Living Trust

Description

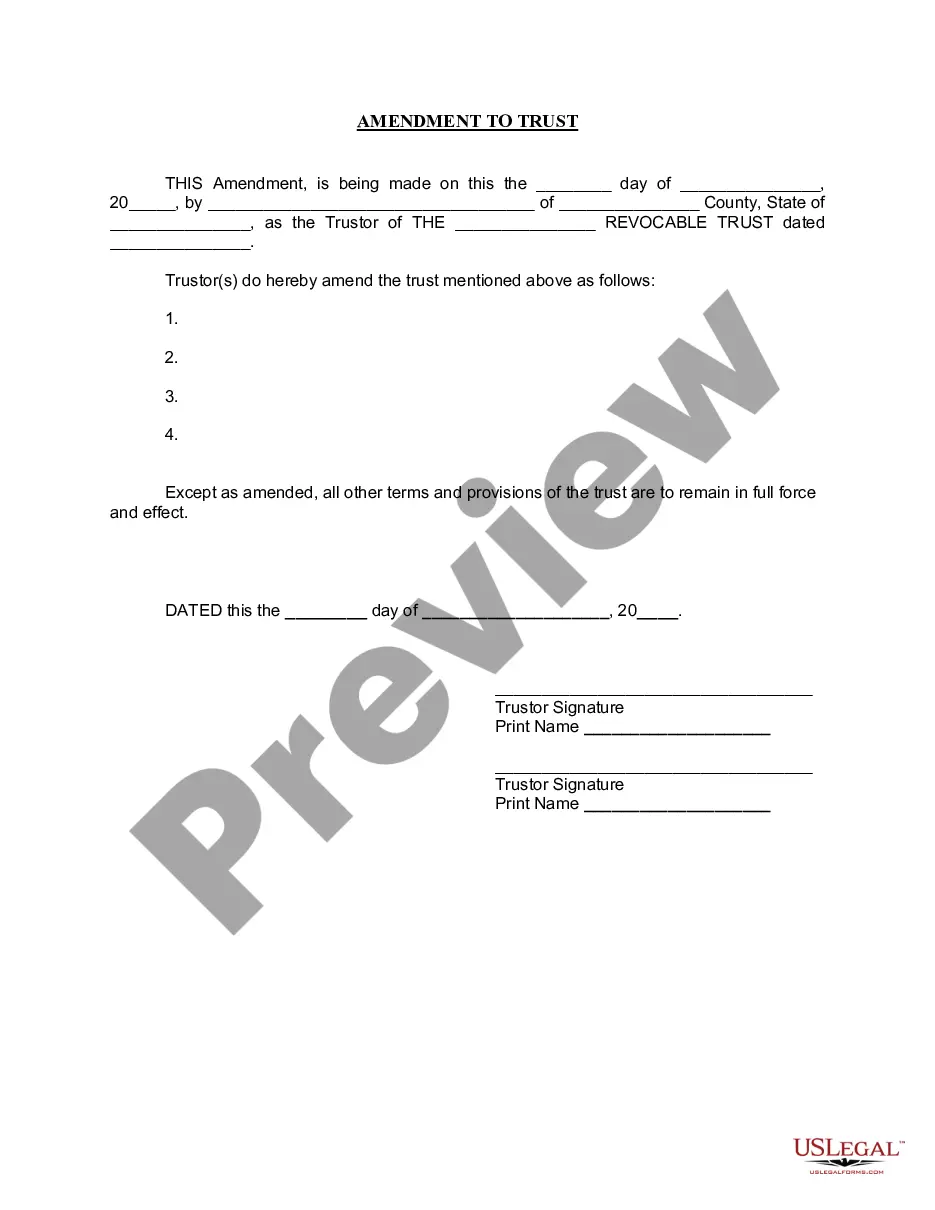

How to fill out New York Amendment To Living Trust?

- Log in to your US Legal Forms account if you are an existing user, or create an account if this is your first visit.

- Browse the extensive form library to find the living trust template that fits your needs. Utilize the Preview mode and read the form description to confirm its suitability for your jurisdiction.

- If needed, search for alternative templates using the Search tab to ensure compliance with local laws.

- Once you’ve selected the appropriate template, click the 'Buy Now' button and choose your preferred subscription plan to access the document.

- Enter your payment information, either through credit card or PayPal, to finalize the transaction.

- Download your living trust template to your device and access it anytime through the 'My Forms' section of your account.

Completing your living trust with US Legal Forms is intuitive and straightforward, ensuring you have access to necessary resources at your fingertips. With their robust collection of forms and expert assistance, your legal document preparations will be seamless.

Begin your journey to secure your assets and loved ones by creating a living trust today. Visit US Legal Forms to explore their extensive library!

Form popularity

FAQ

Failing to file taxes on your living trust can lead to penalties and interest on unpaid taxes. If the trust is revocable, its income is usually taxed on your personal return; neglecting to report this can cause complications. For irrevocable trusts, the trust itself may be liable for taxes, leading to severe financial consequences. To avoid issues, utilizing US Legal Forms can provide clarity on the tax responsibilities associated with your living trust.

You generally do not need to file your living trust with a court as you do with a will. A living trust is a private document, allowing you to manage your assets privately without court involvement. However, if the trust generates income, you may have to include that income on your tax return. Always consult a legal professional for guidance specific to your living trust.

A living trust can become invalid if it does not meet legal requirements, such as lacking proper documentation or not being properly funded. Changes made without adhering to the legal protocols can also render the trust invalid. Additionally, if the trust's creator, known as the grantor, loses mental capacity without creating a successor trustee, it may also lead to issues. To ensure your living trust remains valid, consider utilizing resources like US Legal Forms.

A living trust itself generally does not need to file a tax return unless it generates income. Typically, the income from the living trust is reported on your personal tax return. However, if the trust is irrevocable or becomes a separate tax entity, it may require a separate tax return. It’s wise to consult a tax professional to understand your obligations regarding your living trust.

Setting up a living trust involves several important steps to ensure it meets your needs. First, determine what assets you want to place into the trust, as these can include real estate, bank accounts, and investments. Next, select a trustee, which can be yourself or another trusted individual, to manage the trust properties. Finally, consider using an online service like USLegalForms, which offers user-friendly templates and guidance to help you smoothly establish your living trust.

There is no strict minimum amount required to create a living trust, as it can be tailored to your individual needs. However, it's often recommended to have significant assets to justify the costs associated with setting up and maintaining the trust. A living trust can be a valuable tool for managing your estate when you have considerable assets to protect.

Placing your house in a living trust in Texas can be a wise decision. This strategy allows for seamless transfer of ownership without going through probate, which can save time and reduce stress for your loved ones. However, it’s important to consult with a professional to ensure proper funding and management of the trust.

In Texas, some disadvantages of a living trust include the initial setup and ongoing management costs. You may also face complexities if you own real estate in multiple states, as each property needs to be separately managed within its jurisdiction. Lastly, a living trust does not offer protection from creditors or legal judgments.

The main purpose of a living trust is to manage and distribute your assets according to your wishes while avoiding probate. By placing your assets in a living trust, you can ensure a smoother transfer to beneficiaries upon your death. This arrangement can save time, reduce costs, and provide privacy regarding your estate.

Filling out a living trust involves several key steps. Begin by gathering information about your assets and deciding how you want them distributed. Next, you'll need to complete the trust document, which can often be done using platforms like US Legal Forms for convenience. Finally, ensure you transfer your assets into the trust properly to make it effective.