Nj Disclaimer Of Inheritance Form For Minor

Description

How to fill out New Jersey Disclaimer Of Right To Inherit Or Inheritance?

Creating legal documents from the ground up can frequently feel somewhat daunting. Some situations may demand extensive research and substantial financial commitment.

If you're seeking a simpler and cost-effective method for generating Nj Disclaimer Of Inheritance Form For Minor or any other documents without having to navigate complex procedures, US Legal Forms is always available to assist you.

Our online library of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can swiftly access forms that comply with state and county regulations, carefully prepared for you by our legal experts.

Utilize our platform whenever you require trustworthy and dependable services where you can effortlessly find and download the Nj Disclaimer Of Inheritance Form For Minor. If you're already familiar with our site and have set up an account with us previously, simply Log In to your account, choose the form, and proceed with the download or re-download it later from the My documents section.

US Legal Forms enjoys a strong reputation with over 25 years of experience. Join us today and transform document management into a straightforward and efficient process!

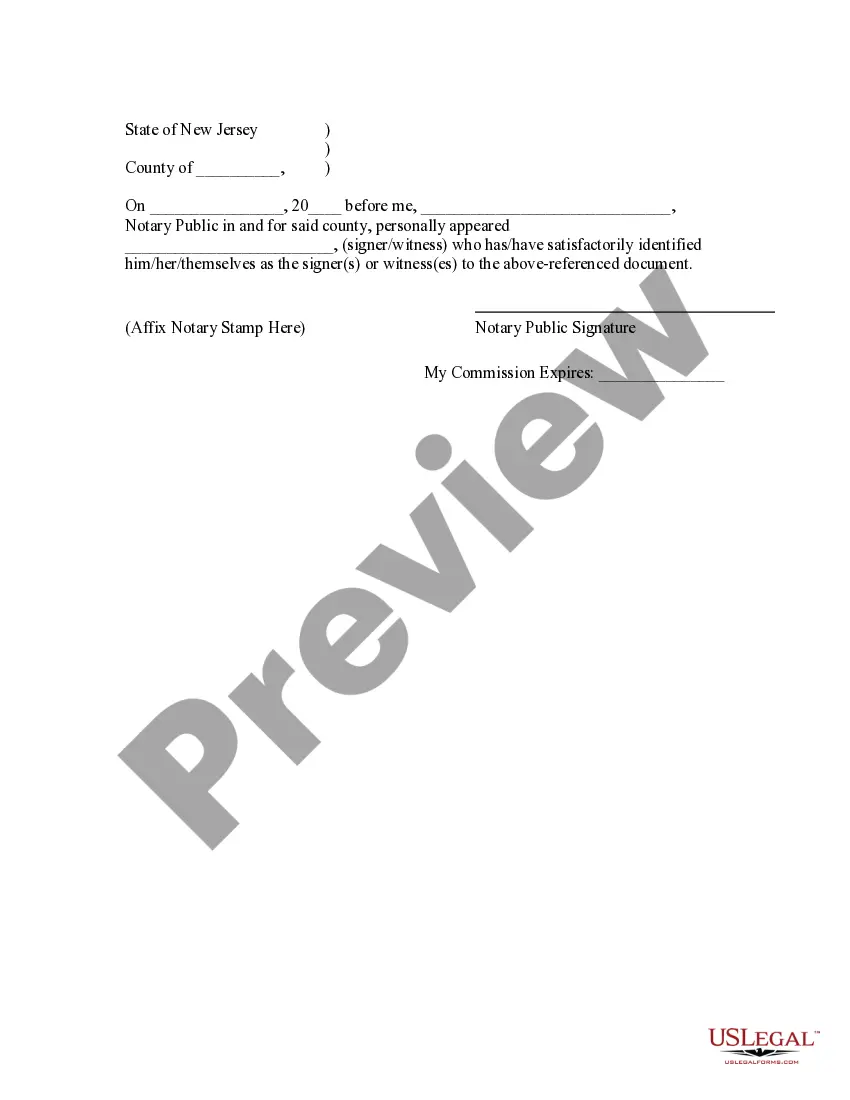

- Examine the form preview and descriptions to ensure you have located the document you need.

- Confirm that the form you choose meets the standards of your state and county.

- Select the most appropriate subscription plan to obtain the Nj Disclaimer Of Inheritance Form For Minor.

- Download the document. Then complete, sign, and print it.

Form popularity

FAQ

To avoid inheritance tax in New Jersey, consider making gifts during your lifetime, as these are typically excluded from taxing once you pass away. Additionally, establishing certain trusts or using a NJ disclaimer of inheritance form for minor can be effective strategies to lessen the tax burden on your heirs. Consulting legal professionals or platforms like UsLegalForms can provide you with tailored solutions that suit your family's needs.

Generally, the executor of the estate must file a NJ inheritance tax return if the total value of the estate exceeds the exemption amount. Beneficiaries who receive property valued above the threshold may also need to file separately. If you are managing an estate that involves minors, utilizing a NJ disclaimer of inheritance form for minor can simplify the process and clarify tax obligations.

To disclaim an inheritance in New Jersey, you must complete a written disclaimer that clearly states your intention to reject the inheritance. This disclaimer must be filed with the appropriate authorities and submitted before you accept any benefits from the inheritance. Using a NJ disclaimer of inheritance form for minor ensures that the process is straightforward and protects the interests of the minor beneficiary.

In New Jersey, children can inherit up to $675,000 without facing any inheritance tax. Any amount above this threshold may be subject to tax rates that vary based on the relationship between the deceased and the beneficiary. This means that a NJ disclaimer of inheritance form for minor can be a valuable tool for minimizing tax obligations and ensuring responsible financial management for your children.

Filing a qualified disclaimer requires following specific steps as outlined in IRS regulations. Start with the NJ disclaimer of inheritance form for minor, ensuring it meets the necessary criteria. You need to file the disclaimer within a stipulated time frame and provide it to the estate or trust administrator to ensure its acceptance.

To file a disclaimer, you must submit the completed NJ disclaimer of inheritance form for minor to the appropriate authority. This typically means providing a copy to the executor of the estate or filing it with the probate court. Ensure you adhere to any deadlines set by New Jersey law to validate your disclaimer.

Writing an inheritance disclaimer involves detailing your decision to refuse property or assets inherited. Start with your personal information, followed by a clear statement of your intention regarding the inheritance. Using the NJ disclaimer of inheritance form for minor ensures compliance with New Jersey law and helps ensure your wishes are respected.

To issue a disclaimer effectively, begin by completing the NJ disclaimer of inheritance form for minor. Make sure to sign and date the form, indicating your willingness to renounce the inheritance. After preparing the document, you must deliver it to the appropriate parties, such as the executor of the estate or the probate court.

To properly write a NJ disclaimer of inheritance form for minor, clearly state your intent to disclaim the inheritance. Include your full name, the decedent’s name, and a description of the property being disclaimed. Ensure you follow any specific legal requirements or formats outlined in New Jersey law, as this will help avoid issues later.

When writing a sample disclaimer of inheritance, start by stating your full name and address. Follow this with a declaration that you are disclaiming specific assets, and cite the name of the estate from which you are receiving the inheritance. It is wise to refer to the NJ disclaimer of inheritance form for minor, ensuring that you include any pertinent details that make your disclaimer legally valid. This approach fosters clarity and maintains legal compliance.