North Dakota Trust With The Us

Description

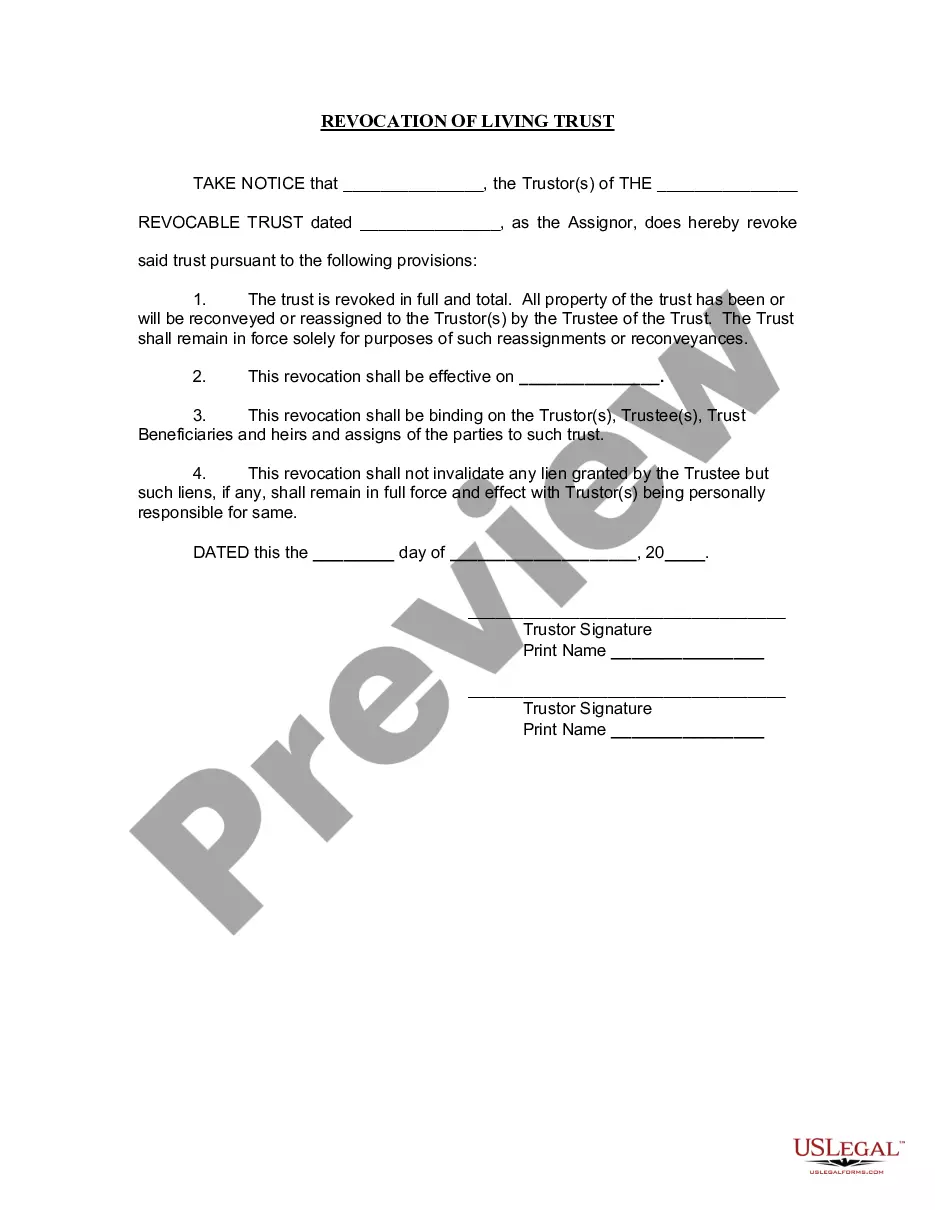

How to fill out North Dakota Revocation Of Living Trust?

- If you're a returning user, start by logging into your account at US Legal Forms. Make sure your subscription is active; otherwise, renew it using your payment plan.

- For first-time users, confirm the document you need by checking the preview mode and form description to ensure compliance with local regulations.

- Use the Search tab if you need to find a different form, ensuring it fits your specific requirements.

- Proceed to purchase the selected document by clicking the 'Buy Now' button and choose your subscription plan.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- Download your legal form to your device and access it any time from the 'My Forms' menu in your account.

US Legal Forms stands out in the legal document preparation space. With more than 85,000 fillable forms and packages available, it boasts a robust collection, exceeding competitors at similar costs.

With our platform, you can also receive expert assistance when filling out your forms, ensuring that every document you create is precise and legally sound. Start your journey with us today!

Form popularity

FAQ

Yes, North Dakota recognizes federal extensions for trusts. This means that if you have filed for a federal extension, your North Dakota trust can benefit from that timeframe. However, it's essential to complete your trust documentation accurately before the extended deadline. You can find helpful resources and templates through the US Legal Forms platform to ensure compliance with both federal and North Dakota trust regulations.

Yes, North Dakota has a state withholding form. This form is necessary for employers to accurately report state taxes withheld from employees' wages. When you establish a North Dakota trust with the US and plan to distribute funds, it’s vital to be aware of any tax implications. Using uSlegalforms makes it easier to navigate these requirements and ensure compliance.

North Dakota offers unique features, such as its extensive natural landscapes and rich Native American culture. These elements create a distinct identity that sets the state apart. Furthermore, the North Dakota trust with the US ensures the preservation of this individuality, enriching the lives of residents and visitors alike.

North Dakota contributes significantly to the US economy through its natural resources, including oil and gas, along with its agricultural sector. The state’s exports help meet national food supply demands and energy needs. This synergy highlights the vital role of the North Dakota trust with the US in maintaining economic stability and growth.

North Dakota's main export is agricultural products, particularly grains and livestock. The state is recognized as a leading producer of crops like wheat and soybeans. This agricultural strength, alongside the North Dakota trust with the US, sustains economic growth and food security for the nation.

Establishing a trust in North Dakota involves specific legal requirements that must be met. These include defining the trust's purpose, appointing a trustee, and drafting a trust agreement. If you're looking to create a trust that aligns with the North Dakota trust with the US, consider using uslegalforms to streamline the process.

North Dakota is important due to its vast natural resources and agricultural output. The state takes pride in its leadership in energy production, particularly oil and wind energy. The North Dakota trust with the US reflects its commitment to resource management, benefiting both local communities and the broader economy.

North Dakota leads the nation in several vital sectors, including agriculture and energy production. It has a thriving agricultural landscape that contributes significantly to the food supply. Emphasizing its role, North Dakota’s trust with the US plays a key part in supporting farmers and sustainable practices.

Yes, you can drive on North Dakota State trust land, but there are specific regulations you must follow. Check local laws to ensure compliance, as some areas may have restrictions for vehicles. Understanding these guidelines will help you enjoy your drive while respecting the North Dakota trust with the US.

Setting up a trust in North Dakota involves several steps. First, determine the type of trust that fits your needs and appoint a trustee to manage the trust. You can draft a trust agreement with the help of a legal professional to ensure compliance with state laws. Tools like USLegalForms can assist in providing the necessary templates and guidance for creating a North Dakota trust with the US.