Actor - Actress Employment Agreement - Self-Employed Independent Contractor

Description

How to fill out Actor - Actress Employment Agreement - Self-Employed Independent Contractor?

Among numerous free and paid templates that you’re able to find online, you can't be certain about their accuracy. For example, who made them or if they’re skilled enough to take care of what you require them to. Keep calm and use US Legal Forms! Locate Actor - Actress Employment Agreement - Self-Employed Independent Contractor samples created by skilled attorneys and prevent the expensive and time-consuming process of looking for an lawyer or attorney and then having to pay them to write a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button near the file you’re seeking. You'll also be able to access all of your previously saved examples in the My Forms menu.

If you’re using our service the very first time, follow the tips listed below to get your Actor - Actress Employment Agreement - Self-Employed Independent Contractor fast:

- Make sure that the document you discover applies where you live.

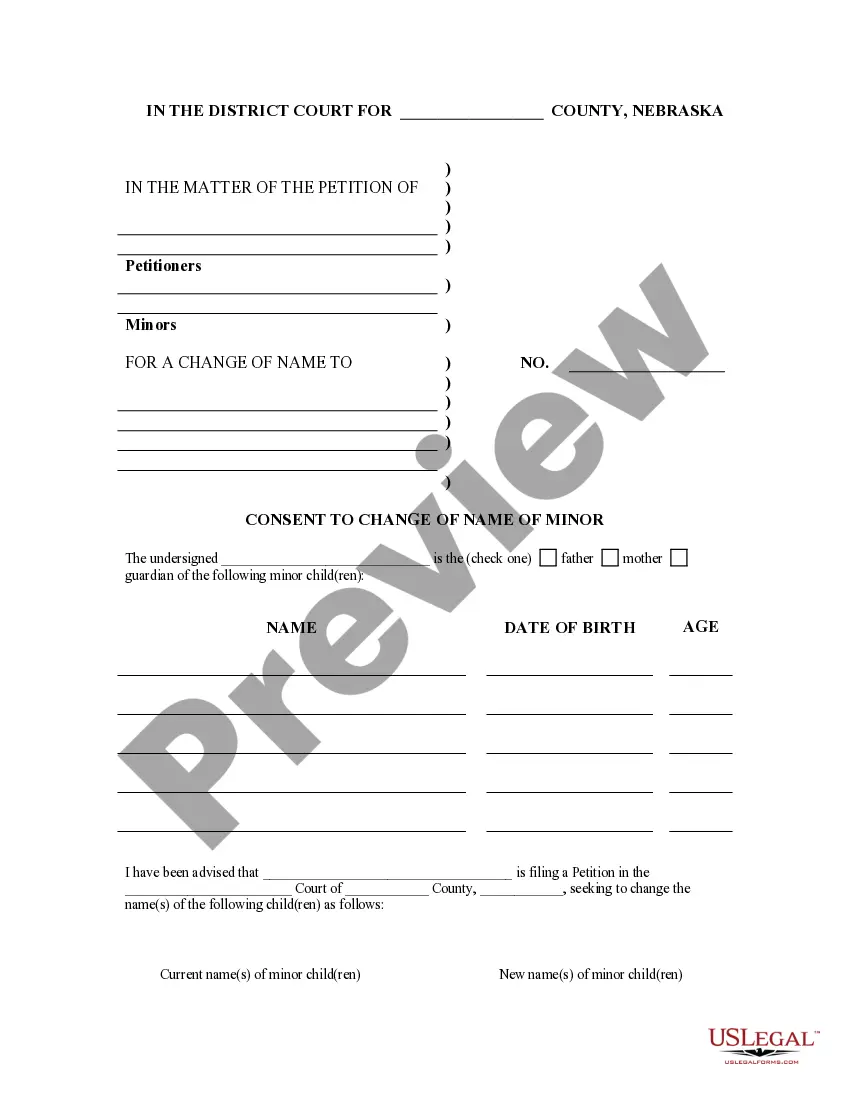

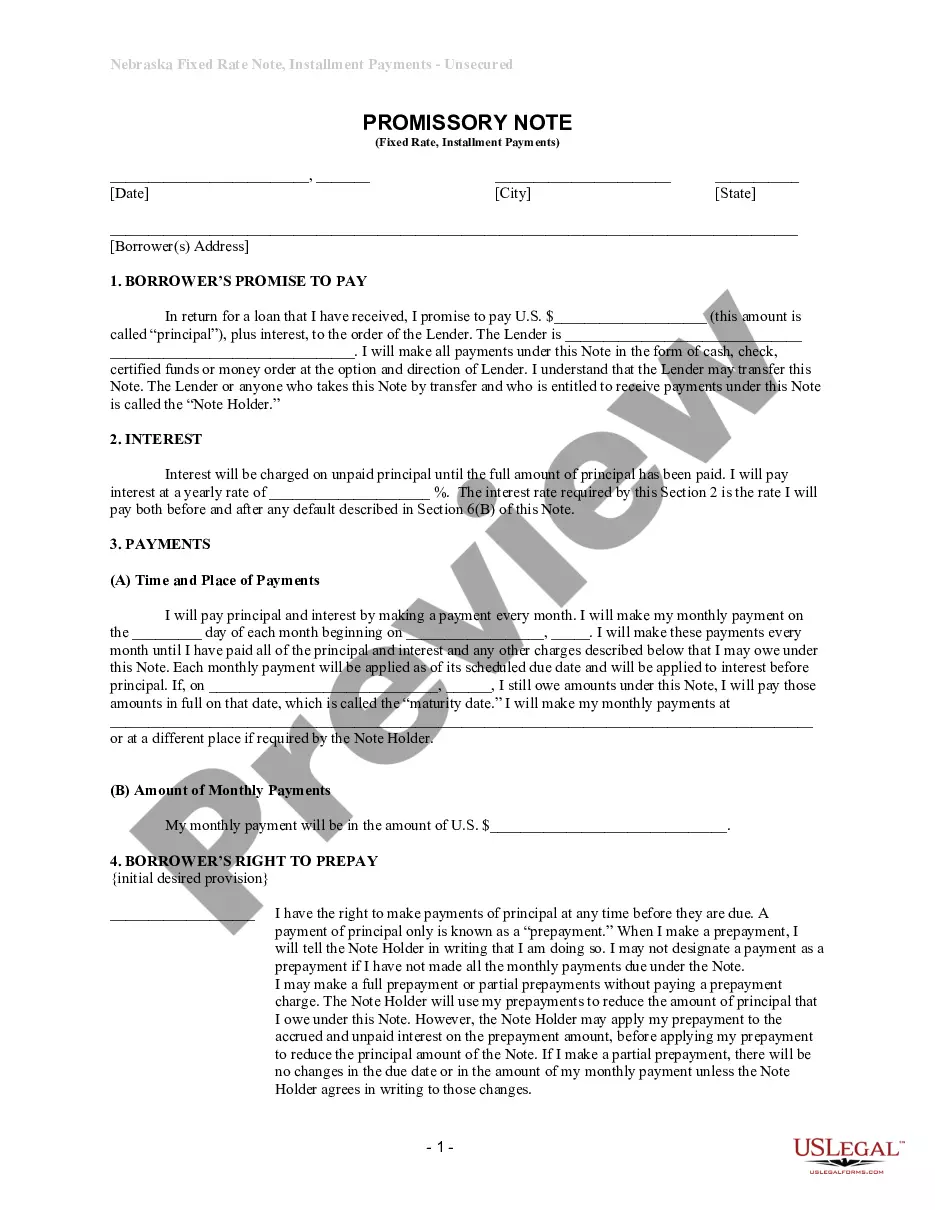

- Review the template by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another template using the Search field located in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

Once you’ve signed up and purchased your subscription, you can use your Actor - Actress Employment Agreement - Self-Employed Independent Contractor as many times as you need or for as long as it continues to be valid in your state. Edit it with your favored online or offline editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

You are probably an independent contractor if: You work for more than one company at a time. You pay your own business and traveling expenses. You hire and pay your own assistants. You can earn a profit or suffer a loss as result of your work for the company.

Models and photography: An employee dressed up as an independent contractor is still an employee.a California court determined that a model for a one-day photoshoot was really an employee of the photographer and was entitled to all of her pay on the same day that she worked.

Models are considered employees with regards to their physical work, and independent contractors regarding the use of their image. Consequently, models enter into two different agreements with their agencies.

A salesperson is an individual engaged in the selling of merchandise or services. The salesperson can be a common law employee, an independent contractor, an employee by specific statute, or an excluded employee by specific statute.

Generally, actors would be considered to be employees the company that hires them exercises a great deal of control over what they do: the company (or director) tells them when to start, when to stop, what to say and what to do.The company that hires them actually has a contract with the actor's company.

Are actors considered self-employed? An actor is considered self-employed if they work for themselves as a sole proprietor, an LLC, or an S corporation or C corporation. Some actors are employees and some actors are self-employed. Self-employed people work for themselves and aren't considered employees of anyone else.

More than four out of five nonunion actors and stage managers in California have been classified as independent contractors and asked to work for less than minimum wage, according to survey results released Tuesday by Actors' Equity, which represents about 51,000 actors and stage managers at theater companies across