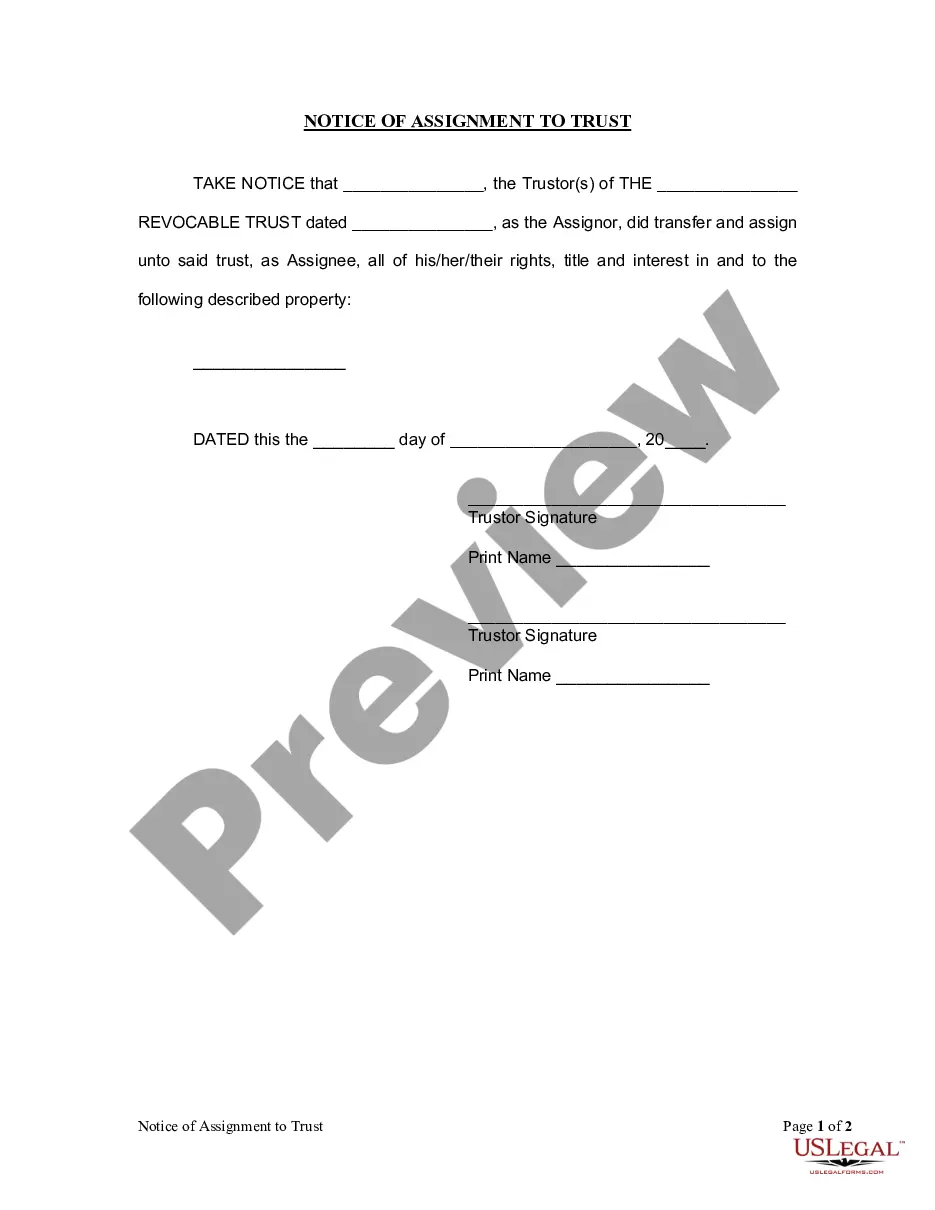

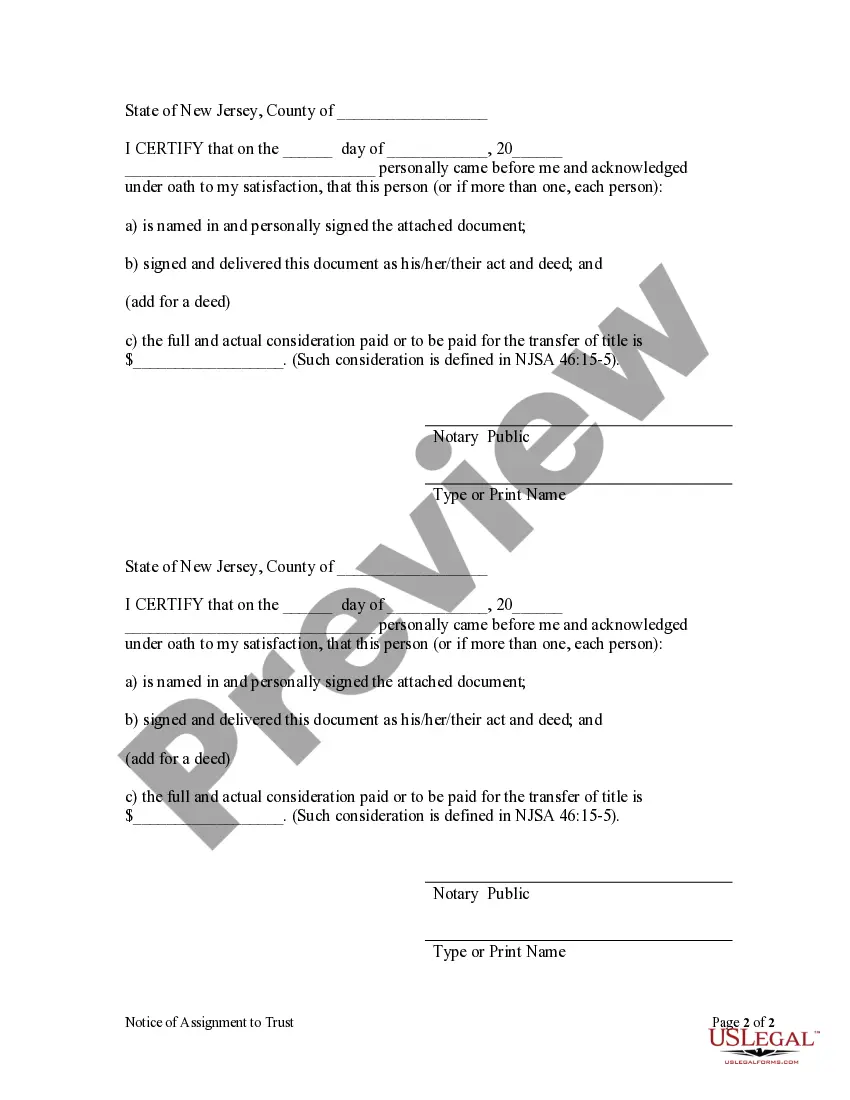

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

New Jersey Trust Withholding

Description

Form popularity

FAQ

Filing taxes on a trust involves submitting a specific form, such as the IRS Form 1041 for federal taxes, and potentially additional state forms for New Jersey. When filing, you must report the income generated by the trust and any distributions made to beneficiaries. Properly addressing New Jersey trust withholding is essential to avoid tax penalties or complications. For assistance in navigating this process, consider using platforms like uslegalforms, which provide resources and templates to simplify tax filings.

Claiming exemption from withholding of NJ gross income tax means that you believe no New Jersey income tax should be withheld from your payments. Generally, this applies to individuals who do not expect to owe tax based on their total taxable income. This claim can be significant for trustees managing trust distributions, as it impacts New Jersey trust withholding strategies. Always ensure the exemption claim is bona fide to prevent underpayment issues.

Any individual who is a resident of New Jersey or owns property within the state must file a NJ estate tax return if their estate meets the taxable threshold. This usually applies when the estate's gross value exceeds the set exemption limit. Filing this return is crucial to ensure that your estate adheres to New Jersey's tax laws related to New Jersey trust withholding. Proper filing can clarify tax obligations and help in the efficient distribution of assets.

Certain individuals may claim an exemption from the NJ exit tax, typically including those with specific circumstances such as active duty military personnel, certain property transfers, and qualifying New Jersey residents who adhere to specific criteria. It’s essential to verify eligibility by reviewing the guidelines set by the state tax authority related to New Jersey trust withholding. Being aware of these exemptions can save substantial costs when leaving New Jersey. Always consult a tax professional to ensure compliance.

The NJ 927 W form is used for New Jersey trust withholding purposes, specifically when it comes to state income tax withholding on estate or trust distributions. This form ensures that the appropriate amount of tax is withheld before distributions are made. By using the NJ 927 W, you help maintain compliance with New Jersey tax regulations, avoiding potential penalties. Understanding this form is crucial for trustees managing a trust in New Jersey.

A trust can pass out withholding tax to a beneficiary based on the distributions made from the trust's income. This tax can be reported on the beneficiary's tax return, helping to ensure transparency and compliance. Understanding New Jersey trust withholding is vital to managing this process effectively. If you have questions, USLegalForms offers resources that can support you.

Yes, withholding can indeed be distributed from a trust to its beneficiaries. This process typically involves allocating the trust's income and the associated tax withholding accordingly. It is essential to manage New Jersey trust withholding properly to avoid any tax complications. For clarity on this process, consulting resources from USLegalForms can be quite helpful.

Filling out the NJW4 form correctly is crucial for accurate tax withholding. To complete it, you need to provide your personal details, including your name, address, and Social Security number. Be sure to follow the instructions carefully to ensure proper New Jersey trust withholding from your income. If you need assistance, consider using tools from USLegalForms to navigate the form smoothly.

Yes, a trust can pass its personal exemption to its beneficiaries under certain conditions. This typically occurs when the trust income is distributed to the beneficiaries, allowing them to claim the exemption on their individual tax returns. Understanding New Jersey trust withholding is essential, as it ensures proper tax reporting and compliance. For detailed guidance, you may want to explore resources offered by USLegalForms.

Yes, New Jersey requires specific tax withholding forms for certain transactions. These forms help ensure compliance with state tax laws regarding trusts. For assistance with completing these forms and understanding New Jersey trust withholding, consider using USLegalForms to streamline the process.