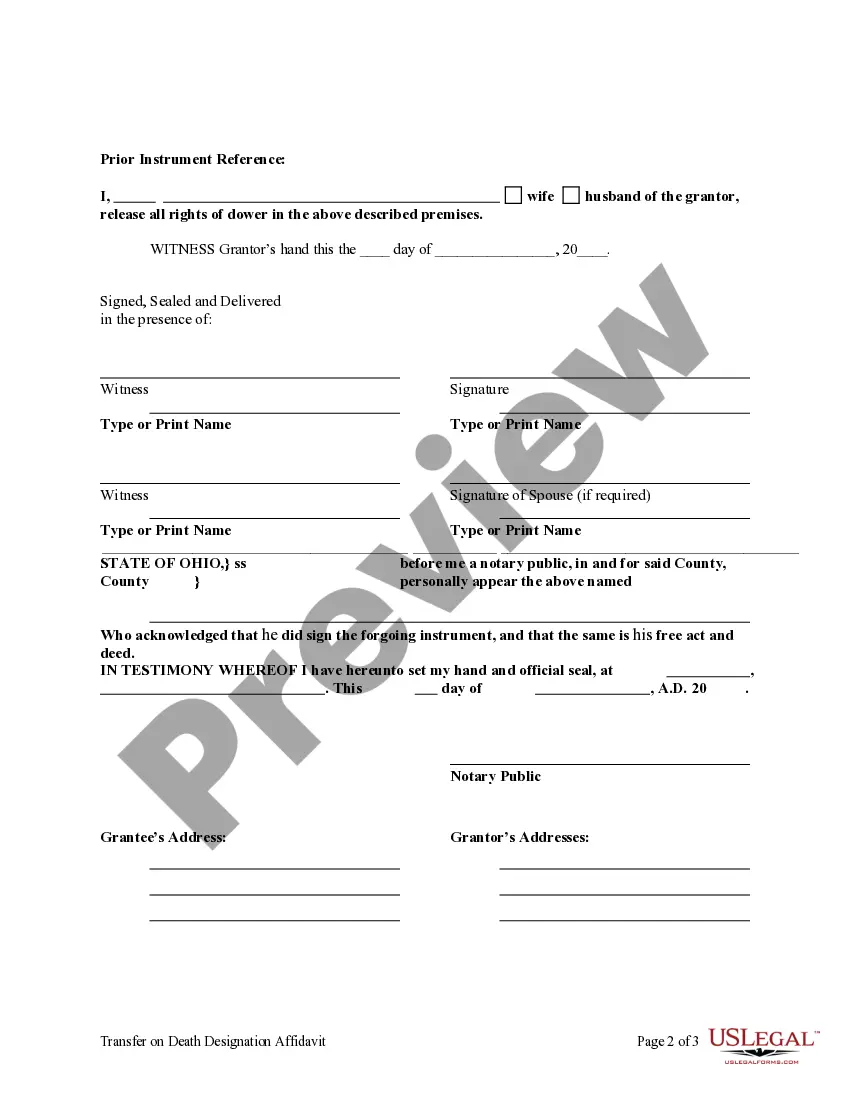

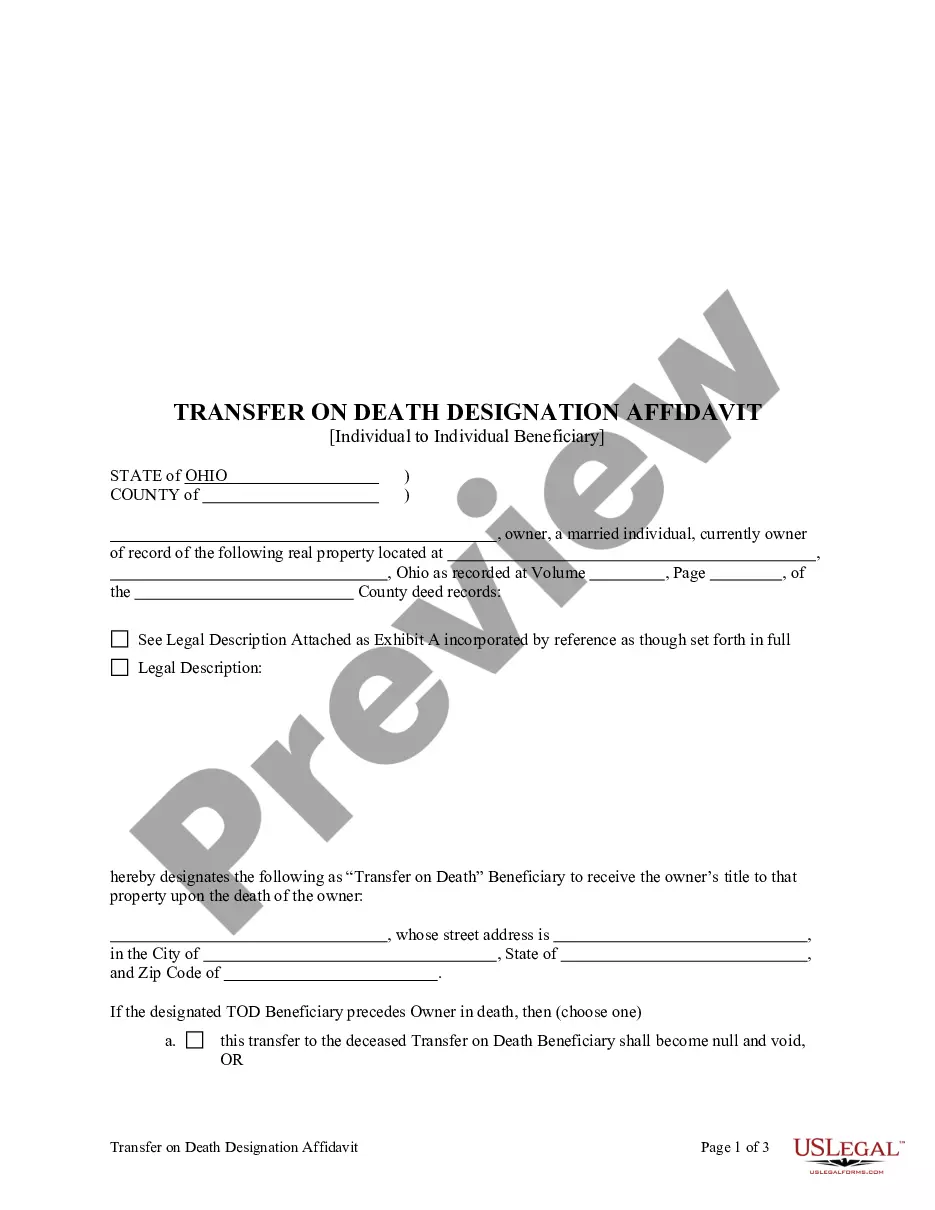

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Individual To Individual Without Contingent Beneficiary?

Whether for professional needs or personal matters, everyone must confront legal circumstances at some stage in their life.

Filling out legal paperwork requires meticulous care, starting from selecting the correct form template.

Once it is saved, you can complete the form using editing software or print it and finish it manually. With an extensive US Legal Forms collection available, you never have to waste time searching for the correct template online. Utilize the library’s simple navigation to find the right template for any situation.

- Obtain the template you require by utilizing the search field or catalog browsing.

- Review the form’s description to verify it fits your situation, state, and region.

- Select the form’s preview to examine it.

- If it is the incorrect document, return to the search feature to locate the Affidavit For Transfer Without Probate Ohio For Estate template you require.

- Download the template if it satisfies your needs.

- If you have a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you may download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Fill out the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Choose the document format you desire and download the Affidavit For Transfer Without Probate Ohio For Estate.

Form popularity

FAQ

Once signed and notarized, the affidavits must be filed with the probate court in the county where the property is physically located. A certified copy of the death certificate and a copy of the will, if any, must be attached to each affidavit, along with title documents for real estate and other large assets.

Arizona allows those without proper estate planning to avoid probate if the estate is small. Arizona allows those without proper estate planning to avoid probate if the estate is small. A small estate is one that consists of less than $100,000 in real estate value or less than $75,000 in personal property.

If the estate qualifies for small estate administration, the personal representative or living heir need only to complete an Affidavit for Collection of All Personal Property and an Affidavit for Transfer of Title to Real Property. There are statutory time constraints associated with small estate administration.

Real Estate and TOD in Arizona In Arizona, real estate can be transferred via a Beneficiary Deed, more commonly known as a TOD deed. This deed allows a property owner to designate a beneficiary who will automatically inherit the property upon the owner's death, avoiding probate.

Real estate or a debt secured by a lien on real property may be transferred to the successor or successors by affidavit if certain requirements are met. This affidavit must be filed in the county where the decedent was domiciled or, if not domiciled in this state, in the county where the property is located.

Under current Arizona law, small estates are defined as those in which the deceased owned less than $100,000 in real estate equity or less than $75,000 worth of personal property. For estates over this size, probate is typically required, and those estates will not be eligible for the small estate affidavit process.

Informal probate is typically used when the value of the estate is less than $75,000 and there are no disputes between the heirs. Formal probate, on the other hand, is typically used when the value of the estate exceeds $75,000 or there are disputes between heirs.