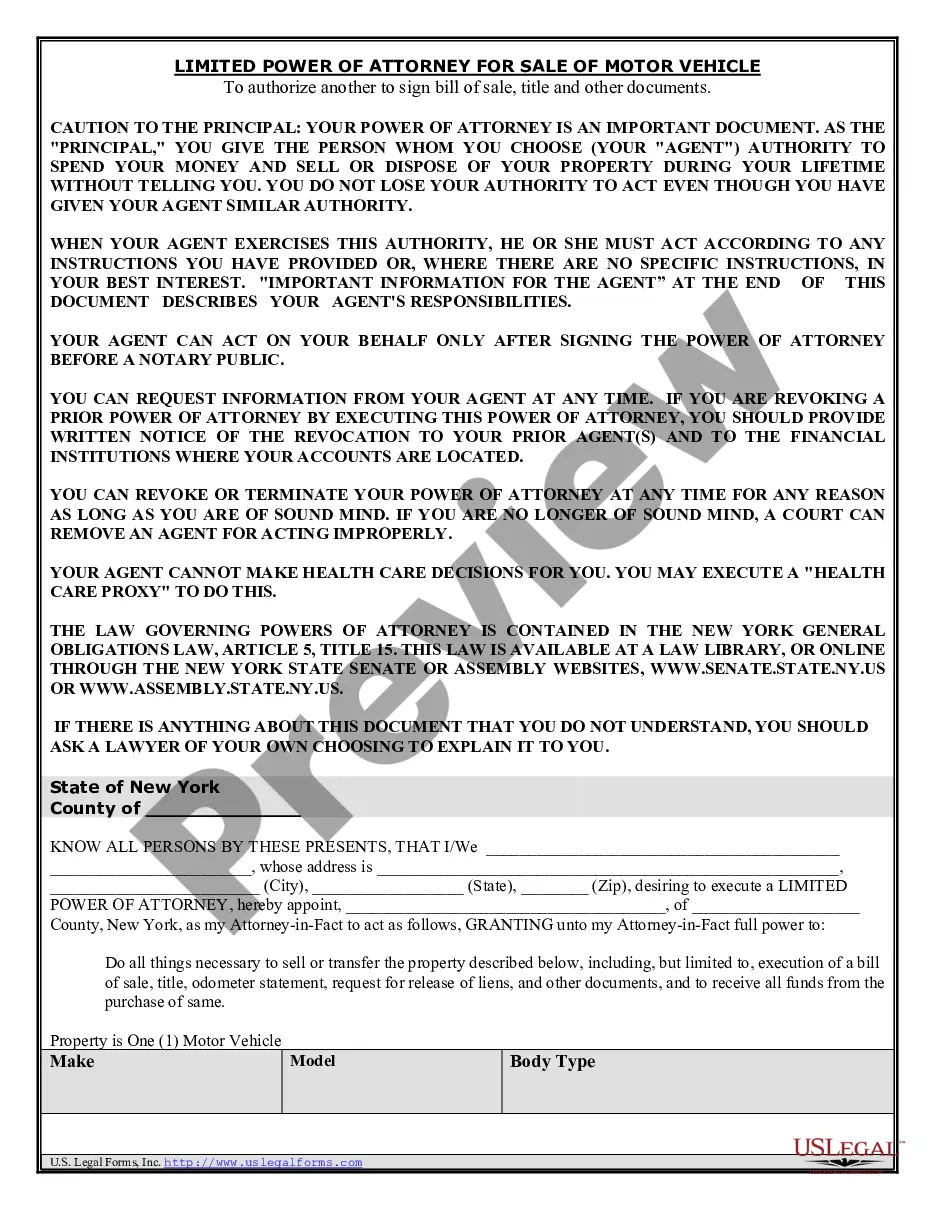

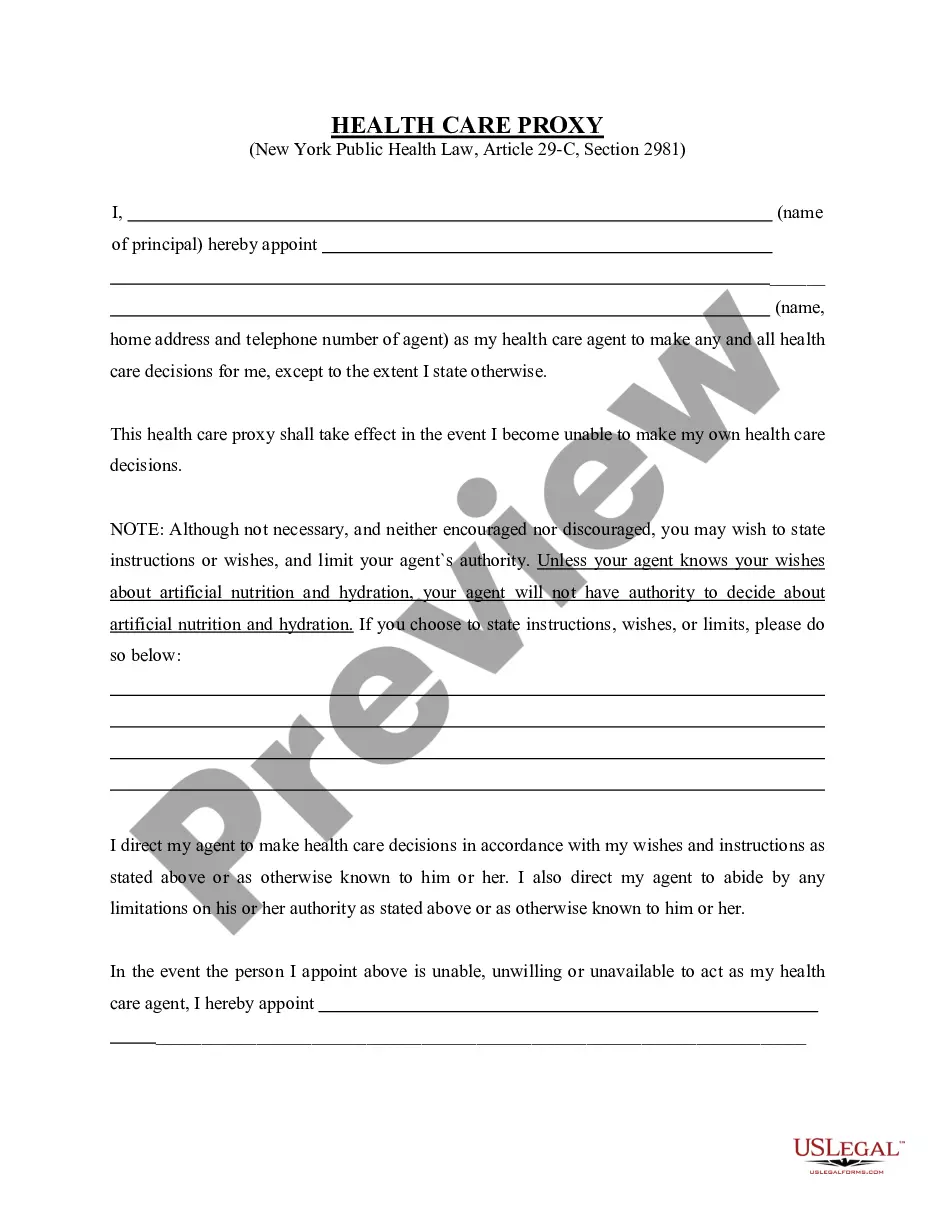

What is Power of Attorney?

Power of Attorney documents enable individuals to grant authority to another person for managing their affairs. These documents are often used in various situations, including financial and healthcare decisions. Explore state-specific templates for your needs.