This form is a Warranty Deed where the grantor is a limited parntership and the grantee is a limited partnership.

Washington Warranty Deed for Limited Partnership to Limited Partnership

Description

How to fill out Washington Warranty Deed For Limited Partnership To Limited Partnership?

Among lots of paid and free templates which you get on the internet, you can't be sure about their accuracy and reliability. For example, who made them or if they are qualified enough to deal with what you need those to. Always keep relaxed and utilize US Legal Forms! Get Washington Warranty Deed for Limited Partnership to Limited Partnership samples developed by professional lawyers and prevent the costly and time-consuming process of looking for an lawyer or attorney and then paying them to write a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button near the file you’re searching for. You'll also be able to access your previously downloaded files in the My Forms menu.

If you’re using our website the very first time, follow the tips below to get your Washington Warranty Deed for Limited Partnership to Limited Partnership quick:

- Ensure that the file you find is valid in the state where you live.

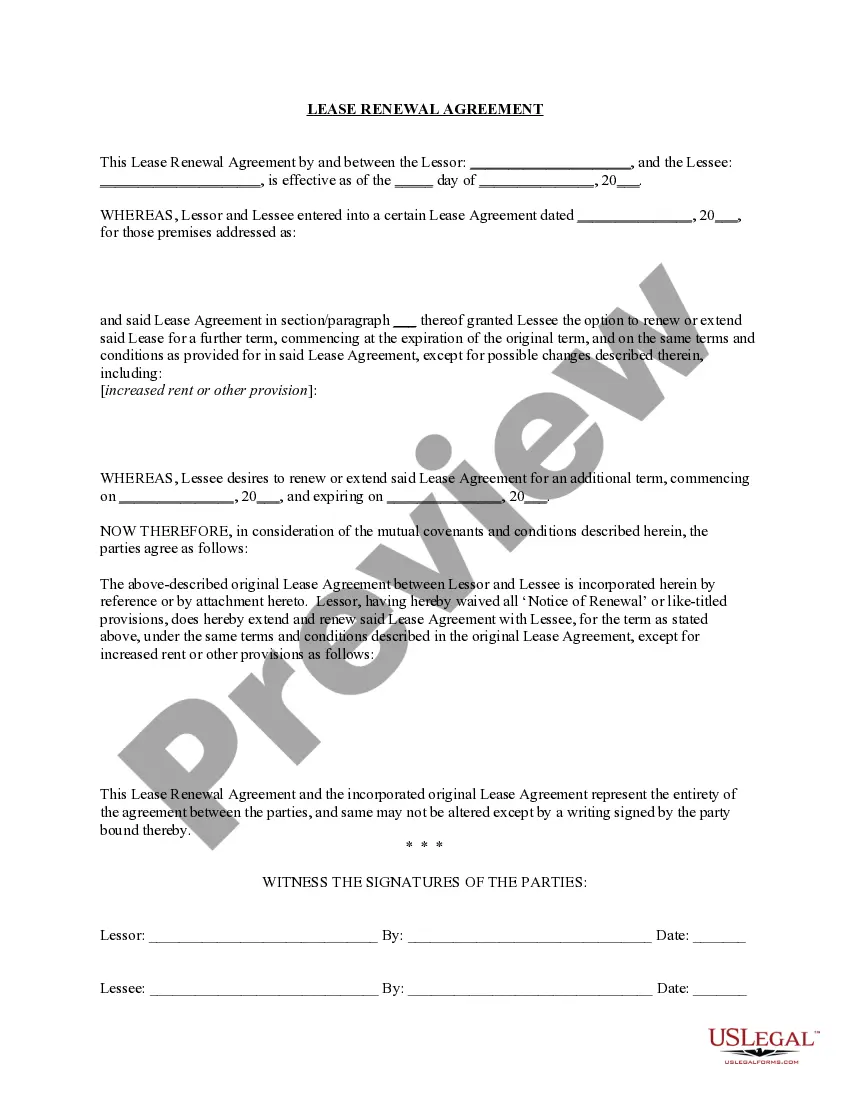

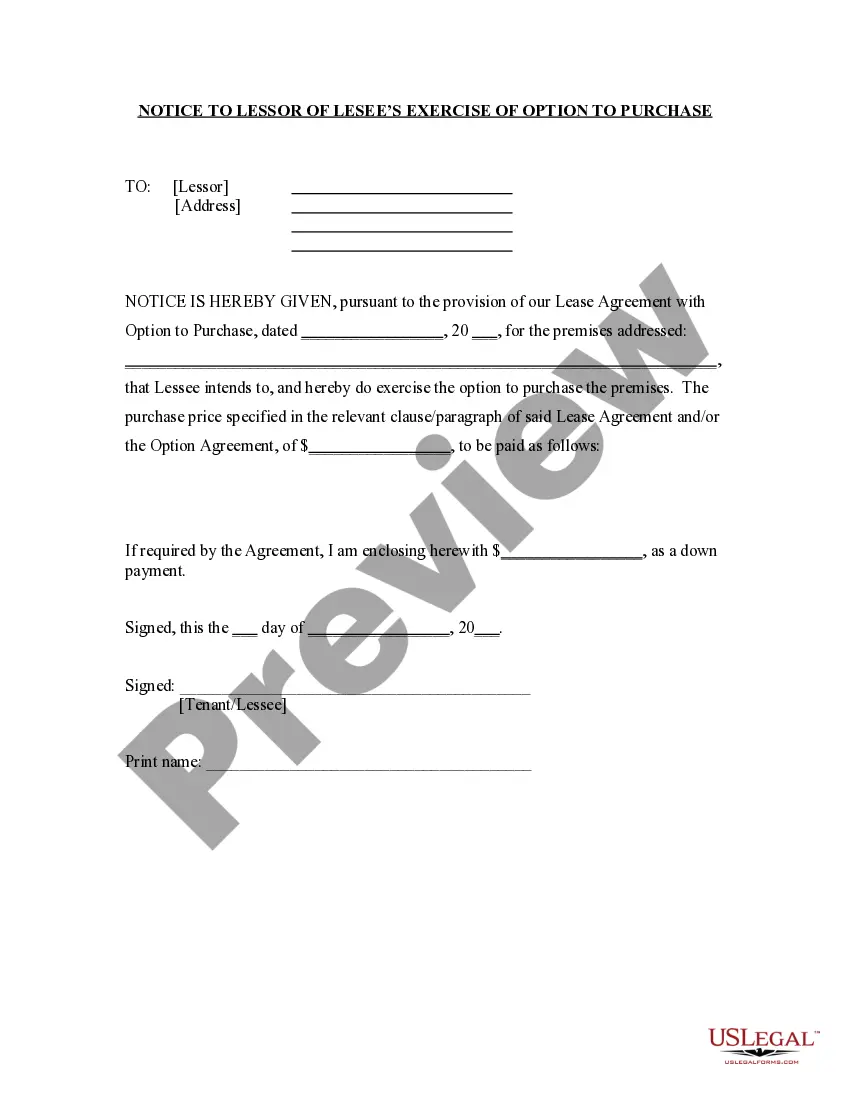

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to start the ordering process or look for another sample using the Search field located in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

As soon as you have signed up and purchased your subscription, you can use your Washington Warranty Deed for Limited Partnership to Limited Partnership as many times as you need or for as long as it continues to be valid in your state. Edit it in your favorite offline or online editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

A limited partnership only requires one managing general partner. However, several natural persons or legal entities can also be active as general partners and jointly manage the company within the framework of a management board, and represent it externally.

General partnerships have no restrictions on who can be owners. Owners can range from individuals to corporations to LLCs. In addition, states do not place restrictions on the types of businesses in which LLCs can participate. Therefore, LLCs can serve as general partners in a partnership.

A limited partner is a part-owner of a company whose liability for the firm's debts cannot exceed the amount that an individual invested in the company. Limited partners are often called silent partners.

(3) The name of a limited partnership that is not a limited liability limited partnership must contain the words "limited partnership", the abbreviation "L.P." or "LP", or the combination "ltd.

Whats the difference in a limited partner and a general partner in an LLC.A limited partner is not liable for any amount greater than his or her original investment in the partnership, while a general partner is liable for all of the partnership's liabilities.

Limited partners are simply investors in the business; they don't have control of day-to-day operations, and they're only liable for as much as they invest in the company.They're considered passive investors because they contribute money to the partnership but don't have control over decisions.

A limited partnership is a type of partnership that consists of at least one general partner and at least one limited partner. A limited liability partnership does not have a general partner, since every partner in an LLP is given the ability to take part in the management of the company.

In general, a partnership is a business agreement between two or more people who are called partners.Typically, the terms general partner and limited partner in all types of partnerships will refer to liability, with general partners pledging their own personal assets while limited partners having limited liabilities.

The same person can be both a general partner and a limited partner, as long as there are at least two legal persons who are partners in the partnership. The general partner is responsible for the management of the affairs of the partnership, and he has unlimited personal liability for all debts and obligations.