Guarantor Form Rental Application

Description

How to fill out North Carolina Guaranty Or Guarantee Of Payment Of Rent?

Handling legal documents and operations might be a time-consuming addition to your entire day. Guarantor Form Rental Application and forms like it usually need you to search for them and understand how you can complete them correctly. For that reason, whether you are taking care of economic, legal, or individual matters, having a comprehensive and practical online catalogue of forms on hand will help a lot.

US Legal Forms is the number one online platform of legal templates, featuring more than 85,000 state-specific forms and a number of tools to help you complete your documents effortlessly. Check out the catalogue of pertinent documents available with just a single click.

US Legal Forms offers you state- and county-specific forms offered by any moment for downloading. Protect your papers management procedures using a high quality services that allows you to make any form in minutes without additional or hidden cost. Simply log in to the profile, identify Guarantor Form Rental Application and download it immediately in the My Forms tab. You can also gain access to formerly downloaded forms.

Could it be the first time utilizing US Legal Forms? Register and set up your account in a few minutes and you’ll gain access to the form catalogue and Guarantor Form Rental Application. Then, follow the steps listed below to complete your form:

- Ensure you have the proper form using the Preview feature and looking at the form information.

- Select Buy Now once ready, and select the subscription plan that is right for you.

- Choose Download then complete, eSign, and print out the form.

US Legal Forms has twenty five years of expertise assisting consumers handle their legal documents. Obtain the form you need today and enhance any operation without breaking a sweat.

Form popularity

FAQ

A guarantor is an individual that agrees to pay a borrower's debt if the borrower defaults on their obligation. A guarantor is not a primary party to the agreement but is considered to be an additional comfort for a lender.

The primary difference between a co-signer and a guarantor is how soon each individual becomes responsible for the borrower's debt. A co-signer is responsible for every payment that a borrower misses. However, a guarantor only assumes responsibility if the borrower falls into total default.

Lenders run a series of checks before approving a guarantor loan to assess whether the borrower or guarantor will be able to repay the loan. Credit checks review your credit history and reveal your credit score, giving the lender insight on how well you've repaid other types of credit and loans in the past.

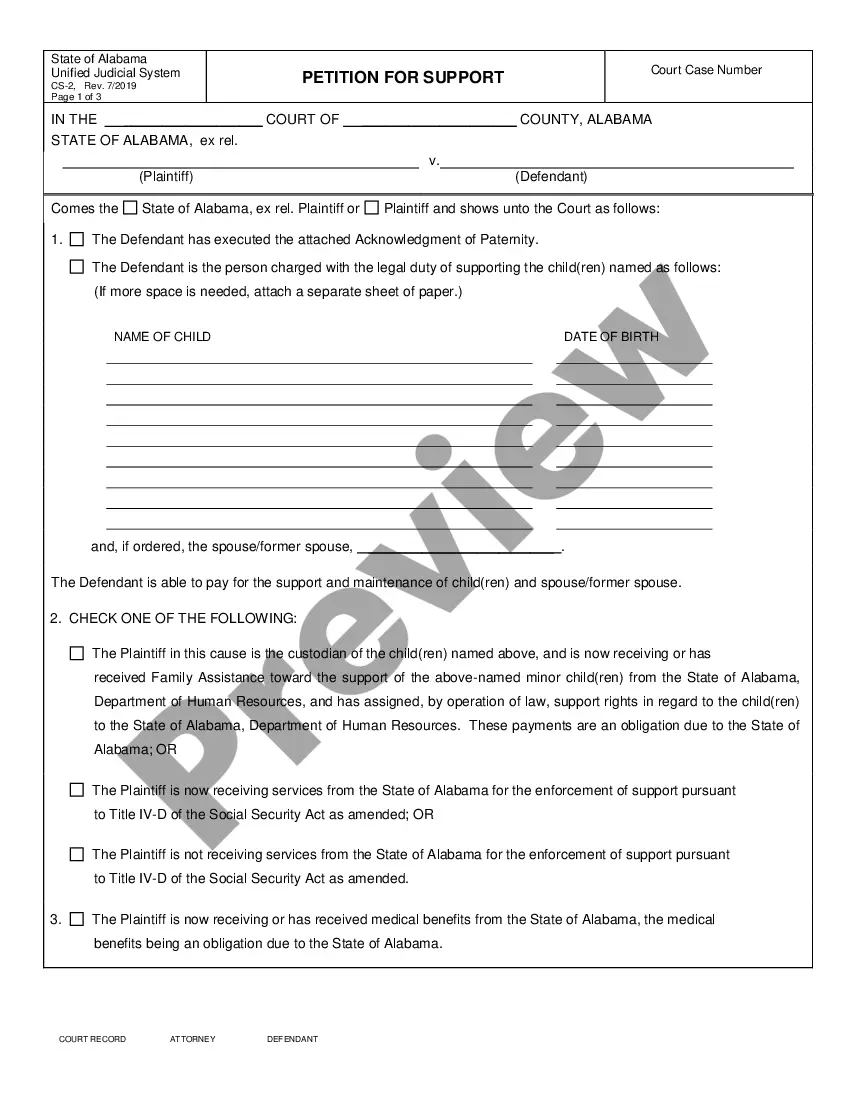

As Guarantor, I hereby agree to guarantee payment of all amounts due under the lease, or that may come due, and all other obligations of the Tenant for the entire duration of the lease attached hereto unless the tenant gives notice of termination within the guidelines of the lease; however, if the lease is renewed ...

One example of a guarantor could occur when someone who is under 21 applies for a credit card but is unable to provide proof that they are capable of making minimum payments on the card. The card company may require a guarantor, who becomes liable for repaying any charges on the credit card.