Revocation Living Trust With A Trustee

Description

How to fill out New York Revocation Of Living Trust?

- Log in to your US Legal Forms account if you are a returning user, and check your subscription status.

- If this is your first time, preview available forms to identify a revocation living trust that fits your needs and local laws.

- Use the search feature to explore alternatives if the first option doesn't meet your criteria.

- Select the appropriate document by clicking 'Buy Now', and choose a subscription plan that suits you.

- Complete your purchase using a credit card or PayPal for secure transaction processing.

- Download the completed form to your device and access it whenever needed via the My Forms section in your profile.

Following these steps ensures that you're equipped with an accurate and customizable revocation living trust document. US Legal Forms not only simplifies the process but also provides a vast library of resources, making it easy to find legal forms tailored to your specific requirements.

Ready to take control of your estate planning? Visit US Legal Forms today and empower yourself with the legal tools you need!

Form popularity

FAQ

A trust can become invalid for several reasons, such as ambiguity in its terms or failure to adhere to legal formalities required in your state. For instance, if a revocation living trust with a trustee lacks proper signing or witnessing, it may not hold up in court. Furthermore, if the grantor does not have the mental capacity to create the trust, it could also be invalidated. It is always wise to consult legal resources to avoid potential pitfalls.

A trust may be deemed void if it lacks essential elements like a valid purpose, proper funding, or if it was created under duress or through fraud. Additionally, failing to comply with state laws can lead to a trust's invalidation. If there is insufficient capacity from the grantor when establishing the trust, it may also be considered void. Ensuring that your revocation living trust with a trustee adheres to legal standards is paramount for its validity.

To remove a trustee from a living trust, the grantor must follow the process outlined in the trust document. This typically involves drafting a formal amendment or revocation document indicating the removal. Additionally, notifying the trustee and any interested parties is crucial to maintain transparency. If needed, consider consulting US Legal Forms for guidance and documentation assistance to ensure compliance with all legal requirements.

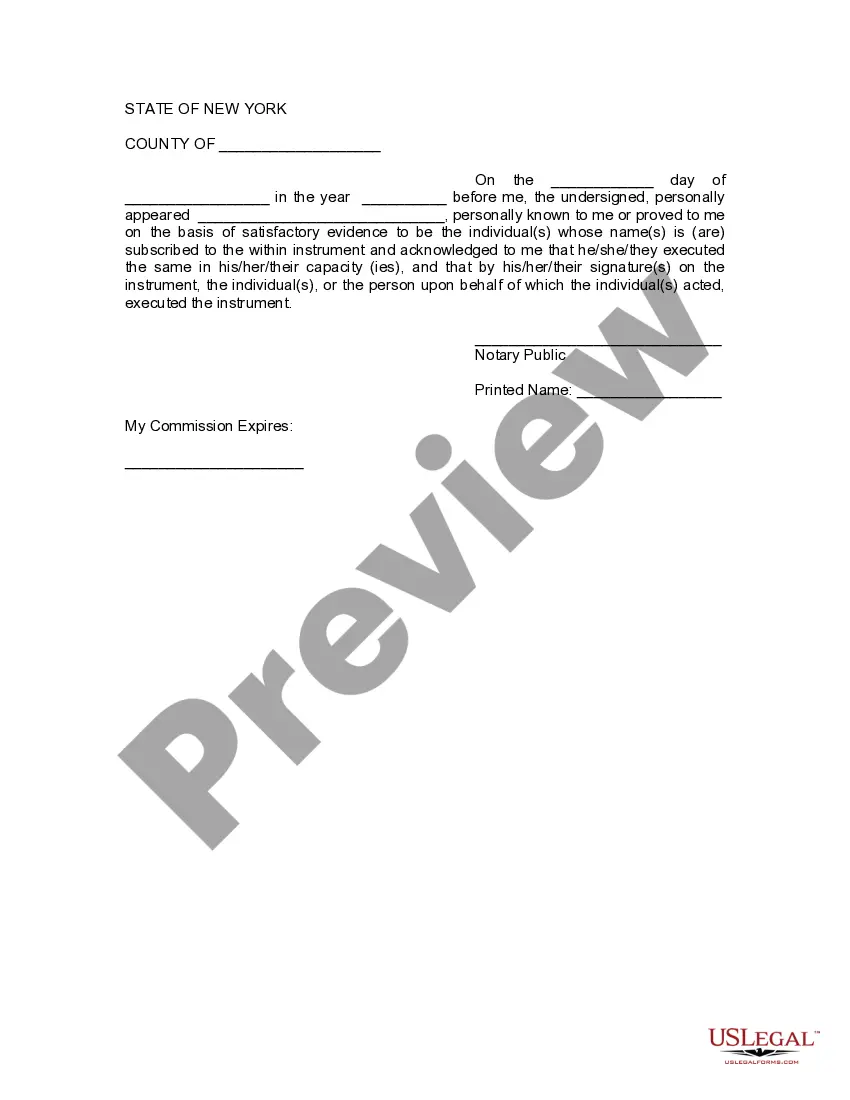

To revoke a revocable living trust with a trustee, the grantor must create a formal document expressing the intent to revoke the trust. This revocation document should outline the trust's name, the date it was established, and clearly state that the trust is no longer valid. Once signed, it’s essential to notify the trustee and any relevant parties involved. This process helps ensure a smooth transition and aligns future asset management with your current wishes.

The 5 year rule for trusts refers to the time frame that affects how assets are treated for tax purposes when placed in a trust. If assets are transferred into a revocation living trust with a trustee and the grantor makes changes or revokes the trust within five years, the assets may be included in the grantor's taxable estate. This rule can complicate distributions and ultimately affect beneficiaries. Understanding these nuances is vital for managing your estate effectively.

A revocable trust becomes irrevocable upon the death of the grantor or when specified conditions outlined in the trust document are met. This means the terms can no longer be changed or revoked. Understanding when your revocation living trust with a trustee shifts to irrevocable status is crucial for your estate planning. Consulting with estate planning professionals can provide clarity and ensure that your trust meets your goals.

Revoking a revocable trust is generally straightforward, especially if you established it with clear terms. You can simply draft a revocation document, sign it, and communicate your decision to your trustee. Remember, keeping your revocation living trust with a trustee updated ensures that your estate planning aligns with your current intentions. It’s sensible to seek professional help to ensure compliance with the law.

You can revoke a revocable trust by following the procedure outlined in the trust document. Generally, this involves creating a written notice of revocation and informing all relevant parties, including your trustee. By effectively managing your revocation living trust with a trustee, you can make changes according to your circumstances. It’s advisable to consult legal experts to guide you through this process.

Removing a trustee from a revocable living trust requires following the guidelines set in the trust document. Typically, you can revoke the trust or appoint a new trustee if you wish to retain the structure while changing management. Be sure to document this change properly to ensure your revocation living trust with a trustee reflects your current wishes. Seeking guidance from legal professionals can also be beneficial in this process.

A nursing home cannot directly take your revocable trust, but it can access its assets to cover care costs if you exhaust your resources. It's important to structure your revocation living trust with a trustee properly. By doing so, you can potentially protect your assets from being seized for long-term care. If you're concerned about this issue, consulting professionals in elder law can help clarify your options.