Trust Deeeds

Description

How to fill out Nevada Quitclaim Deed - Trust To A Trust?

- If you're a returning user, log in to your account and check if your subscription is active. If not, renew as needed.

- For first-time users, start by browsing the extensive online library. Preview form descriptions to ensure they align with your legal needs and local jurisdiction.

- Utilize the Search feature to find alternative templates if the current option doesn't meet your requirements.

- Once you've selected the appropriate document, click on the Buy Now button and choose your preferred subscription plan. You'll need to register for an account.

- Complete your purchase by entering your payment details through credit card or PayPal.

- After payment is confirmed, download your form directly to your device and access it anytime in the My Forms section of your profile.

Using US Legal Forms ensures you have access to a comprehensive library with more forms than competitors for a similar cost. Plus, you can receive expert assistance to ensure your documents are accurate and legally sound.

Unlock the power of effective legal documentation today. Visit US Legal Forms to get started!

Form popularity

FAQ

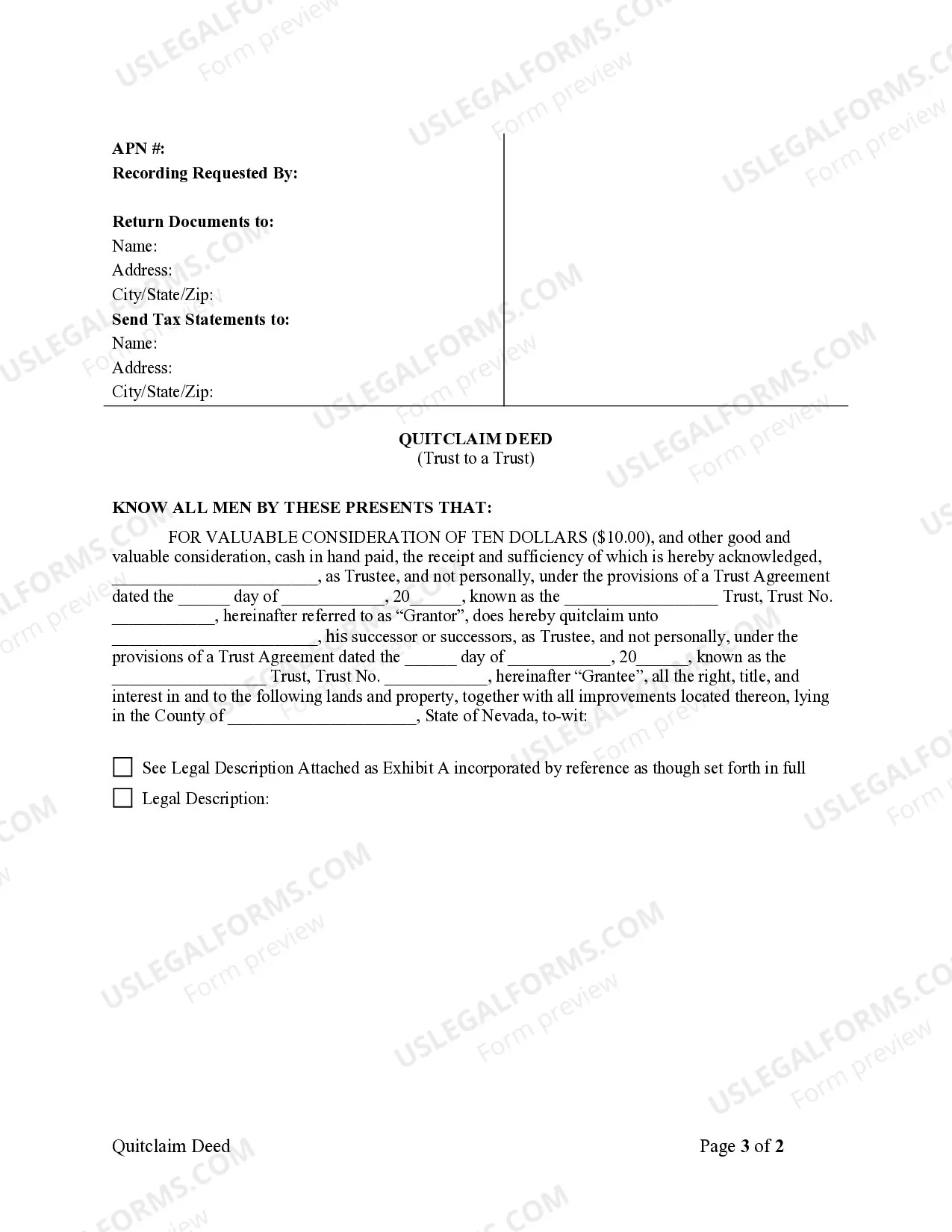

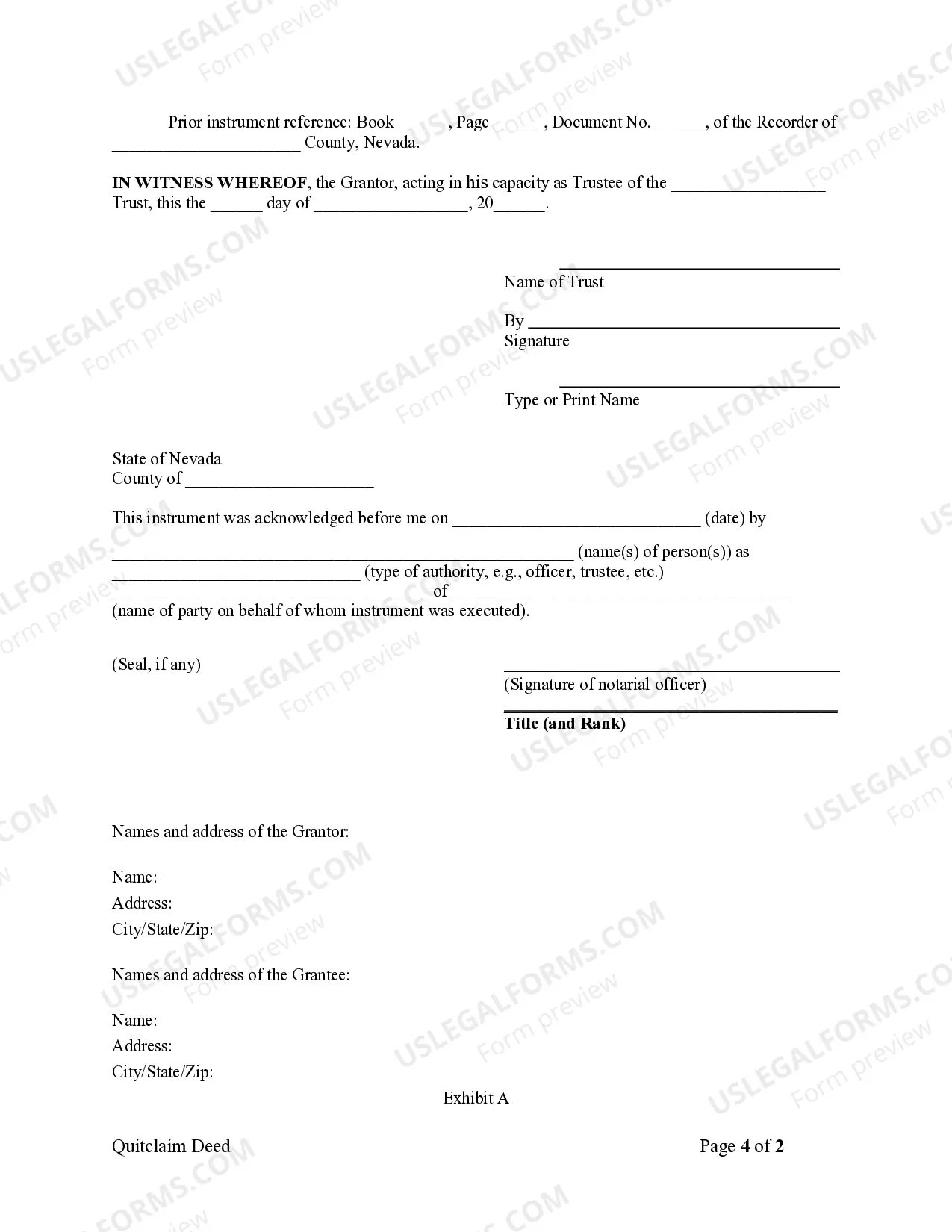

A trust deed typically appears as a formal legal document formatted to include all essential elements like parties' names, property descriptions, and governing terms. It often features sections that delineate the rights and obligations of each party, along with spaces for signatures. While each trust deed may differ slightly based on state laws or the specific agreement, you can find various templates on platforms like US Legal Forms to visualize how trust deeds look.

A deed of trust template is a legal document that outlines the terms of a trust arrangement. It typically includes details about the lender, borrower, and the property involved. Using a template can simplify the process of creating your own trust deed, ensuring you include all necessary legal elements. On platforms like US Legal Forms, you can find customizable deed of trust templates to suit your needs.

Trust deeds feature some disadvantages, primarily related to the borrower's rights. If the borrower defaults, they might face a non-judicial foreclosure, which can occur without a court process. Additionally, lacking sufficient understanding of trust deeds may lead to future complications or disputes. Therefore, it's essential to carefully evaluate trust deeds and seek guidance from professional platforms like uslegalforms.

One disadvantage of a trust deed is that it may not offer the same level of protection as other arrangements. For instance, if the borrower defaults, the lender can initiate a non-judicial foreclosure quickly. This may leave the borrower with less time to remedy the situation or seek alternatives. Understanding these implications is crucial when considering trust deeds.

Someone might use a deed of trust to secure borrowing with lower interest rates and faster access to funds. This option provides lenders with greater security while offering borrowers a straightforward path to homeownership. Trust deeds can also streamline the foreclosure process, which can be beneficial in certain situations.

While it's possible to write your own trust deed, it's not recommended without legal assistance. An improperly drafted deed can lead to enforceability issues or future conflicts. Utilizing a platform like uslegalforms can help ensure you create a valid trust deed that complies with the law.

One major disadvantage of a deed of trust is that it can allow for quicker foreclosure processes. If the borrower defaults, the lender can initiate foreclosure without going through a court. This can pose risks for homeowners, making it essential to understand the implications of such trust deeds before agreeing.

Yes, you generally need to declare a trust deed when taking out a mortgage. Failing to declare it can lead to legal issues and affect your property rights. It's best to be transparent about any trust deeds associated with your property to avoid complications later.

The trust deed is usually drafted by the individual establishing the trust, often with assistance from an attorney or a legal expert. This document is vital as it outlines the rights and responsibilities of the trustee and beneficiaries. Using a platform like US Legal Forms can streamline this process, offering easy access to templates and guidance.

The process in a deed of trust is usually managed by a title company or an attorney who specializes in real estate transactions. They ensure all legal formalities are respected and serve to protect the interests of both the borrower and lender. Involving professionals ensures the trust deed is executed correctly and efficiently.