Vehicle Power Of Attorney Form With Irs

Description

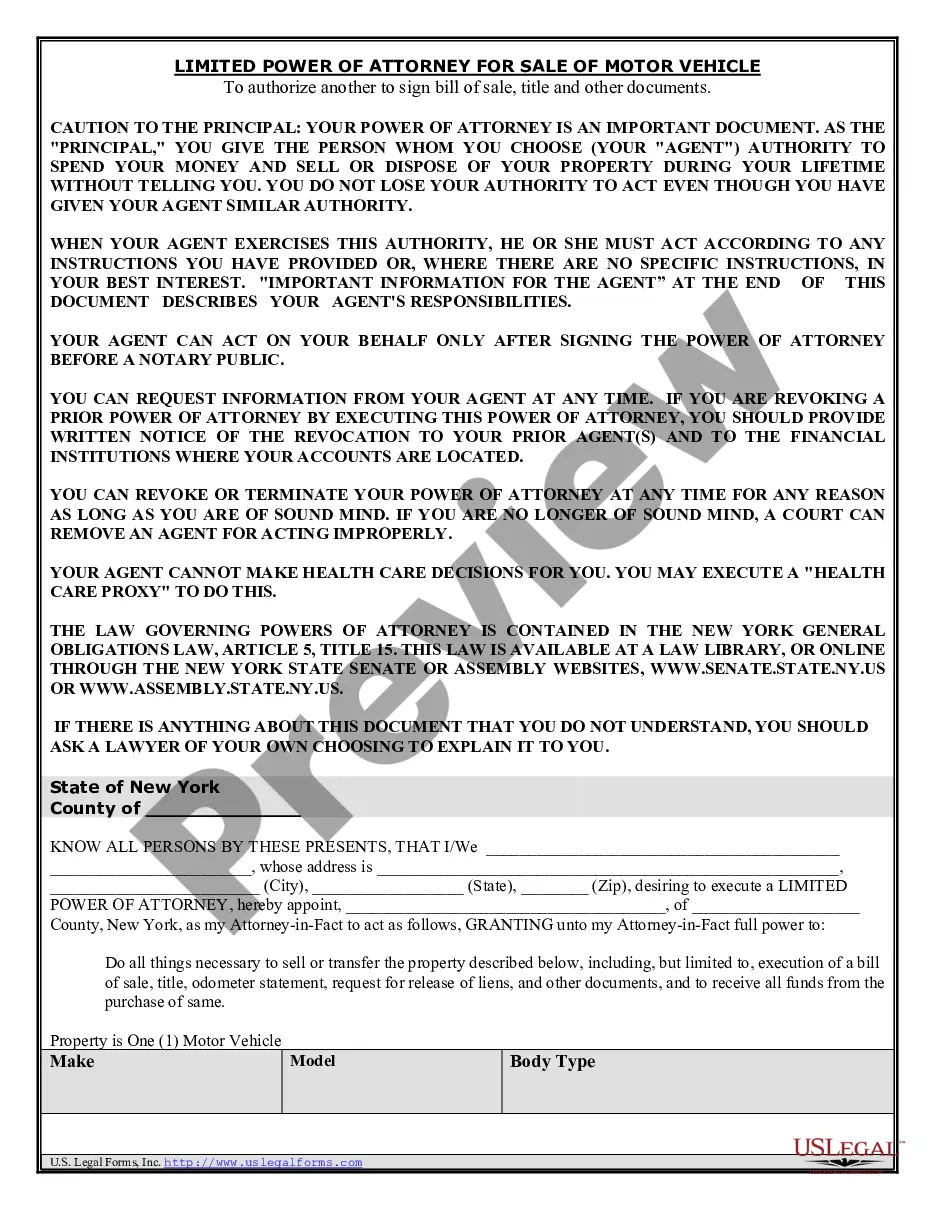

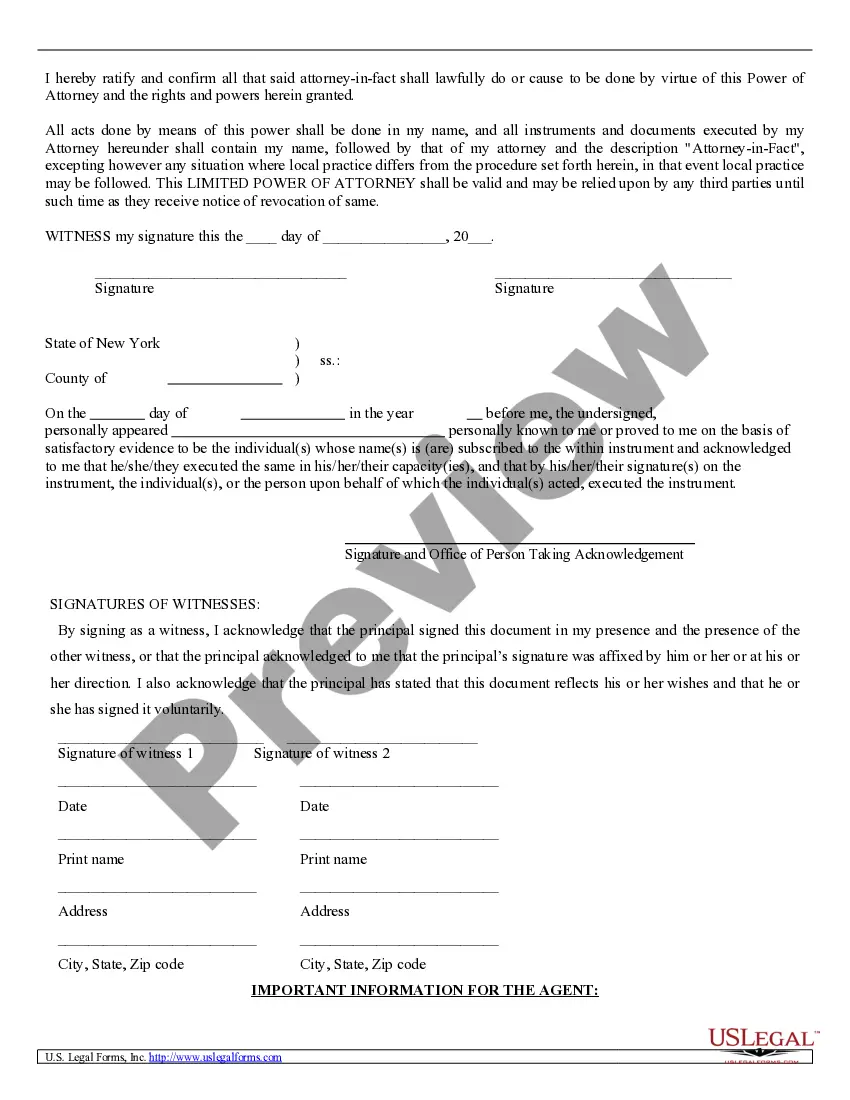

How to fill out New York Power Of Attorney For Sale Of Motor Vehicle?

Whether for business purposes or for personal affairs, everybody has to handle legal situations sooner or later in their life. Completing legal paperwork needs careful attention, starting with picking the appropriate form template. For example, if you select a wrong version of the Vehicle Power Of Attorney Form With Irs, it will be rejected when you send it. It is therefore crucial to have a reliable source of legal files like US Legal Forms.

If you need to get a Vehicle Power Of Attorney Form With Irs template, follow these easy steps:

- Get the sample you need by using the search field or catalog navigation.

- Look through the form’s information to ensure it fits your case, state, and county.

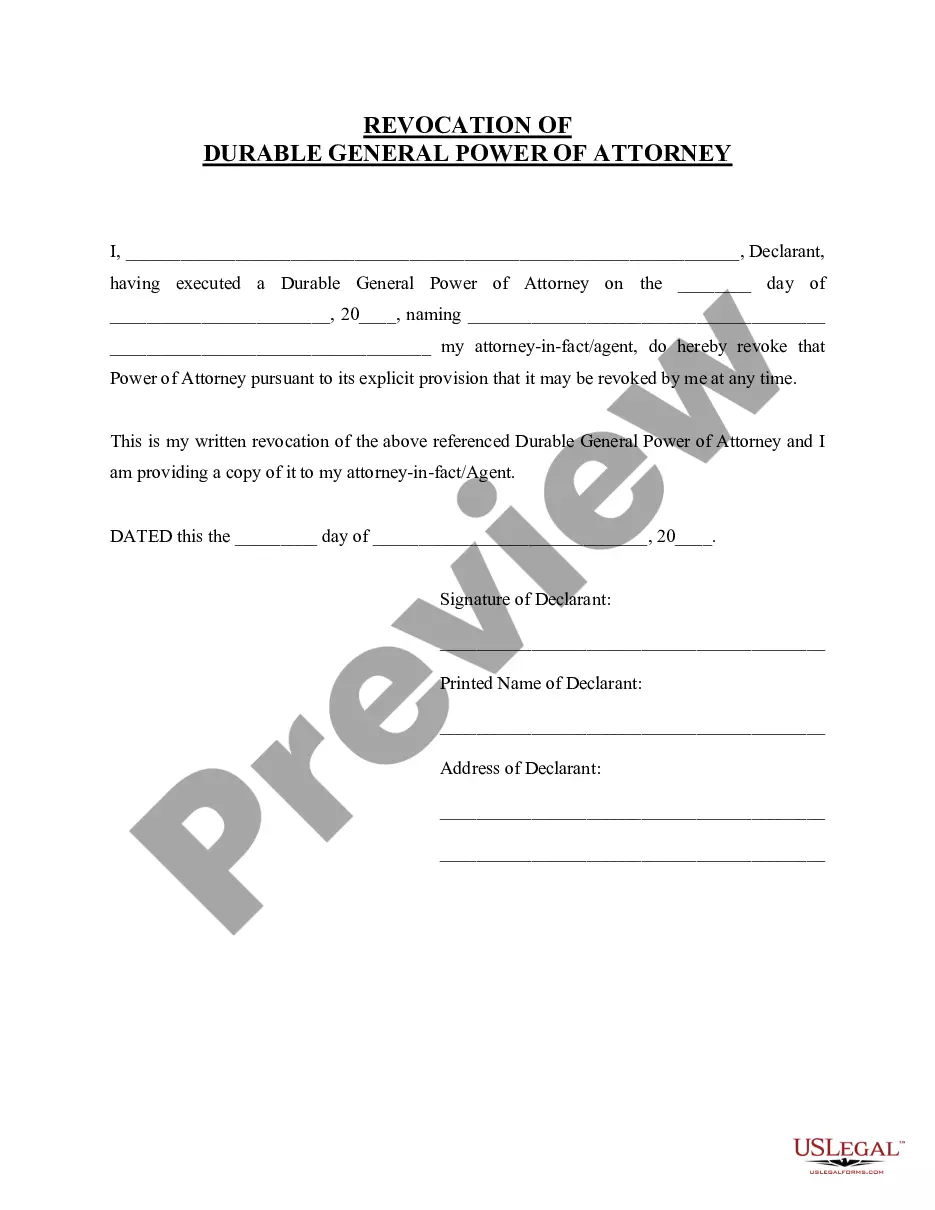

- Click on the form’s preview to view it.

- If it is the incorrect form, return to the search function to find the Vehicle Power Of Attorney Form With Irs sample you need.

- Download the file when it meets your requirements.

- If you already have a US Legal Forms account, simply click Log in to access previously saved templates in My Forms.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Choose the proper pricing option.

- Finish the account registration form.

- Pick your transaction method: you can use a credit card or PayPal account.

- Choose the file format you want and download the Vehicle Power Of Attorney Form With Irs.

- When it is downloaded, you are able to fill out the form with the help of editing applications or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you never need to spend time seeking for the appropriate sample across the web. Use the library’s straightforward navigation to find the appropriate template for any situation.

Form popularity

FAQ

You can use Form 2848, Power of Attorney and Declaration of Representative for this purpose. Your signature on the Form 2848 allows the individual or individuals named to represent you before the IRS and to receive your tax information for the matter(s) and tax year(s)/period(s) specified on the Form 2848.

The fax and mail options for submitting Forms 2848 and 8821 are still available, however signatures on such forms must be handwritten. Using the online option will not accelerate the time necessary for the IRS to process the authorizations, which is currently estimated to be five weeks.

You may also authorize someone to represent you before the IRS in connection with a federal tax matter. This authorization is called Power of Attorney.

Learn How to Fill the Form 2848 Power of Attorney and ... - YouTube YouTube Start of suggested clip End of suggested clip Each must provide their information provide. The name and address followed by the CAF. NumberMoreEach must provide their information provide. The name and address followed by the CAF. Number telephone number and fax number the form 2848.

During the past year, the average time the IRS took to process a POA fluctuated from 22 days to over 70 days and is currently 29 days. The percentage of over age inventory rose to a high of 98 percent and is currently 90 percent.