Nevada Lease Laws

Description

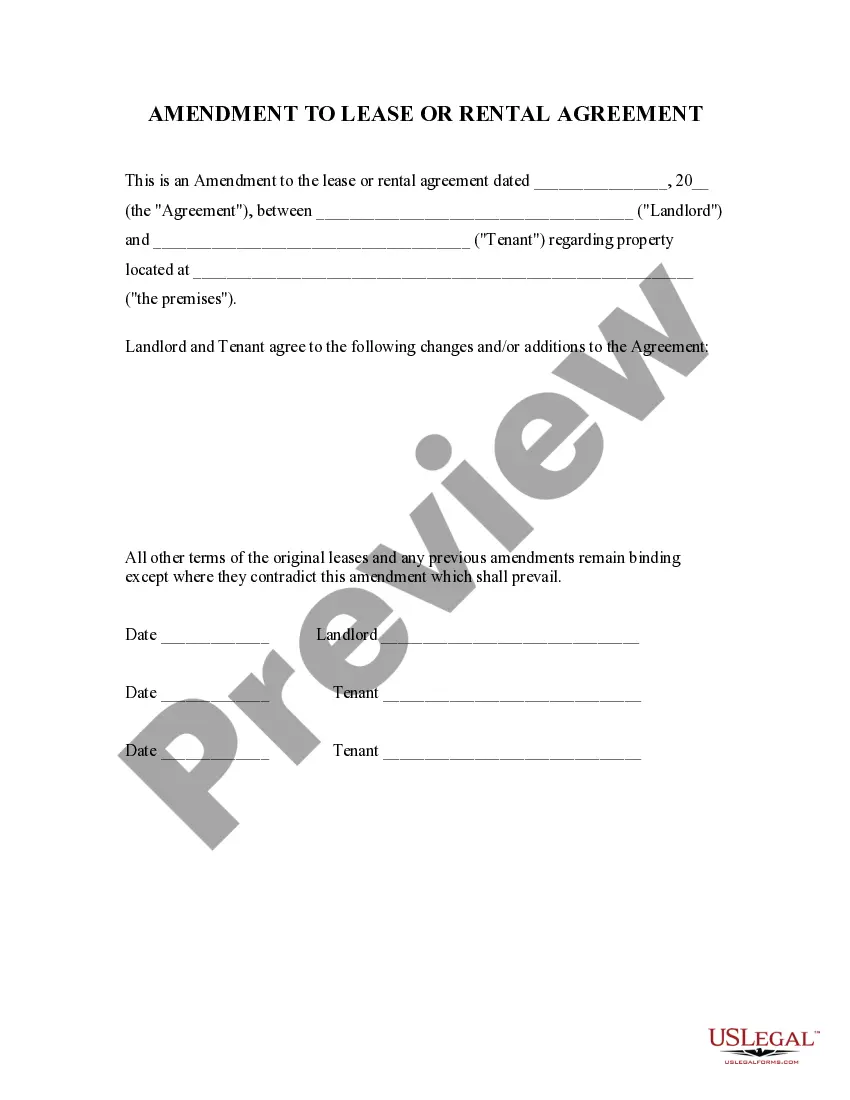

How to fill out Nevada Amendment To Lease Or Rental Agreement?

Establishing a reliable source to obtain the most up-to-date and pertinent legal templates is half the challenge of navigating bureaucracy.

Securing the appropriate legal documents requires precision and carefulness, which is why it is essential to source samples of Nevada Lease Laws exclusively from reputable providers, such as US Legal Forms. An incorrect template can lead to wasted time and prolong the issue you are facing. With US Legal Forms, your concerns are minimal.

Eliminate the hassle associated with your legal paperwork. Explore the extensive US Legal Forms library to find legal templates, assess their relevance to your needs, and download them immediately.

- Use the library navigation or search bar to find your template.

- Examine the form’s description to ensure it aligns with the requirements of your state and region.

- Check the form preview, if available, to confirm that it is the template you need.

- Return to the search to find the appropriate template if the Nevada Lease Laws does not fit your needs.

- If you are confident about the form’s applicability, download it.

- As a registered user, click Log in to verify and access your chosen templates in My documents.

- If you haven't registered yet, click Buy now to acquire the form.

- Select the pricing plan that suits your needs.

- Proceed to register to finalize your purchase.

- Complete your transaction by choosing a payment method (credit card or PayPal).

- Select the file type for downloading Nevada Lease Laws.

- Once you have the form on your device, you can modify it with the editor or print it and complete it manually.

Form popularity

FAQ

In Virginia, you are not required to have an operating agreement submitted to the Virginia state corporation commission. However, it is still strongly recommended as it provides crucial information that may be helpful in times of disagreement regarding how to operate the LLC.

ZenBusiness: Create your LLC in Virginia Step 1: Choose a name for your LLC. ... Step 2: Appoint a registered agent. ... Step 3: Determine if you need a Virginia business license. ... Step 4: File your LLC articles of organization. ... Step 5: Draft an LLC operating agreement. ... Step 6: Comply with state employer obligations.

Virginia LLC Cost. Filing the registration paperwork to officially form your Virginia LLC will cost $100. You'll also need to pay a yearly $50 fee to file your Virginia Annual Registration.

Virginia LLC Processing Times Normal LLC processing time:Expedited LLC:Virginia LLC by mail:2-5 business days (plus mail time)Next day ($100 extra)Virginia LLC online:2-5 business daysNext day ($100 extra)

Step 4: Submit Your Articles of Organization to the State To form a new Virginia LLC, you'll need to submit form LLC1011 and pay a $100 filing fee to the state. To start a new Virginia Professional LLC, you'll need to submit form LLC1103 in addition to paying your filing fee.

Steps to Start a Virginia LLC: Choose a name for your Virginia LLC. Appoint a registered agent. Prepare and file the Articles of Organization with the Virginia State Corporation Commission. Pay the filing fee. Create an operating agreement. Obtain an Employer Identification Number (EIN) File BOI Report for your Virginia LLC.

To form a new Virginia LLC, you'll need to submit form LLC1011 and pay a $100 filing fee to the state. To start a new Virginia Professional LLC, you'll need to submit form LLC1103 in addition to paying your filing fee. You can either file the appropriate form online or via postal mail.

An EIN is required for LLCs that will have employees. Additionally, most banks require an EIN in order to open a business bank account. State tax identification number. Virginia requires a state tax identification number.