Community Property Agreement

About this form

The Community Property Agreement is a legal document that establishes how assets are owned and distributed between spouses. This agreement specifies that, upon the death of one spouse, all community property will transfer to the surviving spouse, ensuring that both parties have a clear understanding of their rights regarding their shared assets. It differs from other estate planning tools by focusing on community property laws specific to married couples, rather than individual wills or trusts.

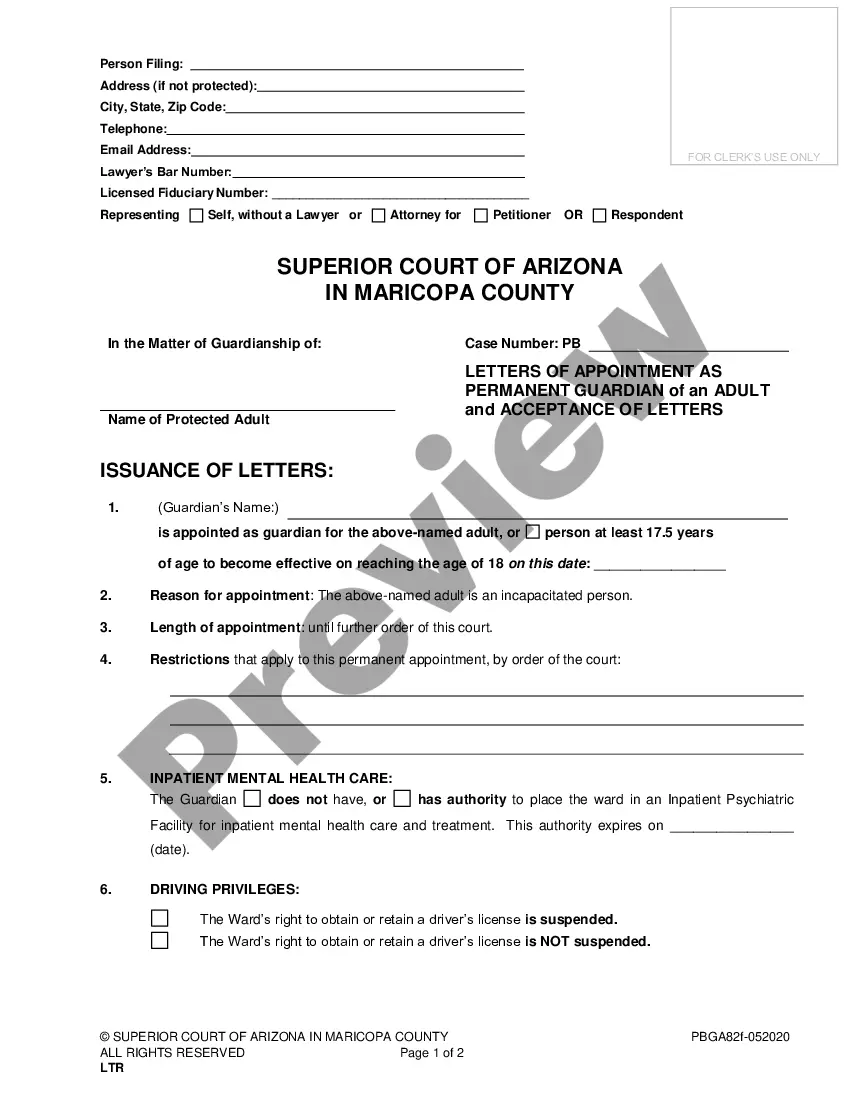

Form components explained

- Revocation of prior agreements: Establishes that any previous community property agreements are nullified.

- Property covered: Clearly defines all community property owned or acquired in the future.

- Vesting: Specifies that the surviving spouse automatically receives all community property upon death.

- Disclaimer: Allows the surviving spouse to refuse interest in any property under specific conditions.

- Automatic revocation: Outlines conditions for termination of the agreement, such as divorce or separation.

- Powers of appointment: Clarifies that existing powers of appointment remain unaffected by this agreement.

When to use this document

This form should be used by married couples who wish to clearly define the ownership and distribution of their community property. It is particularly beneficial when one spouse wants to ensure that all community assets pass directly to the other spouse upon their death, rather than being subject to probate or distribution as dictated by a will. This agreement is useful for couples looking to simplify their estate planning and protect each other financially.

Who should use this form

- Married couples with community property.

- Couples looking to clearly outline property rights and asset distribution.

- Individuals seeking to simplify estate planning.

- Spouses who want to avoid potential legal disputes regarding asset distribution upon death.

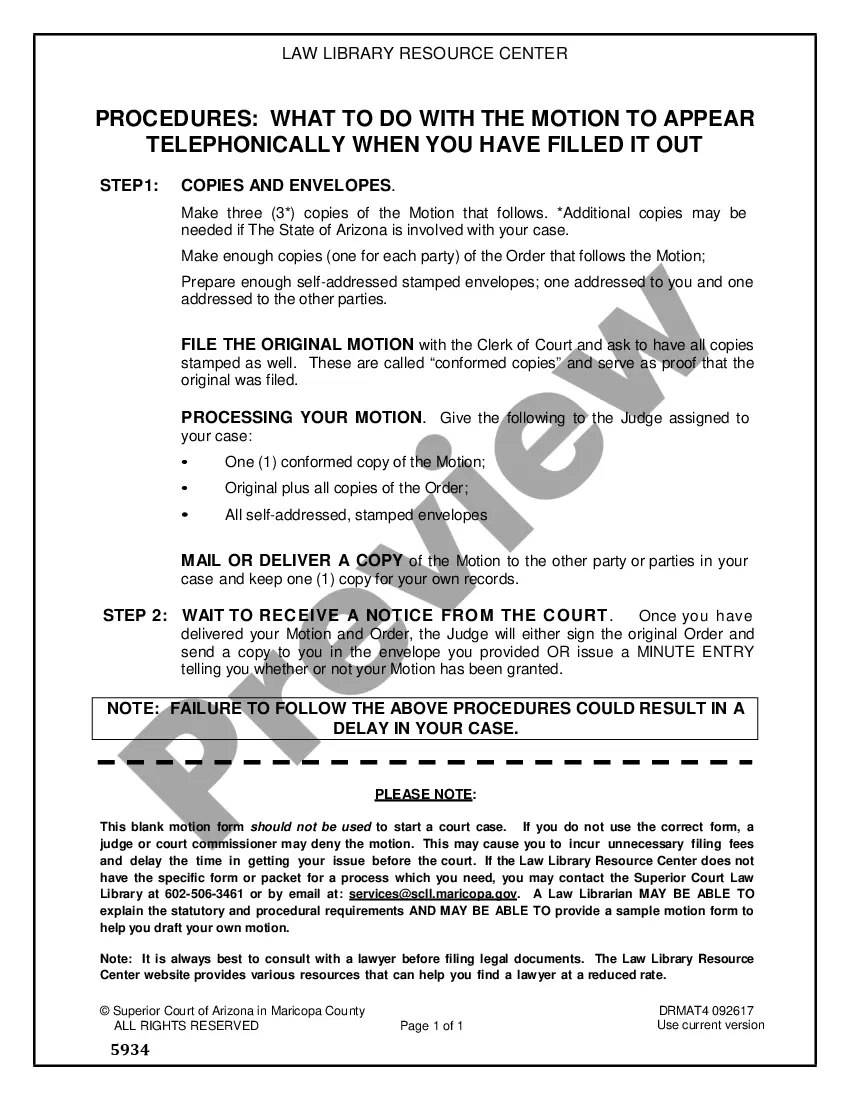

Instructions for completing this form

- Identify the parties: Enter the names of both spouses at the beginning of the agreement.

- Specify the property: Clearly define the community property covered by this agreement.

- Enter the date: Write the effective date of the agreement.

- Signatures: Both spouses must sign and date the agreement.

- Notarization: Ensure the signed document is notarized to ensure its legal validity.

Is notarization required?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

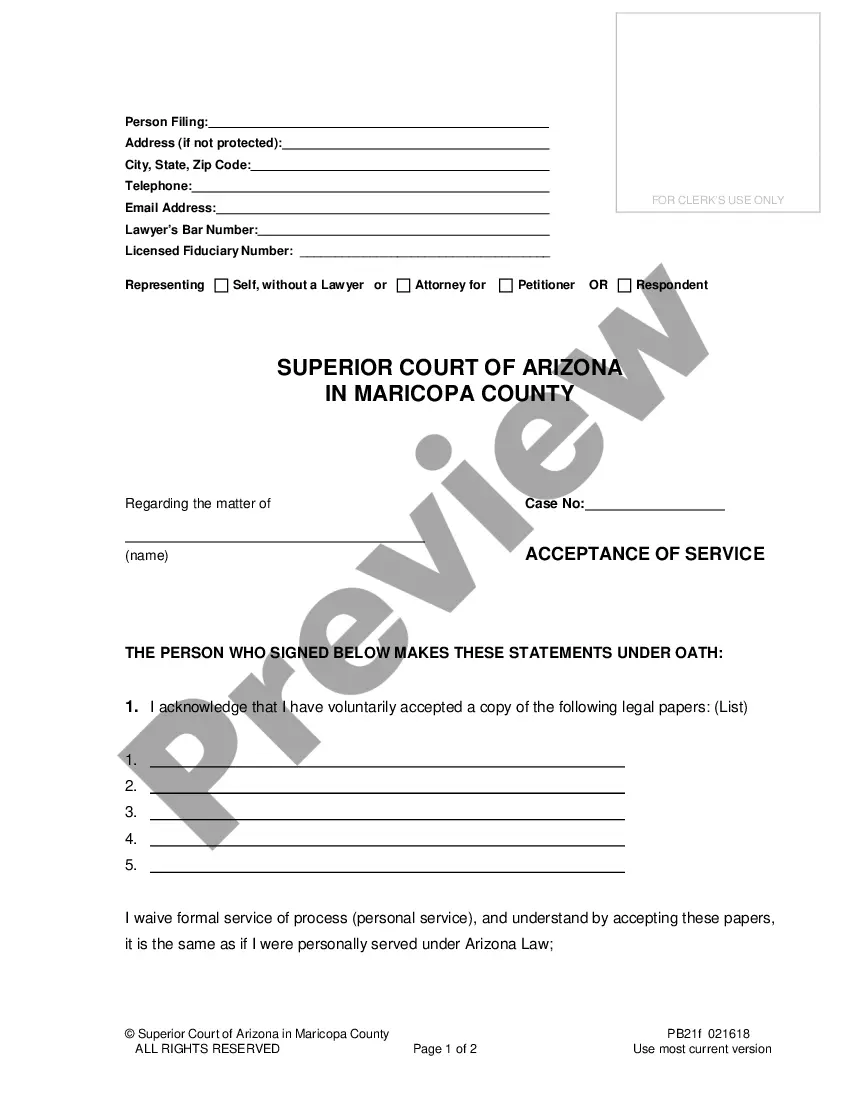

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

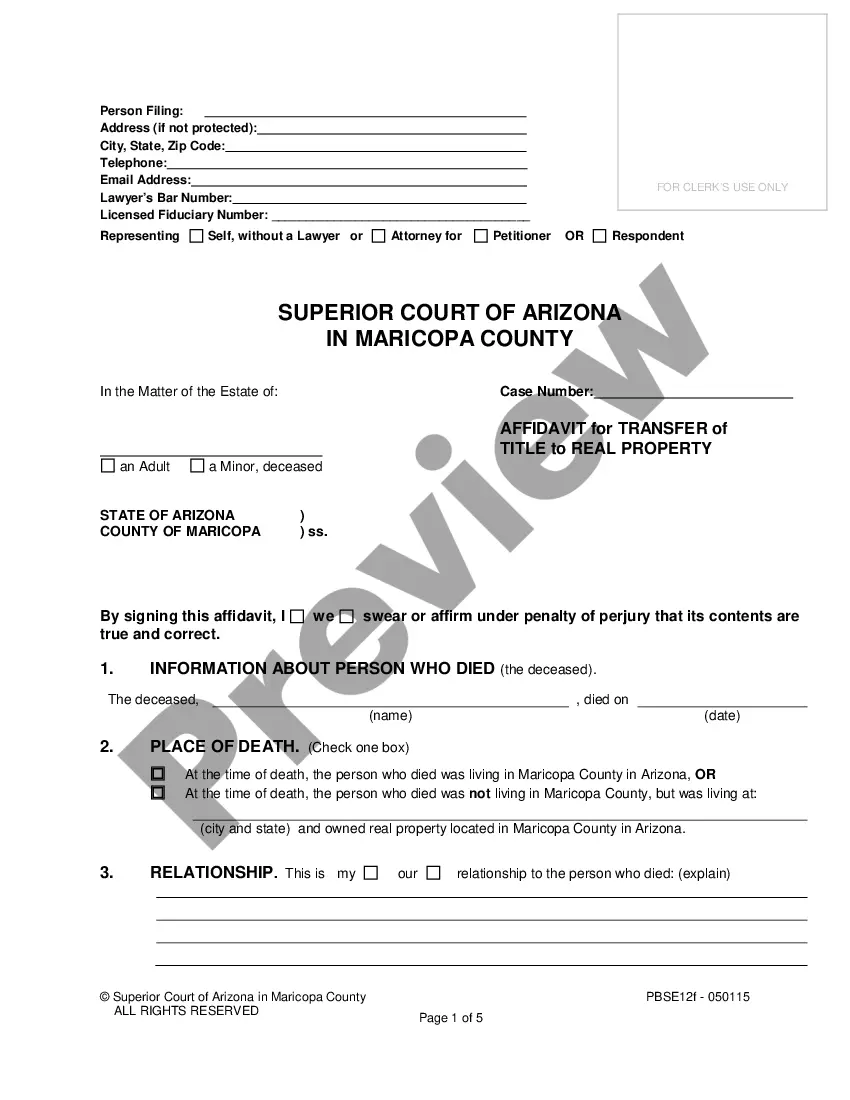

Avoid these common issues

- Failing to include all community property in the agreement.

- Not having the agreement notarized, which may affect its validity.

- Ignoring the impact of prior agreements on the current document.

- Assuming the agreement is automatically binding without proper signatures.

Benefits of completing this form online

- Convenience: Download and complete the form from the comfort of your home.

- Editability: Tailor the agreement to your specific needs easily.

- Reliability: Access forms created and reviewed by licensed attorneys.

Looking for another form?

Form popularity

FAQ

Community property in American English noun. U.S. Law (in some states) property acquired by marriage partners, either individually or together, that is considered by law to be jointly owned and equally shared.

Community property is everything a husband and wife own together. This typically includes all money earned, debts incurred, and property acquired during the marriage.Any real or personal property acquired with income earned during the marriage. This includes vehicles, homes, furniture, appliances and luxury items.

At divorce, community property is generally divided equally between the spouses, while each spouse keeps his or her separate property. Equitable distribution. In all other states, assets and earnings accumulated during marriage are divided equitably (fairly), but not necessarily equally.

Holding title as community property with right of survivorship gives married couples the hybrid benefits of joint tenancy and community property: you avoid probate, your spouse cannot will away his or her ownership to another individual, and the surviving spouse receives a double step-up in basis.

Community Property in Washington A judge will divide all community property items equally during a divorce. Community assets include income, stocks, royalties, rents, cars, the marital home, bank accounts, 401k accounts, credit card charges, and any other assets or debts accumulated during the couple's marriage.

A community property agreement states that when the first spouse or partner dies 1) all property both people own converts to community property and 2) all of the deceased person's property immediately goes to the surviving spouse.

Community property refers to a U.S. state-level legal distinction that designates a married individual's assets. Any income and any real or personal property acquired by either spouse during a marriage are considered community property and thus belong to both partners of the marriage.

A Community Property Agreement is a contract that a married couple in a community property state sign as a couple that specifies how they want their property to be classified.In a community property state, a married person owns only one-half of the community property and all of his or her individual property.