Asset Person Inheritance For Retirement

Description

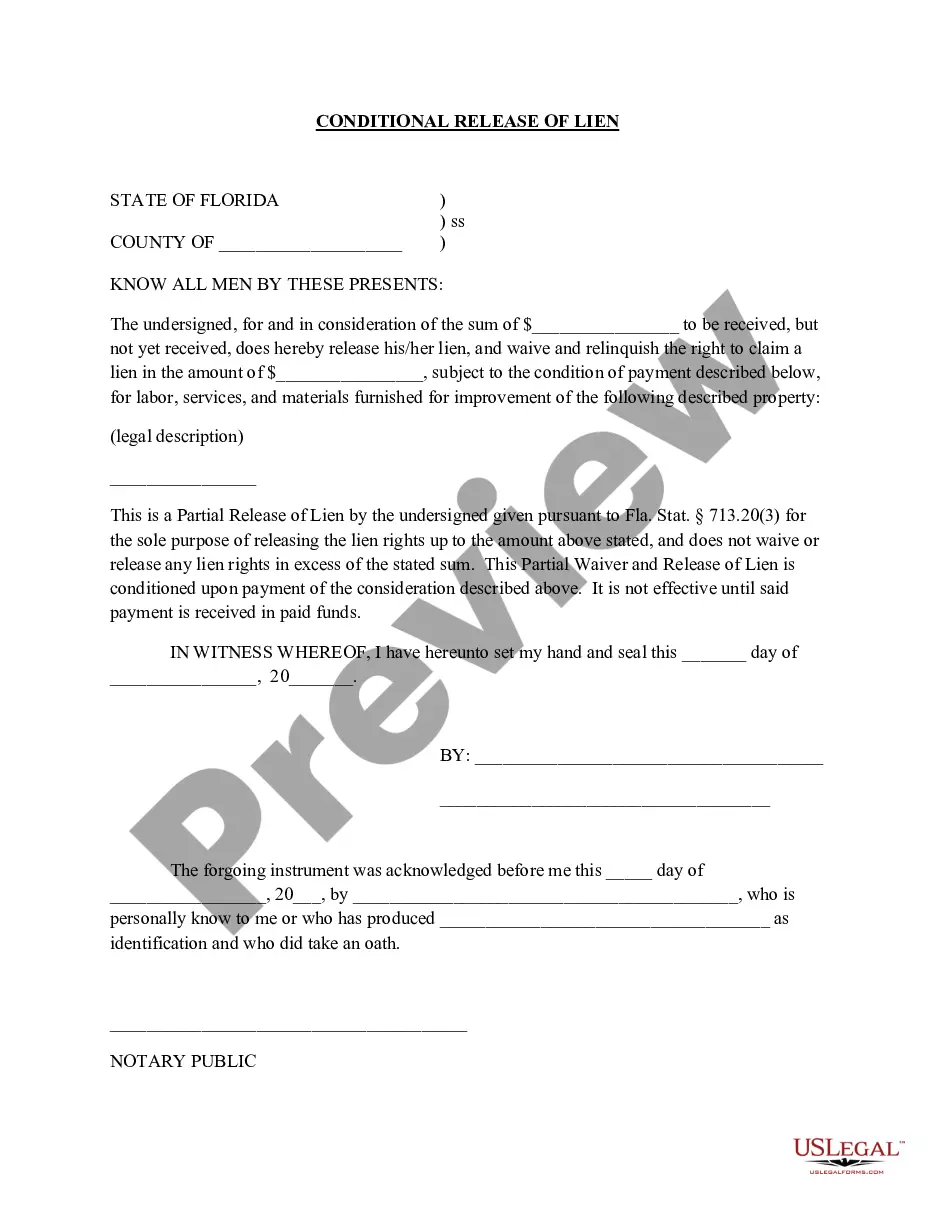

How to fill out USLegal Pamphlet On Disclaiming An Inheritance?

Finding a go-to place to access the most current and relevant legal samples is half the struggle of working with bureaucracy. Choosing the right legal files needs precision and attention to detail, which is why it is vital to take samples of Asset Person Inheritance For Retirement only from reliable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You may access and view all the information about the document’s use and relevance for your circumstances and in your state or county.

Consider the listed steps to complete your Asset Person Inheritance For Retirement:

- Make use of the library navigation or search field to locate your sample.

- View the form’s description to see if it suits the requirements of your state and region.

- View the form preview, if available, to make sure the form is the one you are searching for.

- Return to the search and find the proper document if the Asset Person Inheritance For Retirement does not match your requirements.

- When you are positive regarding the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Select the pricing plan that fits your preferences.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by selecting a transaction method (bank card or PayPal).

- Select the file format for downloading Asset Person Inheritance For Retirement.

- When you have the form on your device, you may change it using the editor or print it and finish it manually.

Eliminate the hassle that comes with your legal paperwork. Explore the extensive US Legal Forms library to find legal samples, check their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

What Is an Inheritance? Inheritance refers to the assets that an individual bequeaths to their loved ones after they pass away. An inheritance may contain cash, investments such as stocks or bonds, and other assets such as jewelry, automobiles, art, antiques, and real estate.

If you inherit a Roth IRA, you're free of taxes. But with a traditional IRA, any amount you withdraw is subject to ordinary income taxes. For estates subject to the estate tax, inheritors of an IRA will get an income-tax deduction for the estate taxes paid on the account.

Beneficiaries of an IRA, and most plans, have the option of taking a lump-sum distribution of the inherited account at any time. Beneficiaries must include any taxable distributions they receive in their gross income.

How to Consider Inheritance in Retirement Planning Learn what you can. Some grantors are open about what they plan to do with their money when they pass. ... Find a role for inherited assets. ... Talk to a financial advisor. ... Consider taxes and probate. ... Know the rules for inheriting retirement funds.

When writing your letter of instruction, include as much information about your estate and your assets as possible, and provide detailed instruction for how you want any assets not mentioned in your formal will to be dispersed among your heirs. Your letter of intent doesn't supersede the terms of your will.