Limited Business

Description

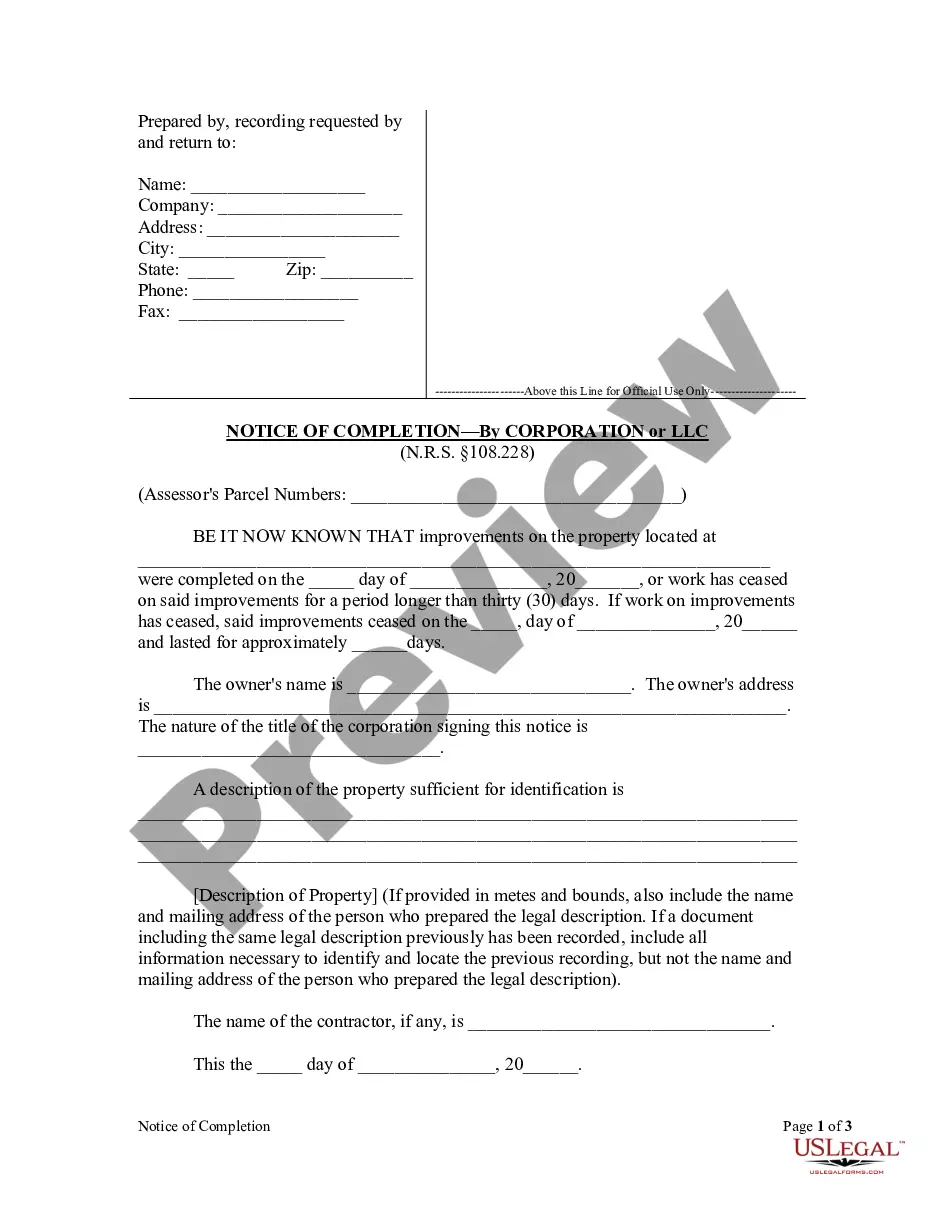

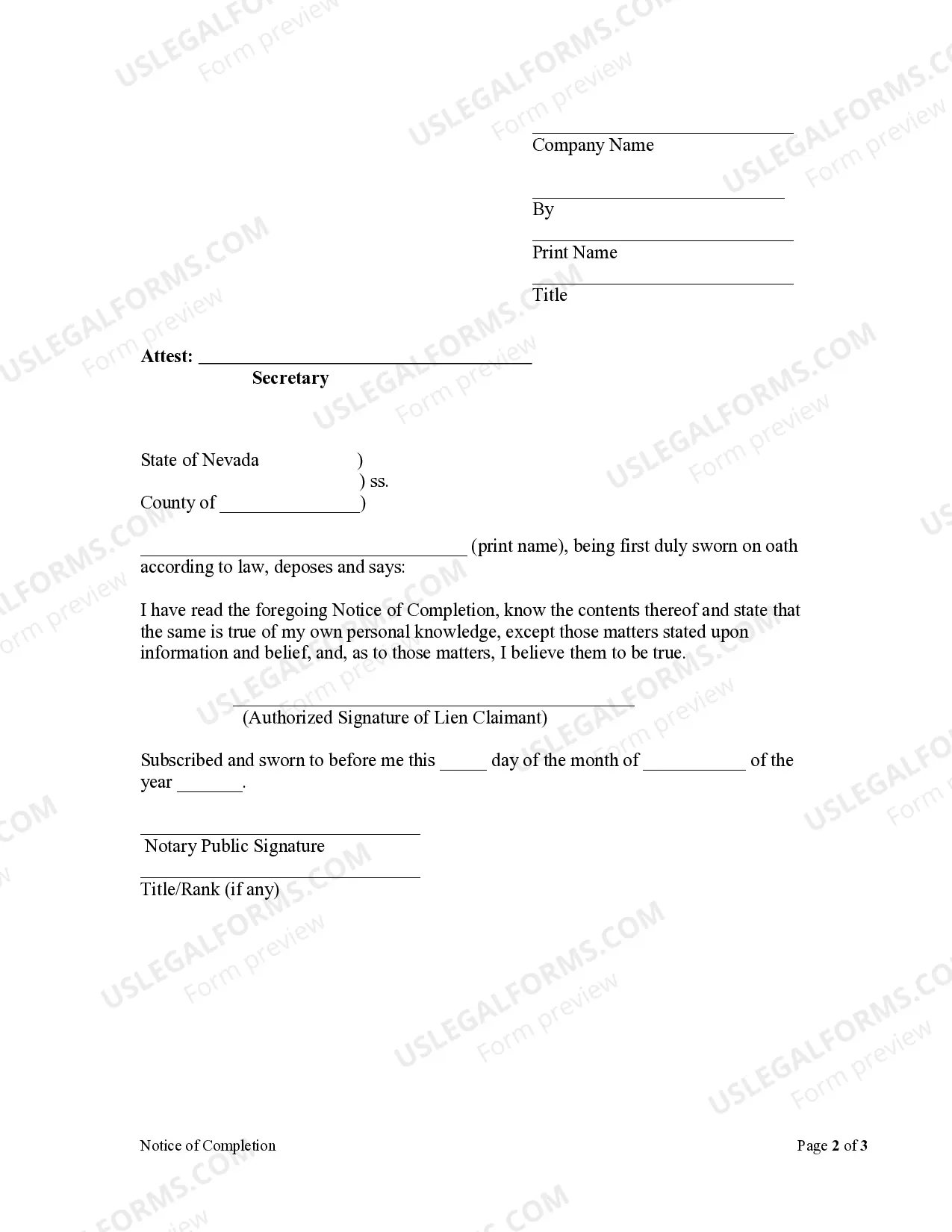

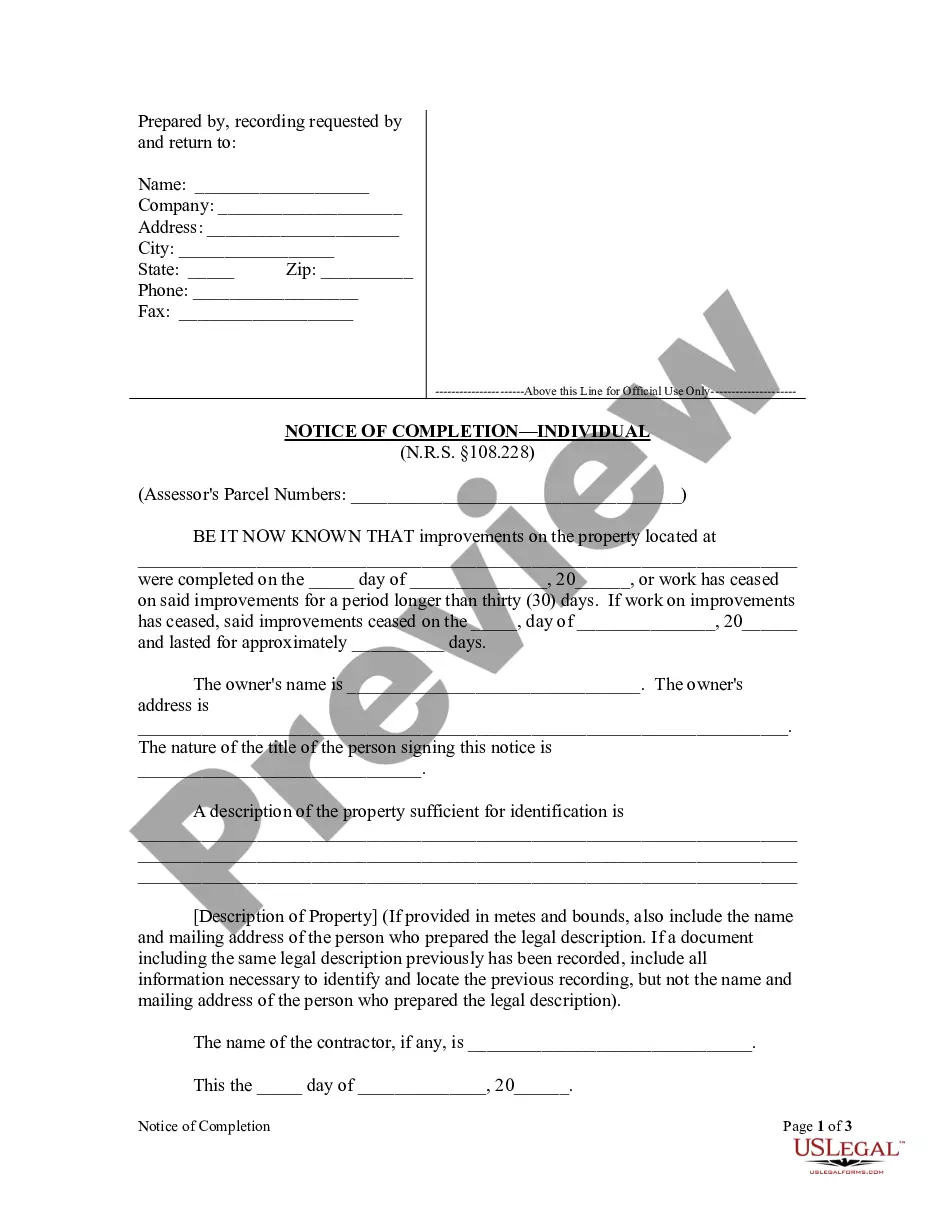

How to fill out Nevada Notice Of Completion - Corporation?

- If you are an existing user, log into your account to download the necessary form. Make sure your subscription is active; renew it if necessary.

- For first-time users, start by browsing the Preview mode and read the form descriptions. Confirm that the chosen document fulfills your requirements and complies with local regulations.

- If you need a different template, utilize the Search tab to find the right form that suits your needs. Once you find it, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting your desired subscription plan. You'll need to create an account for full access.

- Complete the payment process using your credit card or PayPal to finalize your subscription.

- Finally, download the form to your device. You can always access it again via the My Forms section in your profile.

With over 85,000 editable legal forms and packages, US Legal Forms stands out with its robust collection and expert support. This ensures that users can confidently create legally sound documents tailored to their needs.

Ready to streamline your legal processes? Start exploring US Legal Forms today and make managing your limited business easier!

Form popularity

FAQ

Typically, you will file your LLC taxes separately from your personal taxes. However, single-member LLCs are considered disregarded entities, meaning profits and losses can be reported on your personal tax form. Understanding how to properly file these documents will help you manage your limited business finances effectively.

Similar to other businesses, your LLC must file taxes if it earns $400 or more in net income. This income threshold is critical for compliance with tax regulations for your limited business structure. Carefully tracking your income will simplify your tax filing process.

As a small business owner, you need to file taxes once you have net earnings of $400 or more from self-employment. This threshold applies to limited business entities, where tracking your earnings is essential for accurate yearly reporting. Always consult with a tax professional to ensure you understand your obligations.

Even if your business income is under $600, you should still report it to the IRS. The tax code emphasizes that all income from your limited business is taxable, regardless of the threshold. Reporting this income ensures compliance and can support future financing options.

While forming an LLC is not mandatory to operate a small business, it offers distinct benefits. An LLC can protect your personal assets from business liabilities, creating a buffer between your personal and limited business finances. Moreover, having an LLC can enhance your credibility with vendors and customers.

If you are self-employed and earn less than $5000, you may still need to file taxes. Generally, the IRS requires you to report any business income, no matter the amount. This is especially important for maintaining records of your limited business activities. Additionally, filing can help establish your income for future loans or grants.

Determining whether an LTD or an LLC is better depends on your business needs and legal requirements. An LLC is typically simpler to manage, with fewer regulations than an LTD, which might be more common in some countries. Each offers unique benefits regarding taxation and liability protection. To assess which option aligns best with your limited business goals, US Legal Forms offers tailored advice and resources.

A limited company is a business structure that limits the liability of its owners, which protects their personal assets. To qualify, a limited company must be registered and comply with specific legal requirements. These could include having a registered office, maintaining business records, and filing annual accounts. If you're exploring options for a limited business, US Legal Forms provides comprehensive resources to streamline the setup process.

While you can say 'limited' instead of LLC, the terms have distinct meanings. Limited can refer to various forms of business entities that offer limited liability, whereas LLC specifically refers to a limited liability company. It's wise to understand these nuances so you can make an informed decision about your limited business structure. US Legal Forms can assist you in determining the right entity type for your goals.

Choosing a limited partnership over an LLC can be beneficial for specific investment arrangements. A limited partnership has general partners who manage the business and limited partners who invest without liability. This structure allows for flexibility in management and profits. For personalized advice on choosing your best option, consider using US Legal Forms to guide you through the complexities.