Revocation Living Trust With A Will

Description

How to fill out New York Revocation Of Living Trust?

- Login to your US Legal Forms account if you're an existing user, then download the required templates by selecting the Download option.

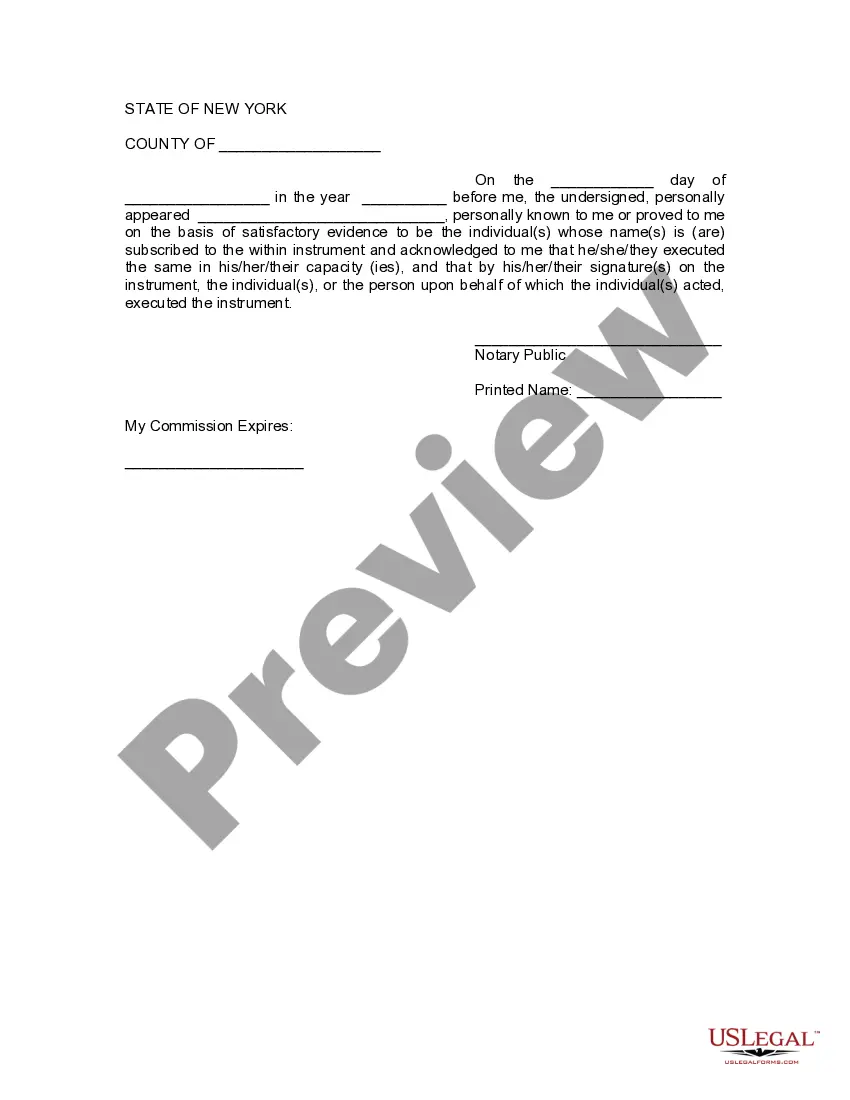

- For new users, start by checking the Preview mode of the relevant forms to ensure they align with your specific needs and local laws.

- If the form doesn't meet your requirements, utilize the Search tab to find the correct template.

- Once you’ve located the desired document, proceed to purchase it by clicking the Buy Now button and selecting an appropriate subscription plan.

- Complete your purchase by entering your payment details via credit card or PayPal for subscription access.

- Finally, download the form to your device and access it via the My Forms menu whenever you need.

In conclusion, US Legal Forms simplifies the process of managing legal documents with a robust collection of over 85,000 easily editable forms. Users can rest assured knowing they have expert support to help ensure accuracy in their documentation.

Start simplifying your legal processes today by exploring the vast resources at US Legal Forms!

Form popularity

FAQ

To dissolve a revocable trust, you generally need a specific form that outlines your intentions to revoke the trust. This form should include the trust's details and be signed according to legal guidelines. It's wise to seek assistance from a legal professional or reliable platforms like US Legal Forms to ensure the dissolution process is correct and your revocation living trust with a will is properly executed.

A trust becomes void when its terms cannot be fulfilled or if it violates laws, such as being established for an illegal purpose. Additionally, if the trust lacks essential elements, such as a legitimate beneficiary or proper funding, it may be deemed void. You should regularly review your trust to ensure it meets legal standards and accurately reflects your intentions. Using resources from US Legal Forms can help keep your revocation living trust with a will valid and enforceable.

To invalidate a living trust, you typically need to follow specific legal procedures that may involve proving specific grounds such as lack of mental capacity or fraud. You may also opt for a formal revocation process if it aligns with your intentions. Engaging an attorney can provide clarity and help navigate the complexities of invalidation. Remember, using a well-structured revocation living trust with a will can safeguard your wishes.

A trust can become invalid for several reasons, including lack of proper execution or failure to meet legal requirements. If the set terms do not align with state laws, the trust may not hold up in court. Additionally, any signs of undue influence or fraud can lead to invalidation. To ensure the validity of a revocation living trust with a will, you may want to consult legal experts or platforms like US Legal Forms.

Yes, a will can override a living trust if it explicitly states intentions that conflict with the trust. In such cases, the terms of the will may take precedence, especially in matters like asset distribution. However, ensuring your documents work together is crucial to avoid confusion and potential legal disputes. Consider using resources from US Legal Forms to create a coherent estate plan.

A typical sample of revocation for a living trust includes a clear statement expressing the desire to revoke the trust, following applicable state laws. The document should identify the trust being revoked and may include the names of involved parties. Utilizing resources from platforms like USLegalForms can offer templates that ensure compliance with legal requirements.

Although a trust can offer many benefits, there are potential downfalls that you should consider. Costs associated with establishing and maintaining a revocation living trust with a will can add up over time. Additionally, improper management or lack of clarity in the trust's terms can lead to misunderstandings or disputes among beneficiaries.

Revoking a revocable living trust is a straightforward process. Typically, it involves drafting a formal document that outlines the intention to revoke the trust. When utilizing a revocation living trust with a will, it is vital to communicate this change clearly to all parties involved and ensure that legal documentation is processed correctly to avoid future complications.

One of the most common mistakes parents make is failing to fund the trust adequately. Creating a revocation living trust with a will is only the first step; transferring ownership of assets into the trust is crucial. If assets remain outside the trust, the intended benefits may not be realized, causing confusion or delays in distribution.

Deciding whether to establish a trust is a significant choice for your parents. A revocation living trust with a will can offer advantages like protecting assets and simplifying inheritance. However, they should weigh these benefits against potential costs and complexities, and consider seeking advice from a legal expert for tailored guidance.