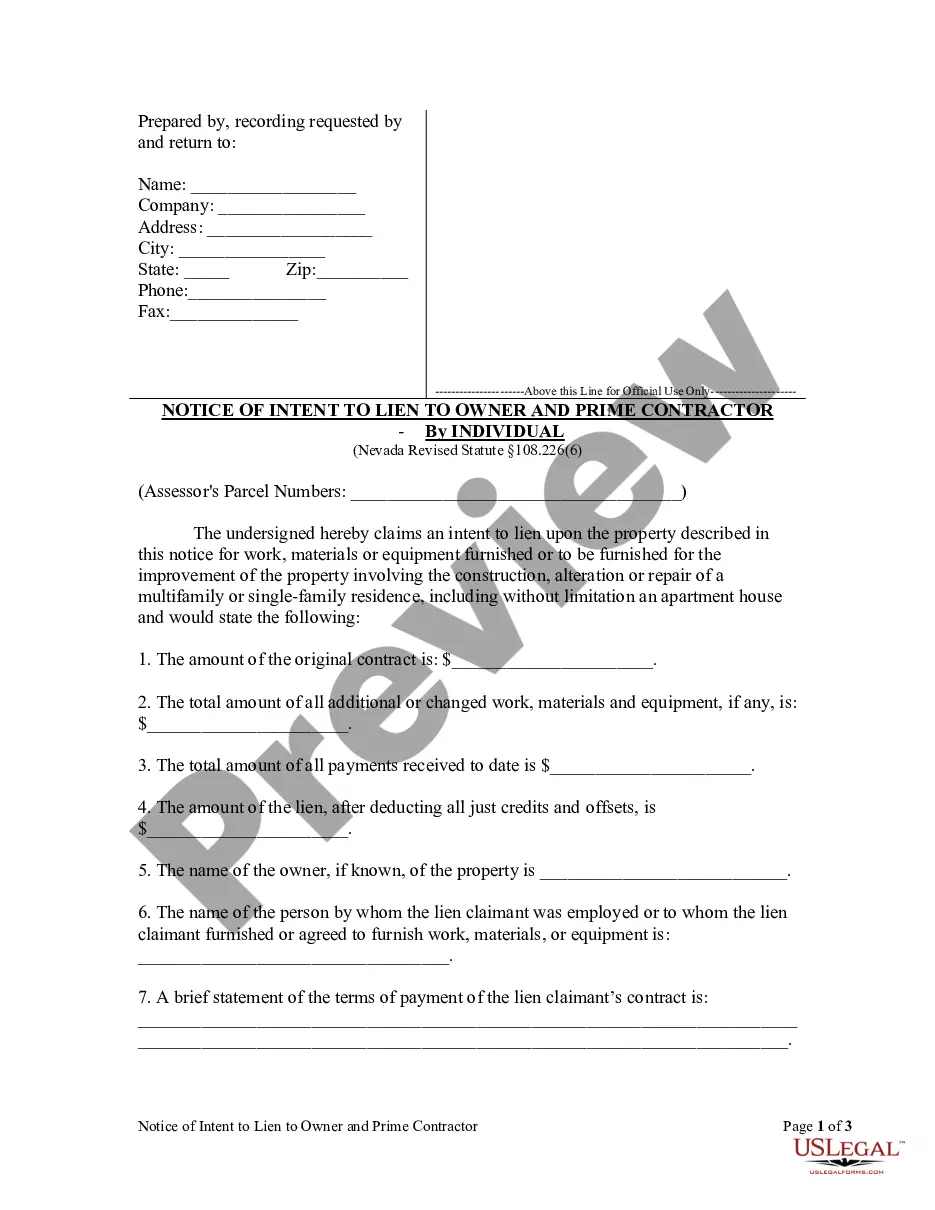

Notice Of Intent To Lien Example

Description

How to fill out Nevada Notice Of Intent To Lien To Owner And Prime Contractor - Individual?

Creating legal documents from the beginning can occasionally be daunting.

Some situations may require extensive research and significant financial investment.

If you seek a simpler and more affordable method of preparing the Notice of Intent to Lien Example or any other paperwork without unnecessary complications, US Legal Forms is readily available.

Our online database of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal affairs.

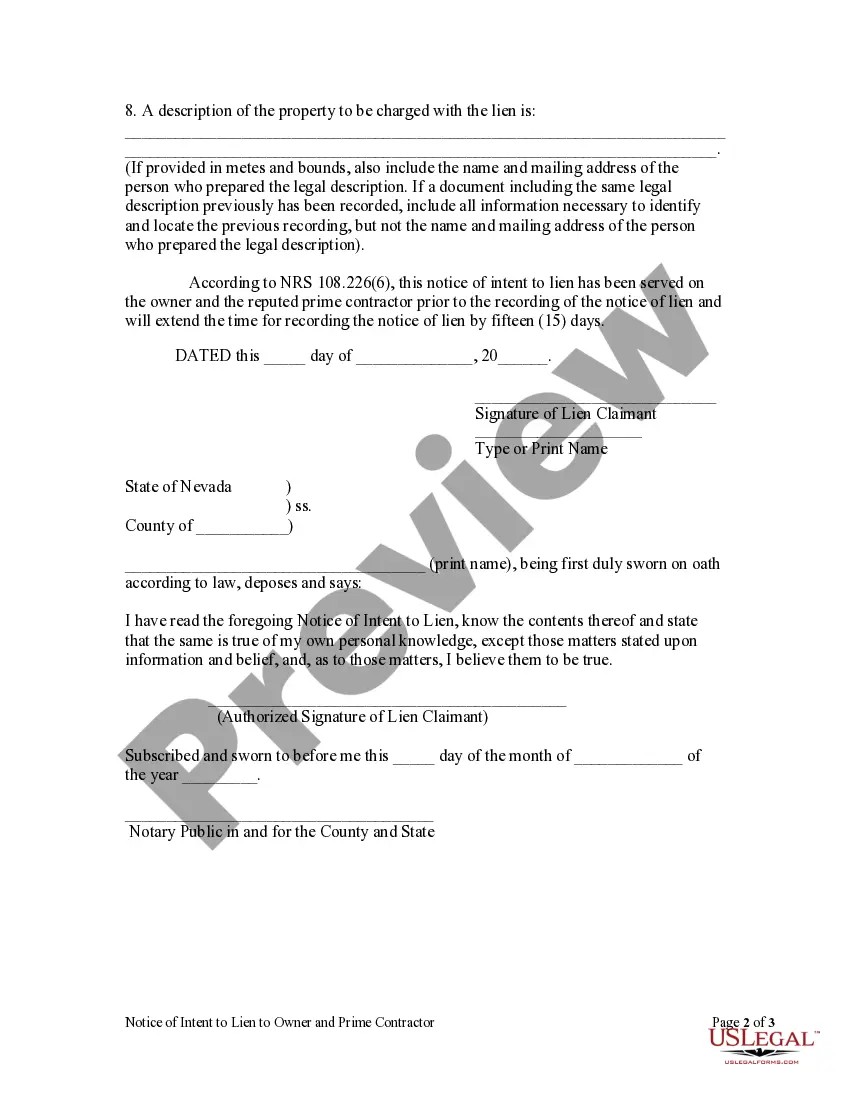

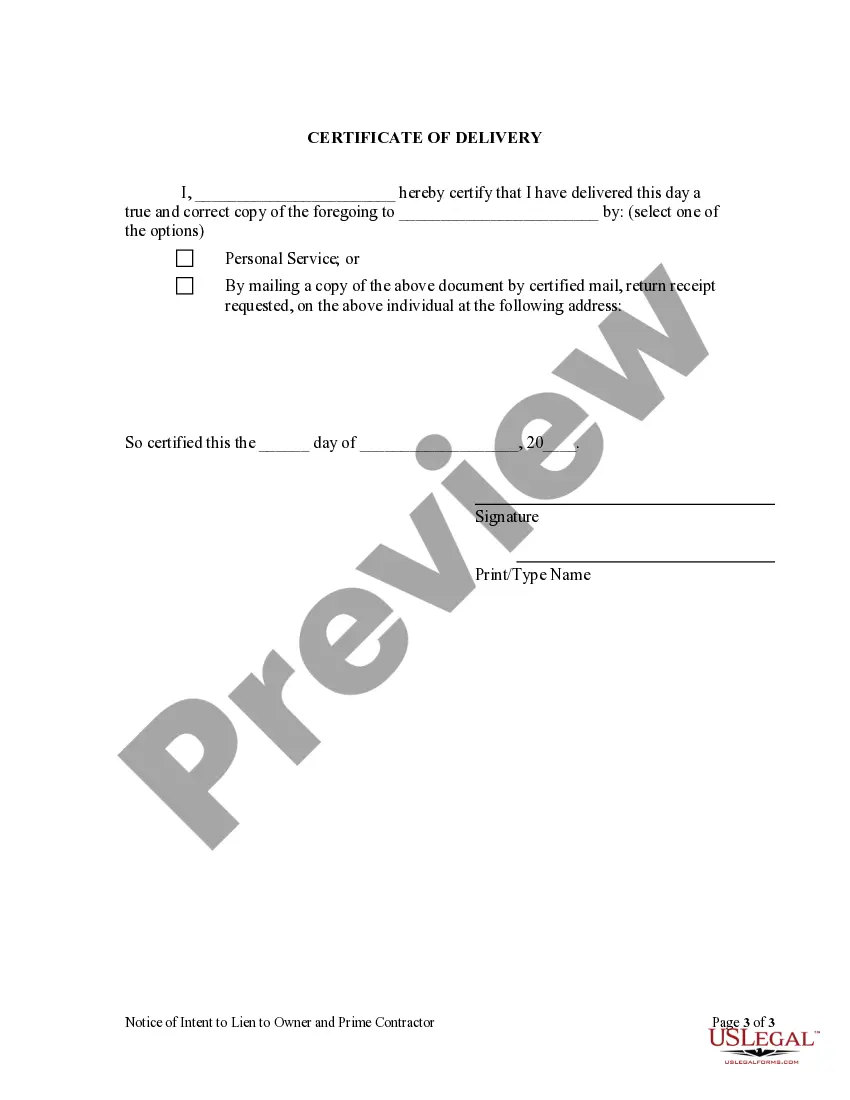

However, before rushing to download the Notice of Intent to Lien Example, adhere to these guidelines: Review the form preview and descriptions to ensure you are on the document you seek. Verify that the template you choose complies with your state and county regulations and laws. Select the appropriate subscription option to obtain the Notice of Intent to Lien Example. Download the document, then complete, validate, and print it out. US Legal Forms boasts a solid reputation and over 25 years of experience. Join us today and make document completion straightforward and efficient!

- With just a few clicks, you can swiftly access state- and county-specific templates meticulously prepared for you by our legal professionals.

- Utilize our website whenever you require dependable and trustworthy services to quickly find and download the Notice of Intent to Lien Example.

- If you are already familiar with our website and have previously created an account, simply Log In to your account, select the template, and download it or re-download it anytime in the My documents section.

- Not registered yet? No worries. It only takes a few minutes to sign up and browse the catalog.

Form popularity

FAQ

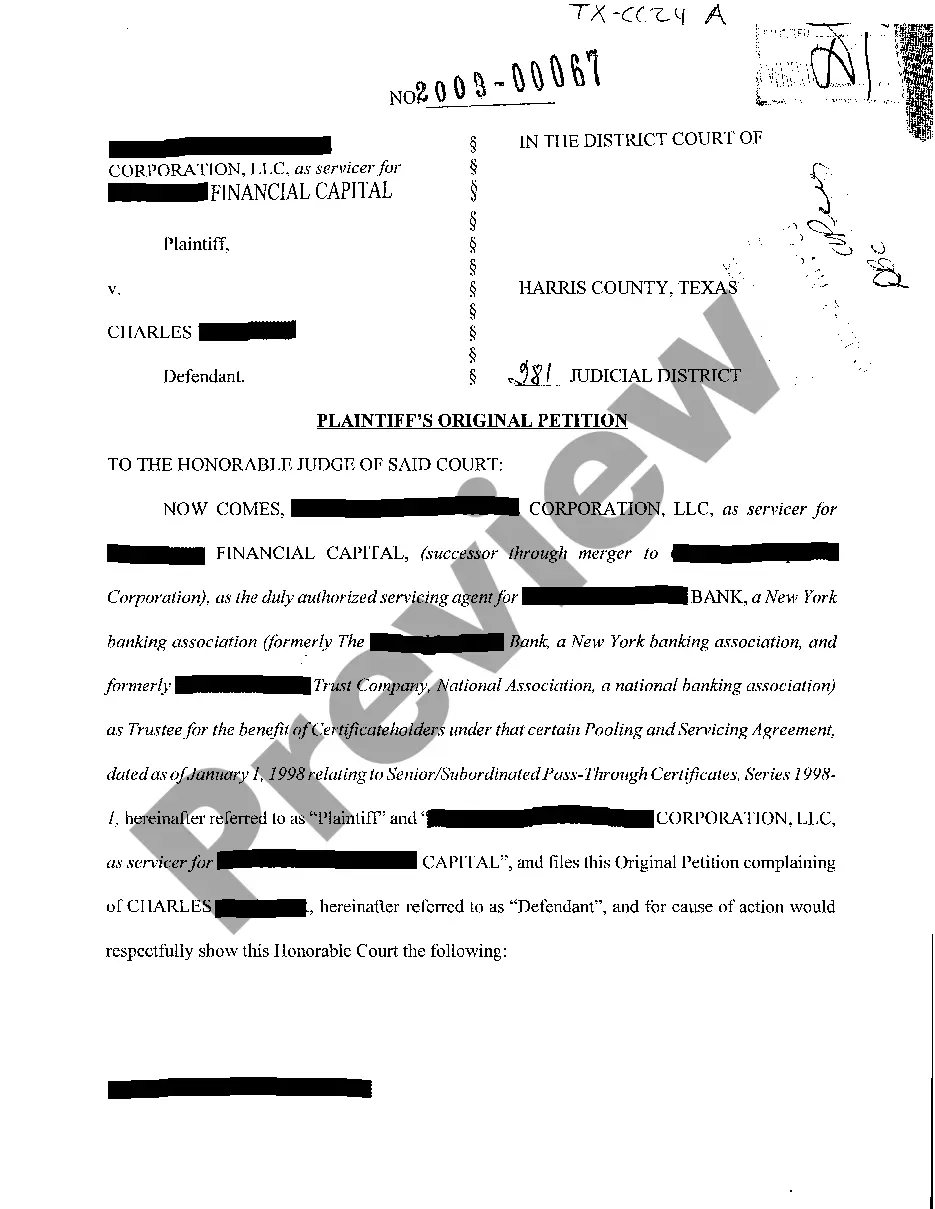

Yes, in Texas, someone can potentially file a lien on your property without your immediate knowledge. However, property owners should receive notice if a lien is placed. Understanding the process can be crucial, so it is wise to familiarize yourself with documents like a Notice of Intent to Lien example. Being informed empowers you to address any potential issues swiftly.

Utah LLC Cost. It costs $54 to file your Certificate of Organization and form your Utah LLC. You will also need to consider the cost of your LLC's Annual Report, which is $20. Though those costs are low, you'll want to factor in the fees you'll pay for a registered agent and local or state licenses.

Utah: Comprehensive LLC Laws. Corporations or individuals can form an LLC easily and without much paperwork. Additionally, the state doesn't impose any personal income tax on businesses. That makes Utah a great option for businesses looking to avoid taxes and maximize profits in their first year of operations.

Delaware does NOT require an operating agreement. However, it is highly recommended to have a LLC operating agreement even if you are only a single member LLC. The state of Delaware recognizes operating agreements and governing documents.

By default, a Utah LLC is taxed by the Internal Revenue Service (IRS) based on the number of Members the LLC has. Then the Utah State Tax Commission honors this and taxes your LLC the same way at the state level. An LLC with 1 owner (Single-Member LLC) is taxed like a Sole Proprietorship.

There is no set requirement for what an operating agreement must contain, but it generally governs, at the very least, relations among the members as members and between the members and the company; rights and duties of manager(s); activities and affairs of the company and how they are to be conducted; and how the ...

Utah LLC in 5 Steps Name your Utah LLC. The first step to starting a Utah LLC is to name your business. ... Appoint a registered agent in Utah. All Utah LLCs are required to appoint a registered agent. ... File Utah Certificate of Organization. ... Create a Utah operating agreement. ... Apply for an EIN.

Is an operating agreement required in Utah? Utah doesn't specifically require LLCs to enter into an operating agreement. However, in the absence of one, your LLC will be governed by the Utah Revised Uniform Limited Liability Company Act.

Common pitfalls of a poorly drafted Operating Agreement include failing to: (i) specify what authority managers or members have; (ii) carve out key decisions that require a higher approval threshold (e.g., dissolution, sale of all or substantially all of the assets of the LLC, etc.); (iii) address how deadlocks in the ...