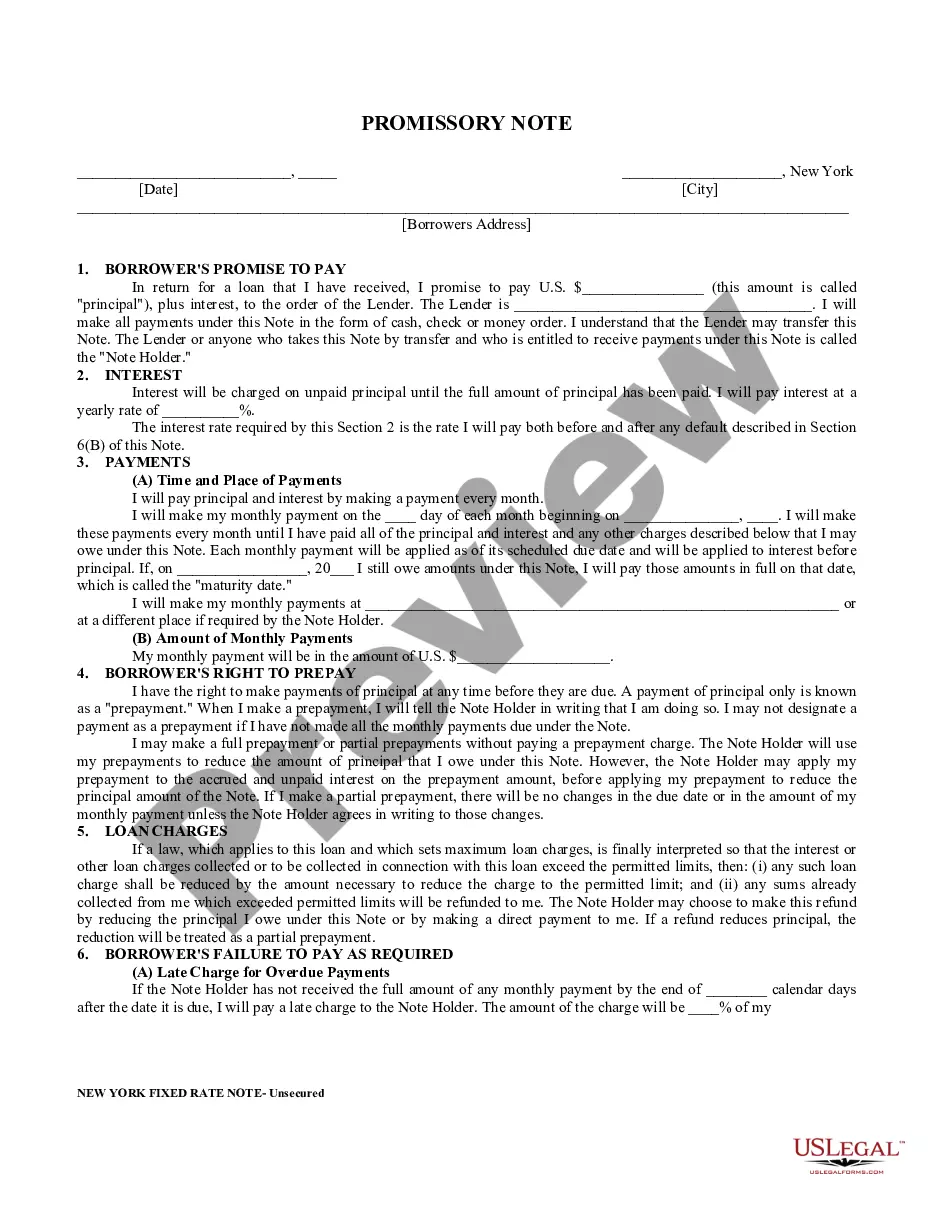

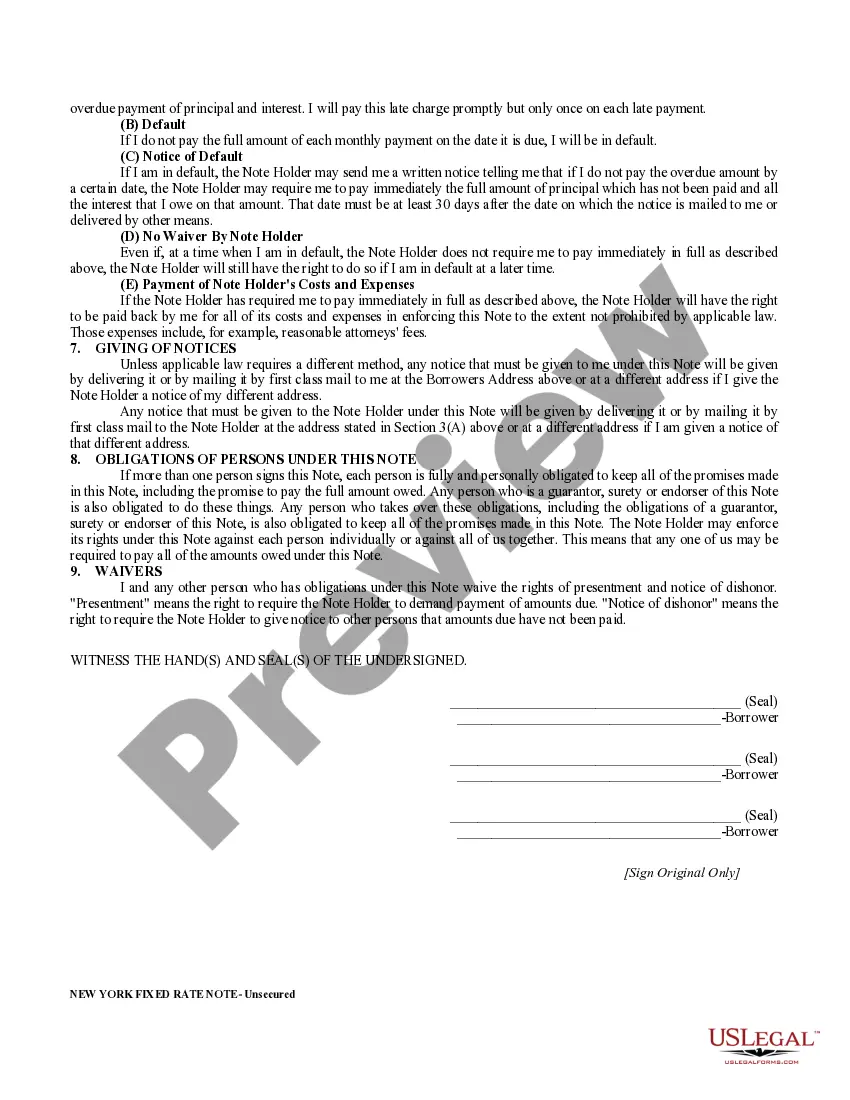

New York Promissory Note Requirements

Description

How to fill out New York Unsecured Installment Payment Promissory Note For Fixed Rate?

How to obtain professional legal documents in line with your state regulations and create the New York Promissory Note Requirements without hiring an attorney.

Numerous online services provide templates for various legal circumstances and formalities. However, it might take some time to determine which of the existing samples meet both your specific needs and legal standards.

US Legal Forms is a reliable service that assists you in locating formal documents crafted in compliance with the most recent updates in state laws, helping you save on legal fees.

If you do not have a US Legal Forms account, please follow the guide outlined below: Review the webpage you have accessed and determine if the form meets your requirements. To assist with this, use the form description and preview options where applicable. If necessary, search for another template in the header for your state. Click the Buy Now button once you identify the appropriate document. Select the most fitting pricing plan, then Log In or create a new account. Choose your preferred payment method (by credit card or via PayPal). Change the file format for your New York Promissory Note Requirements and click Download. The acquired templates are yours to keep: you can always access them in the My documents tab of your account. Register for our platform and draft legal documents independently like a seasoned legal expert!

- US Legal Forms is not merely a standard online library.

- It boasts a selection of over 85,000 validated templates for various business and personal situations.

- All documents are categorized by field and state to expedite your searching process and make it more user-friendly.

- Moreover, it integrates with advanced tools for PDF modification and electronic signatures, allowing users with a Premium subscription to swiftly finalize their documents online.

- It requires minimal effort and time to obtain the necessary paperwork.

- If you possess an account, Log In and verify that your subscription is active.

- Download the New York Promissory Note Requirements using the corresponding button adjacent to the file name.

Form popularity

FAQ

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A promissory note would include information such as the principal amount, interest rate, maturity date, date and place of issuance, and maker's signature. You may have noticed there that I did not list the holder's signature. That is because the holder is not required to sign the note and often doesn't do so.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

Characteristics of promissory note:It is a written legal document. There must be a clear, point to point and unconditional promise of paying a certain amount to a specified person. It should be drawn and signed by the maker. It should be stamped properly. It specifically identifies the name of the maker and payee.