Gst On Sale Of Motor Vehicle With Private Use

Description

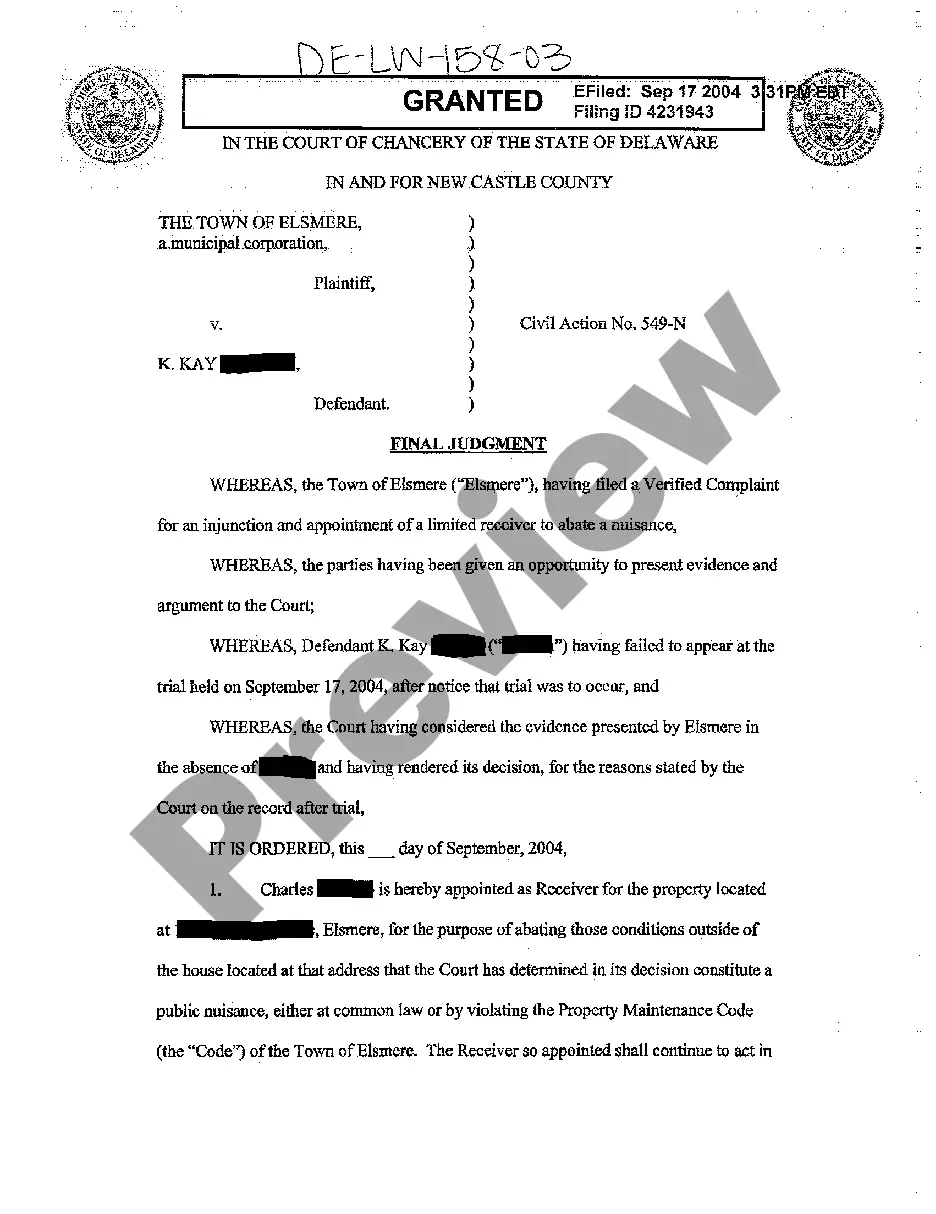

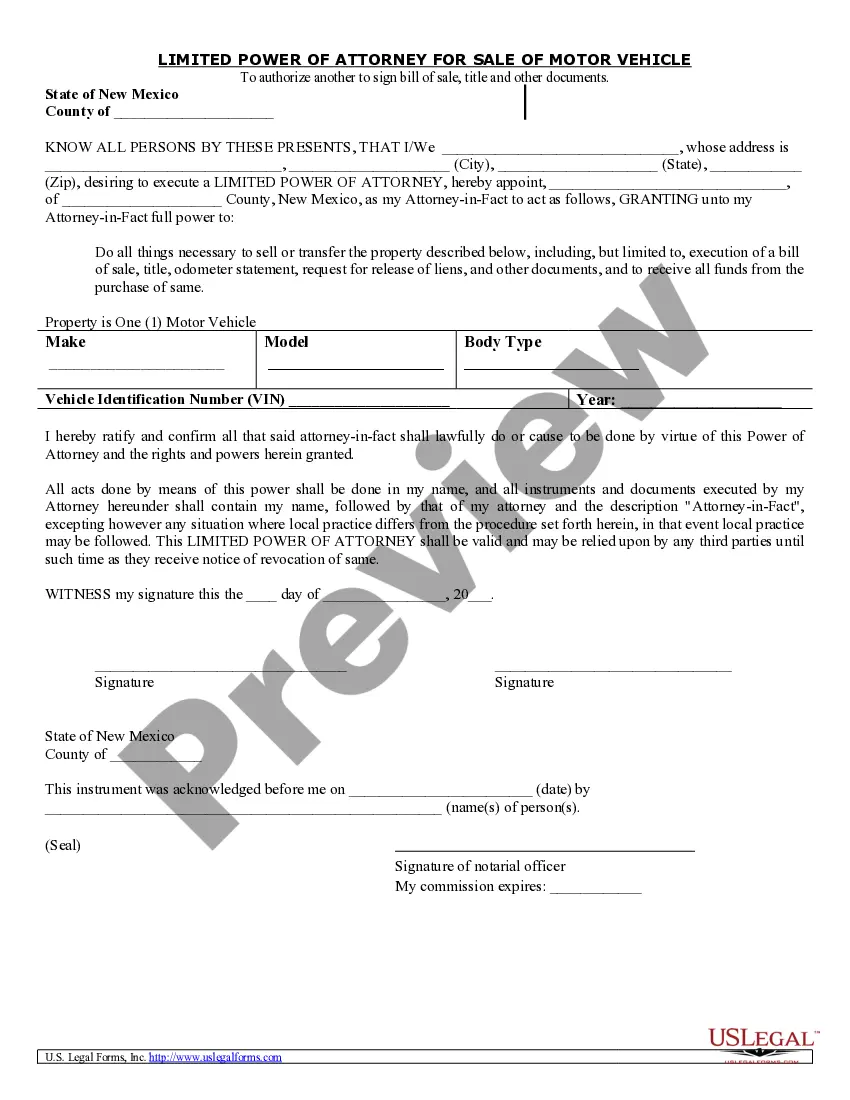

How to fill out New Mexico Power Of Attorney For Sale Of Motor Vehicle?

- Log into your US Legal Forms account if you are a returning user, ensuring your subscription is active. If it requires renewal, select your payment plan.

- For first-time users, begin by browsing the extensive library and previewing form descriptions to identify the correct template that aligns with your needs.

- If any discrepancies are found, utilize the search feature to locate alternative templates that fit your requirements.

- Once you've identified the suitable document, click on the Buy Now button and choose your subscription plan. Registration for an account is necessary to gain full access to the resources.

- Complete your purchase by entering your payment information via credit card or PayPal.

- After successful payment, download your form, which will be conveniently saved in your profile under the My Forms menu for anytime access.

By utilizing US Legal Forms, you gain access to a robust collection of over 85,000 easy-to-fill legal documents, outpacing competitors in both quantity and quality.

Don't let paperwork overwhelm you; start accessing the legal forms you need today and ensure your sales transactions are compliant. Visit US Legal Forms to get started.

Form popularity

FAQ

To protect yourself when selling a car, always conduct the transaction in a safe environment and meet in public places. Document every detail of the sale, including the payment method and the buyer's information. Additionally, consider informing buyers about Gst on sale of motor vehicle with private use to clarify tax responsibilities. Using platforms like uslegalforms can help you create a proper bill of sale to safeguard your interests.

When a business sells a vehicle, it needs to consider the Gst on sale of motor vehicle with private use. The business must ensure compliance with applicable tax regulations and report the sale accordingly. It is crucial to properly document the transaction to avoid any legal complications. Additionally, businesses should consult with tax professionals to understand potential tax liabilities.

Yes, you should report the sale of a car on your taxes if you made a profit. The income received from selling the vehicle may be subject to taxes. In cases where GST on sale of motor vehicle with private use applies, it’s crucial to accurately report any gains to the IRS to keep your tax record clean.