This deed conveys and grants the property from two individual grantors to husband and wife grantees as joint tenants with the right of survivorship. The property is conveyed with General Warranty Covenants. This deed complies with all state statutory laws.

Ohio Survivorship Deed - Two Individuals to Husband and Wife as Joint Tenants

Description

Definition of the Ohio Survivorship Deed

The Ohio Survivorship Deed is a legal document used to transfer real estate ownership to two individuals as joint tenants. This type of deed ensures that if one tenant dies, the surviving tenant automatically receives the deceased's interest in the property, thereby avoiding the lengthy process of probate.

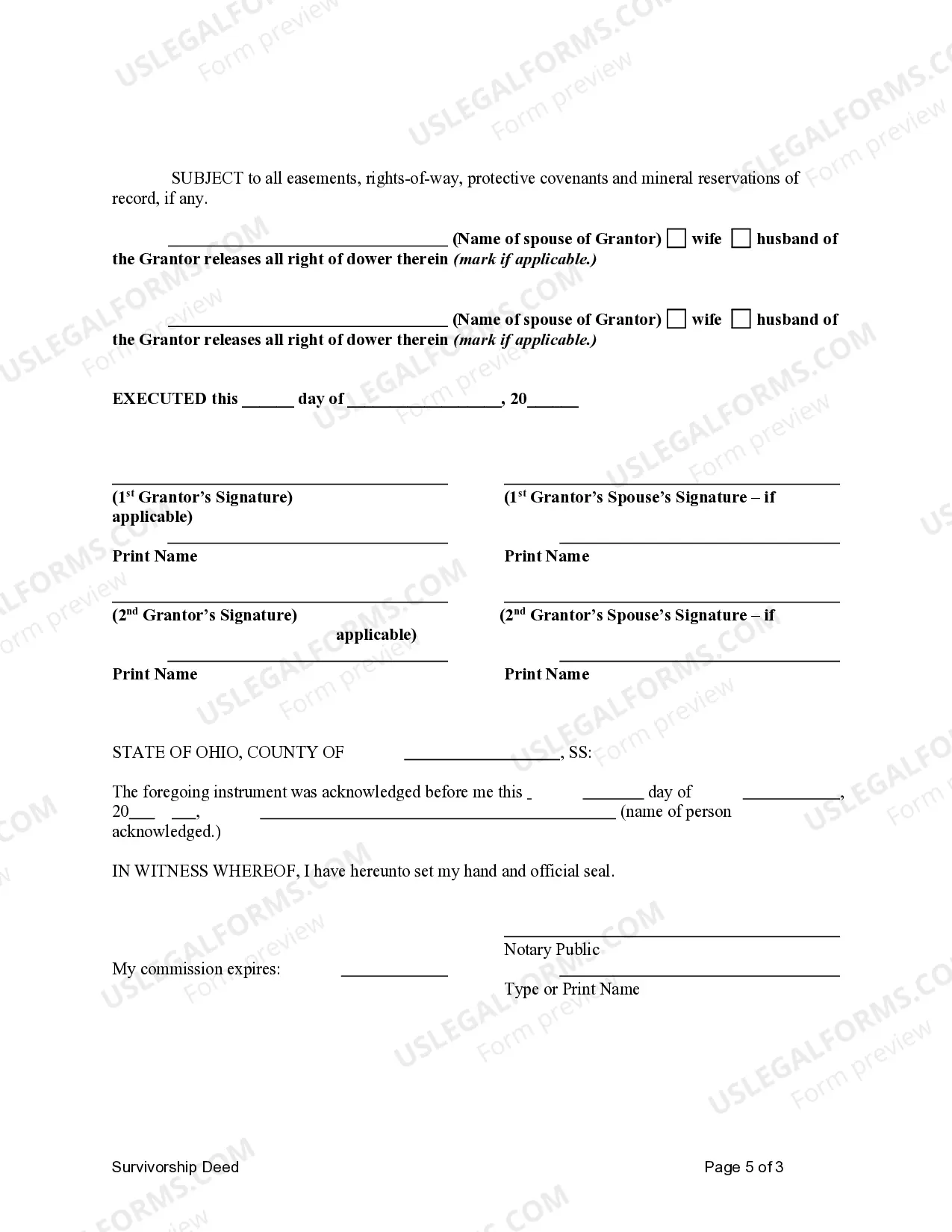

How to Complete the Ohio Survivorship Deed

Completing the Ohio Survivorship Deed involves several steps:

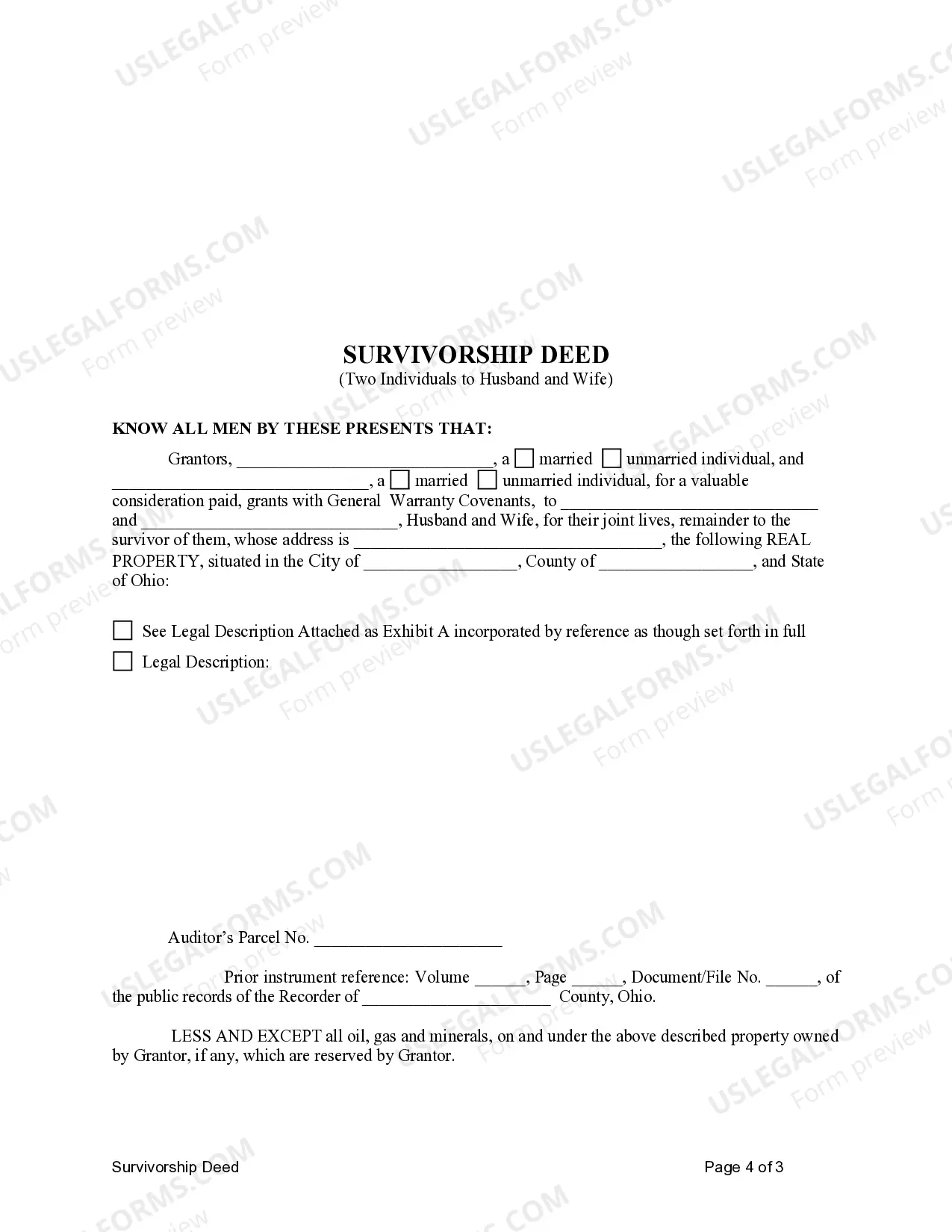

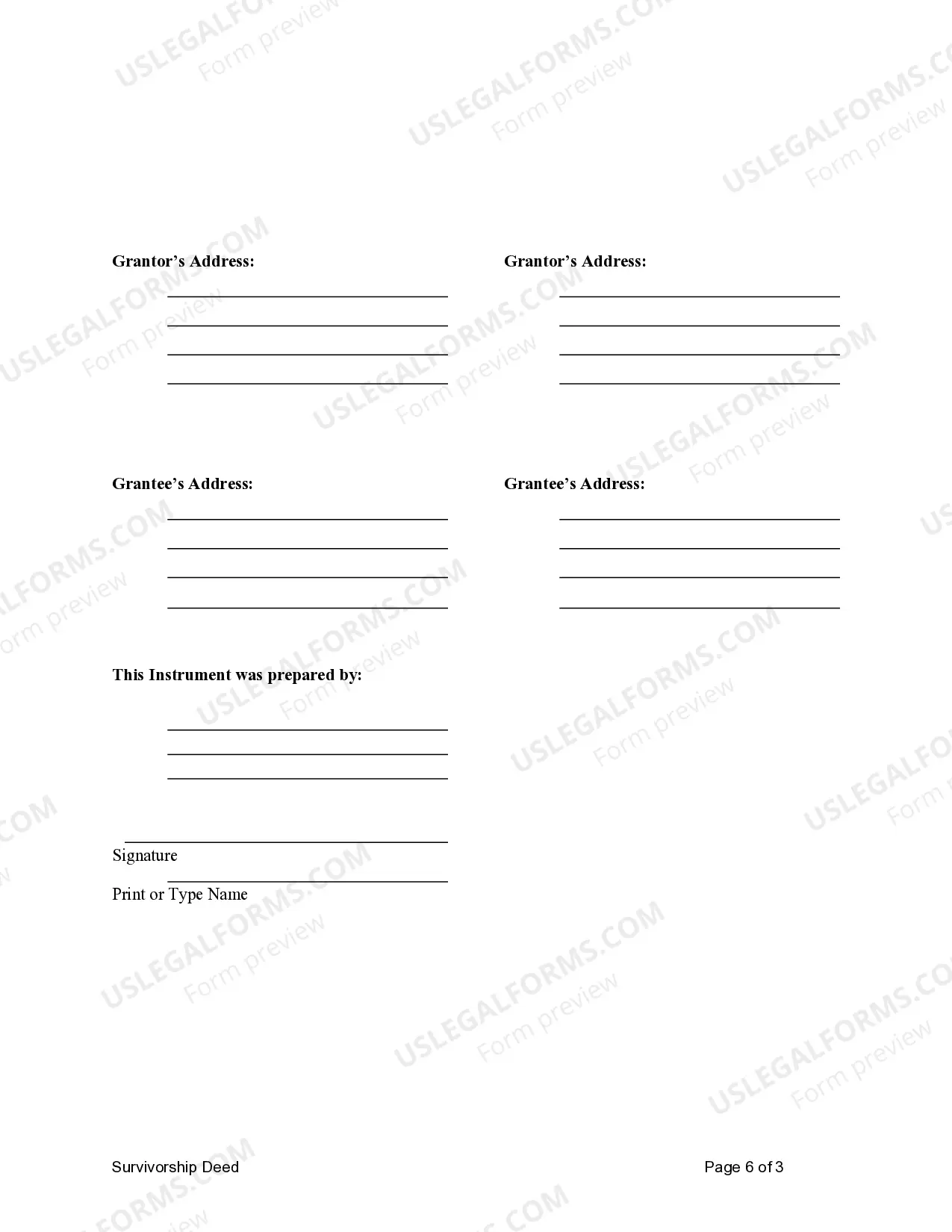

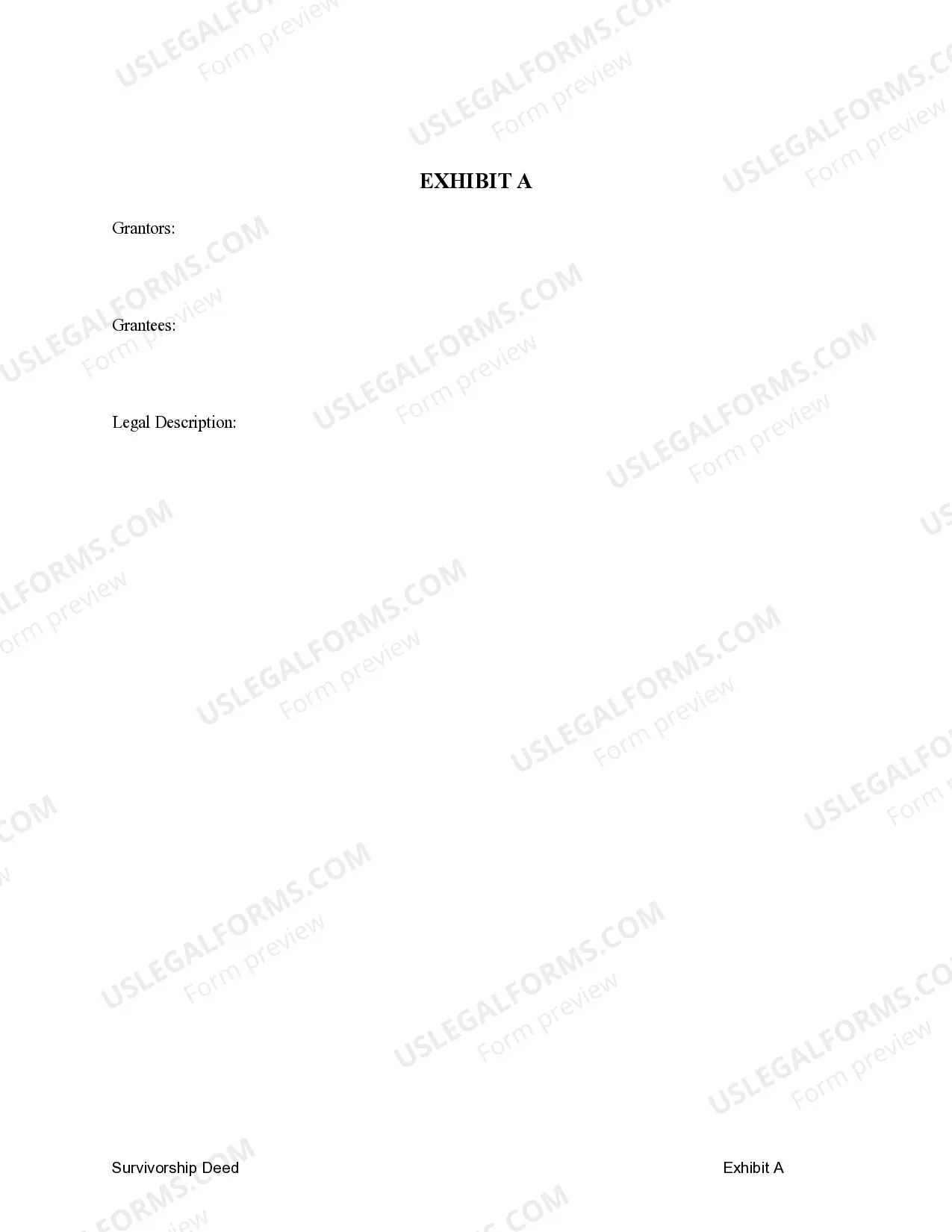

- Begin by filling out the names of the grantors, who are the individuals transferring the property.

- Specify the names of the grantees, who will hold the property as husband and wife.

- Detail the property description, including the Auditor’s Parcel Number and legal description.

- Include any relevant disclaimers and signatures, ensuring all parties involved consent to the terms.

Make sure to have the deed notarized to validate the document.

Who Should Use This Form

This form is ideal for married couples in Ohio who wish to hold the title to their property jointly. It provides a streamlined way to ensure that upon the death of one spouse, the surviving spouse automatically inherits the property, simplifying the transition of ownership.

Key Components of the Ohio Survivorship Deed

Important elements of the Ohio Survivorship Deed include:

- Grantors: The individuals transferring the property.

- Grantees: The husband and wife receiving the title as joint tenants.

- Property Description: A detailed account of the property being transferred.

- Survivorship Clause: A statement confirming that ownership will pass to the surviving tenant.

- Notarization: A requirement for legal validation.

Legal Use and Context

The Ohio Survivorship Deed is recognized under Ohio law and is specifically designed to address real property ownership between spouses. This deed provides legal assurance that the surviving spouse inherits the property without the necessity of probate, contributing to a more efficient transfer of assets after death.

What to Expect During Notarization

Notarization of the Ohio Survivorship Deed is a crucial step that involves the following:

- The grantors must present valid identification to the notary public.

- All parties must sign the deed in the presence of the notary.

- The notary will then apply their seal, confirming the authenticity of the signatures.

Be prepared for any fees associated with the notarization process, and check the notary’s regulations in Ohio.

How to fill out Ohio Survivorship Deed - Two Individuals To Husband And Wife As Joint Tenants?

In terms of filling out Ohio Survivorship Deed - Two Individuals to Husband and Wife as Joint Tenants, you almost certainly imagine a long process that requires choosing a perfect sample among numerous similar ones and after that having to pay out legal counsel to fill it out for you. Generally, that’s a slow-moving and expensive option. Use US Legal Forms and choose the state-specific template within clicks.

In case you have a subscription, just log in and click Download to find the Ohio Survivorship Deed - Two Individuals to Husband and Wife as Joint Tenants template.

If you don’t have an account yet but need one, keep to the point-by-point guideline below:

- Be sure the file you’re downloading applies in your state (or the state it’s required in).

- Do so by looking at the form’s description and through visiting the Preview function (if offered) to find out the form’s content.

- Click Buy Now.

- Find the suitable plan for your budget.

- Subscribe to an account and select how you would like to pay: by PayPal or by credit card.

- Save the document in .pdf or .docx format.

- Find the record on the device or in your My Forms folder.

Professional legal professionals draw up our samples so that after saving, you don't have to bother about editing and enhancing content material outside of your individual info or your business’s information. Sign up for US Legal Forms and receive your Ohio Survivorship Deed - Two Individuals to Husband and Wife as Joint Tenants example now.

Form popularity

FAQ

Survivorship rights take precedence over any contrary terms in a person's will because property subject to rights of survivorship is not legally part of their estate at death and so cannot be distributed through a will.

The General Rule. In the great majority of states, if you and the other owners call yourselves "joint tenants with the right of survivorship," or put the abbreviation "JT WROS" after your names on the title document, you create a joint tenancy. A car salesman or bank staffer may assure you that other words are enough.

Only a husband and wife can jointly own property as community property.Second, unlike tenancy in common, when one dies owning property as a joint tenant, one's portion immediately and automatically is transferred to the other joint tenants by operation of law. This is called the right of survivorship.

One of the main differences between the two types of shared ownership is what happens to the property when one of the owners dies. When a property is owned by joint tenants with survivorship, the interest of a deceased owner automatically gets transferred to the remaining surviving owners.

Danger #1: Only delays probate. Danger #2: Probate when both owners die together. Danger #3: Unintentional disinheriting. Danger #4: Gift taxes. Danger #5: Loss of income tax benefits. Danger #6: Right to sell or encumber. Danger #7: Financial problems.

In title law, when we talk about tenants, we're talking about people who own property.When joint tenants have right of survivorship, it means that the property shares of one co-tenant are transferred directly to the surviving co-tenant (or co-tenants) upon their death.

While the joint tenant with right of survivorship can't will his share in the property to his heir, he can sell his interest in the property before his death. Once a joint tenant sells his share, this ends the joint tenancy ownership involving the share.

Joint Tenancy With Survivorship In this arrangement, tenants have an equal right to the account's assets. They are also afforded survivorship rights in the event of the death of another account holder. In simple terms, it means that when one partner or spouse dies, the other receives all of the money or property.

Unity of time. Unity of title. Unity of interest. Unity of possession.