Fixed Promissory Note Without Interest Tax Implications

Description

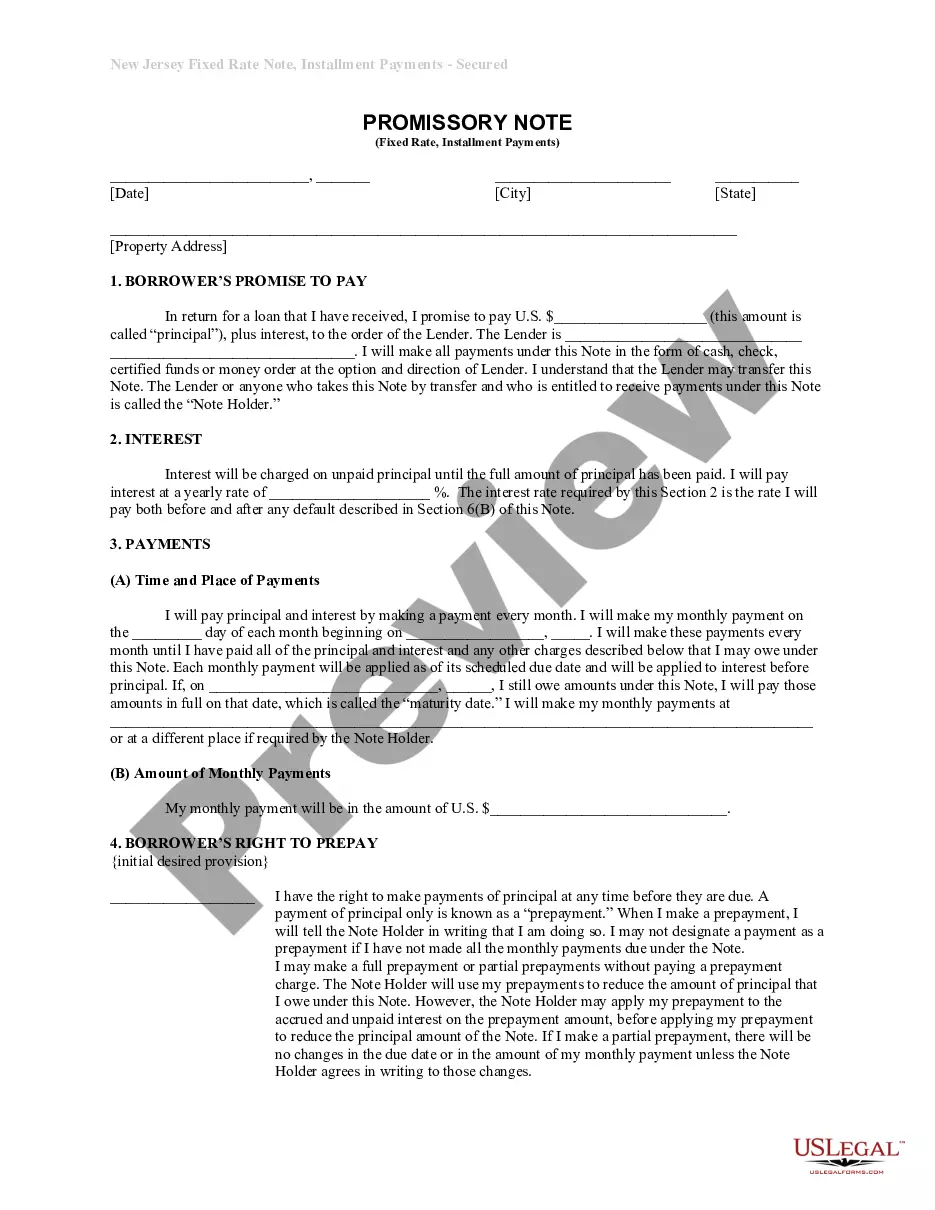

How to fill out New Jersey Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Individuals often connect legal documentation with a notion of intricacy that exclusively a professional can manage.

In a certain sense, this is accurate, as formulating a Fixed Promissory Note Without Interest Tax Implications necessitates considerable knowledge in subject matters, including regional and local laws.

Nonetheless, with US Legal Forms, the process has become simpler: pre-made legal templates for every personal and business event tailored to state regulations are gathered in a single online repository and are now accessible to anyone.

Print your document or upload it to an online editor for a quicker completion. All templates in our library are reusable: once acquired, they are stored in your profile. You can access them whenever needed via the My documents section. Explore all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current documents organized by state and usage area, so searching for a Fixed Promissory Note Without Interest Tax Implications or any other specific template takes mere moments.

- Previously registered users with an active subscription must Log In to their accounts and click Download to receive the document.

- New users of the service will need to create an account and subscribe before downloading any forms.

- Here are the step-by-step instructions on how to obtain the Fixed Promissory Note Without Interest Tax Implications.

- Carefully examine the page content to ensure it meets your requirements.

- Review the form description or look it over through the Preview feature.

- If the previous document does not fit your needs, find another template using the Search bar in the header.

- Once you identify the correct Fixed Promissory Note Without Interest Tax Implications, click Buy Now.

- Select a subscription plan that aligns with your preferences and budget.

- Create an account or Log In to move forward to the payment page.

- Pay for your subscription using PayPal or your credit card.

- Choose the format for your template and click Download.

Form popularity

FAQ

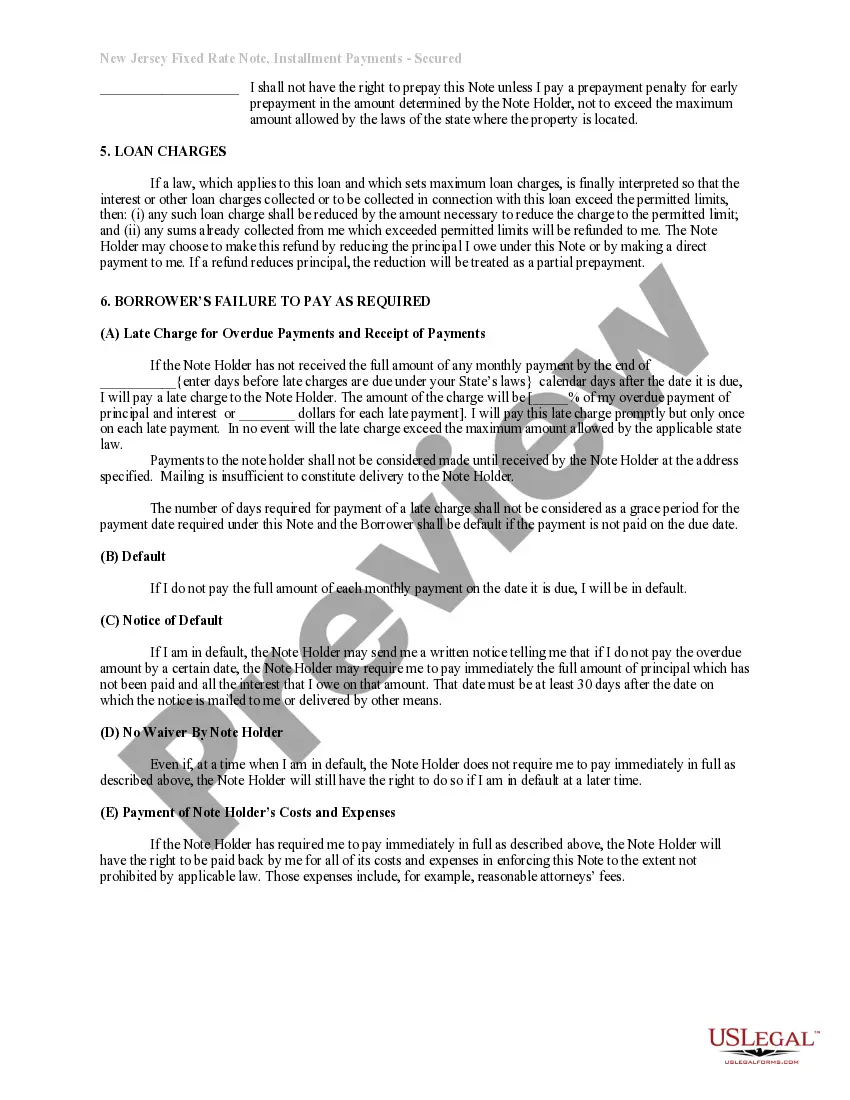

A simple promissory note will state the full amount is due on the stated date; you won't need a payment schedule. You can decide whether to charge interest on the loan amount and include the interest in the document if needed.

A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.

If interest on your loan is calculated as simple interest, the formula for calculating interest begins with the total principal balance multiplied by the interest rate. For example, if the principal is $5,000 and the interest rate is 15 percent, multiply 5,000 by 0.15 to equal 750.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.