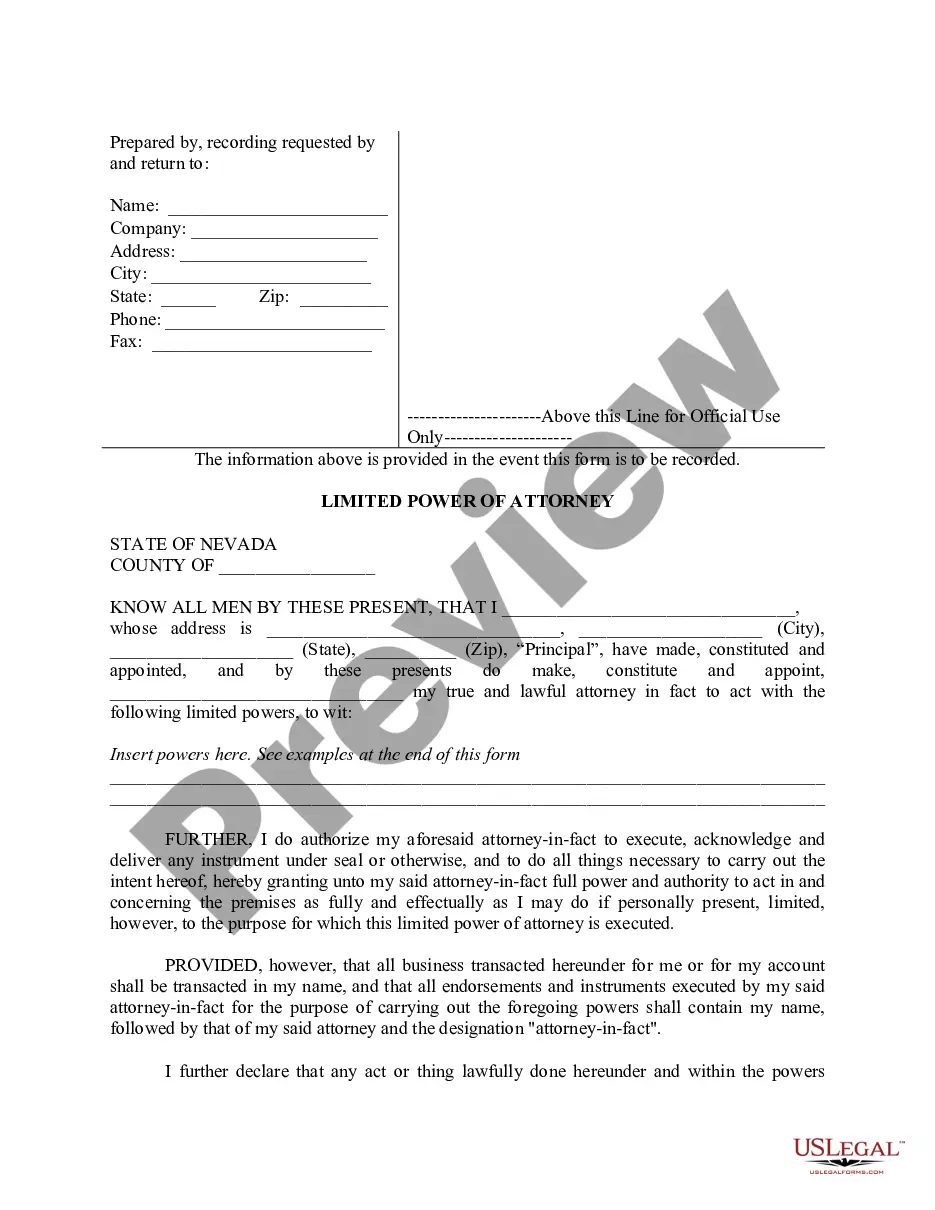

Power Attorney For Property

Description

How to fill out Nevada Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- Start by logging into your existing US Legal Forms account. If you're a new user, create an account to access the wide array of documents available.

- Browse through the preview mode and form descriptions to ensure you've selected the right power attorney for property that aligns with your local jurisdiction requirements.

- If necessary, use the search feature to find alternative templates that might better suit your needs.

- Select the document you want and proceed to the purchase by clicking the 'Buy Now' button. Pick a subscription plan that works for you.

- Complete your payment via credit card or PayPal to finalize your order.

- Once purchased, download the form to your device for easy completion. You can also access it later under 'My Forms' in your account.

By following these straightforward steps, you can easily obtain your power of attorney for property through US Legal Forms. Our service not only provides an extensive library of over 85,000 forms but also connects you with legal experts for additional guidance.

Take control of your property management needs today. Visit US Legal Forms and start your journey towards efficient legal solutions.

Form popularity

FAQ

In North Carolina, you do not necessarily need a lawyer to create a power of attorney; however, having legal guidance can be beneficial. You can create a valid power attorney for property by following state laws and using reliable forms. Online services like US Legal Forms can assist you in drafting the document correctly. This ensures that your property decisions are legally sound without the immediate need for legal counsel.

You can obtain a power of attorney without a lawyer by using online resources. Many platforms, such as US Legal Forms, provide templates and guidance for creating a power attorney for property. It is important to carefully fill out the necessary documentation and ensure it meets your state requirements. Taking these steps allows you to manage your property matters independently.

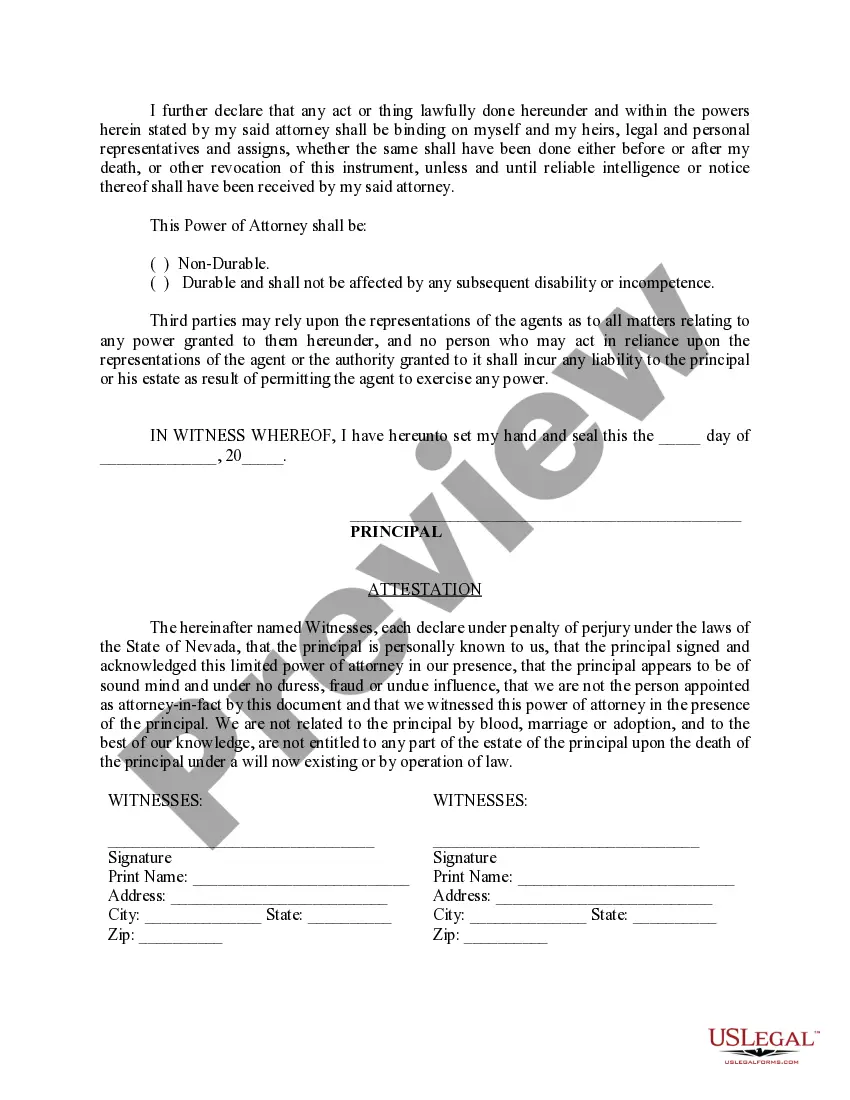

In Pennsylvania, a power of attorney for property requires a signed document that specifies the authority granted. The document must be signed by you and a witness, and it may also need to be notarized. Familiarizing yourself with the state requirements can streamline the process. You can use resources like US Legal Forms to ensure that your power attorney for property meets all legal standards.

Choosing the best person for power of attorney involves selecting someone you trust deeply. This person should be reliable and capable of managing your property affairs, making decisions that align with your values. It is wise to discuss your intentions and expectations with them beforehand. This way, they can handle your property according to your wishes.

The best person to give power of attorney is someone you trust to handle your property matters responsibly. This individual could be a family member, close friend, or a trusted advisor. The critical factor is that they understand your wishes and will act in your best interest regarding your property. By choosing wisely, you ensure that your property is managed effectively.

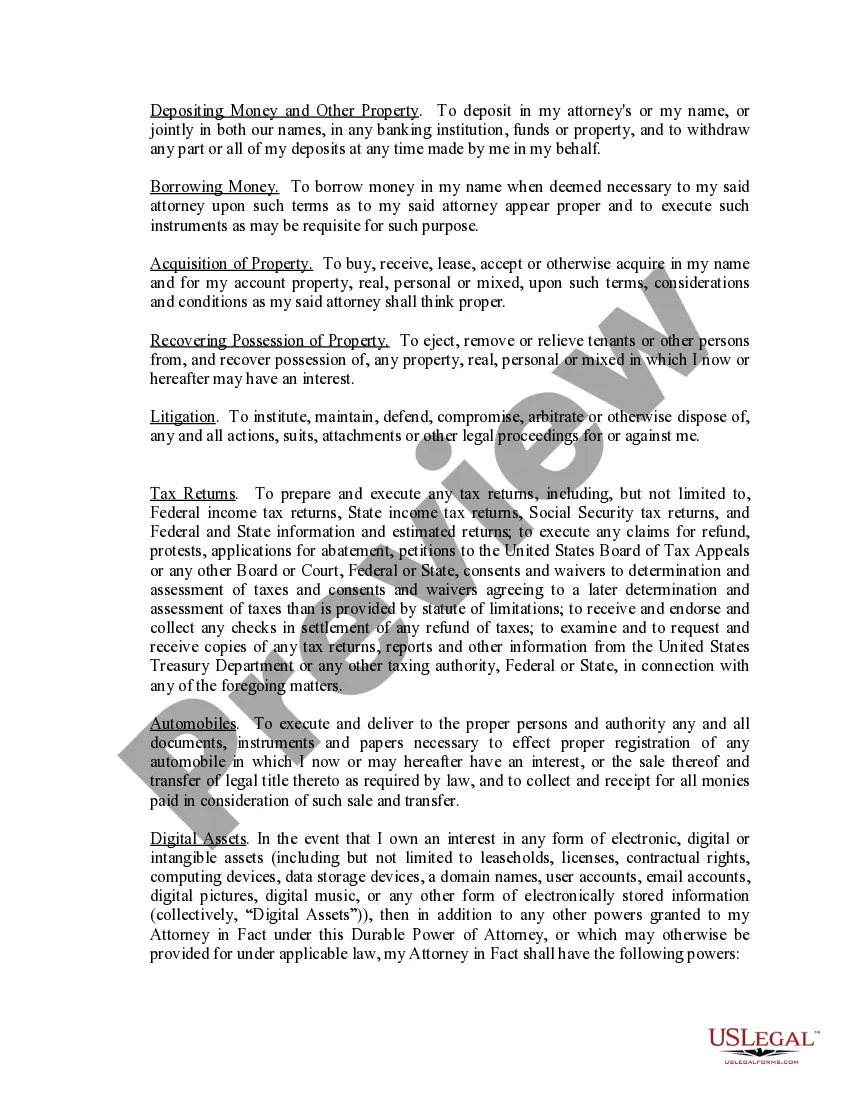

Certain critical decisions remain off-limits for someone holding a power attorney for property. The agent cannot make decisions regarding your health care without specific authorization. They also cannot change your will or make decisions that pertain to your marriage or divorce. Clear boundaries help protect your personal autonomy and ensure that your preferences are respected.

To simplify creating a power attorney for property, consider using a reliable legal document service like USLegalForms. They provide templates and guidance that are easy to follow, allowing you to craft a document tailored to your needs. This approach eliminates confusion and ensures all legal requirements are met efficiently. With the right resources, empowering someone to manage your property becomes a straightforward process.

Being appointed as a power attorney for property comes with significant responsibility. One downside is the potential for liability if mistakes are made in managing someone's financial affairs. Furthermore, the role can be emotionally taxing, especially if family dynamics are involved. It's essential to weigh these challenges carefully before accepting the role, ensuring you can fulfill the responsibilities required.

While a power attorney for property offers substantial authority, there are limitations to what an agent can do. For instance, an agent cannot make healthcare decisions unless explicitly authorized. Additionally, the agent cannot change your will or act against your best interests as defined in the document. Understanding these boundaries is crucial when drafting your power of attorney to protect your rights.

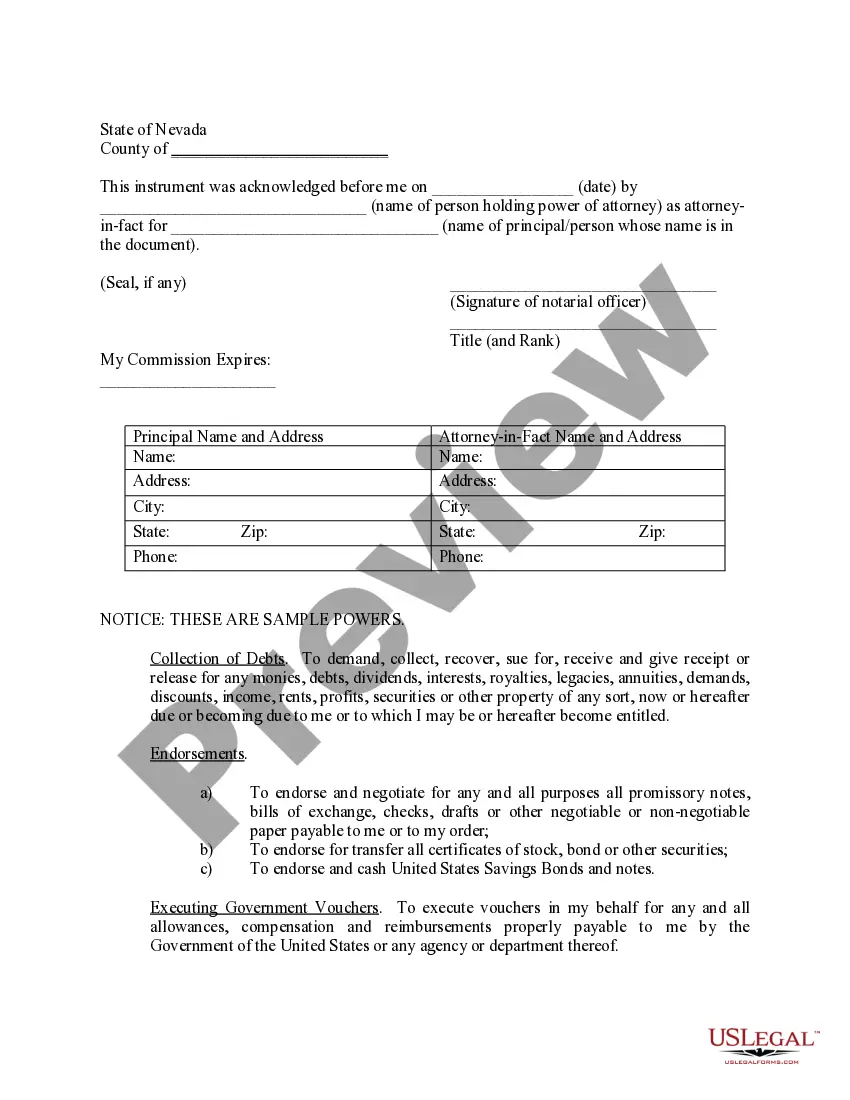

A power attorney for property allows you to grant another person the authority to manage your real estate and financial affairs. This may include buying or selling property, managing investments, and handling banking transactions. By establishing this trust, you can ensure that your financial matters are handled according to your wishes. It's essential to clearly define the scope of authority in your power of attorney document to avoid confusion later.