Benefits Of Joint Tenants With Rights Of Survivorship

Description

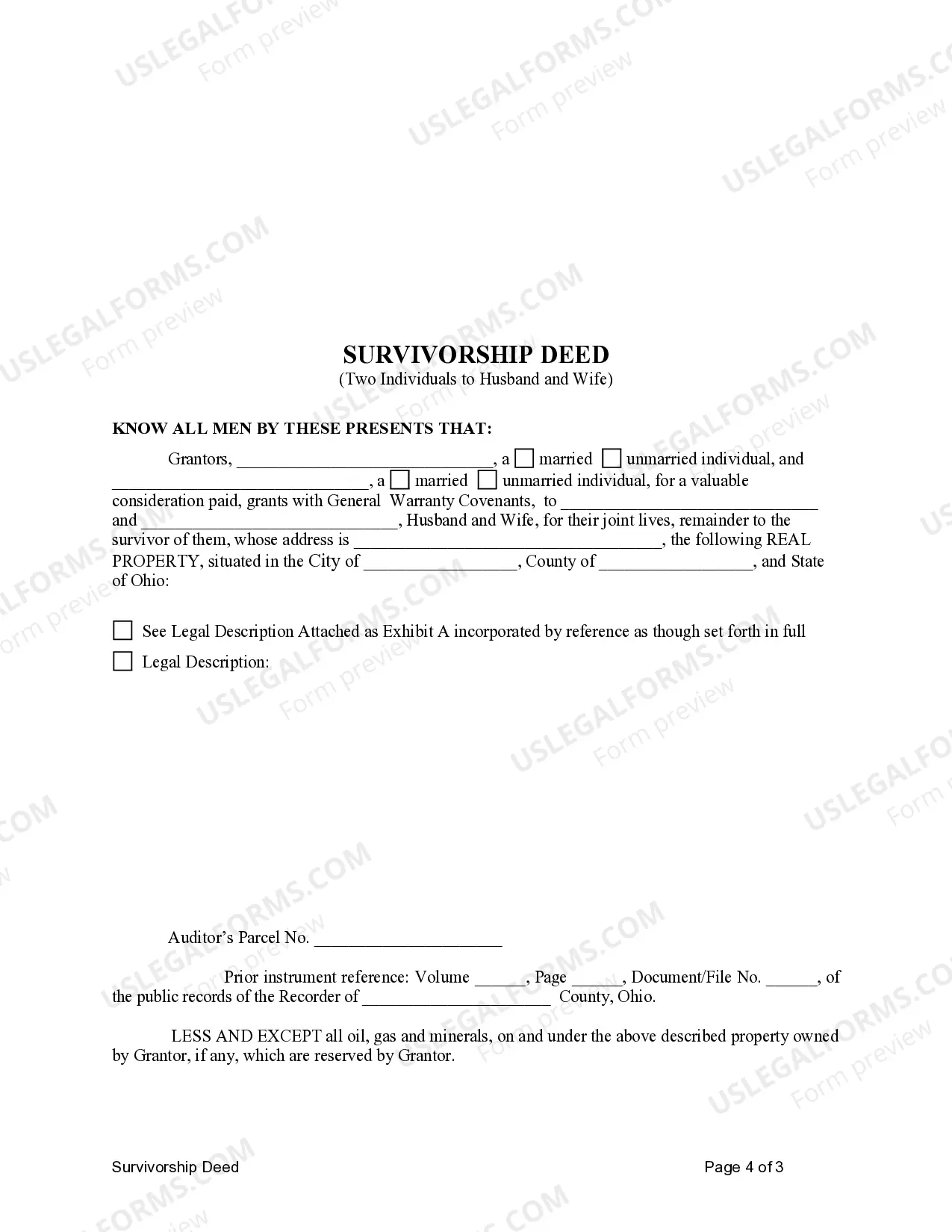

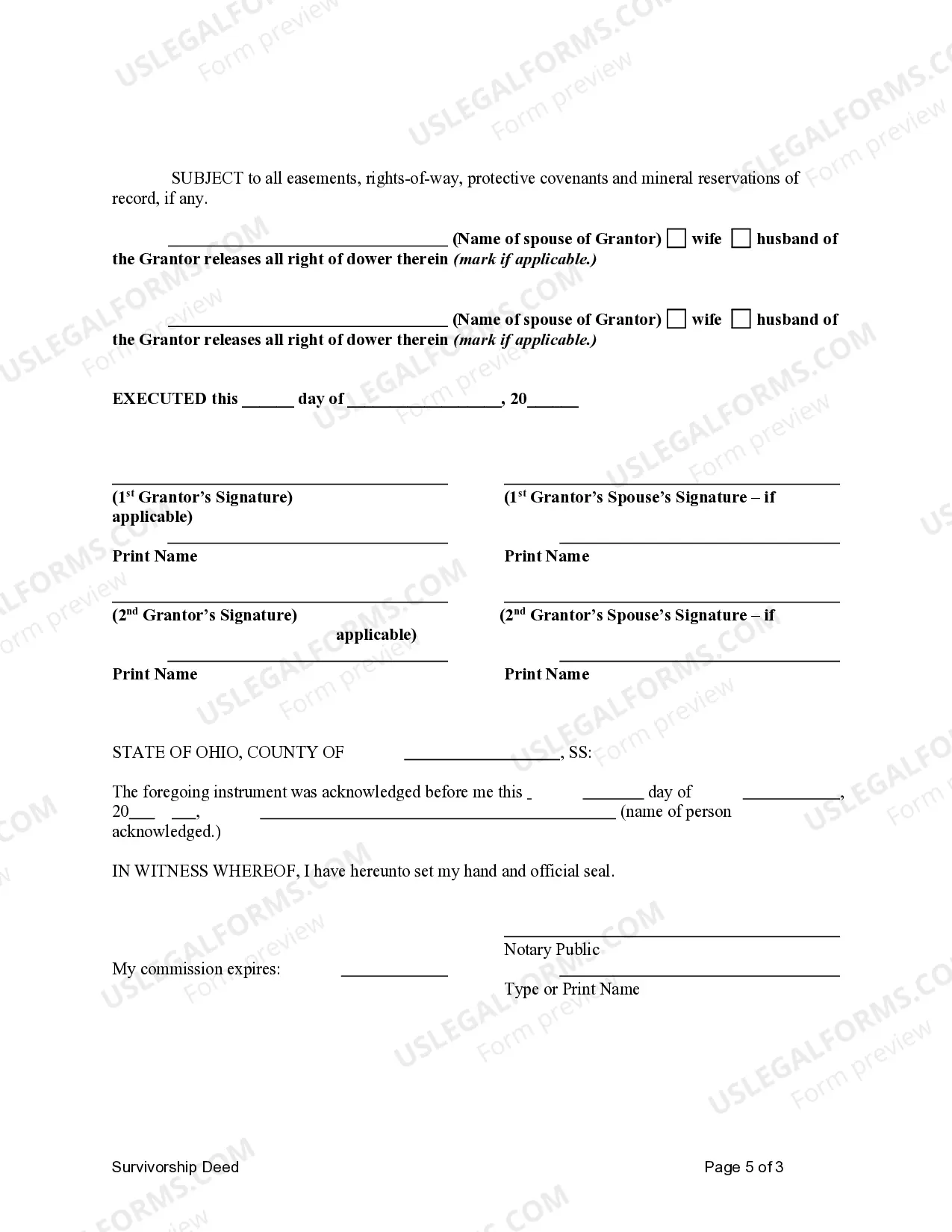

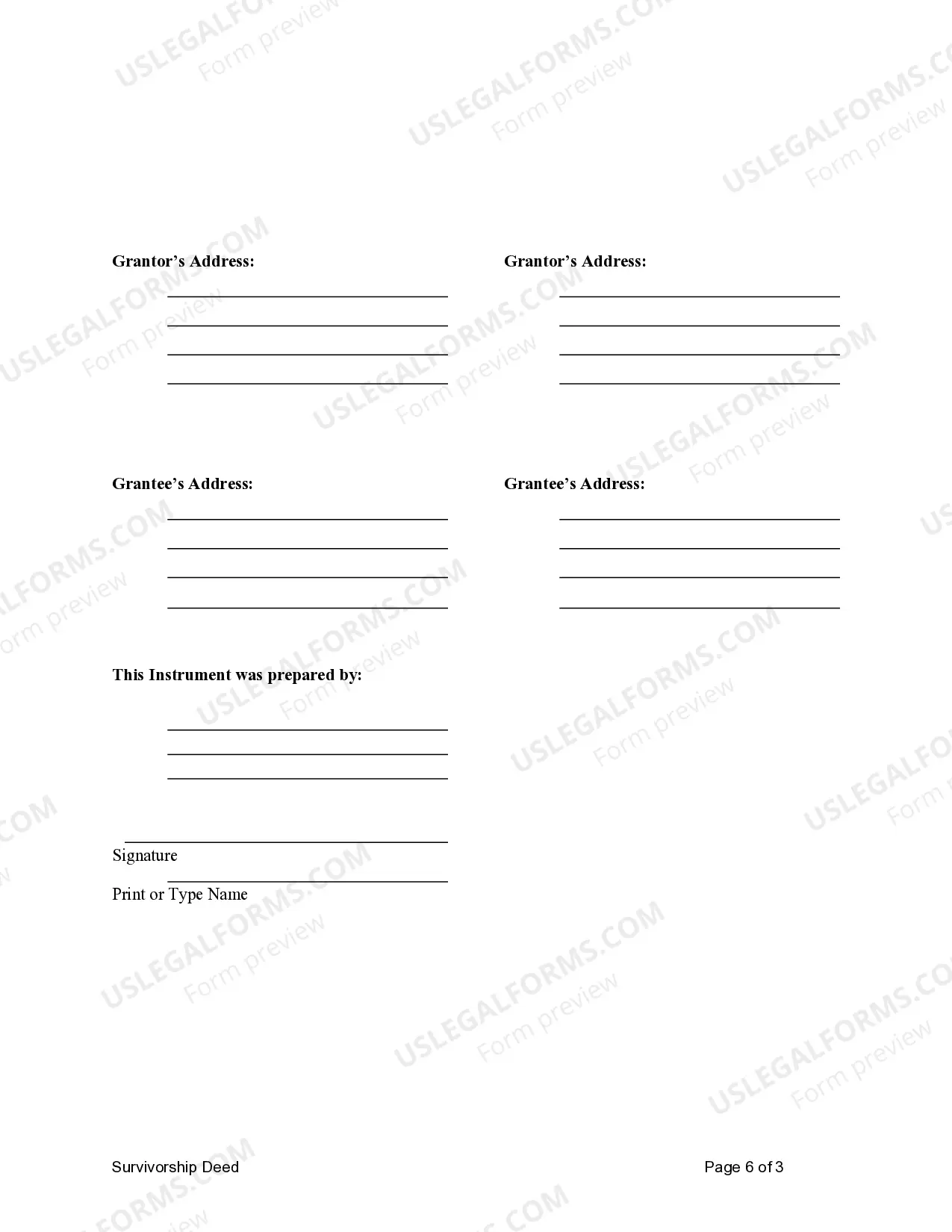

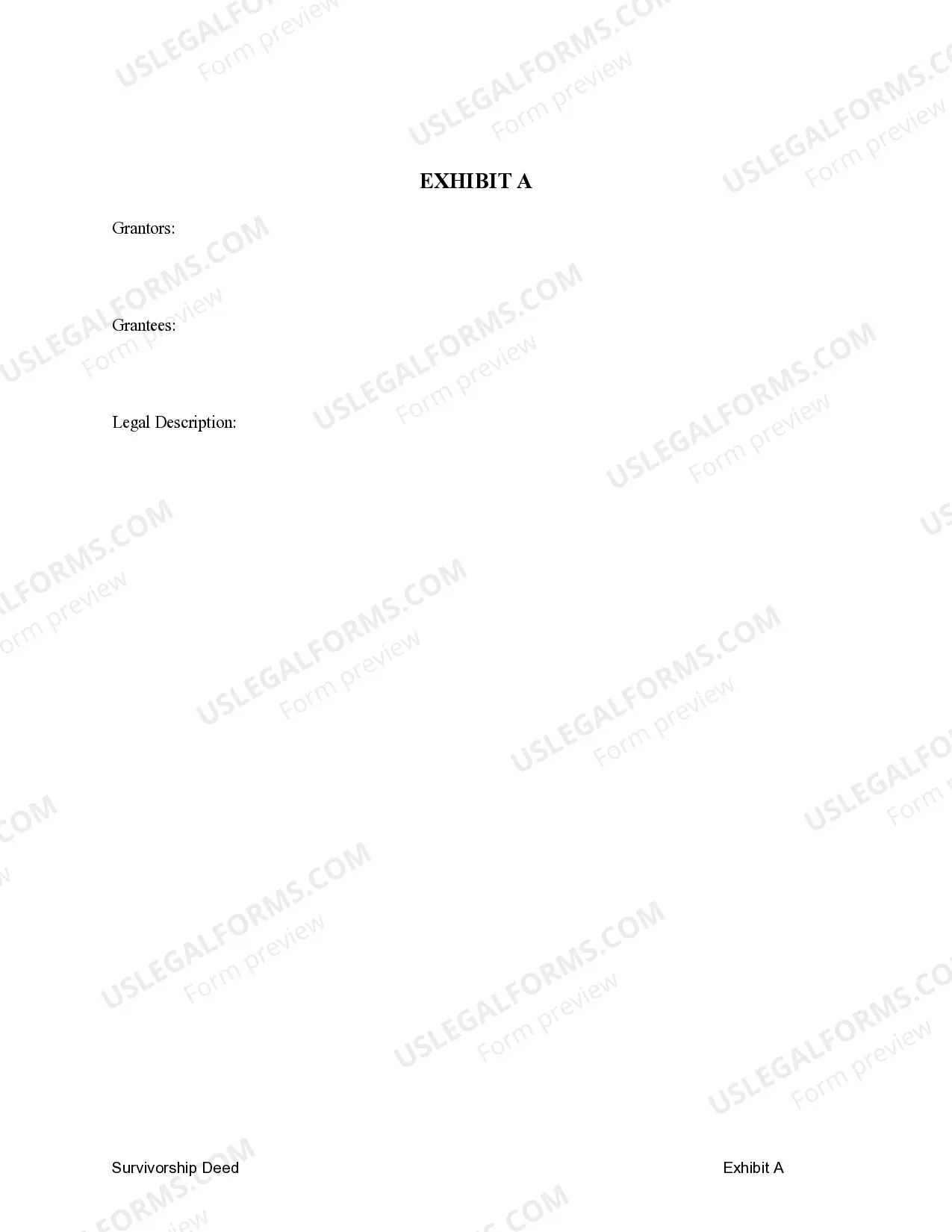

How to fill out Ohio Survivorship Deed - Two Individuals To Husband And Wife As Joint Tenants?

Using legal document samples that meet the federal and local laws is a matter of necessity, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the correctly drafted Benefits Of Joint Tenants With Rights Of Survivorship sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and life scenario. They are easy to browse with all files grouped by state and purpose of use. Our specialists stay up with legislative updates, so you can always be sure your form is up to date and compliant when obtaining a Benefits Of Joint Tenants With Rights Of Survivorship from our website.

Obtaining a Benefits Of Joint Tenants With Rights Of Survivorship is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the preferred format. If you are new to our website, adhere to the instructions below:

- Examine the template utilizing the Preview feature or via the text description to make certain it fits your needs.

- Browse for another sample utilizing the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the right form and select a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Benefits Of Joint Tenants With Rights Of Survivorship and download it.

All templates you find through US Legal Forms are reusable. To re-download and complete earlier saved forms, open the My Forms tab in your profile. Enjoy the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

JTWROS automatically transfers ownership to a spouse or business partner upon the death of the first partner, so it avoids probate. That is an enormous advantage for those who need the funds immediately.

For example, if two people, Mark and Amanda, own a property together and Mark dies, then Amanda will become to sole owner of the property even if this is not detailed in the will because the two of them purchased the property together.

If you hold the title to a JTWROS account with your spouse, 50% of its value will be included in your taxable estate. If it is titled as JTWROS with someone besides your spouse, the entire value of the account may go into your taxable estate, unless the other owner has made contributions to the account.

If you hold the title to a JTWROS account with your spouse, 50% of its value will be included in your taxable estate. If it is titled as JTWROS with someone besides your spouse, the entire value of the account may go into your taxable estate, unless the other owner has made contributions to the account.

For spouses: Assets in JTWROS accounts may get a step-up on cost basis when either spouse passes away. This can help reduce capital gains taxes when selling a property, but you can only step-up half of the full value of the asset. This 50% step-up represents the portion owned by the joint owner who died.