What Is A Lien With The Irs

Description

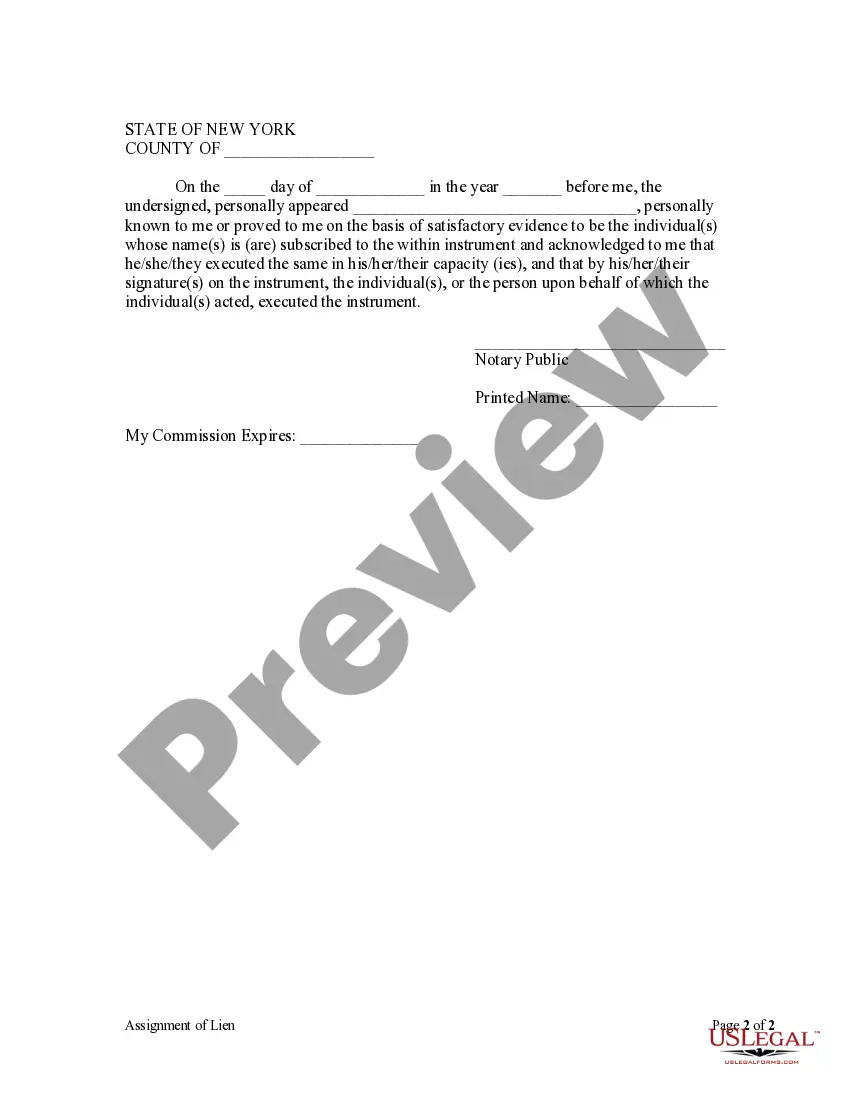

How to fill out New York Assignment Of Lien By Individual?

- Log in to your account if you're a returning user. Ensure your subscription is active before proceeding to download the needed forms.

- For new users, start by checking the form description and preview. This ensures you select the appropriate document that meets your jurisdiction's requirements.

- If the available forms don't meet your needs, utilize the Search feature to find the exact template you require.

- Once you've selected the right document, click 'Buy Now' and select your preferred subscription plan. You'll need to register for an account to proceed.

- Complete your purchase by entering your payment information. You can use a credit card or your PayPal account.

- After purchasing, download the form to your device, and you can access it anytime in the 'My Forms' section of your profile.

In conclusion, US Legal Forms simplifies the process of obtaining necessary legal documents through an extensive library and user-friendly platform. By following these steps, you can efficiently secure the forms you need.

Start utilizing US Legal Forms today and ensure your legal documentation process is smooth and compliant.

Form popularity

FAQ

You can contact the IRS about a tax lien by calling their customer service hotline or visiting your local IRS office. Be ready to provide your Social Security number and other identifying details. Engaging with the IRS directly allows you to ask questions about the lien and seek resolutions tailored to your financial situation.

To get an IRS lock-in letter released, start by contacting the IRS directly. You may need to provide your financial information to demonstrate that your circumstances have changed. Additionally, using the services of platforms like USLegalForms can simplify the process of preparing the required documents, ensuring you manage your tax situation effectively.

To release your lien, you should confirm that all tax liabilities are settled. You can then file a request for a lien release with the IRS, usually completed through Form 668(Z). It is important to follow up to ensure the IRS processes your request and updates their records accordingly.

To look up a lien with the IRS, start by visiting the IRS website and navigate to the 'View Your Tax Account' section. You will need to verify your identity by providing your personal information. Once authenticated, you can access details regarding any tax liens filed against you, bringing clarity to your financial status with the IRS.

The IRS can keep a lien on you for a maximum of 10 years from the date it is filed, provided the tax debt remains unpaid. After this period, the lien should automatically expire unless extended under certain circumstances. Understanding the timeline related to a lien with the IRS will help you strategize how to resolve your tax issues effectively. Timely action is key to minimizing the impact on your finances.

If the IRS puts a lien on you, it can negatively impact your credit score and restrict your financial transactions. This means you may face challenges when trying to sell assets or secure loans. Additionally, the IRS gains the right to seize your property if the tax debt remains unpaid. Being informed about what a lien with the IRS entails is essential for planning your next steps.

When the IRS puts a lien on you, it signifies that they have a legal claim to your property due to unpaid taxes. This lien can affect your ability to secure loans, sell property, or access credit. It is crucial to address this situation promptly, as ignoring it can lead to more severe financial consequences. Understanding what a lien with the IRS implies can help you navigate your options more effectively.

Yes, IRS liens can often be negotiated, particularly through careful discussions about your payment options or by proposing an Offer in Compromise. While negotiation may take time and requires detailed financial documentation, it is possible to reach a resolution that is favorable. By understanding what is a lien with the IRS, you can leverage your situation to negotiate effectively. Consulting with professionals like those at US Legal Forms can also be beneficial in this process.

Dealing with an IRS lien involves understanding your options for resolution, which may include paying off your tax debt or negotiating a settlement. It's critical to stay proactive and communicate effectively with the IRS to explore potential solutions. Knowing what is a lien with the IRS empowers you to make informed decisions and take the appropriate steps. US Legal Forms can provide you with the documents and guidance needed to manage this situation.

An example of a tax lien is a situation where the IRS files a notice of lien against your property, such as your home or business assets, due to unpaid federal taxes. This lien publicly announces the government's claim on your property and can deter potential buyers or lenders. Understanding what is a lien with the IRS can help you recognize the seriousness of the situation. By working with professionals, you can take steps to address the lien.