Living Trust Taxes

Description

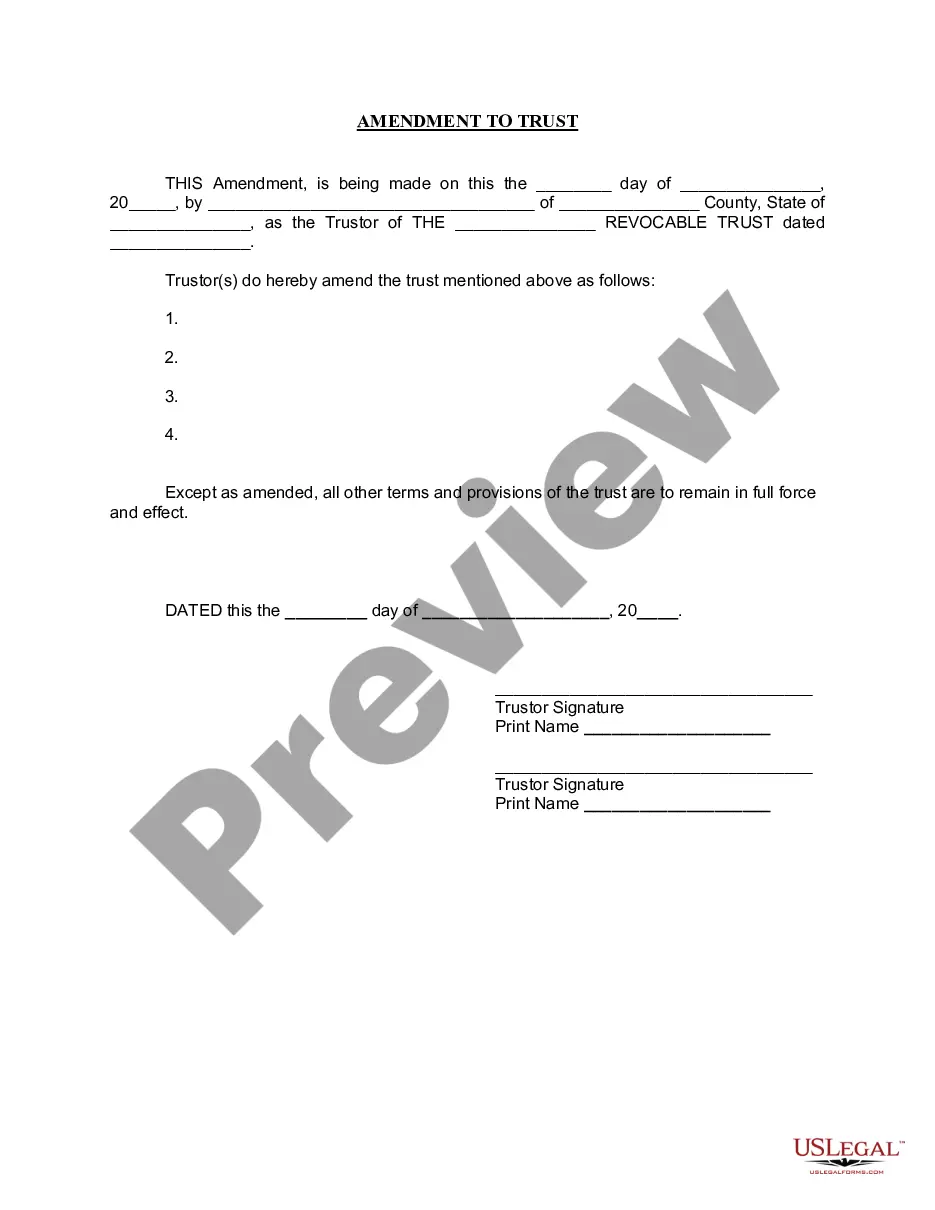

How to fill out New York Amendment To Living Trust?

- If you are a returning user, log in and access your account to download the necessary template by clicking the Download button. Ensure your subscription is up-to-date; if it’s expired, renew it based on your payment plan.

- For new users, begin by exploring the Preview mode and the description of each form. Confirm you select the appropriate document that aligns with your requirements and complies with your jurisdiction.

- If necessary, search for an alternate template using the Search tab to find a suitable option. If you identify a discrepancy, this feature will assist you in locating the correct form.

- Proceed to purchase the document by clicking the Buy Now button. Select your preferred subscription plan and create an account to unlock the full library of resources.

- Finalize your purchase by entering your credit card information or opting to use PayPal for payment.

- Once your purchase is complete, download your form and save it on your device. You can also access your document at any time through the My Forms section in your profile.

US Legal Forms offers an extensive collection of over 85,000 legal templates that are fillable and editable, which means you can customize them to suit your specific needs. The platform is designed for both individuals and attorneys, ensuring that all legal documents produced are accurate and compliant with local regulations.

In conclusion, navigating living trust taxes is easier with the right documentation. Take advantage of US Legal Forms today for a seamless experience and ensure your legal documents are executed correctly. Start your journey now!

Form popularity

FAQ

Having a living trust does not inherently change your tax situation, as the trust is often revocable and considered part of your estate. However, living trust taxes come into play when the trust earns income, as that income can affect your personal tax return. Implementing a living trust can streamline your estate management and ensure that you remain informed about any potential tax responsibilities. U.S. Legal Forms provides tools and information to help you effectively manage your living trust and its tax implications.

Trust beneficiaries are typically taxed on the income they receive from the trust. Specifically, if the trust distributes income to you, you must report that income on your tax return, affecting your overall tax obligation. Understanding living trust taxes can help you prepare for any potential tax liabilities associated with your inheritance. By using U.S. Legal Forms, you can access resources to better navigate these tax implications.

A living trust does not count as income in the traditional sense. Instead, the assets within a revocable living trust retain their original tax status, meaning any income generated is taxed as personal income to the trust’s creator. This contrasts with irrevocable trusts, where the income may be subject to different tax rules. Knowing how living trust taxes work can help you manage your estate effectively.

A living trust itself does not usually file a separate tax return as long as it remains revocable. Instead, the income generated by the trust's assets is reported on your personal income tax return. However, if you create an irrevocable trust, it may need to file its own tax return. Familiarizing yourself with living trust taxes can simplify your financial planning, and resources like US Legal Forms can guide you through this process.

Beneficiaries of a trust may face taxes depending on the type of distributions they receive. Distributions from a revocable trust usually pass through without incurring taxes, as the grantor is still alive and controls the assets. In contrast, irrevocable trusts may generate income, which the beneficiaries must report on their tax returns. Understanding living trust taxes can help beneficiaries plan accordingly.

To avoid inheritance tax with a trust, consider creating an irrevocable trust, as it typically removes assets from your taxable estate. This means that the assets placed in the trust are no longer considered part of your estate when you pass away. It’s essential to understand the nuances of living trust taxes, as different states have varying rules regarding inheritance tax. Utilizing tools like US Legal Forms can help you set up the right trust.

Trusts can avoid income taxes through strategic tax planning and asset management. Many irrevocable trusts, for example, remove assets from the grantor's taxable estate, thus potentially lowering tax liability. However, it's essential to know that revocable trusts do not provide this advantage, as assets remain taxable. Therefore, exploring living trust taxes with a professional can provide clarity.

While living trusts offer many benefits, they may also have tax disadvantages. For instance, the assets in a revocable living trust remain under your control, meaning they can be taxed as part of your income. This eliminates the possibility of certain tax breaks available with irrevocable trusts. Therefore, understanding living trust taxes is crucial to making informed decisions about estate planning.

The responsibility for filing a trust tax return generally falls to the trustee or the person managing the trust. In cases involving a living trust, the grantor often conducts this task while they are alive. After the grantor passes away, the successor trustee typically handles the filing of any living trust taxes. Using platforms like USLegalForms can help simplify this process by providing necessary documentation and guidance.

The new IRS rule stipulates that certain trusts must file tax returns, even if there is no income. This change emphasizes clarity in reporting and compliance regarding living trust taxes. Those holding assets in a trust should be aware of these new requirements to avoid potential penalties. Staying informed will help you maintain your trust’s tax compliance effectively.