Affidavit Regarding A Change Of Name With Irs

Description

How to fill out North Dakota Objection To Name Change Of A Minor Child?

Individuals typically link legal documents to something complex that only an expert can manage.

In a sense, this holds true, as crafting an Affidavit Regarding A Change Of Name With IRS demands considerable knowledge of subject criteria, encompassing state and local laws.

However, with US Legal Forms, the process has become more straightforward: ready-to-go legal documents for any personal and business circumstance tailored to state regulations are compiled in one online catalog and are now accessible to all.

Select the format for your sample and click Download. Print your document or upload it to an online editor for faster completion. All templates in our catalog are reusable: once purchased, they remain saved in your profile. You can access them anytime needed via the My documents tab. Experience all advantages of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current documents organized by state and area of use, making the search for an Affidavit Regarding A Change Of Name With IRS or any specific template only a matter of minutes.

- Users who have previously registered with an active subscription must Log In to their account and select Download to obtain the form.

- New users will need to establish an account and subscribe before they can save any documentation.

- Here is a detailed guideline on how to obtain the Affidavit Regarding A Change Of Name With IRS.

- Review the page content thoroughly to confirm it meets your requirements.

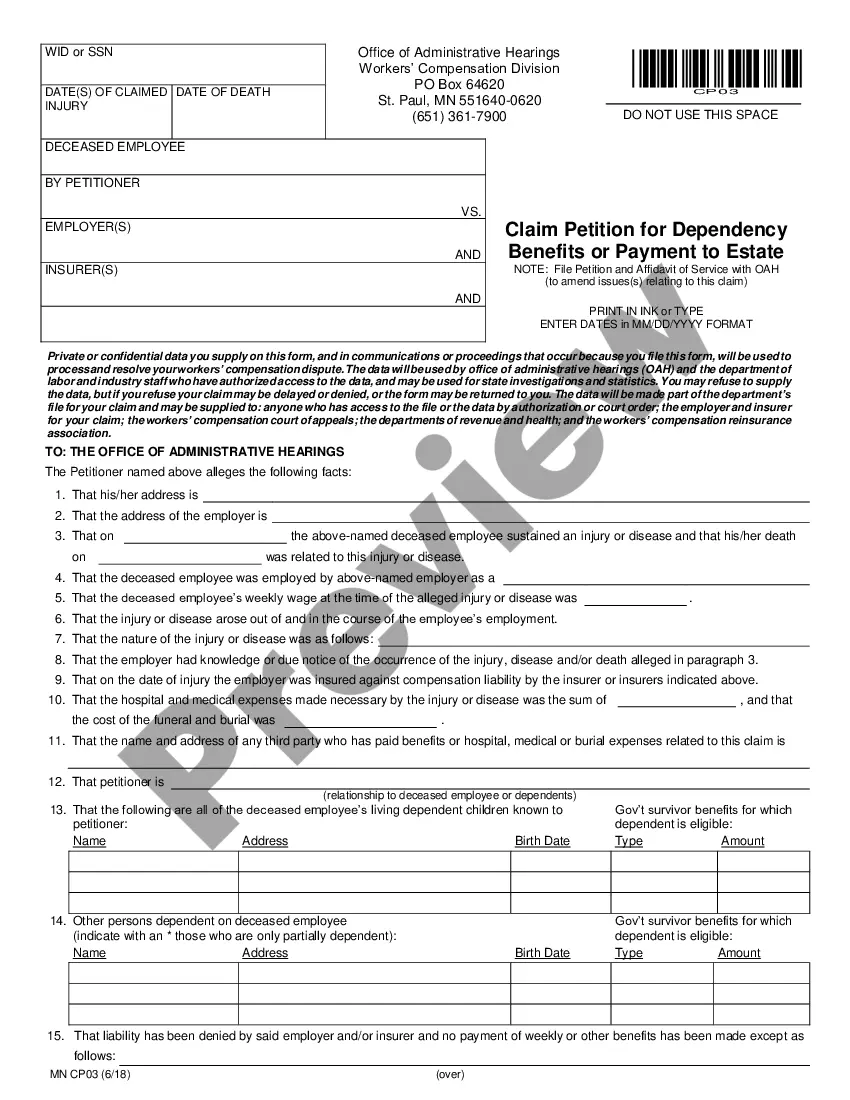

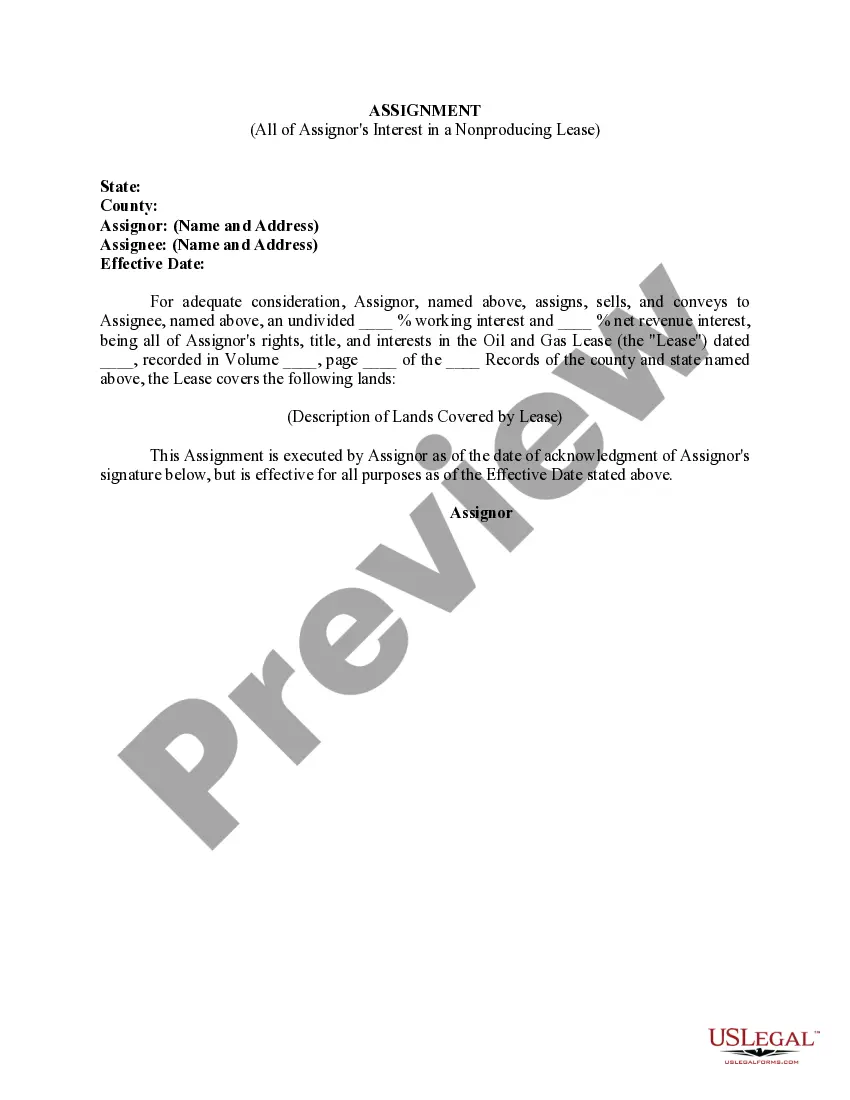

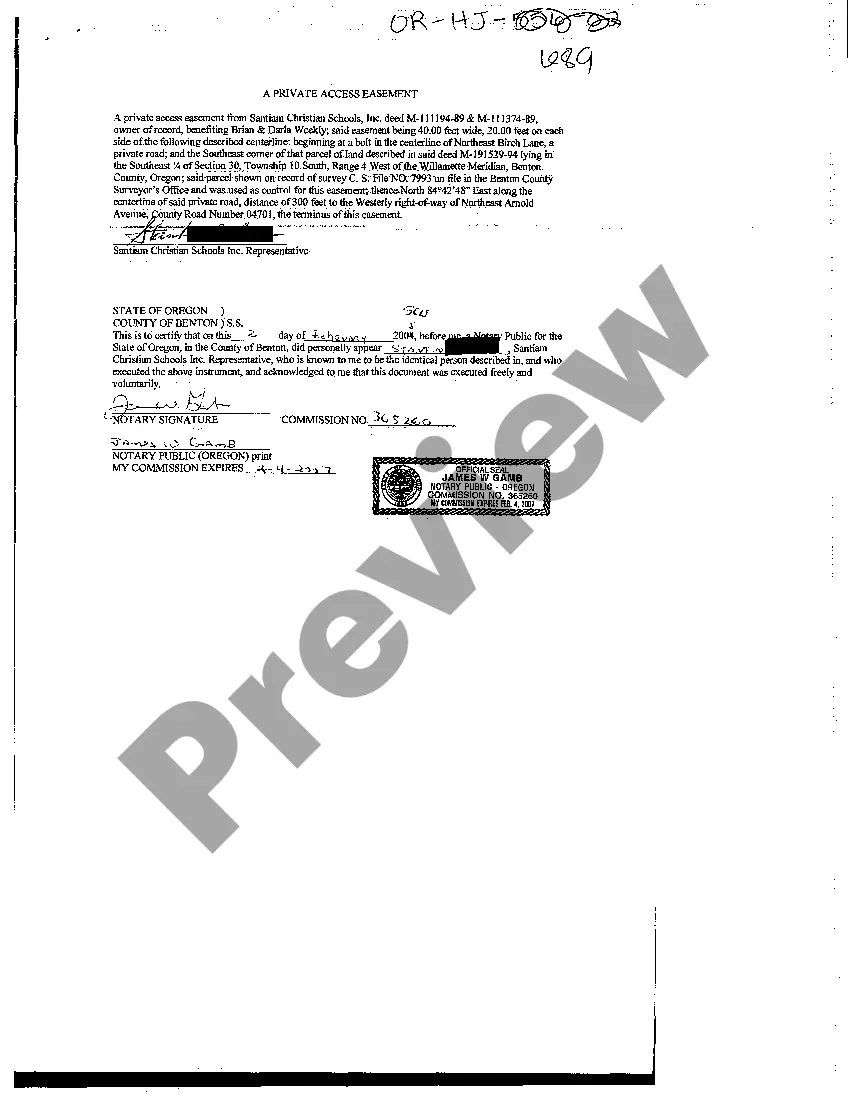

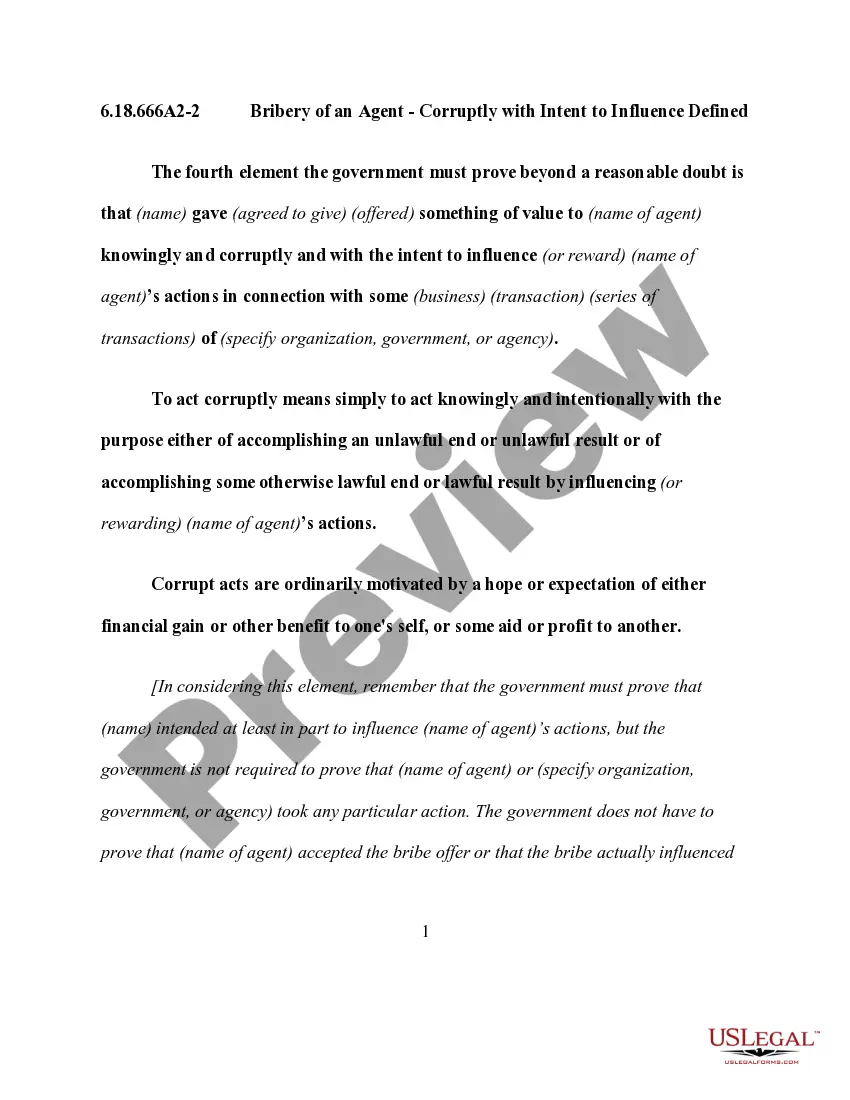

- Examine the form description or validate it through the Preview option.

- If the previous option does not meet your needs, seek another sample utilizing the Search bar above.

- Once you find the appropriate Affidavit Regarding A Change Of Name With IRS, click Buy Now.

- Select a subscription plan that aligns with your needs and budget.

- Create an account or Log In to move to the payment page.

- Complete your payment via PayPal or using your credit card.

Form popularity

FAQ

Report any change to the Social Security Administration by visiting their website or calling them at 800-772-1213 (TTY 800-325-0778). Note: The spelling of your name on your tax return will be used on any refund check we issue you.

You do not have to report your name change directly to the IRS. However, it's important to report it to the Social Security Administration (SSA) before you file your tax return. You can change your name by mail or go to your local Social Security office.

Whether you file Form SS-5 at your local Social Security office or by mail, you'll need to provide documents to support your legal name change, such as an original or certified copy of your marriage certificate. For more information, go to IRS.gov.

Form 56 is used to notify the IRS of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship under section 6036.