Community Property Disclaimer

What this document covers

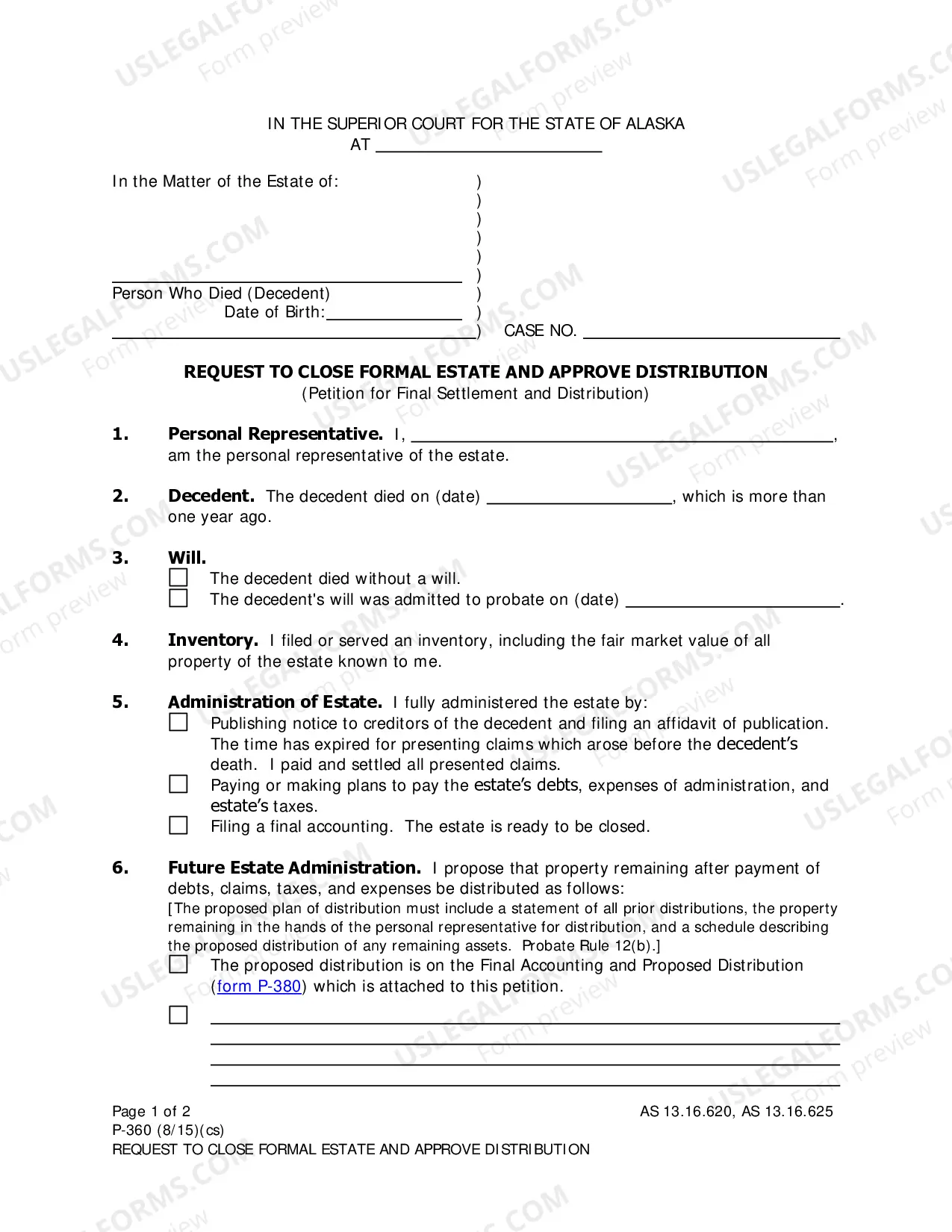

A Community Property Disclaimer is a legal document that clarifies the ownership of a property between a Grantor and a Grantee. This form states that the Grantor is conveying the property to the Grantee while disclaiming any rights, claims, or liens on the property. Unlike similar forms, the Community Property Disclaimer emphasizes that the property is the separate property of the Grantee, ensuring clear ownership without the intent of gifting the property.

Main sections of this form

- Effective Date: The date from which the disclaimer takes effect.

- County and State: The location of the property being conveyed.

- Grantor and Grantee Information: Names, addresses, and zip codes of the parties involved.

- Property Description: The physical address and legal description of the property.

- Disclaimer Language: Statements clarifying that the property is separate and free from claims by the Grantor.

- Signatures: Required signatures of the Grantor, along with notarization if applicable.

When to use this document

This form is necessary when a property owner, or Grantor, wishes to officially declare that a property is the sole and separate property of another individual, or Grantee. It is commonly used in situations involving divorce settlements, estate planning, or when one partner in a marriage owns property acquired before the marriage. The disclaimer serves to prevent any potential claims by the Grantor on the Grantee's property.

Who this form is for

- Property owners wanting to clarify ownership of their real estate.

- Individuals undergoing divorce proceedings where property division is involved.

- Those involved in estate planning to ensure clear property transference.

- Couples where one partner owns property prior to marriage.

Instructions for completing this form

- Identify the parties: Enter the names and addresses of the Grantor and Grantee.

- Specify the property: Provide the physical address and legal description of the real property.

- Enter the effective date: Fill in the date when the disclaimer takes effect.

- Review the disclaimer language: Ensure that all stated rights, claims, and the nature of property ownership are as intended.

- Obtain signatures: Both Grantor and Grantee must sign the form in the presence of a notary.

Notarization guidance

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to properly describe the property, which can lead to future disputes.

- Not including the effective date, making it unclear when the disclaimer is valid.

- Omitting the signature of the Grantor or not having it notarized, voiding the document.

Main things to remember

- A Community Property Disclaimer is crucial for clarifying property ownership.

- This form is suitable in cases of divorce, estate planning, or when one partner owns property prior to marriage.

- Ensure the form is completed accurately and notarized for legality.

Looking for another form?

Form popularity

FAQ

Key Takeaways. Community property law requires that a divorcing couple split their assets 50/50, but only assets acquired while they were domiciled in the state. Property owned by either spouse prior to the marriage or after the legal separation may not be considered or divided as community property.

In a community of property marriage, all assets and liabilities belonging to you and your spouse are merged together into one joint or communal estate, subject to a few exceptions. For instance, if a will stipulates that an inheritance should not form part of the joint estate, then that inheritance must be excluded.

California is a community property state. In most cases, your spouse receives one-half of all community property in a divorce case.

Although the default rule is that anything either spouse earns during marriage becomes shared marital property, this rule doesn't apply to inheritances. Whether you received your inheritance before or during your marriage, it is yours to do with as you please. You have no legal obligation to share it with your husband.

Community property states follow the rule that all assets acquired during the marriage are considered "community property." Marital property in community property states are owned by both spouses equally (50/50).

Inheritance is Considered Separate Property It's also considered separate property under California law. This means that it is yours, and yours alone, if and when you get a divorce. Your spouse will have no ownership rights to that inheritance.

California is a community property state.In fact, California law expressly prohibits a spouse from giving away community property for less than fair and reasonable value without the written consent of the other spouse. Failure to follow this rule can lead to complicated litigation after a spouse's death.

Community Property Laws At the death of one spouse, his or her half of the community property goes to the surviving spouse unless there is a valid will that directs otherwise. Married people can still own separate property. For example, property inherited by just one spouse belongs to that spouse alone.