Nj Llc Form With Example

Description

How to fill out New Jersey Limited Liability Company LLC Operating Agreement?

Obtaining legal templates that comply with federal and state laws is a matter of necessity, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the correctly drafted Nj Llc Form With Example sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by attorneys for any business and personal situation. They are easy to browse with all files collected by state and purpose of use. Our experts stay up with legislative updates, so you can always be sure your form is up to date and compliant when getting a Nj Llc Form With Example from our website.

Getting a Nj Llc Form With Example is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the right format. If you are new to our website, adhere to the steps below:

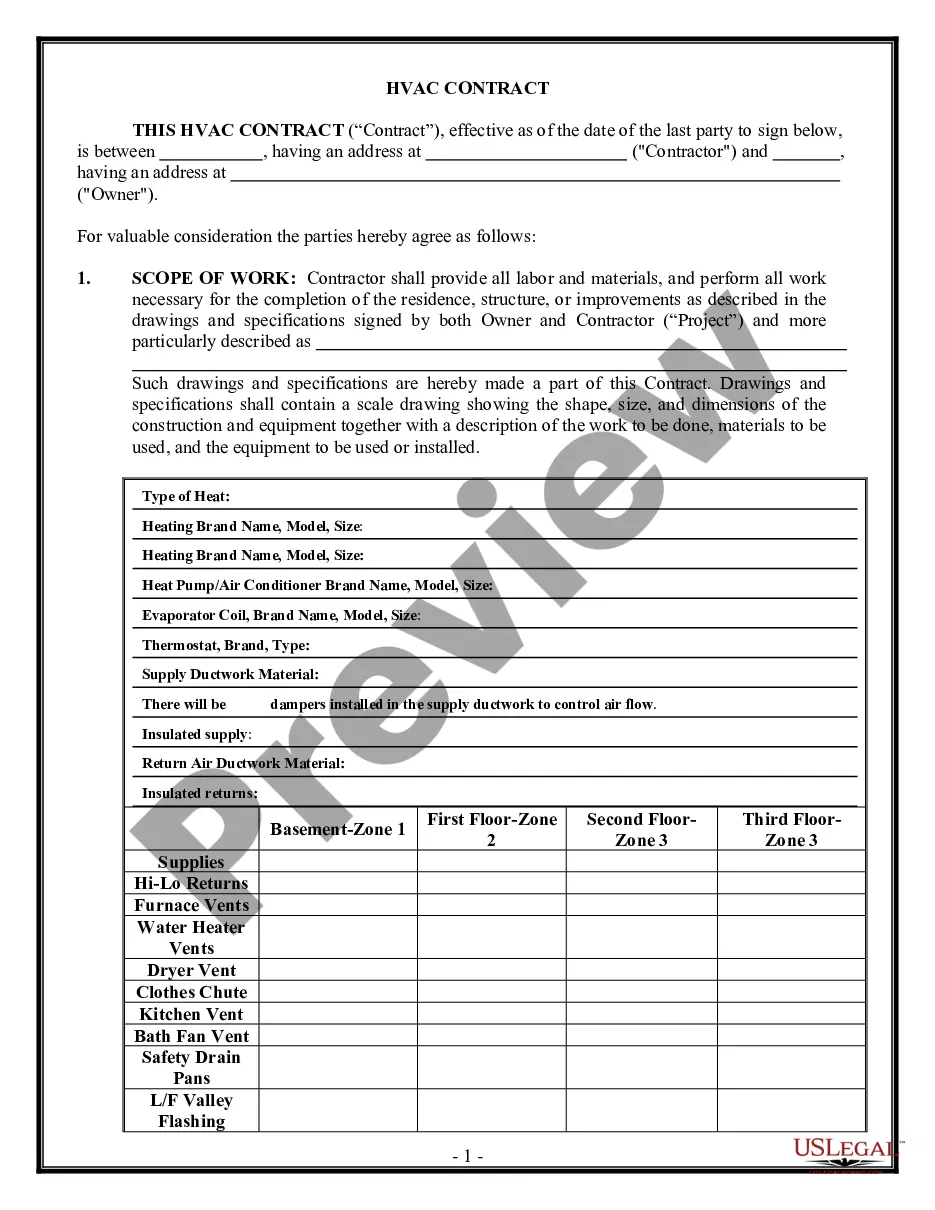

- Take a look at the template using the Preview feature or via the text description to ensure it meets your needs.

- Locate a different sample using the search tool at the top of the page if needed.

- Click Buy Now when you’ve located the right form and select a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Nj Llc Form With Example and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and complete previously purchased forms, open the My Forms tab in your profile. Enjoy the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

All New Jersey LLCs are required to register with the New Jersey Department of Revenue regardless of whether they collect a state tax or have employees. New Jersey LLCs are required to file an annual report. The report is due on the last day of the anniversary month of the LLC's formation.

The cost to establish an LLC in New Jersey is $125 The standard processing time is about four weeks and can vary depending on how many LLCs are currently being reviewed by the Division of Revenue and Enterprises You can expedite the process by paying an additional fee.

Forming an LLC in NJ Step 1: Choose a name for your NJ LLC. Step 2: Choose a registered agent in NJ. Step 3: Obtain an NJ business license. Step 4: File your certificate of formation. Step 5: Draft an LLC operating agreement. Step 6: Comply with state and federal obligations. Pros. Cons.

No, New Jersey statutes do not state that LLCs are required to have an operating agreement. However, you'll need an operating agreement for several important tasks, like opening a bank account for your LLC and maintaining limited liability status.

New Jersey doesn't require an SMLLC to have an operating agreement. Even though you're the only member of your SMLLC, you should still create an agreement. The operating agreement is usually made between the single member and the LLC itself.