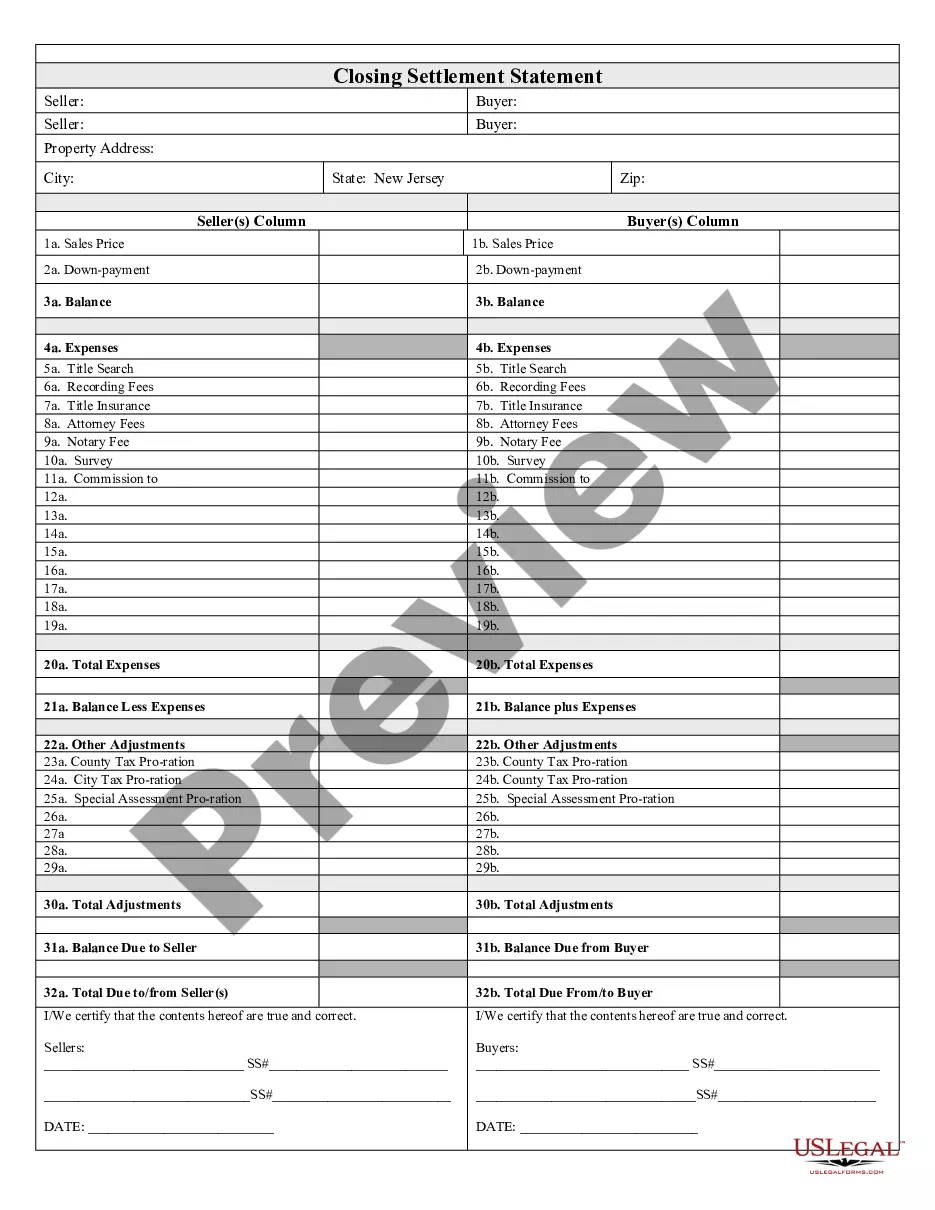

New Jersey Statement With 401k

Description

How to fill out New Jersey Closing Statement?

Utilizing legal templates that adhere to federal and local regulations is essential, and the internet provides a multitude of choices. However, what’s the use in squandering time searching for the appropriate New Jersey Statement With 401k example online if the US Legal Forms digital library already has such templates compiled in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by attorneys for any professional and personal situation. They are easy to navigate with all documents categorized by state and intended use. Our specialists remain informed about legislative updates, ensuring your paperwork is consistently current and compliant when obtaining a New Jersey Statement With 401k from our site.

Acquiring a New Jersey Statement With 401k is straightforward and quick for both existing and new users. If you already possess an account with an active subscription, Log In and store the document sample you need in the correct format. If you are new to our platform, follow the instructions below.

All documents you find through US Legal Forms are reusable. To re-download and complete previously purchased forms, access the My documents tab in your account. Take advantage of the most comprehensive and user-friendly legal documentation service!

- Examine the template using the Preview function or through the text outline to confirm it meets your requirements.

- Search for a different example using the search tool at the top of the page if necessary.

- Click Buy Now once you’ve found the appropriate form and select a subscription option.

- Create an account or Log In and process a payment with PayPal or a credit card.

- Choose the format for your New Jersey Statement With 401k and download it.

Form popularity

FAQ

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

All employees, except those who file state income taxes with the Commonwealth of Pennsylvania, must file a form NJ-W4. NJ Form W4 must be completed and signed before an employee can be paid.

401(k) distributions, including contributions made on or after January 1, 1984, are fully taxable since the contributions were not taxed when made, and earnings are taxable.

All wages and employee compensation paid to a resident working in New Jersey is subject to withholding. If you employ New Jersey residents working in New Jersey, you must register, file, and pay New Jersey employer withholdings.

Any amounts contributed to a 401(k) plan by a sole proprietor on behalf of employees or on his or her behalf as an employee receive tax-deferred treatment and are deductible to the same extent as for federal income tax under N.J.S.A. 54A: 6-21.