New Mexico Llc Forms Withdrawal

Description

How to fill out New Mexico Limited Liability Company LLC Operating Agreement?

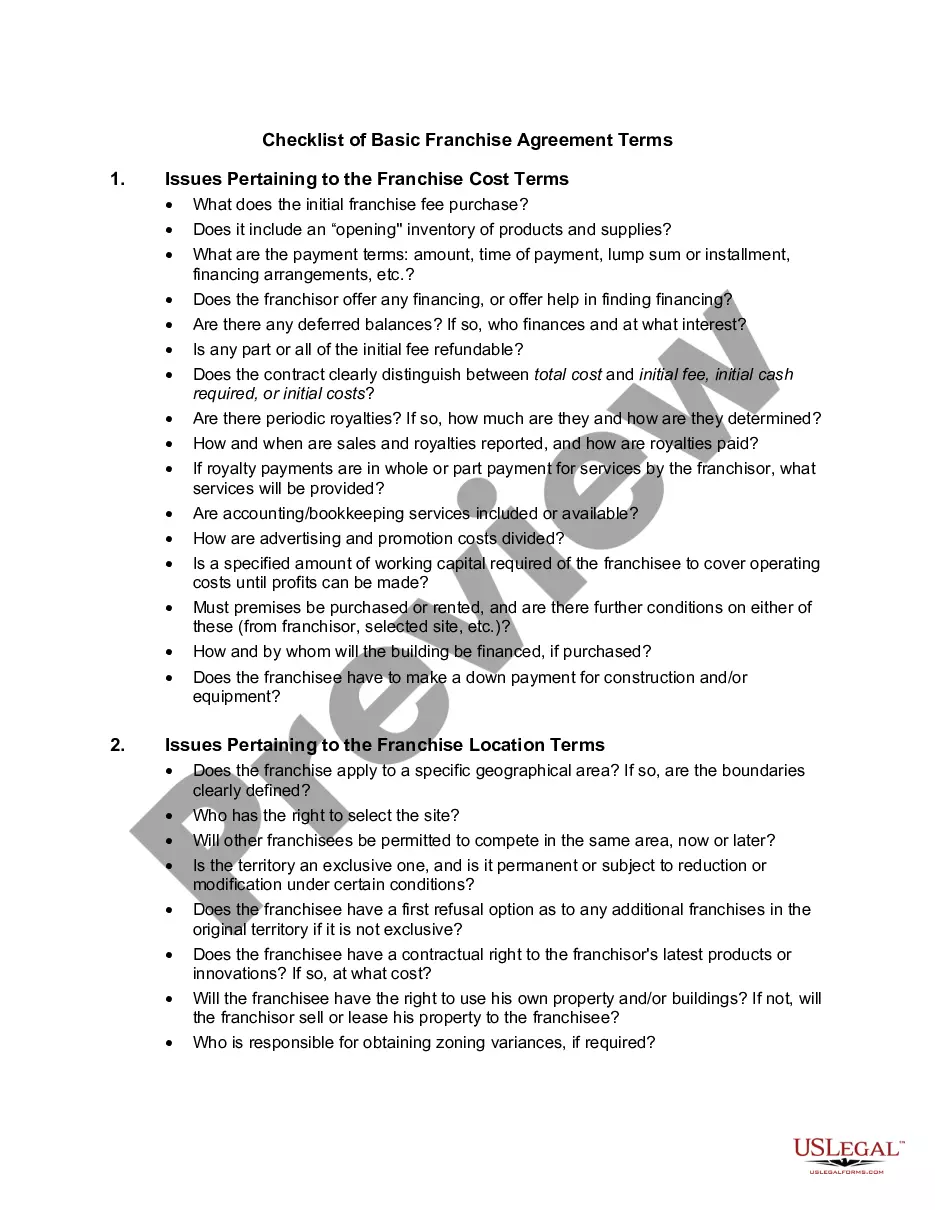

It’s obvious that you can’t become a law professional overnight, nor can you learn how to quickly prepare New Mexico Llc Forms Withdrawal without the need of a specialized set of skills. Putting together legal documents is a long venture requiring a particular education and skills. So why not leave the creation of the New Mexico Llc Forms Withdrawal to the pros?

With US Legal Forms, one of the most extensive legal document libraries, you can access anything from court paperwork to templates for in-office communication. We know how crucial compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all forms are location specific and up to date.

Here’s how you can get started with our platform and obtain the document you need in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to determine whether New Mexico Llc Forms Withdrawal is what you’re looking for.

- Begin your search again if you need a different form.

- Set up a free account and select a subscription option to buy the form.

- Choose Buy now. Once the payment is complete, you can download the New Mexico Llc Forms Withdrawal, fill it out, print it, and send or mail it to the necessary people or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your documents-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

Although fees vary by state when it comes to forming an LLC and keeping it in compliance, New Mexico is considered one of the best states to form an LLC in. This is because there is no annual fee.

Dissolving an LLC in New Mexico comes with a $25 filing fee for submitting the Articles of Dissolution to the Secretary of State. However, there may be additional costs for same-day processing, tax advice, and settling obligations with your registered agent.

If you wish to dissolve your New Mexico LLC, you must file Articles of Dissolution with the Secretary of State and the Public Regulation Commission. Regardless of whether we formed your LLC in New Mexico, or act as your registered agent, we are happy to assist you with this process.

If you are dissolving or withdrawing a corporation from the State of New Mexico, you must request a Corporate Certificate of No Tax Due from the New Mexico Taxation and Revenue Department. You may also contact the Secretary of State (SOS) for information regarding any further requirements administered by that agency.