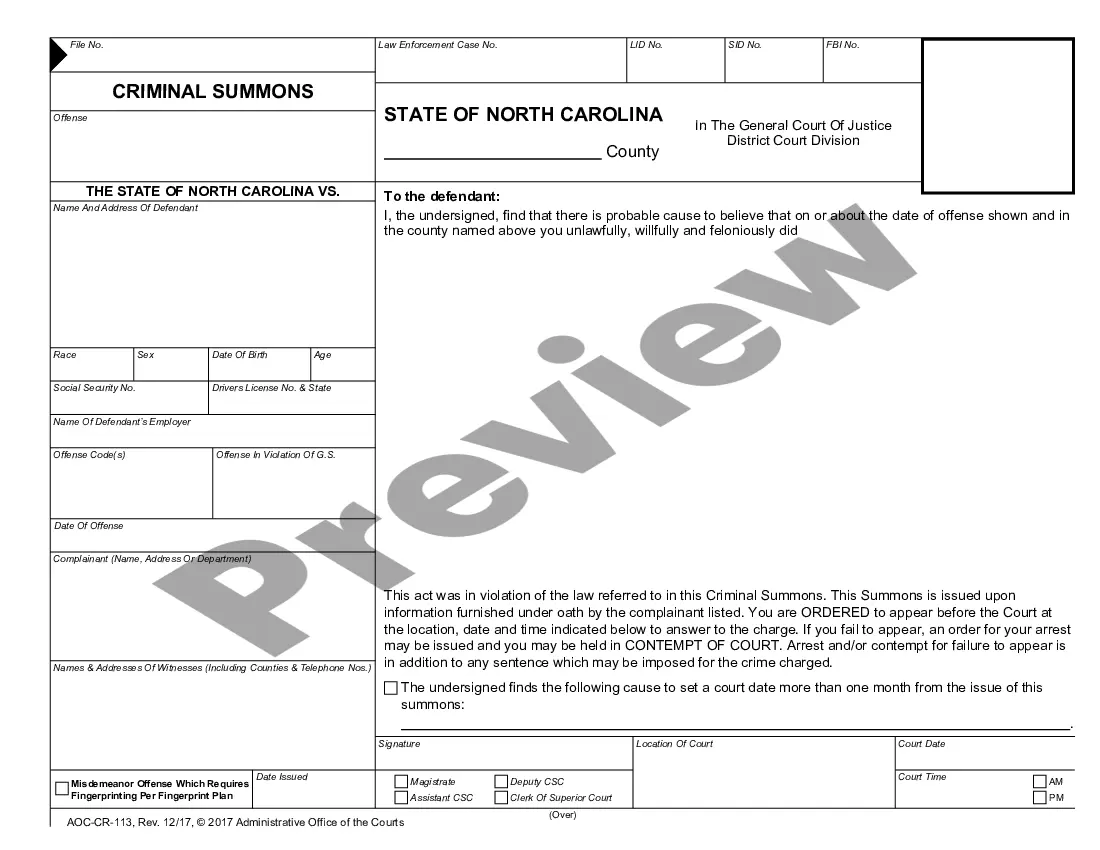

Out of Country Process Verification Recall and Transmission (For use when process electronically transmitted to out of county agency): This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

North Carolina Process For Retirement

Description

Form popularity

FAQ

The North Carolina Pension Committee (NPC) generally aims to approve retirement applications quickly, often within 30 to 60 days. However, delays can occur if additional information is needed or if there is a high volume of applications. Therefore, it's advisable to keep your documents organized and complete. Using resources like uslegalforms can streamline your submission, helping you navigate the North Carolina process for retirement more efficiently.

Filing for retirement in North Carolina involves a few clear steps. Start by determining your eligibility and reviewing your retirement options. Next, complete the necessary retirement application forms accurately, which are available through the retirement system’s website or platforms like uslegalforms. Finally, submit your application to the state retirement system and follow up to confirm receipt.

After applying for a refund from NC retirement, you can expect the process to take anywhere from six to twelve weeks. This duration can fluctuate based on various factors, including processing demands and the accuracy of your submitted information. Staying proactive in tracking your application can help alleviate any concerns during this period. You might find uslegalforms helpful in preparing and submitting your application effectively.

The process for an NC retirement refund can take between six to eight weeks after your application is submitted. Factors such as the completeness of your documentation and the workload of the retirement system can affect this timeframe. To enhance your chances of a timely refund, ensure that your application is filled out correctly. Consider leveraging uslegalforms for a quick and efficient application process.

When seeking a refund from the North Carolina Department of Revenue (NCDOR), the expected processing time is generally up to six weeks. However, delays can happen during peak tax seasons or if additional information is needed. To stay informed about your refund status, you can check the NCDOR website. Utilizing uslegalforms can also help you navigate the refund process smoothly.

The North Carolina process for retirement withdrawals typically takes around 30 to 90 days. This timeframe can vary based on the type of retirement plan and any additional documents required. To ensure a smooth process, be sure to submit all necessary paperwork accurately and on time. If you need assistance, consider using uslegalforms to access easily understandable forms and guidance.

To begin your retirement process in North Carolina, you should visit the official North Carolina Retirement Systems website. This site provides comprehensive resources and guidance on how to navigate your specific situation. Additionally, platforms like uslegalforms can assist you with essential forms and documents you may need. This step ensures that you complete each part of the North Carolina process for retirement thoroughly and accurately.

Yes, it is essential to notify Social Security when you turn 65 to discuss your Medicare options and ensure that your benefits are in place. Your retirement process in North Carolina should include aligning with Social Security guidelines to maximize your benefits. Therefore, reach out in advance to avoid any lapses in coverage. Understanding these timelines can make your retirement transition smoother.

To start your retirement process in North Carolina, you should first gather all relevant documents, including your years of service and any personal contributions. Then, you can visit the North Carolina Retirement Systems website or communicate with your HR department for guidance. Following the North Carolina process for retirement will help ensure that you have everything in order. Consider using professionals like uslegalforms to simplify paperwork and ensure your retirement applications are accurate.

To receive a pension in North Carolina, you generally need to work a minimum of five years. This period allows you to qualify for a monthly benefit upon retirement. Understanding this requirement is an essential part of navigating the North Carolina process for retirement. Take the time to plan your career path accordingly.