Nj Disclaimer Of Inheritance Form For Estate

Description

How to fill out New Jersey Disclaimer Of Right To Inherit Or Inheritance?

Dealing with legal documents and procedures can be a lengthy addition to your day.

New Jersey Disclaimer Of Inheritance Form For Estate and similar forms usually necessitate you to locate them and navigate the correct way to complete them accurately.

Therefore, if you are handling financial, legal, or personal matters, having a comprehensive and easy-to-use online directory of forms readily available will be extremely beneficial.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific forms along with various resources to help you finalize your documents promptly.

Is this your first time using US Legal Forms? Sign up and create your account in just a few moments and you will get access to the form catalog and New Jersey Disclaimer Of Inheritance Form For Estate. After that, follow the steps outlined below to complete your form.

- Examine the array of pertinent documents available with a single click.

- US Legal Forms offers state- and county-specific forms available for download anytime.

- Safeguard your document management processes through a quality service that enables you to prepare any form in minutes without additional or concealed charges.

- Simply Log In to your account, search for New Jersey Disclaimer Of Inheritance Form For Estate, and download it immediately from the My documents section.

- You can also access previously saved forms.

Form popularity

FAQ

The rules for disclaiming an inheritance in New Jersey include submitting a signed disclaimer within nine months of learning about the inheritance. Importantly, you cannot accept any benefits from the estate to qualify for a disclaimer. To adhere to these rules efficiently, using the NJ disclaimer of inheritance form for estate is advisable, as it provides a structured approach to meeting all legal requirements.

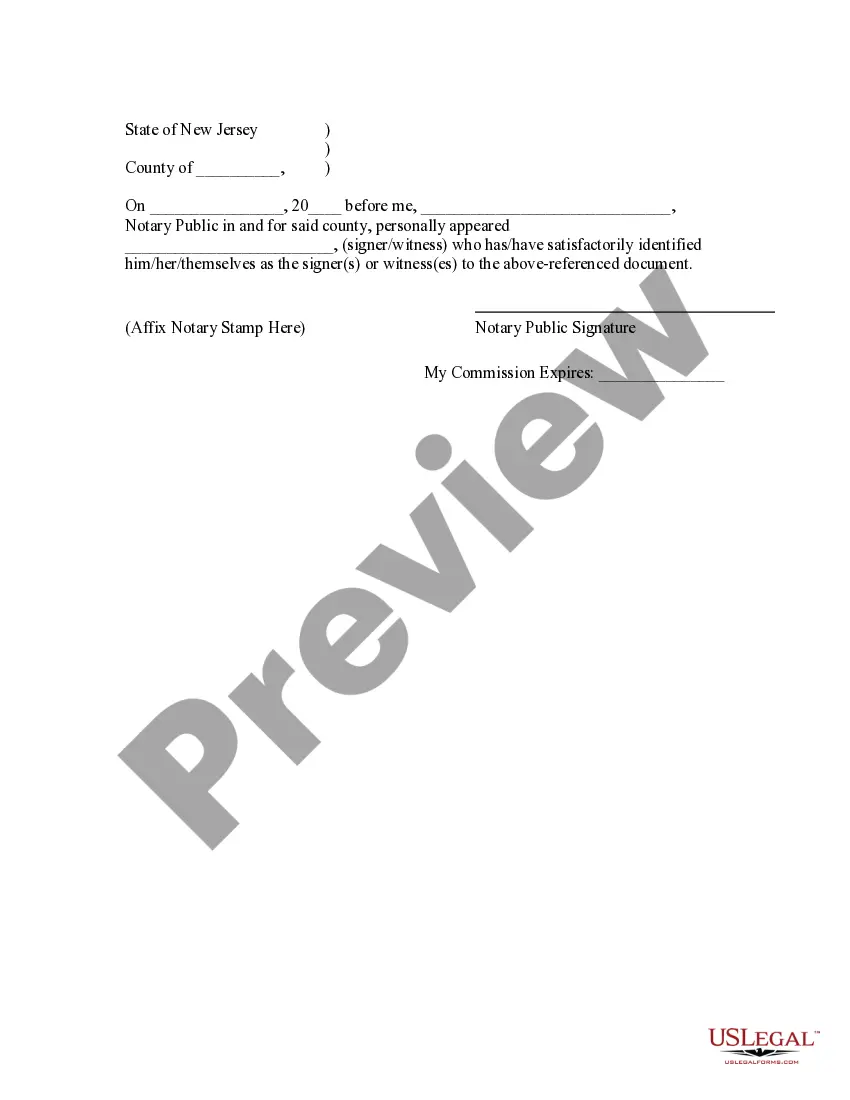

In New Jersey, a disclaimer of inheritance typically does not need to be notarized, but it should be in writing and signed by the disclaimed heir. However, some individuals may choose to have it notarized for added security and verification. Always ensure that you follow the requirements when completing the NJ disclaimer of inheritance form for estate to avoid any potential issues.

To write a disclaimer letter for inheritance, begin with a formal greeting and introduce yourself as the heir. Clearly express your intention to disclaim the inheritance, and specify the items or amounts you are rejecting. Conclude the letter with your signature and date. For a streamlined experience, consider using the NJ disclaimer of inheritance form for estate for accurate documentation.

When writing a sample disclaimer of inheritance, start with your full name, address, and the date. Clearly state that you are disclaiming the inheritance and identify the property involved. Use a simple, formal tone and include your signature at the end. Utilizing the NJ disclaimer of inheritance form for estate can provide a useful template to guide you in this process.

The most common document proving inheritance is the decedent's will, which outlines the distribution of their estate. If there is no will, a court may issue letters of administration, confirming the heirs. It's important to have this documentation accessible when filling out the NJ disclaimer of inheritance form for estate, as it provides the necessary context.

Disclaiming an inheritance in New Jersey involves submitting a signed disclaimer to the estate's executor or administrator. This process must occur within nine months of becoming aware of the inheritance. Using the NJ disclaimer of inheritance form for estate can simplify this process by providing you with a clear template that meets legal standards.

To file a disclaimer in New Jersey, you need to submit your disclaimer in writing to the executor or administrator of the estate. Make sure to include pertinent details, such as your name and the property you are disclaiming. After preparing the NJ disclaimer of inheritance form for estate, consider consulting with an attorney to ensure compliance with all legal guidelines and timelines.

A disclaimer is considered qualified if it meets certain legal criteria laid out by the state of New Jersey. Specifically, the disclaimer must written, signed, and filed within a specific timeframe after the inheritance becomes known to the heir. Additionally, the disclaimer must not involve any acceptance of benefits from the estate. Understanding these requirements is essential when using the NJ disclaimer of inheritance form for estate.

An example of a disclaimer of estate could be a scenario where a person receives a property from a relative but chooses not to accept it. For instance, if an heir receives a house but knows it carries significant debt, they might use a NJ disclaimer of inheritance form for estate to formally refuse that property. This action allows the estate to pass directly to the next eligible heir, avoiding potential financial burdens.

Writing a disclaimer for an inheritance involves a few essential steps. First, clearly state your intent to refuse the inheritance in writing. You must include your name, the name of the deceased, and specify the property or interest you are disclaiming. Finally, consider using the NJ disclaimer of inheritance form for estate, ensuring that you follow all legal requirements for your disclaimer to be valid.