Foreclose

Description

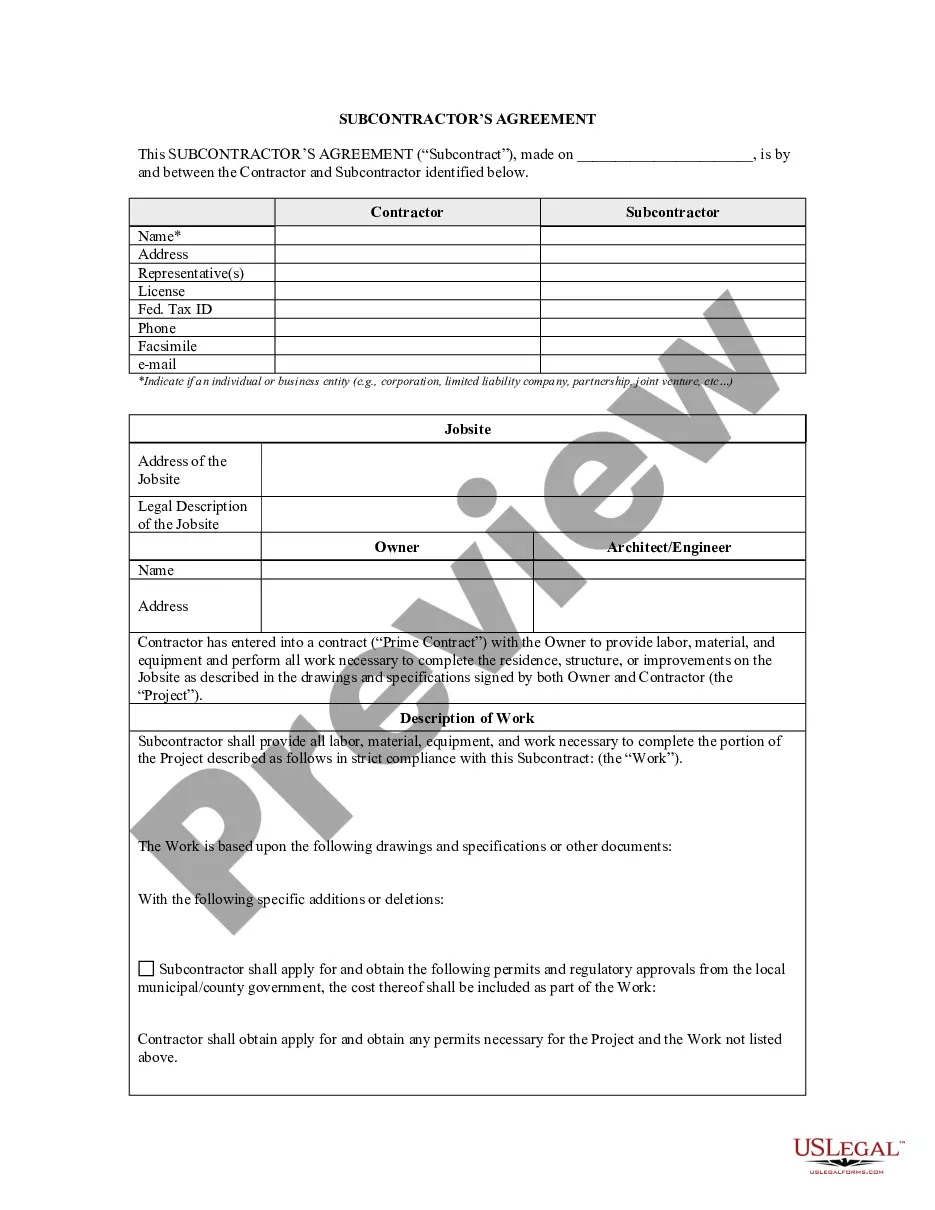

How to fill out New York Referee's Deed In Foreclosure?

- For existing users, log into your account and navigate to the form you need. Ensure your subscription is active to access all features.

- If you're new, start by browsing the Preview mode to explore form descriptions. Confirm you have selected the appropriate document that complies with your local laws.

- If you notice discrepancies, utilize the Search tab to find alternative forms that fit your requirements.

- Once satisfied, click the Buy Now button, choose a subscription plan, and create an account to access the vast library.

- Proceed to payment by entering your credit card information or linking your PayPal account.

- Finally, download your form and save it to your device. You can also revisit it anytime via the My Forms section in your profile.

US Legal Forms stands out with its robust collection of documents, offering more forms than many competitors for a similar price. With the ability to access premium expert assistance, users are ensured that their forms are completed accurately and meet legal standards.

Start your foreclosure process today with US Legal Forms and experience the ease of handling legal documents. Visit us now to get started!

Form popularity

FAQ

A foreclosure can have significant implications for your taxes. When a lender forgives a portion of your mortgage debt through foreclosure, that amount may be considered taxable income. It is crucial to report this accurately on your tax return, as not doing so can lead to penalties or further complications. Consulting with a tax professional can help you understand how to navigate these challenges effectively.

To write about foreclosure effectively, start by clearly defining what foreclosure is and the reasons it can occur. Incorporate real-life examples and relevant statistics to make your writing relatable. Additionally, providing insights into the legal processes and emotional impact can enhance your narrative. Utilizing the uslegalforms platform can streamline the research process to find accurate, helpful legal language around foreclosure.

You may receive a 1099 form after a foreclosure, especially if there was any canceled mortgage debt. This form, known as Form 1099-A, reports the acquisition or abandonment of secured property, and your lender is required to send it to you if applicable. It is essential to review this form carefully, as you will need to use the information for tax reporting purposes. Staying organized can help you navigate this requirement smoothly.

In Tennessee, foreclosures typically occur through a judicial process. When a borrower defaults on their mortgage, the lender must file a lawsuit to initiate the foreclosure process. The court will then oversee the proceedings, allowing the borrower to defend against the foreclosure if necessary. Understanding this process can help you take appropriate actions if facing foreclosure in Tennessee.

Yes, you may be able to write off certain aspects of a foreclosure on your taxes. When a foreclosure occurs, if you had canceled debt, you might qualify for the Mortgage Debt Relief Act, which allows you to exclude forgiven debt from your taxable income. It is crucial to consult with a tax professional to explore your options and determine the best course of action for your unique situation. This can help you effectively manage your financial obligations.

To report a foreclosure on your tax return, start by obtaining IRS Form 1099-A, which you should receive if your lender canceled your mortgage debt. In the event of a foreclosure, you must report any canceled debt as income, as it may affect your tax liabilities. Additionally, ensure you keep comprehensive records of all transactions and documentation related to this process. This way, you will accurately reflect the foreclosure on your tax return.

To get access to foreclosures, start by researching various listing services and websites dedicated to real estate. Many banks and governmental organizations also provide listings of foreclosed homes. Additionally, you can consider attending local auctions where foreclosures are sold. Using resources like US Legal Forms can help you gather necessary documents and stay organized throughout the process.

Getting a foreclosed home can be straightforward if you are prepared. Engaging with a knowledgeable real estate agent can help identify suitable properties and guide you through offers. Most foreclosures sell quickly, so acting fast is crucial. With the right approach, including leveraging tools from US Legal Forms, you can streamline the buying process.

Buying a foreclosed house can be challenging, but it's manageable with the right approach. You need to understand the process of bidding at auctions and navigate through bank-owned listings effectively. Researching the property condition is essential, as many foreclosures need repairs. Utilizing platforms like US Legal Forms can simplify your documentation needs.

The foreclosure process in Alabama typically spans about 90 to 120 days, depending on whether it is judicial or non-judicial. Factors such as borrower responsiveness and legal challenges can impact the duration. It's important to remain informed and proactive throughout the process. Utilizing US Legal Forms can ensure you have the necessary legal documentation to navigate this efficiently.