Dissolution Dissolve Company For 10 Years

Description

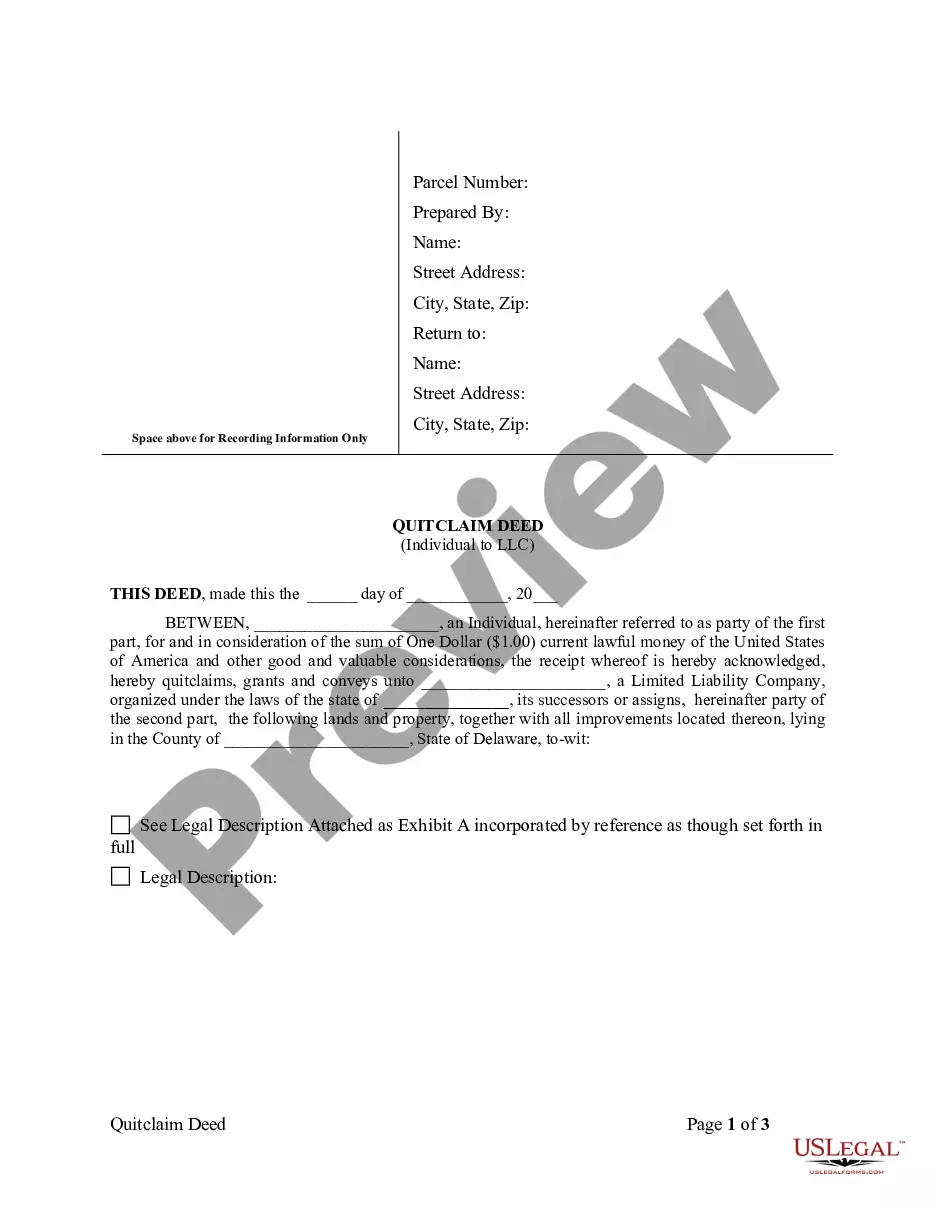

How to fill out New York Dissolution Package To Dissolve Limited Liability Company LLC?

- Log in to your existing US Legal Forms account and verify your subscription status. If your subscription has lapsed, take a moment to renew it based on your preferred payment plan.

- Review the available document previews and their descriptions to confirm you are selecting the correct dissolution form aligned with your state regulations.

- If your needs evolve, explore further templates using the Search tab, to ensure you have the right documentation.

- Proceed to purchase the form by clicking the Buy Now button, where you can select your desired subscription plan—registration is required for full access.

- Complete your transaction by entering your credit card information or using PayPal to finalize payment for your subscription.

- Upon successful transaction, download the document directly to your device. You can also access it anytime through the My Forms section in your account.

In conclusion, US Legal Forms not only provides an extensive repository of forms but also empowers users to manage their legal documentation confidently. With expert assistance available, you can be assured of compliance and accuracy in your dissolution process.

Start your dissolution journey with US Legal Forms today and ensure your legal needs are met effectively!

Form popularity

FAQ

If a corporation continues to operate after dissolution, it risks significant legal penalties and personal liability for its officers. The state may impose fines, and creditors may pursue owners for debts incurred during this time. It's crucial to formally cease operations to avoid these complications. Using US Legal Forms can provide you with the necessary steps to ensure compliance during the dissolution of a company for 10 years.

Dissolving an LLC can lead to potential tax implications and the difficulty of re-establishing your business later if needed. Owners lose personal liability protection for debts incurred during operation once dissolution occurs. This process can also lead to challenges in resolving pending contracts or outstanding obligations. Weighing these cons carefully is essential before deciding to dissolve your company for 10 years.

In a dissolved corporation, the assets are typically distributed to the shareholders after all debts are settled. If the corporation had multiple shareholders, the distribution may be proportional to their ownership stakes. It's essential to document this process to avoid potential legal disputes later. For managing the dissolution process, consider using US Legal Forms to simplify how assets are handled during your company’s dissolution for 10 years.

Dissolving a company means officially ending its existence while terminating an LLC specifically refers to ending its operational rights without necessarily liquidating assets. Both processes involve notifying state authorities, yet dissolution usually includes asset distribution to owners. Understanding these differences can help you navigate the process of dissolution and ensure compliance for a company that's been operating for 10 years.

After dissolution, using a corporate bank account poses legal risks. Any transactions after the official dissolution date can lead to personal liability for directors and shareholders. It is best to close the bank account and distribute remaining assets as part of the dissolution process. For assistance with this, you can refer to US Legal Forms for guidance on completing your dissolution correctly.

Once a corporation undergoes dissolution, the responsibility for its debts typically shifts to its directors and shareholders depending on the situation. If the debts were incurred during the corporation's operation, creditors may pursue the owners if the corporation was found to be negligent. In some cases, a bankruptcy process may be necessary to settle outstanding obligations. Therefore, understanding how dissolution can affect personal liability is crucial for anyone looking to dissolve a company for 10 years.

Dissolution can occur through voluntary means, such as a decision by the owners, or involuntary means, such as legal actions from the state. Administrative dissolution may also happen if a company fails to meet regulatory requirements. Understanding these pathways is essential for anyone considering how to dissolve a company effectively over the past 10 years.

You can prove a business is dissolved by obtaining a certificate of dissolution from the state where the entity was formed. This certificate serves as official documentation of the dissolution process, certifying that the business no longer exists. Additionally, maintaining records of all dissolution filings and communications with the state provides further proof. Having access to tools like uslegalforms can streamline acquiring necessary documentation.

The speed at which a company can be dissolved varies by state and the type of dissolution chosen. Some entities can dissolve in a matter of weeks if all paperwork is filed correctly and no outstanding issues exist. Involuntary dissolution may take longer due to legal proceedings. It's crucial to understand the specific requirements in your state to expedite the process.

To notify the IRS of your corporate dissolution, you must file your final tax return and check the box indicating that it is a final return. Additionally, you may need to address any outstanding tax obligations before completing the dissolution process. Ensure that all required forms are filled out correctly to avoid complications. Utilizing services like uslegalforms can simplify this process.