Account Transfer Trust With Vanguard

Description

Form popularity

FAQ

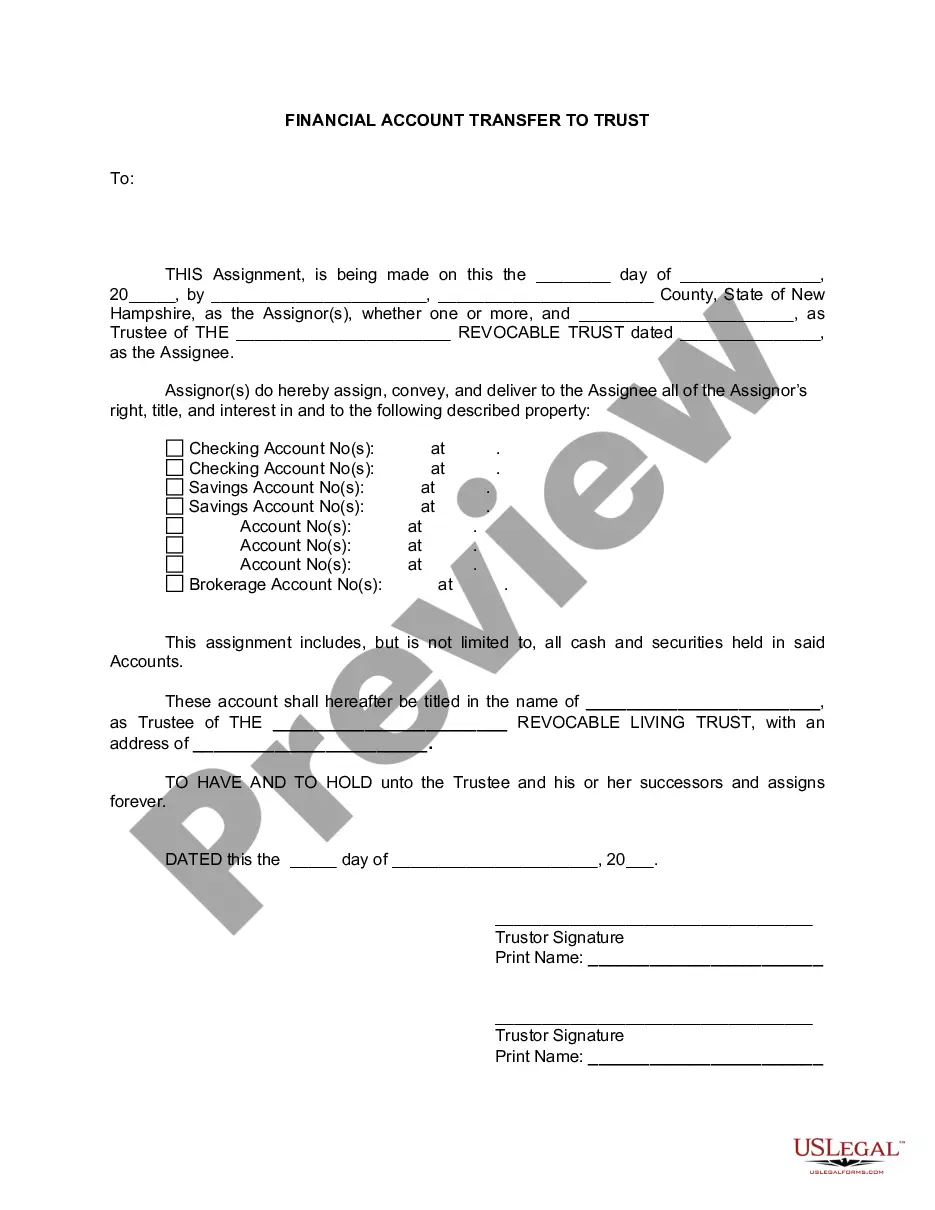

Transferring a brokerage account to a trust requires you to first set up the trust with legal documentation. After that, contact your brokerage firm for their specific requirements and forms related to transferring an account to a trust. Be sure to indicate that this is an account transfer trust with Vanguard, so they provide you with the right guidance. If you need assistance with the paperwork, USLegalForms can simplify the process for you.

To transfer out of Vanguard, you first need to contact your new brokerage or financial institution. They will typically provide a transfer form that you must complete. Ensure you have your Vanguard account details ready, and confirm that you want to initiate an account transfer trust with Vanguard. Once you've submitted the form, your new institution will coordinate the transfer process.

A common example of a trust account is a revocable living trust account, which allows you to manage your assets during your lifetime and specifies how they are distributed after your death. This type of account simplifies the probate process and ensures your wishes are followed. Utilizing an account transfer trust with Vanguard can help you establish this kind of account efficiently.

Retitling an account on a trust involves changing the legal ownership of that account to reflect the name of the trust. This process is important as it ensures that the assets are managed according to the terms of the trust. It's a crucial step in establishing an account transfer trust with Vanguard and ensuring that the assets align with your estate planning goals.

When titling a brokerage account to a trust, use the trust's official name and add the date the trust was established. For instance, you can title the account as 'John Doe Trust dated July 5, 2021.' This specific titling helps clarify the ownership and supports the creation of an effective account transfer trust with Vanguard.

To transfer a Vanguard account to a trust, first, make sure the trust is properly established and documented. Then, reach out to Vanguard's customer service for guidance on completing the transfer form, which usually requires trust details and supporting documents. Following these steps will facilitate an efficient account transfer trust with Vanguard.

Transferring accounts into a trust usually involves contacting the financial institution where the accounts are held. You will need to provide certain documentation, including the trust agreement and identification. It's recommended to consult with a legal advisor to ensure that the account transfer trust with Vanguard is executed smoothly.

A trust account should typically be titled in the name of the trust itself. For example, if your trust is called the Smith Family Trust, you would title the account as 'The Smith Family Trust' followed by the date of the trust. This clear titling helps maintain organization and ensures proper management of the account transfer trust with Vanguard.

To put your brokerage account in a trust, start by establishing the trust with the help of a legal professional. Next, contact your brokerage firm to understand their specific procedures for transferring assets into a trust. They will often require documentation proving the trust's existence and its terms. This process is essential for creating an account transfer trust with Vanguard.

One downside of placing assets in a trust is the potential for added complexity in managing those assets. An account transfer trust with Vanguard may incur fees related to setup and administration. Additionally, you may lose some control over your assets that are now governed by the trust terms. It's wise to weigh these factors before making a decision.