Spousal Allowance Nc Form For Probate

Description

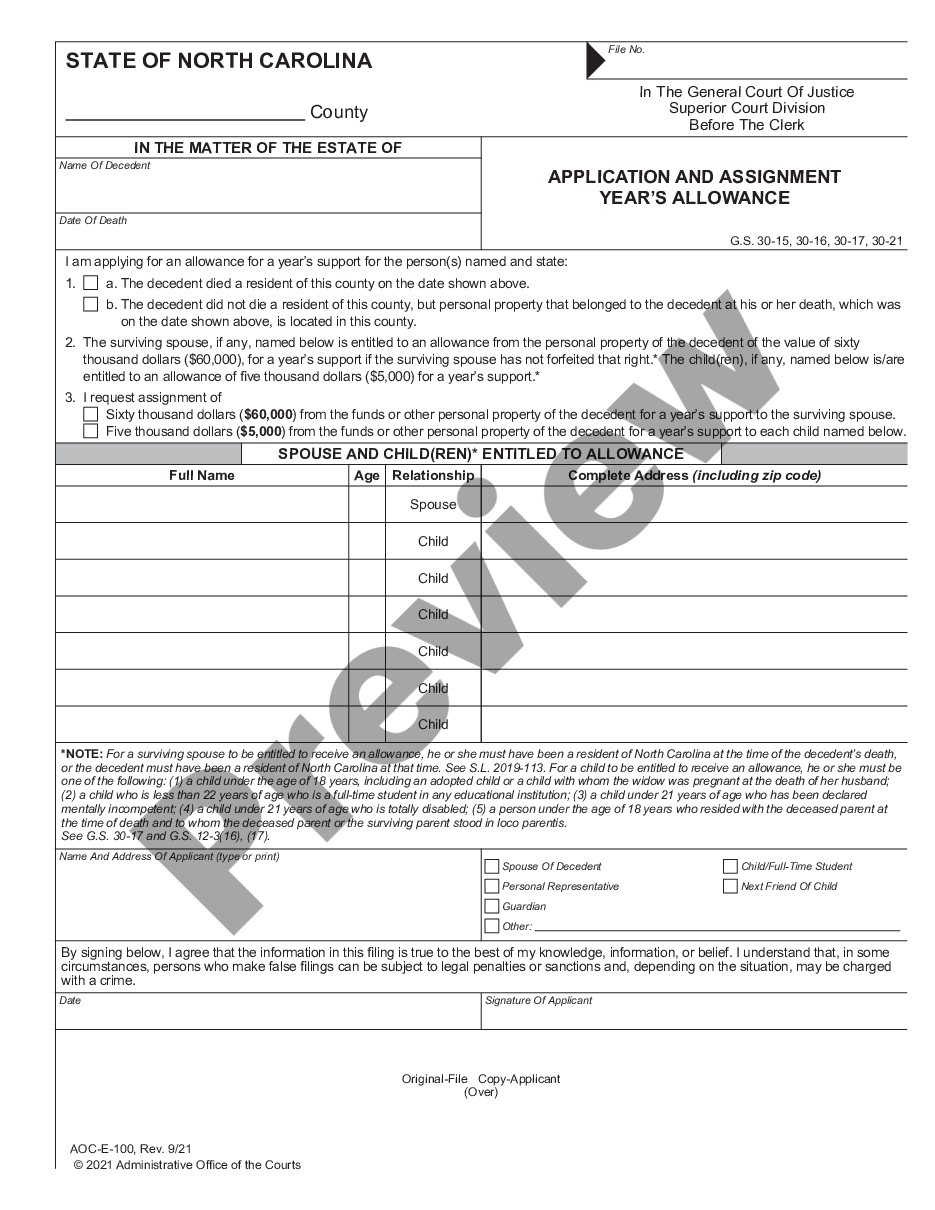

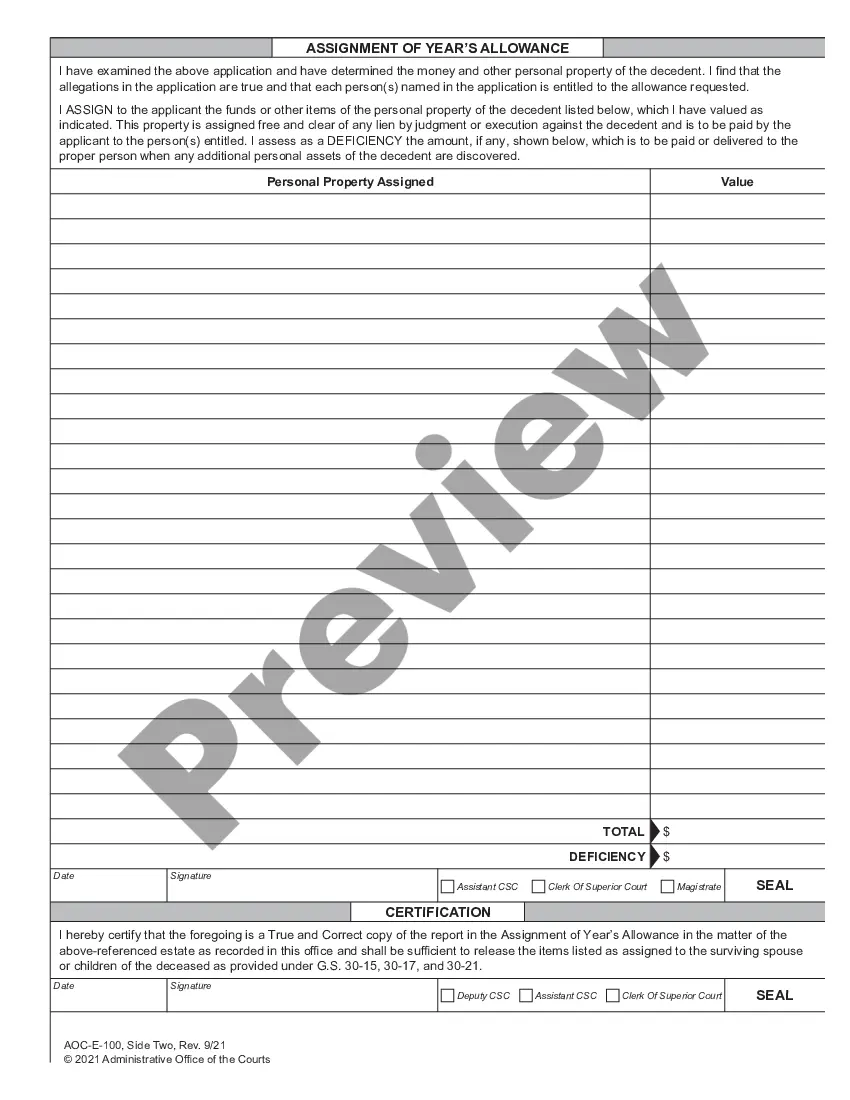

How to fill out North Carolina Application And Assignment Year's Allowance?

Legal document management might be overwhelming, even for skilled specialists. When you are interested in a Spousal Allowance Nc Form For Probate and do not get the time to devote trying to find the correct and updated version, the processes can be stressful. A strong online form catalogue could be a gamechanger for everyone who wants to handle these situations successfully. US Legal Forms is a industry leader in online legal forms, with over 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, it is possible to:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any demands you may have, from individual to enterprise documents, in one place.

- Make use of advanced resources to complete and control your Spousal Allowance Nc Form For Probate

- Access a resource base of articles, guides and handbooks and resources connected to your situation and requirements

Help save effort and time trying to find the documents you need, and utilize US Legal Forms’ advanced search and Review feature to discover Spousal Allowance Nc Form For Probate and download it. For those who have a subscription, log in to the US Legal Forms profile, look for the form, and download it. Take a look at My Forms tab to see the documents you previously saved and to control your folders as you see fit.

Should it be your first time with US Legal Forms, register a free account and get limitless usage of all benefits of the library. Listed below are the steps for taking after getting the form you want:

- Validate this is the correct form by previewing it and reading its description.

- Be sure that the sample is recognized in your state or county.

- Pick Buy Now once you are ready.

- Choose a subscription plan.

- Find the file format you want, and Download, complete, eSign, print and deliver your papers.

Take advantage of the US Legal Forms online catalogue, backed with 25 years of expertise and trustworthiness. Change your day-to-day papers managing in a easy and user-friendly process today.

Form popularity

FAQ

The maximum spousal year's allowance is one half of the average annual net income of the deceased spouse for the three years immediately prior to the deceased spouse's death.

NCGS 30-15 provides that a surviving spouse shall be entitled to an allowance of the value of $60,000 from the personal property of the deceased spouse to support the surviving spouse. The surviving spouse must apply for this allowance through the Clerk of Court within one year of the deceased spouse's death.

In some instances, the surviving spouse may apply for a higher spousal allowance based on the income of the deceased spouse. The maximum spousal year's allowance is one half of the average annual net income of the deceased spouse for the three years immediately prior to the deceased spouse's death.

A surviving spouse is entitled to a percentage of their spouse's estate. The following percentages apply in North Carolina: If the couple was married for less than 5 years, the surviving spouse gets 15% of total net assets. 25% if the couple was married for more than 5 years, but less than 10 years.

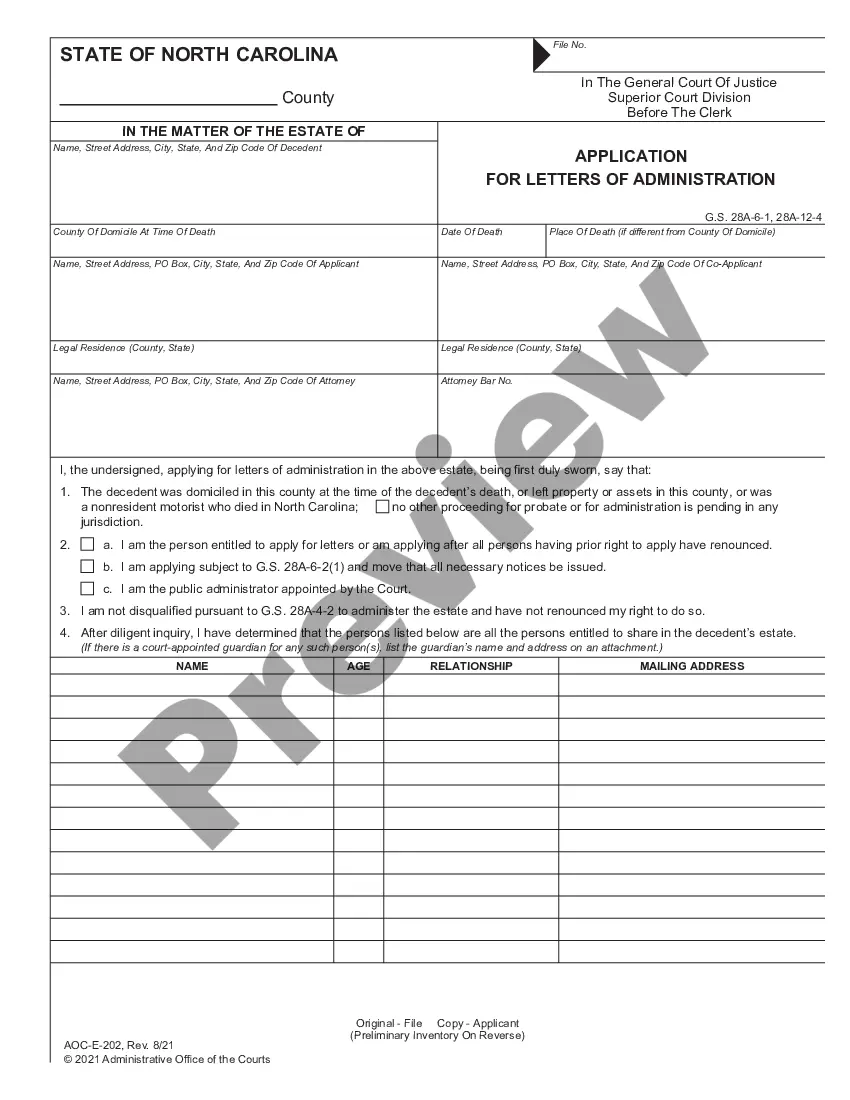

Section 28A-19-1 - Manner of presentation of claims (a) A claim against a decedent's estate must be in writing and state the amount or item claimed, or other relief sought, the basis for the claim, and the name and address of the claimant; and must be presented by one of the following methods: (1) By delivery in person ...